Nordea har analyseret virkningen på finansmarkedet af krisen om Ukraine og Rusland og når til den konklusion, at krisen IKKE bliver den vigtigste risikofaktor i år. Derimod vil de velkendte forhold som f.eks. inflation og forsyningsproblemer udgøre de største risici. Nordea tror ikke, at krisen vil slutte i meget lang tid. Rublen bliver påvirket negativt, men Nordea tror, den vil styrkes senere, selv om en større militær konflikt kan føre til et markant fald i rublen. Selv om de globale finansmarkeder ikke vil påvirkes ekstremt af Rusland-krisen, så kan der bliver negative konsekvenser for de virksomheder, der er stærkt engageret i Rusland og Ukraine.

Week Ahead: Russian roulette

Financial markets have been following the Russia-Ukraine crisis closely, and the recent developments indicate that tensions might not have peaked yet. Limited escalation is still likely, but spillover to broader risk sentiment should stay limited.

“During the recent Direct Line, when I was asked about Russian-Ukrainian relations, I said that Russians and Ukrainians were one people – a single whole. These words were not driven by some short-term considerations or prompted by the current political context. It is what I have said on numerous occasions and what I firmly believe.” [1]

– Vladimir Putin, President of Russia, July 12, 2021

Geopolitics have stolen the spotlight and created worries for investors and people around the world. The Russia-Ukraine crisis is still ongoing and unfortunately we are far from certain that geopolitical risks have peaked. Judging by the recent market moves, the Russia-Ukraine tensions have been one of the drivers behind general risk sentiment, and also oil prices have been sensitive to headlines from the Ukraine.

Going forward, we do not expect the current crisis to be the key driver of the risk sentiment this year. It’s much more likely that central banks and the inflation outlook will dominate the narrative in the financial markets. However, countries and companies which are closely linked to Russia could face negative spillover effects and the Russian rouble remains vulnerable.

Chart 1. Financial markets have been eager to move on, but geopolitics have offered surprises.

The Russia-Ukraine crisis is complicated, but future developments can be illustrated through three scenarios.

- De-escalation.

- Limited (military) escalation or a “military-technical” response.

- Significant escalation and harsh sanctions for Russia.

We still see the second scenario as the most likely one, but the market reaction depends on the size of military action. There have already been reports on cyber attacks and shelling, but if the escalation will be more focused on cyber attacks, it is likely that the hardest sanctions will be avoided.

De-escalation is still on the table too, but NATO has stated it will not accept Russia’s demands, which creates a major challenge for the negotiations. Tensions are high, and it’s hard see a deal which would be acceptable by all parties. The parties seem to be too far away from each other, and the current situation will not be solved in the short term.

Significant escalation is also a real possibility, but the parties are eager to avoid open war. Russia would face severe sanctions, if the third scenario materialises, with even Russia’s exclusion from the SWIFT payment system and sanctions against Russian banks on the table. In addition, there is a high probability that the war could last for years and that’s something Putin prefers to avoid.

On the sanction side it is noteworthy that the probability of SWIFT sanctions is rather low. Western countries have already somewhat softened their stance, and cutting Russia off from SWIFT would also create challenges for the EU. The EU has often indicated it tries to avoid sanctions which create problems for all Russians, and SWIFT sanctions clearly fall into that category. Sanctioning Russian banks and sovereign debt in the secondary markets is a more likely scenario if tougher sanctions are needed.

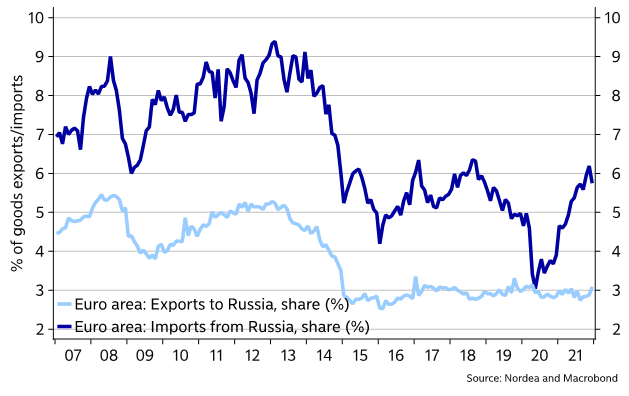

Chart 2. Russia’s share of foreign trade is quite low, but some European countries rely on Russian gas.

