Nordea forudser ikke blot fire amerikanske rentestigninger i år, men også fire i 2023, mens ECB vil være mere tilbageholdende i år. Dog venter Nordea, at ECB standser sine opkøb i 2023, ligesom ECB vil begynde at hæve renten i 2023. Dollaren vil svækkes i årets løb, men til næste år bliver det euroen, der styrkes. Den 10-årige amerikanske obligationsrente vil stige til 3 pct. ved slutningen af 2023, forudser Nordea.

Major forecasts: A four-by-four to contain inflation

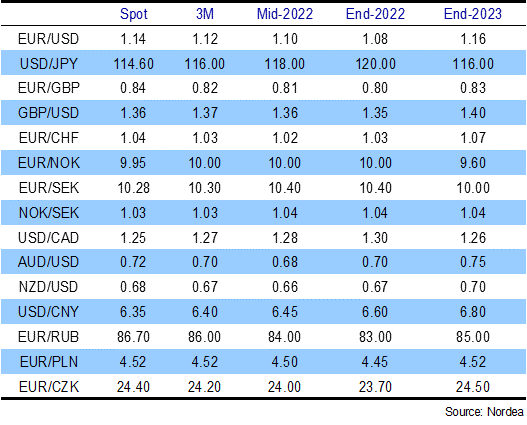

In response to rampaging US inflation, we now expect the Fed to hike rates four times this year followed by another four in 2023. We see more upside for long yields and expect EUR/USD to bottom by the end of the year.

The Fed is turning more hawkish by the day, and for good reason, as US inflation pressures are strong and persistent and will increasingly be reflected in the labour market as well. The ECB will feel some heat as well, but likely more so only next year. Against this background, we expect:

- the Fed to hike rates four times both this year and next and also decide to start contracting the balance sheet during the summer

- the ECB to stop net bond purchases in the first half of 2023 and raise rates towards the end of next year

- EUR/USD to bottom at 1.08 at the end of this year and already rebound sharply in 2023

- US 10-year yield to rise to 3% by the end of next year, but the bulk of the increase is likely to be seen already this year.

