Den hidtil mest dystre prognose for Kinas økonomi som følge af coronakrisen kommer fra Nordea, der forudser en negativ vækst i 1. kvartal på 15 pct., og Nordea vil ikke udelukke en nul-vækst for hele året, måske endda en negativ vækst.

Uddrag fra Nordea:

China: No signs of a strong rebound yet

China’s monthly data revealed a very dark picture of the economy. The Coronavirus impact on the Q1 GDP could be close to -15%. Looking forward, the data points towards a much weaker recovery than was earlier expected.

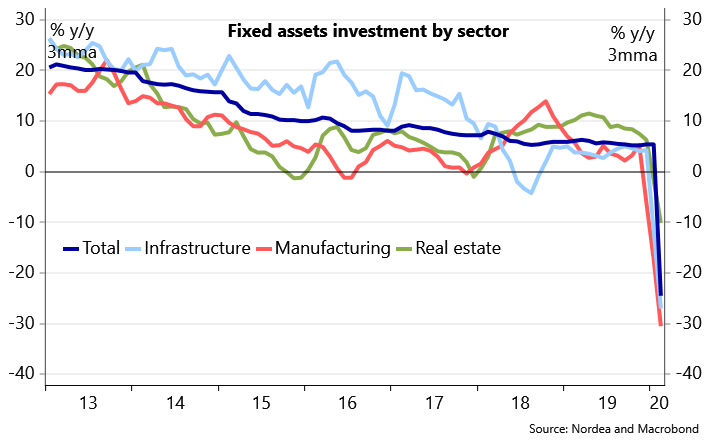

The monthly data on the Chinese economy showed dramatic declines in all sectors. As a few examples, the annual drop was -14% in industrial production, -21% in retail sales and -25% in fixed asset investments for the first two months of this year.

Based on the monthly data and an expectation that most sectors of the economy will gradually recover towards a full capacity by the end of March, we expect China’s GDP to contract 10-15% q/q and around 10% y/y in the Q1 2020. It is of course another question whether China will, however, publish such low official GDP numbers even if the monthly data is widely considered to be reliable.

The data and news from China are even more worrying from the perspective of the future rebound. For sure, the growth numbers will turn considerably better already in the spring (if the virus does not start spreading again) but there are risks that the profile will be much weaker than has been expected. Although the level of uncertainty is enormous and a quick turn to more positive development is possible, we can’t rule out a scenario where China’s annual GDP growth rate is close to 0% or even negative in 2020. The main facts pointing to a weak rebound are:

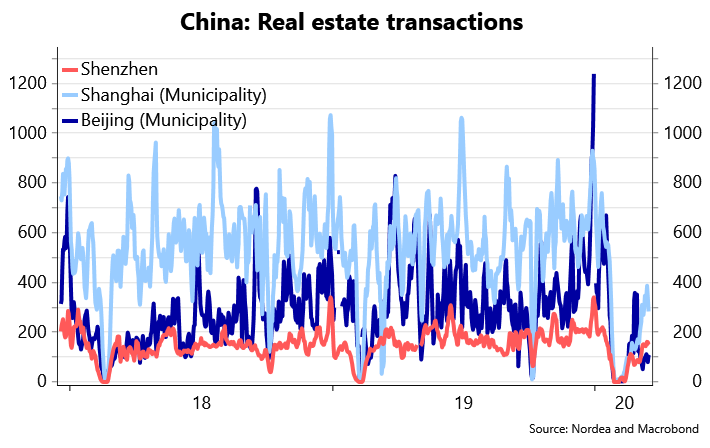

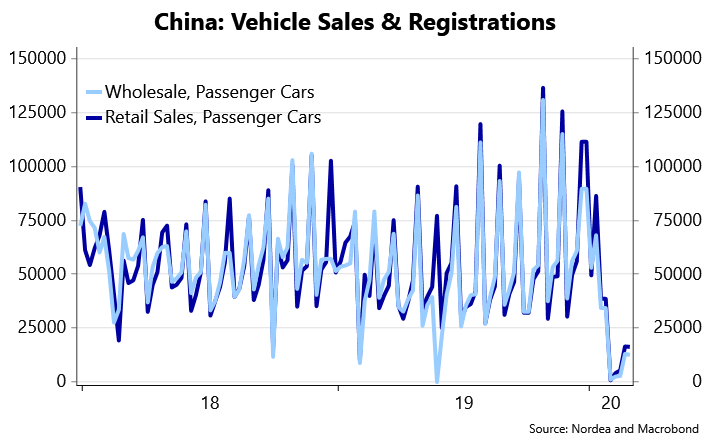

First, the consumer confidence was hit more severely than expected and the demand continues to be weak in many sectors. Consumers’ hesitancy together with problems in logistics were most likely the reason for a decline even in online shopping in January-February. The high-frequency data on e.g. car sales and the real estate sector show that demand has continued to be weak and activity levels continue to be much lower than were seen prior to the Coronavirus outbreak. This indicates that consumers are left with low confidence possibly for a long period of time which can imply that they keep on saving a high share of their income.

Second, unemployment rose more rapidly than expected. The unemployment rate rose by 1 full percentage point to 6.2%. Although the quality of China’s labour market data leaves room for improvement, the rise in unemployment also speaks for a slow rebound. When economic structures break down, a recovery always takes longer due to e.g. that employees have to find a new job and in the meantime they will reduce their consumption. Furthermore, the recovery has already now taken much longer than was originally expected which directly implies that for example many self-employed persons will experience considerable losses of income that are practically impossible to regain. Thus, the aggregate household income development will be sluggish and also imply a weaker rebound in the whole economy.

Third, the rest of the global economy is very likely already in a recession and the tightening of global financial conditions will negatively affect some Chinese companies as well. Thus, the demand for Chinese goods and services will remain weak for the coming quarters and at the same time, there are less investors willing to invest in China.

Fourth, even if the data points to a weaker than expected recovery, Beijing has been silent over a large-scale stimulus package. Of course, China has implemented many measures that have improved liquidity and provided financing to the real sector but the leaders have not come up with anything that would compensate for the losses already taken place. This may, of course, change any day.

Drop in the Q1 2020 GDP will be dramatic

Weak data keeps on coming