Nordea skriver i en analyse, at uenigheden blandt EU-landene om eurobonds er så stor, at det kun er ECB, der har kræfter til at levere den nødvendige finansiering for at håndtere coronakrisen. ECB må komme med et nyt QE-program. Nu drejer det sig om at undgå en konkursbølge.

Uddrag fra Nordea:

FX weekly: The EUR-tyranny of the minority

A big majority within the Euro area favors Eurobonds, but the important minority keeps blocking them. It leaves the ECB as the only game in town and they simply don’t buy enough (yet). On the other side of the pond, NIRP is suddenly in play.

If you want to receive a copy of FX weekly directly in your inbox, you can sign up via this link.

Quote of the week:

“The threat to the single market is clear: uneven fiscal support implies that a firm’s location, rather than its business model, will be the decisive factor in determining whether it survives this crisis.” Fabio Panetta, ECB Member

The Italian ECB board member, Fabio Panetta, went all-in pathos on the case for Eurobonds, among other things arguing that well-driven businesses in Spain and Italy could be forced into bankruptcy due to the lack of funds available for Corona-bailouts as local authorities are running out of ammo. A less viable German competitor will on the other hand be backed by healthier public finances, why the Euro area risk saving less competitive companies in certain sectors due to unequal access to bail-out packages.

It admittedly feels awkward to hear a central bank official suddenly worry about zombie-companies being kept alive, but Panetta is probably right on this one. It is an issue if the access to Corona-bailouts is unevenly distributed across the Euro area.

The issue is to get Germany to ultimately back the funding of equally levelled Corona-support across the common currency. A firm majority of countries are in favor of Coronabonds, but we also reckon that it would be fairly easy to find a majority in favor of forcing Warren Buffet to pay for dinner in a 27-person-wide dinner company. The only difference between the two is that Buffet never voluntarily joined a club with a common currency.

Germany is probably never going to accept to pay everything for everyone, not least because cultural differences are simply too big for that to ever happen. That is the (fair) tyranny of the minority in the EUR. The problem is just how to make EUR function properly over time, if Germany doesn’t accept to pay? A gordian knot for the Germans.

This leaves the ECB as the only game in town (more on that in a sec), even if they ultimately also need political blessing to buy the amount of bonds that could be needed to keep everything afloat in the Euro area. The Euro area PMIs revealed that the depth of the Corona-crisis is at least double that of the GFC, or maybe even triple. SAD! as the Orange Man would have put it.

Chart 1: The Corona-crisis in between 2 and 3 times as bad as the GFC?

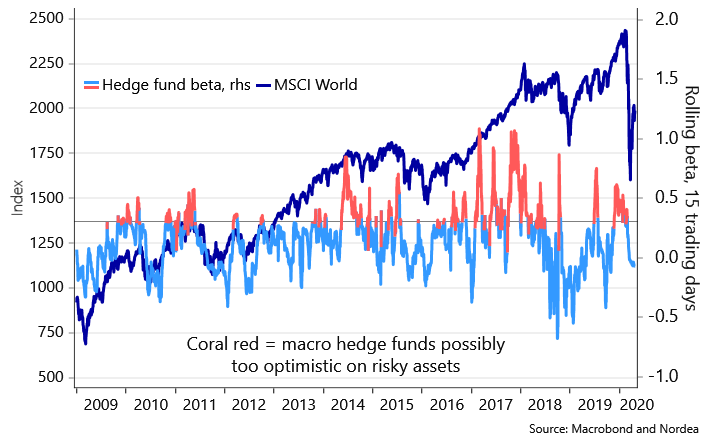

We are, despite the above chart, bored of “this is worse than 2008” charts. We all know by now; it is old news and most asset classes almost couldn’t care less. Positioning has become bearish, also among macro HFs, but nothing out of the ordinary. We reckon that the Fund Manager Survey exaggerated the actual bearishness in positioning, and recent activity in commodity markets tend to support that notion. The commodity market may reveal the true state of the global economy, since it is the only market where true bears can express themselves without risking being run over by a central bank liquidity steamroller.

The liquidity crunch phase is behind us and central banks have ensured that it doesn’t repeat itself. The question is whether we move to the liquidation phase next. Less than 50% of US small businesses will be able to operate under the current conditions another month from here (15-20% less than a month), and help may arrive too late due to bureaucracy in processing of applications. The same is by the way the case in Europe. 1st of May could be a crucial line in the sand as bills start coming in again. Small businesses don’t have the time and the resources to await a lengthy political blame game within the Eurogroup or in the US Congress, for that matter.

Chart 2: Positioning among Macro HFs is slightly bearish, but definitely nothing out of the ordinary

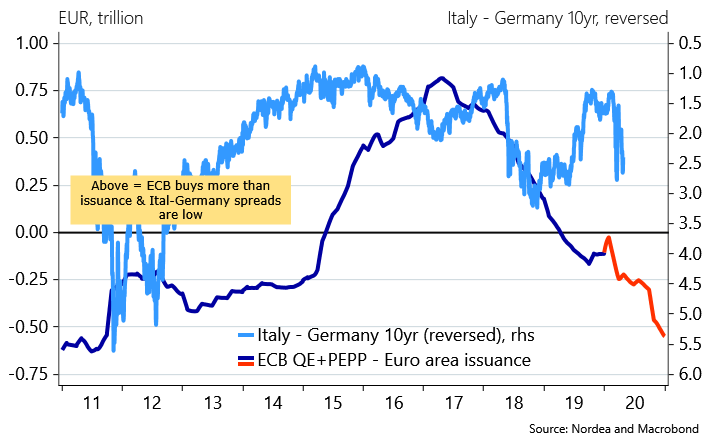

Swap-lines and repo-programs for everyone have proven adequate to end the liquidity crunch, which is also the most important reason why the FX menace (e.g. seen in Scandis and EM) in March is behind us. The Fed is even likely to buy more than the total new issuance of US Treasuries during 2020, but the same cannot be said about the ECB yet.

If we assume that a little more than EUR 1500bn worth of net supply (more than official forecasts but still conservative IOHO) will flood EUR govie markets, then the ECB will fall at least EUR 0.5trn short of buying it all. The last time the net issuance adjusted for central bank purchases reached such levels was in 2011-2012 and we assume that we don’t have to remind you of what happened back then? The ECB will probably have to buy (a lot) more as they are the only game in town.

Even if a QE program is both theoretically and practically negative for the underlying currency, we would still argue that a whatever it takes 2.0 QE program could turn into a EUR-positive, rather than the opposite. Gluing the ship together again matters more for the EUR-pricing than the size of the monetary base.

Chart 3: The ECB is not close to buying it all (as the Fed does). Time to step it up?

T