Nordea hæfter sig ved, at millioner af amerikanere ikke kommer tilbage på arbejdsmarkedet, selv om masser af jobs er ledige. Samtidig er der tegn på en langt stærkere inflation, end de fleste forventer, især på fødevarer. Det er, som om alle ignorere det, mener Nordea. Har vi lært den rette lektie fra finanskrisen i 2008-09?

The boomers ain’t coming back!

Could it be that we have seen a structural shift lower in the labour supply and that everyone will mix up the difference between a supply- and a demand shock in the aftermath of the Covid crisis? Let’s keep spending – the boomers ain’t coming back!

On the surface it was another weakish job US-report with fever jobs added than anticipated but maybe it is not that big a surprise after all. Loads of schools are still closed, which is an issue for the labour supply. Lots of people are not willing to go back to the old job as per Dallas Fed research and the willingness to take on the pre-Covid 19 job drops month after month currently.

Maybe we are simply overestimating the supply of labour that will eventually return to the market when the crisis is over (inflationary)? A complete vice versa of the great financial crisis when right about every economist underestimated the slack in the economy (disinflationary), which ultimately ended in an economic catastrophe in Europe again in 2011-2012.

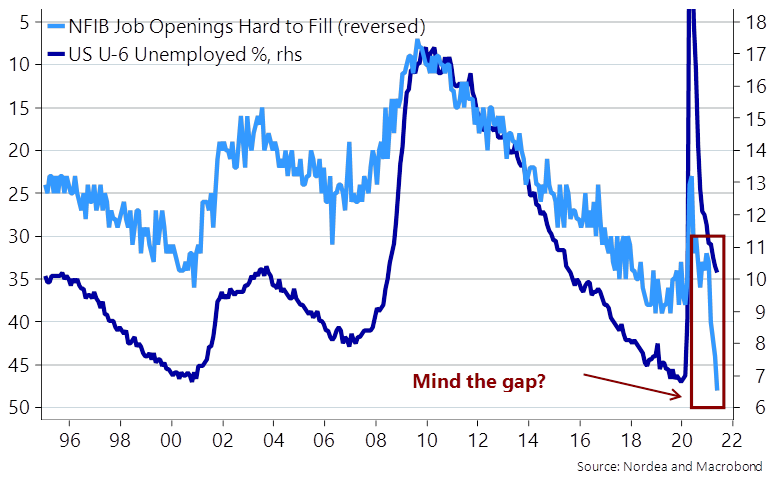

First, we tend to think that the labour market is running hotter than anticipated already as supply is not going to return as boomers ain’t coming back. Second, we urge you to follow U-6 unemployment as it is simply a better gauge in the current situation with closed schools and other labour supply limitations.

We admittedly have to summon our inner “patient-istas” as we won’t know the answer to the labour supply question before at least a couple of quarters from now, but for the first time in at least a few decades we find that the structural winds are changing in an inflationary direction.

Chart 1. Jobs are there but no one is willing to take them. Do we overestimate the post-crisis labour supply?

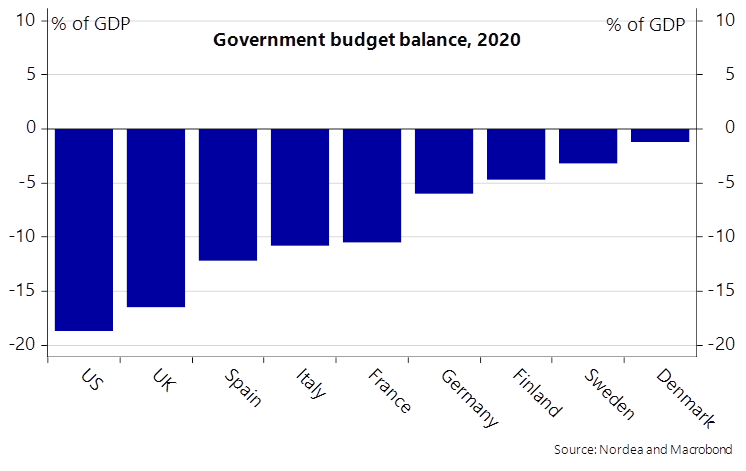

The signal is still firm from G-7 leaders. They want to keep spending as the inflationary risks are muted, while also the global minimum corporate tax agreement is another leftist turn of the economic consensus post Covid-19. No-one wants to repeat the post-GFC mistakes when interest rates were increased too swiftly (in Europe), while spending was slowed too early.