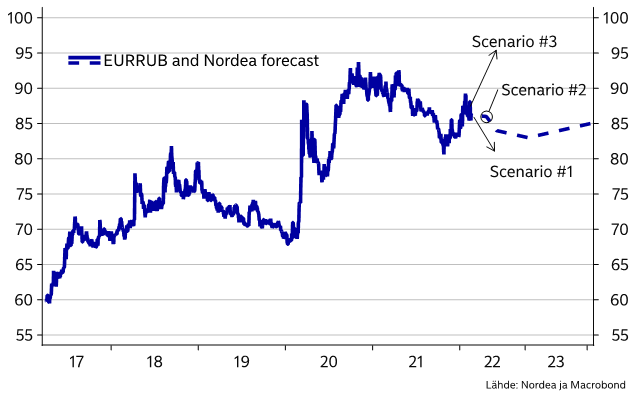

The Russian rouble will remain volatile in the coming weeks as markets are constantly reacting to the different headlines. In the short term we see risks tilted towards a weaker ruble, but later on we expect EUR/RUB to stabilise around 86. However, usually markets tend to overreact and we would not be surprised if the ruble depreciates strongly in case of negative news. Overall, the risk for the ruble is an asymmetric one – it may depreciate more than it may gain.

Chart 3. Russian rouble and scenarios

Longer out the ruble will remain rather weak as risk premium will not vanish due to (geo)political uncertainty and the threat of sanctions is also constant. Moreover, the Russian long-term growth outlook is dim. The working-age population is declining, investment appetite is low and productivity is not expected to pick up significantly.

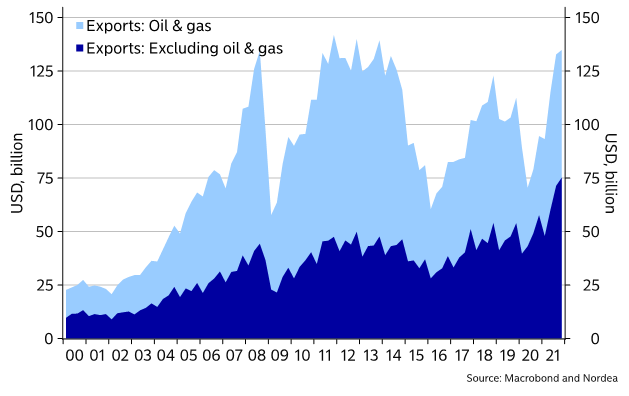

The Russian economy is still heavily tilted towards hydrocarbons, while more and more countries are moving away from fossil fuels. The transition period will be a long one, but it seems that Russia has no major intention of transferring towards renewables, which will cause more problems in future.

Chart 4. Russian exports are one-sided

If the current geopolitical situation escalates, implications for Euro-area interest rates are complicated. On the other hand, the risk sentiment would deteriorate and safe-haven demand should supress bond yields in the very short term, but there are other factors as well. Inflation has been above the ECB’s target since July 2021 and wage pressures are rising. European natural gas prices are heavily influenced by Russia and the escalation could easily transfer into higher energy prices, and headline inflation would remain higher than currently forecast.

The text book monetary policy answer is that the central bank should not react to one-off price increases, but in the current inflation environment high headline inflation could easily turn into higher wage increases. This is something that the ECB and investors are watching closely, and the central bank could turn even more hawkish, although rising energy prices decrease households’ real incomes and poses risks to the economic outlook.