Mens de vestlige centralbanker begynder at stramme pengepolitikken, går Kina den modsatte vej og giver lidt flere stimuli til økonomien. Centralbanken har sænket reservekravet for bankerne og har taget fat på andre stimuli. Det kommer som følge af, at økonomien svækkes en smule. Dampen er især ved at gå ud af ejendomssektoren. I de seneste måneder har der været et stort fald i byggeri, salg og priser. Nordea venter, at den økonomiske vækst vil blive lavere end forventet, og det vil fortsætte ind i det nye år. Svækkelsen af økonomien har ikke ført til en svækkelse af yuan, der er steget kraftigt. Det vækker bekymring i centralbanken, og der er tegn på, at centralbanken vil standse yuan-styrkelsen. Yuan er kommet på sit højeste niveau siden 2018.

Uddrag fra Nordea:

Kina slækker på tøjlerne for at stimulere økonomien

Not all central banks are in the process of removing or thinking about removing stimulus. The People’s Bank of China (PBOC) announced a cut in the required reserve ratio (RRR) of banks and has unveiled further targeted easing measures as well. The move comes after the Chinese economy has continued to lose momentum and the Omicron variant poses further risks, not least due to China’s strict policies regarding COVID-19 infections.

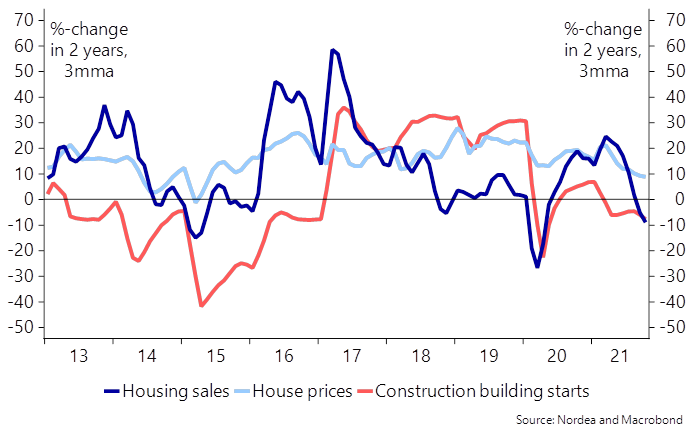

Especially the situation in the property sector continues to raise a lot of questions. We remind readers that a big part of the cooldown in the property market has been in response to earlier policy tightening measures, and as such should not have come as a big surprise to the Chinese authorities.

While we expect further monetary loosening ahead, the Chinese authorities are likely rather seeking to engineer a soft landing than to give credit growth another notable boost. While the importance of economic growth should not be downplayed, the current Chinese leadership has many other goals as well. Increased government control over for instance debt levels does not come without costs, and slower economic growth is likely to be among those costs.

The inflation outlook is not a big obstacle for easier monetary policy. While headline inflation climbed to 2.3% in November, the highest level in more than a year, the rise was lower than expected and largely driven by the base effects from food prices. Excluding food and energy, the inflation rate is below 1.5%, far below the readings in the US and even the Euro area.

The bottom line is that even if limited further policy loosening looks likely, such measures will have only a limited impact and compete with other goals of the Chinese government. One also has to bear in mind that the visible monetary policy tools such as the RRR and interest rates mirror only partly the real monetary policy stance in China. The direct instructions to the banks are much more important and are often visible only afterwards in the credit growth numbers. We continue to see clear downside risks for the Chinese economy and expect below-consensus growth next year.

Chart 3. Chinese housing market is losing steam

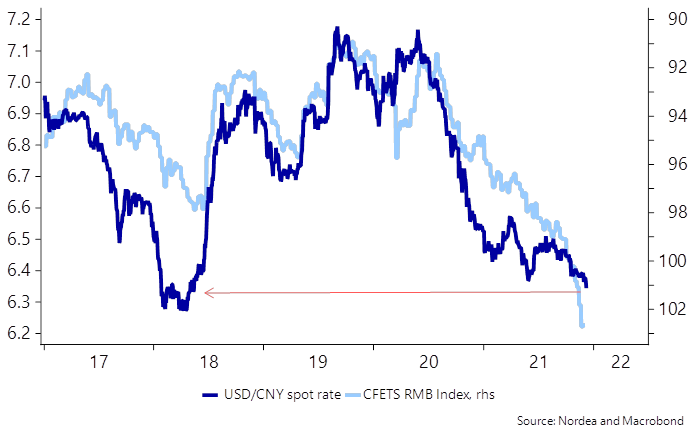

But the downside risk to the economy and monetary easing have not slowed the strengthening of the Chinese yuan. This week USD/CNY moved further down and broke below 6.36 heading down to 6.34. This is the strongest level for the CNY against the USD since May 2018. It has been very surprising that the PBoC has allowed the CNY to strengthen as much as it has. This year the trade-weighted CFETS-index is up by 8%. But as long as the interest rate differential is in favour of the CNY and capital inflows move into China there will be upward pressures on the Chinese currency.

However, the PBoC steeped in Thursday (9 December) and raised banks’ FX reserve requirements which followed lowering of banks’ FX reserve requirements earlier in the week. Both measures are clear signs that the monetary authorities are unhappy with the strengthen of the CNY. And in 2022 we should see the tide change for the CNY as the Fed tightens aggressively while the PBoC will be easing further.