Nordea vurderer, at et sammenbrud af det store kinesiske ejendomsselskab Evergrand ikke er så alvorlig, som mange i Vesten tror. Det vil ikke have samme effekt som Lehmans sammenbrud. Kinas største ejendomsselskab Country Garden klarer sig fint. Men Evergrand er udtryk for et kreditfinansieret ejendomsmarked, og når der sker en overophedning, og når myndighederne strammer tøjlerne, kommer der en effekt som det, der sker nu med Evergrand.

There’s a Lehman in China every 36 months

Is Evergrande a Lehman event? We sincerely doubt it. It is (way) easier to contain Evergrande than Lehman, but it doesn’t mean that the Evergrande blow-up doesn’t come with repercussions. Markets will likely stay in “stagflation mode”.

Markets are getting scared by the Evergrande story. Judging from the number of questions we received from clients and sparring partners during the latter parts of last week, this is currently the question number one to answer.

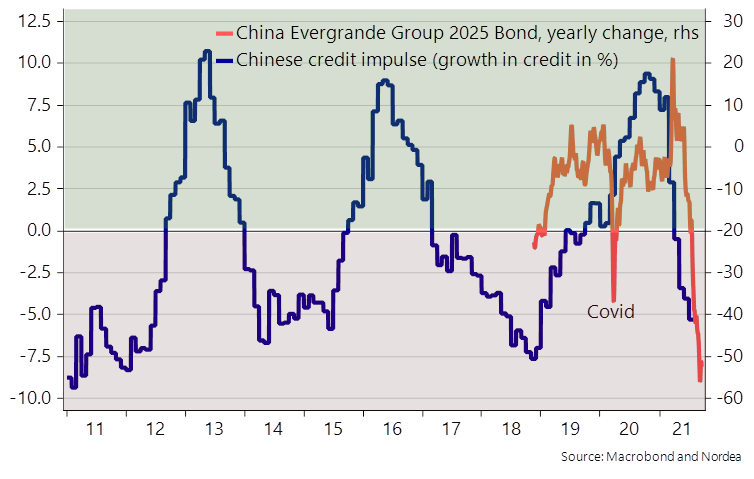

Evergrande has been struggling for four to five months in a row due to weak project sales, but it may be that the landslide of the real estate developer is revealing an even bigger landslide in the Chinese credit growth than what is “officially known”. This is the biggest issue when debating Chinese economic issues; We basically don’t know as we are deliberately kept in the dark on many metrics by the authorities.

The otherwise widely used Tom-Tom GPS data from Chinese cities has been halted (likely) by the authorities, which makes it tricky to assess the true development. Financial Twitter is accordingly (again) full of China doom mongering from people who have never even visited mainland China as it is a cheap sell to the bear crowd, but it seems like another one of those popular China is going bonkers narratives to us.

We understand the uncertainty due to the lack of real-time data and/or the lack of a true feeling about Chinese economic data, but we still find compelling reasoning behind calling this another Chinese “cry wolf” event.

Chart 1. Is Evergrande a signal that Chinese credit growth is even worse than we had anticipated?

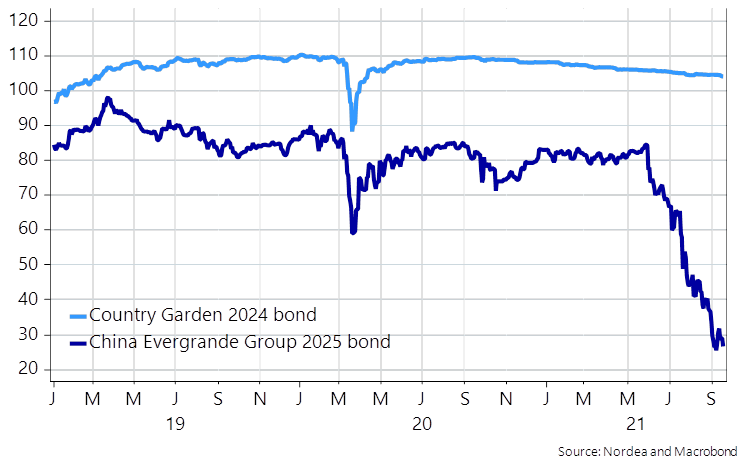

Contagion effects from Evergrande are likely to be decently contained and markets are yet to care about true spill-over effects in for example Country Gardens (Chinas biggest real estate developer) tradable bonds, while Chinese high yield has been selling moderately off in a broader scale. This doesn’t seem like a market truly scared of a true Lehman-like contagious meltdown scenario despite Evergrande bonds trading at a “recovery rate” of one to four or thereabout. This could be our famous last words, but we struggle to get really scared about Evergrande, but obviously one can never say never (grande).

