Nordea har analyseret Kinas påvirkning af inflationen i Vesten og kommer til den konklusion, at Kina har en megen beskeden virkning, så lille som 2 pct., dels fordi Kina bidrager til at holde prisudviklingen nede, dels fordi værdiforøgelsen på udenlandske produkter, der samles i Kina, er meget beskeden. Den udvikling ventes at fortsætte, når Kina i stigende grad vil producere produkter af høj værdi, mens lavprisprodukter ryger til andre lande. Også high-end produkter kan blive forholdsvis billigere på grund af den kinesiske effektivitet.

Inflation from China? – don’t get overexcited!

Inflation is now a hot topic and all possible sources of it are closely analysed – also China. However, it is worth noting that despite rising cost pressures, there are many factors limiting China’s inflationary impact on our economies.

1. The share of Chinese production costs in the Western consumer price index is surprisingly small, perhaps 2%

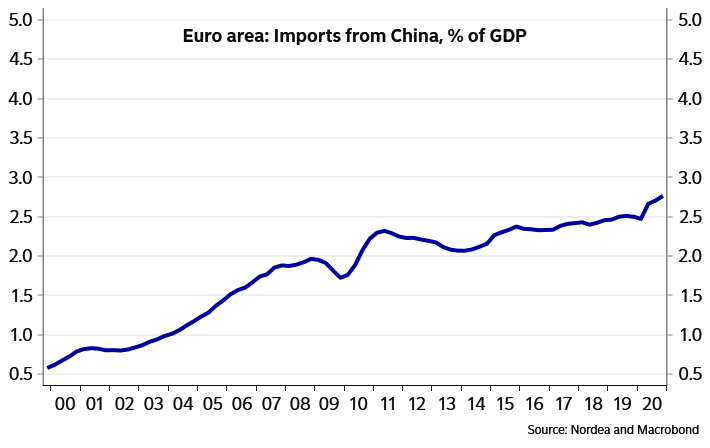

Chinese products cover a substantial share of consumption in western economies. For example in the Euro area, the sectors that are often dominated by goods made in China such as electronics, textiles, shoes and furniture cover 17% of the core inflation price index.

However, that number does not say much about the price pressures that are actually coming from China. The value-added made in China is often very small.

For example, there are studies showing that out of iPhone’s factory price, less than 5% remains in China and the share of the retail price is of course even smaller. This is because for many foreign brands especially, Chinese workers mainly assemble imported components and the value-added of that part of production is very small.

Thus, we end up with a very rough estimate that China’s weight in our consumer basket is most likely not more than 2%. This implies that the direct impact of China’s rising costs on consumer price inflation in the Euro area is rather small.

This was probably also the reason why Trump’s tariffs on many Chinese consumer goods in September 2019 did not have any visible impact on US consumer prices. Different parts of the supply and retail chain probably participated in carrying the costs of the tariffs which originally were set to 15% but then lowered in 2020 to 7.5% as part of the Phase I US-China trade deal.

The impact of Chinese imports on the Euro-area inflation should not be overestimated

2. China has been able to compensate rapidly rising wage costs by increasing productivity

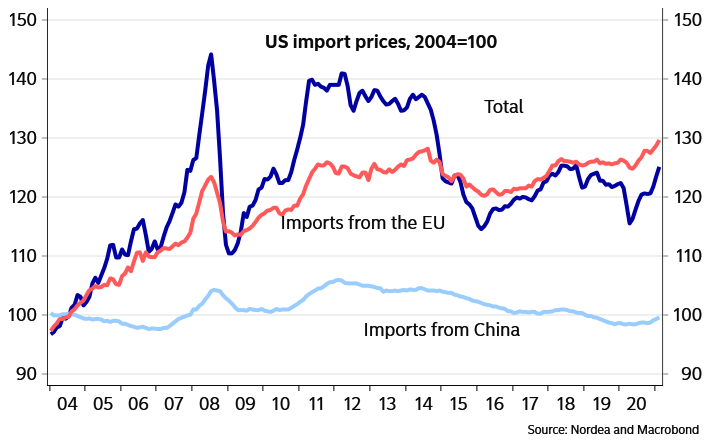

It is not a new thing to see wages and other type of production costs rise rapidly in China. In the 2000s it was common to have annual wage increases of clearly above 10%. However, the companies in China have been successful in compensating the rising costs by improving productivity. Thus, the final prices for Chinese products have been surprisingly stable and the pressure from China’s rising costs on inflation in other countries have remained limited.

For example, the US import price data show that when prices are corrected for their higher quality, imports from China have not become more expensive at all since the data starts in 2004. Interestingly, import prices from the EU have increased substantially at the same time.

US import price data show that imports from China have not become more expensive

3. China is not the end of globalisation

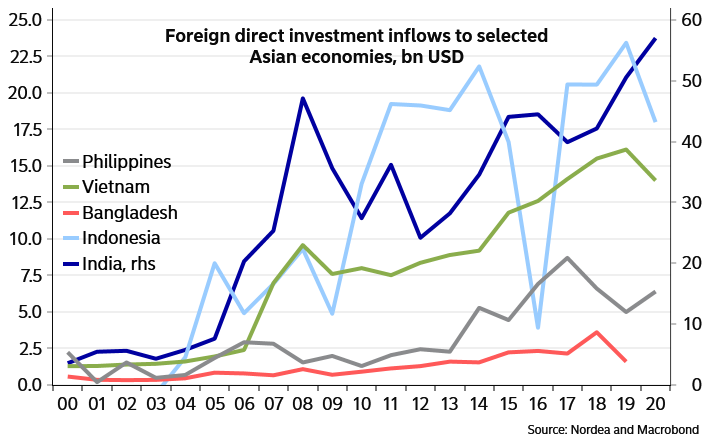

One reason for the exceptional export price development is of course the transfer of production of low-value-added goods from China to cheaper countries while China itself has been able to concentrate on new products containing more value-added and high-tech. FDIs to many Asian countries with a large population have boomed recently. This has partly been due to production which is moving out of China as a result of higher costs.

Thus, even if production costs are rising in China and some countries are raising trade barriers against China, there are other countries with low costs that can still cause also deflationary pressures globally. For example, the total population of Bangladesh, Indonesia and Vietnam is more than half a billion and there are also recent examples of production moving from China to either Africa or India where the potential is even larger.

FDIs to many South-East Asian countries are increasing

4. China will boost competition in new sectors

We should also notice that China will most likely increase competition and cause downside pressures in many new sectors and new parts of the supply chain in the coming years. China’s new five-year plan is extremely ambitious and pays a lot of attention to innovations, advanced manufacturing and technological self-sufficiency (read our take aways from the five-year plan and National Congress here). China is going to invest a lot in R&D, and its aim is to bring new Chinese brands and products to the global markets.

Thus, in the big picture we expect China to continue bringing deflationary pressures to the new segments of the economy.