At Danmark har ophævet alle corona-restriktioner har skabt nyheder i hele Europa, men Nordea advarer mod for stor optimisme: Europa kan i efteråret og til vinter blive ramt af en ny corona-bølge med nye lock-downs. Vaccinationer er ikke en garanti mod Delta-spedningen. I UK og Spanien taler flere om lock-downs. Den optimisme, der var i USA i sommer, er forduftet.

Don’t rule out new lock-downs in Europe this autumn/winter

Even if a country like Denmark has deemed that Covid is no longer a “socially critical” disease, we remain unconvinced that politicians in Europe won’t lock down this winter. Remember the virus seasonality.

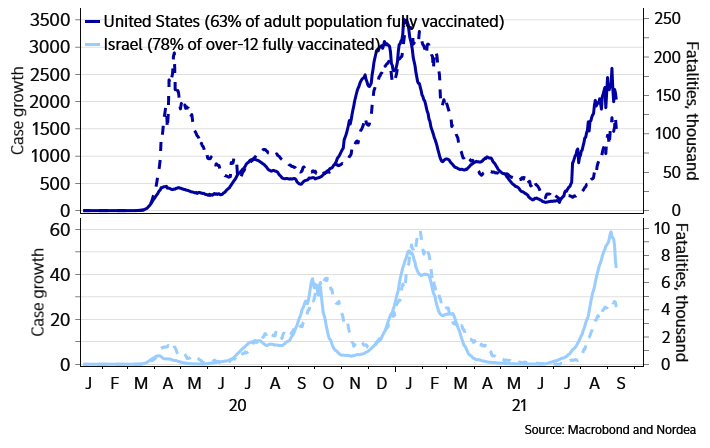

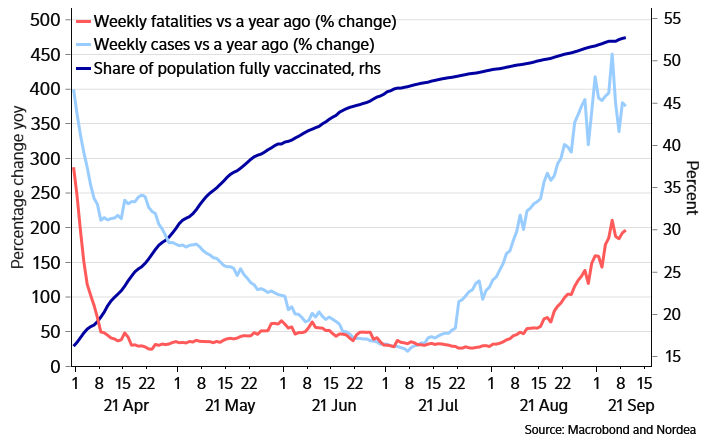

As evidenced by developments in heavily-vaccinated Israel and Iceland, vaccines aren’t helping much in preventing the virus from spreading (nor were they designed to). In the US, weekly cases are up ~45% vs a year ago while weekly fatalities are ~30% higher than a year ago, despite more than 50% of the population being fully vaccinated (semper necessitas probandi incumbit ei qui agit).

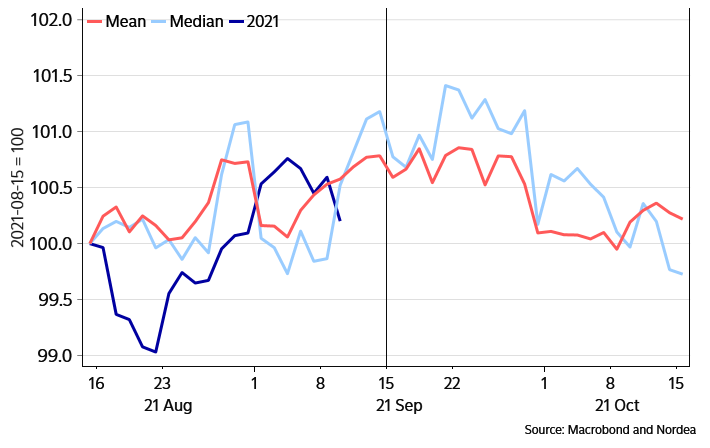

Chart 1: Vaccination rates don’t do much to depress case growth (nor fatality growth)

But, instead of US authorities admitting they oversold the vaccines, the chosen path forward is vaccination mandates and booster shots forever, at least in the land of the free and home of the brave. In Europe, we probably haven’t seen just an inch of the case count surge that is likely to hit the continent during October/November. We are yet to be convinced that continental Europe will make it through the winter without a new round of lock-downs / curfews. There are even loud lock-downista voices in Spain and UK already now.

Chart 2: Virus >> vaccines

Only two months ago, Biden came close to declaring the US’ “independence” from the virus, while saying “America is coming back together”. These are both falsehoods. We will all have to learn to live with the virus, and we see no (one) America that is coming together. Biden, by scapegoating the unvaccinated (“your refusal has cost all of us”), may help the blue tribe stick together, but will also quite likely make the red tribe even more incalcitrant.

