Nordea mener, det er sandsynligt med en svag lempelse fra ECB i december, men generelt ser banken en øget usikkerhed på markederne indtil det amerikanske valg. På længere sigt ser banken en svagere dollar og en svag stigning i den lange rente.

Major forecasts: More easing but how?

Major central banks are not done easing monetary policy, but their choice of tools varies. The ECB will boost its asset purchases in December, while yield curve control by the Fed now looks less likely. The USD will weaken and curves steepen.

Increased uncertainty has gradually crept into financial markets in the autumn. The number of Covid-19 cases has shot up, new restrictions are being introduced, the recovery is experiencing bumps and the important US elections and Brexit deadlines are approaching.

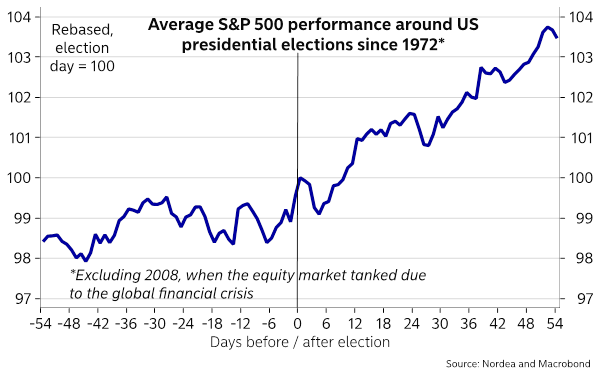

We think that uncertainty will prevail for now, and risk appetite could be under pressure over the coming month, as is often the case ahead of US presidential elections. Beyond the elections, we could see a rebound in risk appetite, irrespective of the winner – assuming that we have a clear winner, that is.

Highlights:

- We see a clear risk of EUR/USD >1.25 in (2021 forecast at 1.26)

- USD weakness is likely to be broad-based against most peers including Scandies

- Bond yields have little room to move, especially at the short end, but the curve could steepen moderately

US equities tend to rebound after election-related uncertainty abates

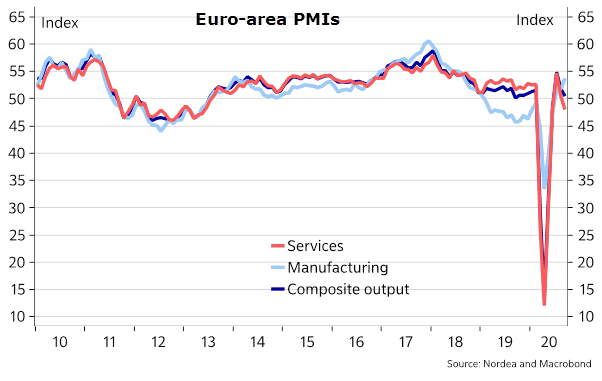

The V-shaped narrative has taken a beating in to Q4 as it is no longer “as easy” to increase activity versus the month before now that Corona restrictions are no longer eased by the month. It could be that Q4 turns into a tricky quarter for economic activity but we remain (very) upbeat on 2021 as a lagged consequence of all of the stimulus seen during 2020.

Economic recovery already experiencing some setbacks

ECB will ease again in December

Recent comments from the ECB have not illustrated a central bank in a hurry to ease further. In fact, the tone of the September meeting was surprisingly optimistic.

However, Chief Economist Lane has been clear that there has been only partial progress in combating the negative impact of the pandemic on projected inflation dynamics, while over the coming months, a richer information set will become available that will help to inform the calibration of monetary policy.

The latter is a signal often used in the Draghi-era to signal more easing was being prepared.

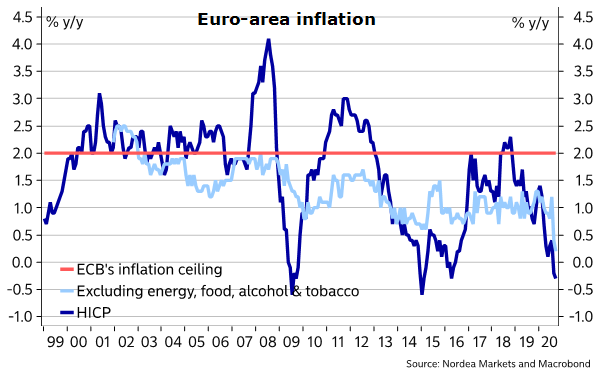

Euro-area core inflation has surprised to the downside lately and hit a record-low in September. While temporary factors, such as later summer sales and the German VAT cut, have exerted downward pressure on prices, the ECB will have a hard time disregarding the weak price data.

Market-implied inflation expectations have fallen again lately, and survey expectations show disbelief towards the symmetricity of the central bank’s target.

The ECB’s staff forecast horizon will cover 2023 for the first time in December, and a staff forecast showing inflation still clearly below target in 2023 will be hard to ignore.

Can the ECB disregard these inflation numbers?

We continue to expect the ECB to boost the Pandemic Emergency Purchase Programme (PEPP) by another EUR 500bn at the December meeting. The ECB has also been happy with the Targeted Longer-Term Refinancing Operations (TLTROs), and is likely to provide further easing via them.

The central bank will probably unveil more of these operations (currently the last one takes place in March 2021) and ease further by extending the applicability of the depo minus 50bp rate (currently the rate applies only until 23 June 2021 and will rise to the depo rate thereafter).

Rates: Limited room for steeper curves

The big picture has not changed. The sizable central bank asset purchases and a commitment to continue conducting them for a long time while keeping benchmark rates low do not leave bond yields much room on the upside. The downside, on the other hand, is limited by the reluctance to cut rates further.

In the very short term, flight-to-safety demand and disappointing economic data can still push bond yields slightly lower. However, longer out yields are more likely to rather creep higher, as the economic recovery proceeds and Covid-19-related worries gradually ease.

then, central banks seem determined to keep bond yields low to make sure that easy monetary conditions support the recovery, against the background of repeatedly having missed the inflation target. Higher real yields and their restrictive impact on the economy is a risk the central banks will rather want to avoid for quite some time.