Hawks in the air

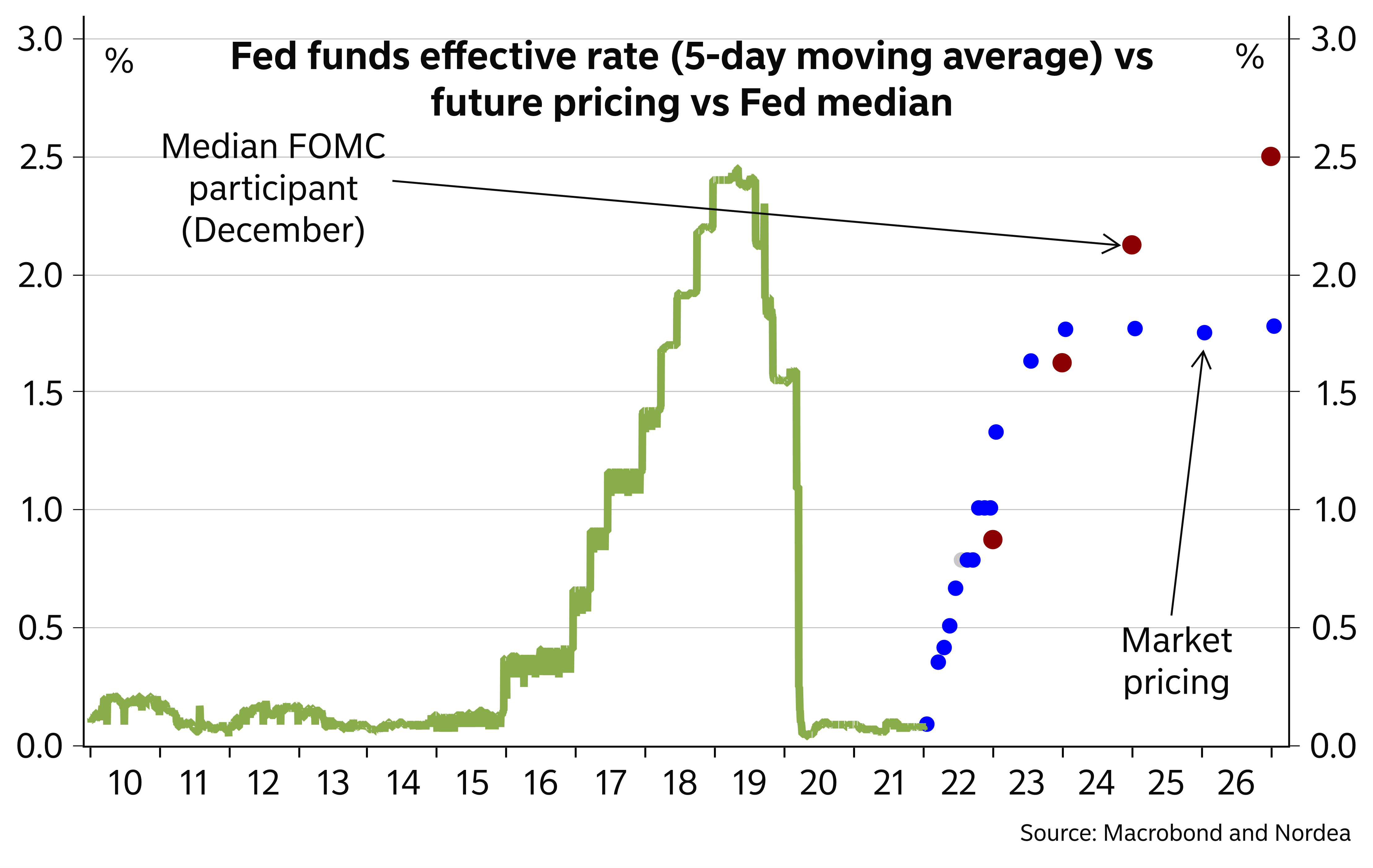

The Fed has toughened its stance and rhetoric meeting by meeting. While recent data definitely support the case that the Fed should already have started to tighten policy, the more gradual change in the Fed’s tone probably also reflects the reluctance for big changes at one go. The process of the Fed turning increasingly hawkish is unlikely to be complete yet, and the three hikes the median FOMC participant signalled at the December meeting are still likely to be less than what the Fed will eventually go for.