What does this have to do with macro? Well, it may be that vaccination mandates could worsen supply constraints already evident across the US economy, especially in sectors dominated by “Red America”. Vaccination propensity is after all correlated with whether one voted Republican or not. There has already been talk of trucker shortages and nurse shortages. A New York hospital recently announced it will stop delivering babies after September 24 as too many workers have resigned over COVID vaccination mandates. Are expectant mothers expected to “just hold it in”? There has even been some talk of shortages of military personell(!)…

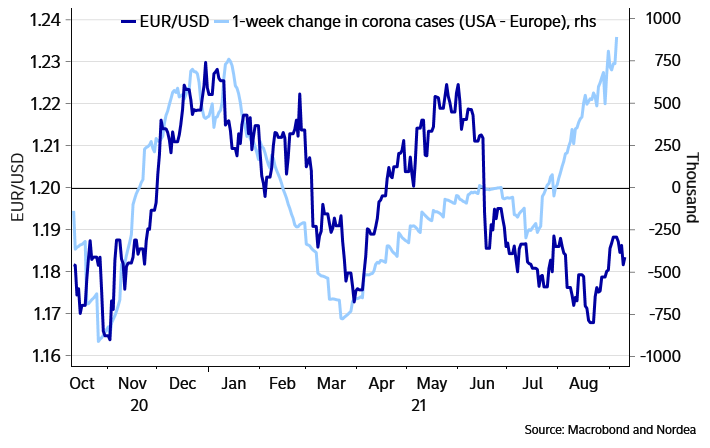

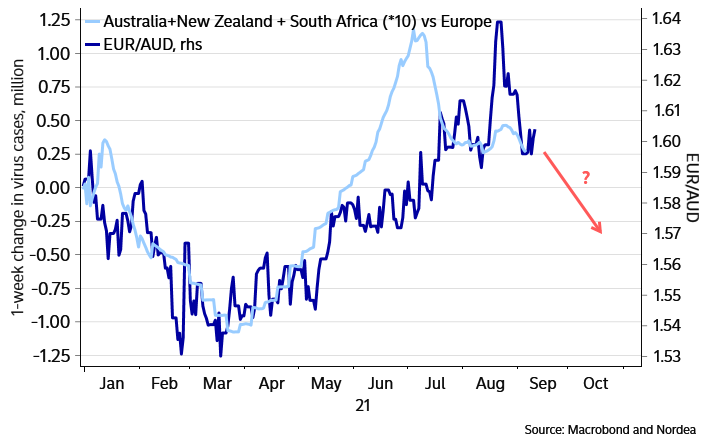

Chart 3: Virus momentum has been helpful for EUR/USD

EUR/USD has recently been underpinned by a range of factors, including focus on a “tapering” by the ECB (which continues to look misplaced in our view), hopes that the German election will fuel a green #Euroboom (probably misplaced as well, because Germans gonna German, at least if Laschet is the next kanzler), weaker US macro and lowered US Q3 GDP forecasts, relative virus news, and the months of September & October historically good news for steepeners (which in turn tend to be dollar-negative).

Chart 4: EUR/USD rises into Apple launch events, declines afterwards

What’s more, EUR/USD tends to rise ahead of Apple launch events, but level off and decline afterwards. At least that’s what the past 10 years of data is telling us. We have no idea why this should be the case, but with Tim Apple planning his next product launch September 14, we thought we’d let you know.

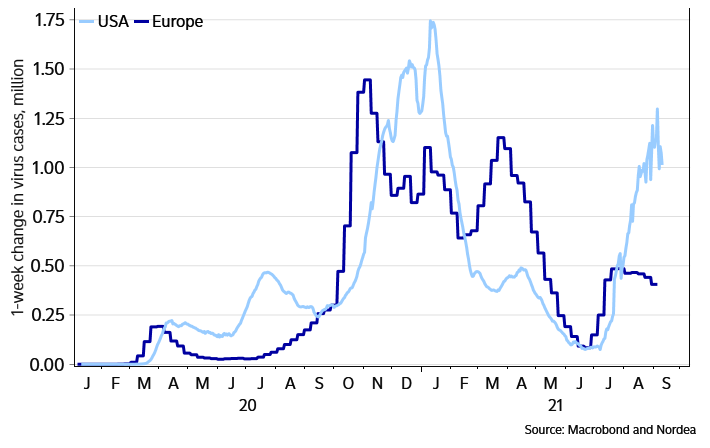

Chart 5: US virus cases surged during late summer of 2020, but Europe caught up in October

We would like to remind our readers of the virus developments in 2020. Back then US saw a pick-up in virus cases during summer, while the situation in Europe looked contained. A few months later – especially in October – the case count in Europe went on an absolute tear. It could be that this reflects different seasonality for the spread of the virus. The current #Euroboom psychology could thus get dented later this year, weighing on EUR/USD. The same applies from the weakening of China’s credit cycle, we believe.