Chart 2. Contagious effects from Evergrande still remain sparse in a bigger perspective

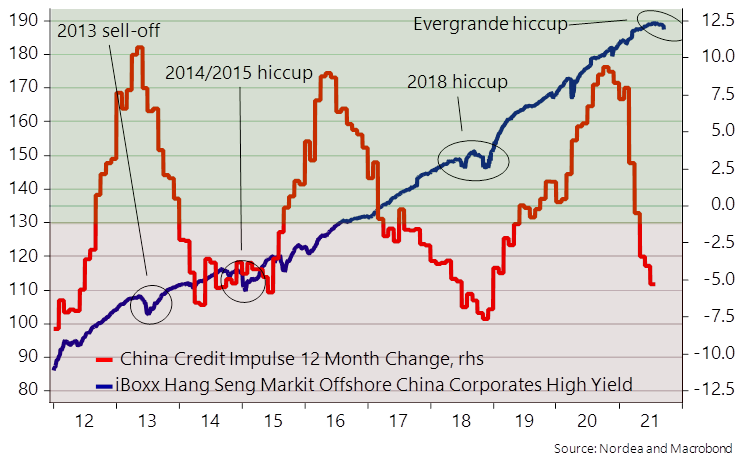

We tend to get a round of “China is melting down” with an interval of 2-3 years and they usually always occur when the Chinese credit impulse is negative. China is a credit-fuelled economy and there are always casualties when the authorities decide to take the foot of the pedal.

This was also the case in 2014/2015 and 2018 when the Chinese markets suffered markedly due to a clearly negative credit impulse and in sharp contrast to the US in 2008 Chinese authorities hold all the ammo needed to turn the tide on credit growth (if needed). They can essentially credit grow the “beep” out of everyone trying to bet against them if they want.

Chart 3. There’s a Lehman in China every 36 months and usually the authorities solve it

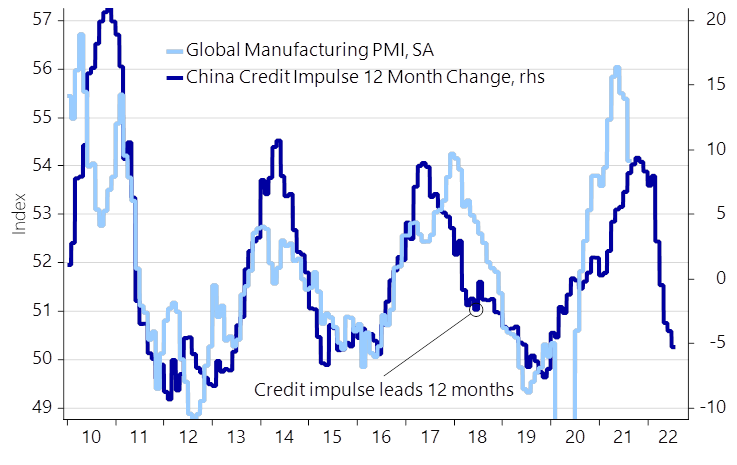

It doesn’t mean that the Evergrande/China slowdown comes without global repercussions. The global credit impulse has been (mainly) driven by China in recent years but currently we see a very uniform decelerating impulse across jurisdictions. The interesting thing is that the impulse is now clearly negative (a contraction of credit on the second derivate) likely because of a voluntary drawdown on the revolving facilities that were widely utilized during Q2/Q3-2020. In other words, credit growth is slowing fast as 1) liquidity facilities are not as needed now and 2) the impulse from the fiscal and monetary side is weakening in YoY terms. Gravity pulls.

The big question is if this is something to worry about. We think it warrants a shift in asset allocation trends away from cyclicals to defensives (Global: How to position for a (clearly) weaker credit impulse?)

Chart 4. The cyclical part of the global economy is about to lose pace due to a slowing credit impulse