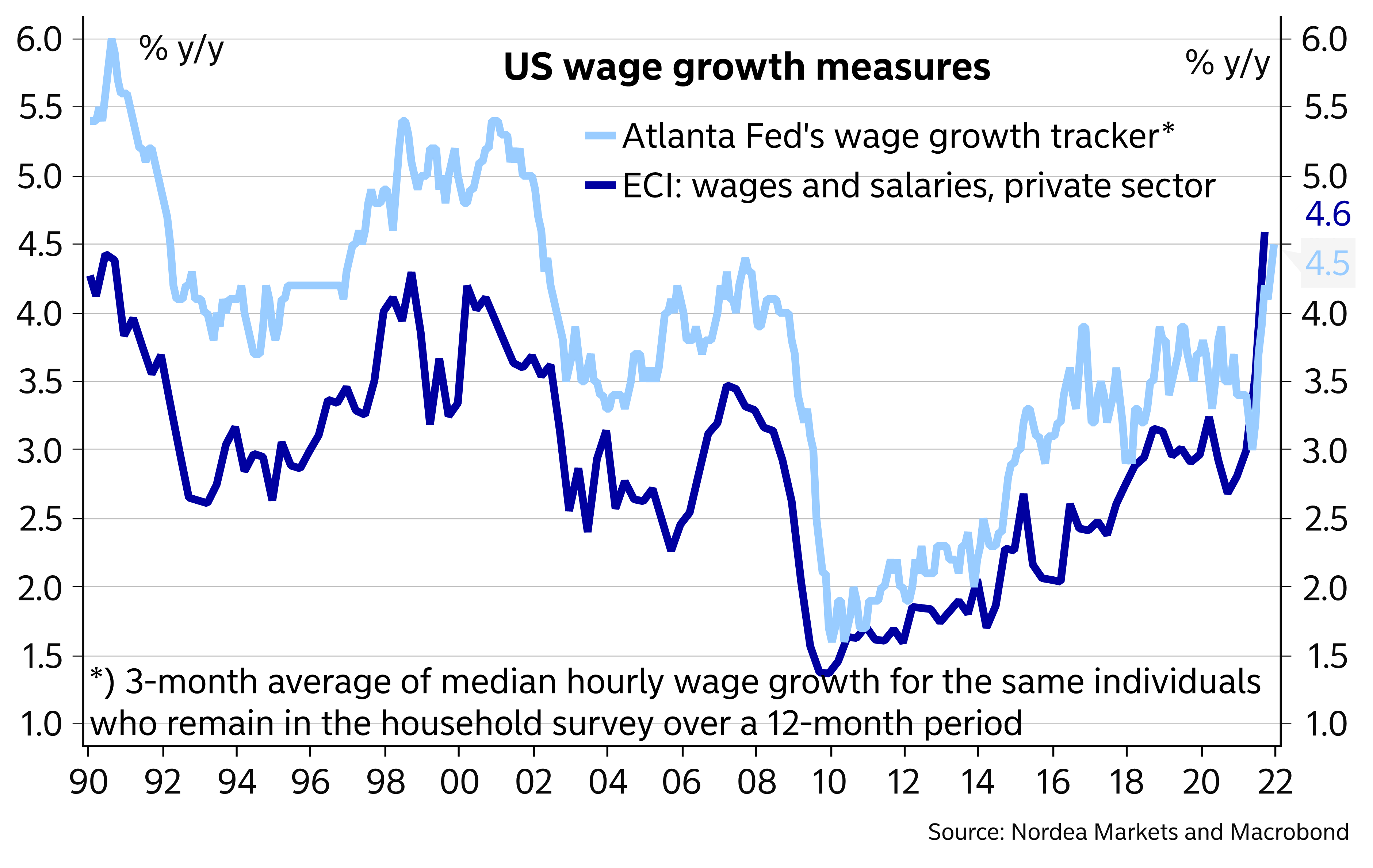

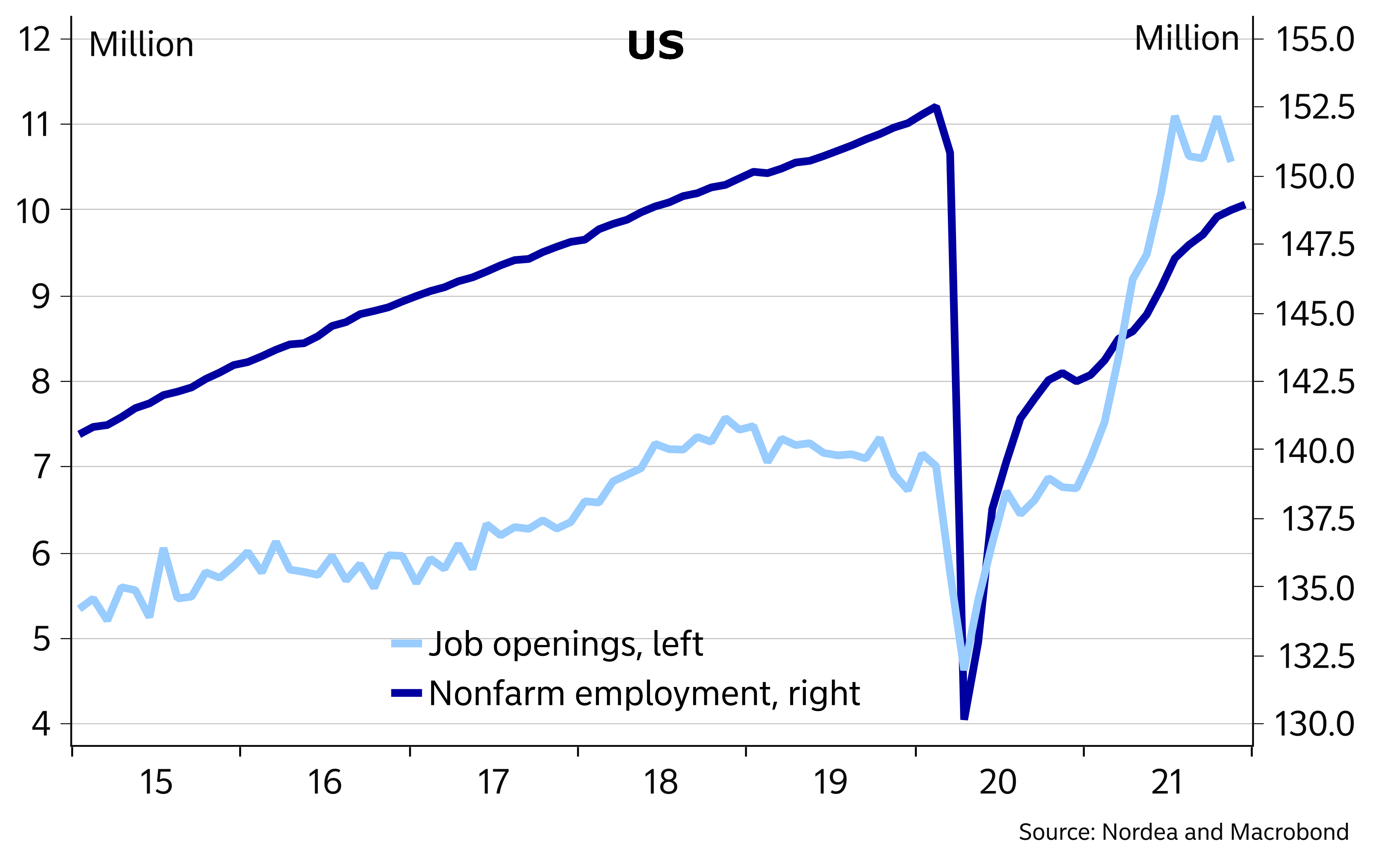

While headline inflation is likely peaking, underlying inflationary pressures look broadly based. Traditional measures of spare capacity still suggest that the labour market is not yet super tight, but wage growth has already picked up and both surveys and the number of job openings strongly suggest that shortage of labour will push wage growth further up – and keep underlying inflationary pressures elevated.

Given the challenging outlook for prices, any fine-tuning of monetary policy will clearly not be sufficient to bring inflation back to the Fed’s flexible 2% target. In response to the economic and inflation outlook together with the increasingly hawkish Fed comments, we add hikes to our baseline forecasts. We now expect the Fed to hike four times this year, starting in March, to be followed by another four in 2023.