The issue is just that the economic response to a crisis is always calibrated on the back of the most recent economic crisis (recency bias), but two crises never look similar. The risk is now that we act on Covid-19 as if it is a demand-crisis, which it is obviously not. The potential endgame of massive public spending during a supply shock crisis is a so-called “bottleneck crisis”; maybe exactly what we are already in the midst of.

Chart 2. SPEND SPEND SPEND.. that is the message from the G7 meeting

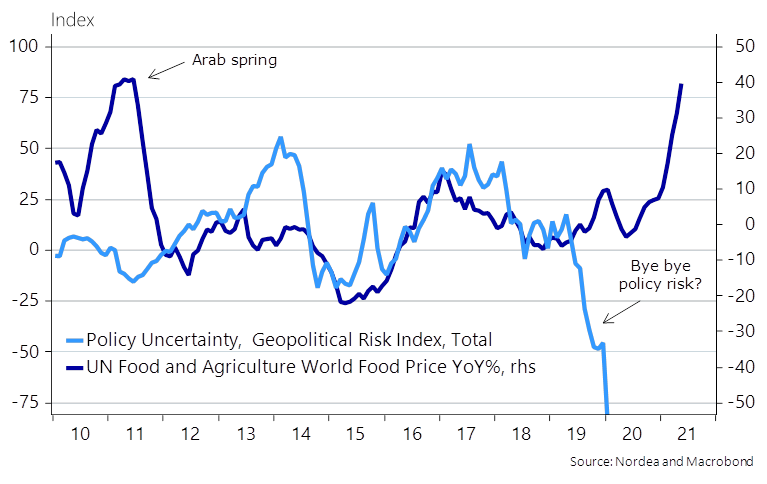

Even before the Fed finally decides to taper (likely in H2-2021) in response to the soaring wage- and price inflation, there may be another source of volatility coming. Food prices are now up 40% over the year, which was also the case ahead of the outburst of the Arab spring. When food prices are up this much, it simply increases the risk of riots and/or regime-shifts/coups.

Meanwhile, the Geopolitical risk index has fallen off a cliff during the past 6-12 months, which makes the political risk premium look oddly low. If not for reasons related to tapering of QE, then buying volatility may be worthwhile considering due to the risk of riots and/or attempted regime-shifts?

Chart 3. When food prices are up this much, political risks follow!

The other potential source of volatility is the Fed taper decision, which everyone and their mother is currently debating. This is also exactly why no-one in markets even cared to act as if they were surprised by the big jump in inflation in April, which is also the key take-away from the new macro letter written by our friend- and speaking partner Alfonso Peccatiello from ING – look here.

We are currently stuck in the “it is just temporary” narrative as the market doesn’t even bother caring about huge directional upside surprises to the inflation index as long as it seems driven by bottle-necked sectors such as commodity markets and used cars. Next week will bring about another inflation shocker from a level perspective (USD inflation preview: Prepare for another shocker), but we doubt that markets will care too much about it, even if core inflation breaks through 4% as we see a clear risk of either in May or June.

The next phase of the inflation cycle is likely going to prove disinflationistas right as YoY contributions from oil, food and cars will start fading in July/August, which will prove to be a blessing for the “transitionistas”.

ECB

On the other side of the pond, the ECB is starting to sound more and more like the Fed did ahead of the Jackson Hole conference of 2020. More voices, including the Finnish governor, are calling for AIT-like setups, which in case could be seen as a more dramatic change of scenery compared to the AIT-setup of the Federal Reserve.

The ECB has been undershooting on inflation ever since Trichets disastrous hikes in 2011, which makes the task of launching a credible AIT-regime much more difficult. Realistically, inflation expectations need to print at least around 2.50-2.75% in a 5y5y inflation swap for anyone to trust that inflation will now print at 2% on average going forward.

This would lead to a new dovish shift from the ECB with a subsequent promise to keep printing new EURs paired with a very lenient forward guidance, why the emerging hiking bets in e.g. the 2y1y EUR swap will have to be faded. Nothing much will happen at the ECB meeting next week, but the Sintra conference after summer will prove to be interesting.