Labour market likely already tighter than it first appears

Wage growth set to continue to pick up going forward

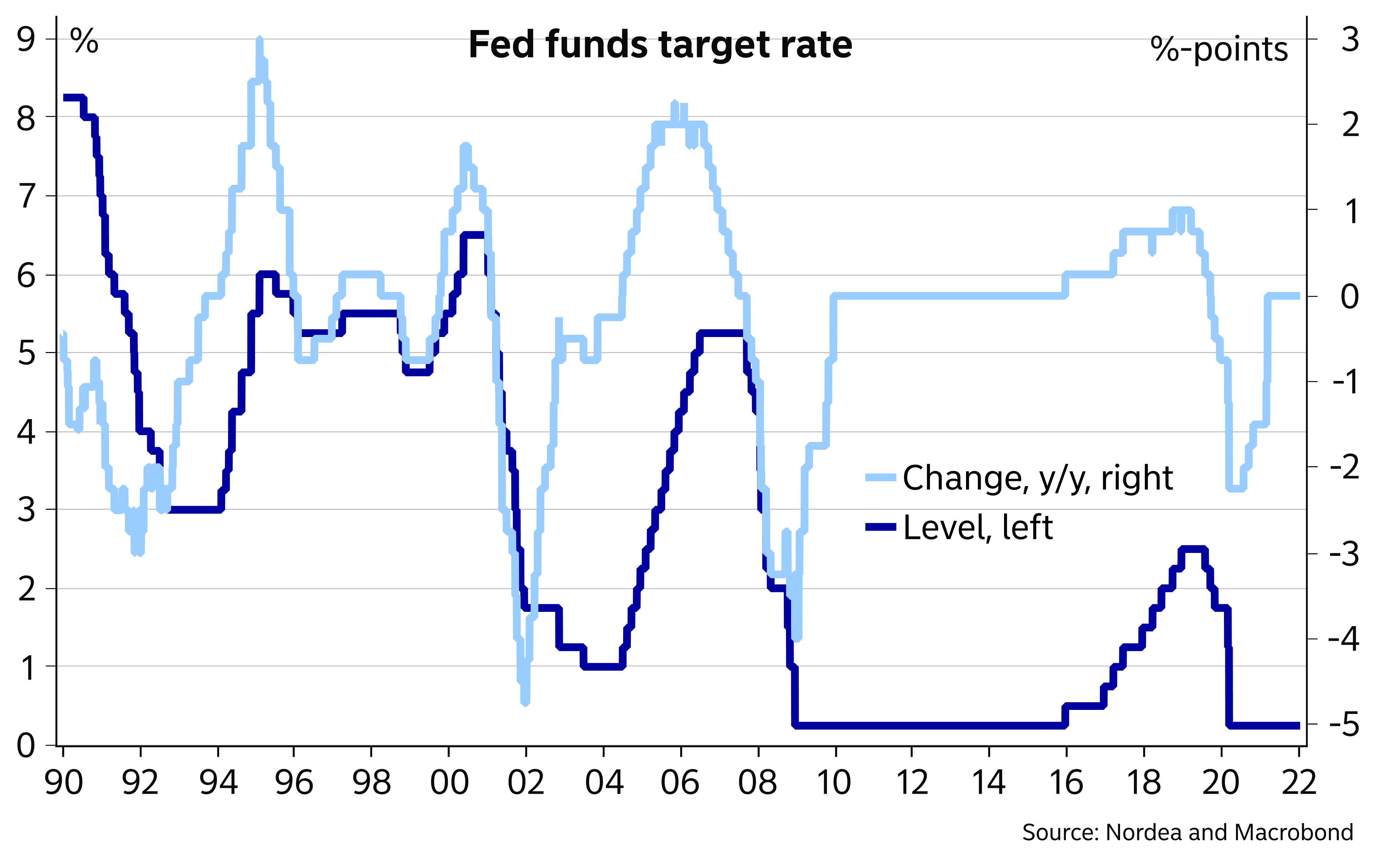

While the Fed is likely to at least start its rate hikes at a quarterly pace, that is by no means the fastest the Fed could go. While that was the pace of tightening mostly seen in the previous hiking cycle – when inflation was not the primary driver of higher rates – historically the Fed has often tightened much faster. In the hiking cycle that started in 2004, the Fed hiked rates by 25bp at every meeting, i.e. by a total of eight times a year, and at that time such a pace was considered quite gradual, or measured in the words of Alan Greenspan, the Fed Chair at the time. The risk of even faster hikes should thus by no means be disregarded if a slower pace of tightening fails to tame inflation.

Quarterly rate hikes would still be a rather moderate tightening pace historically seen

The balance sheet measures should put upward pressure on long yields as well, and help the Fed to have a desired impact at the longer end of the curve as well. Longer yields, after all, are more important for US financing conditions compared to shorter ones.

ECB approaching the target

The ECB paved the way out of the pandemic-era support measures at the December meeting. Net purchases under the Pandemic Emergency Purchase Programme (PEPP) will end by the end of March. The Asset Purchase Programme will be temporarily boosted, but after October, net purchases under that programme will return to EUR 20bn – the pace prevailing before the pandemic.

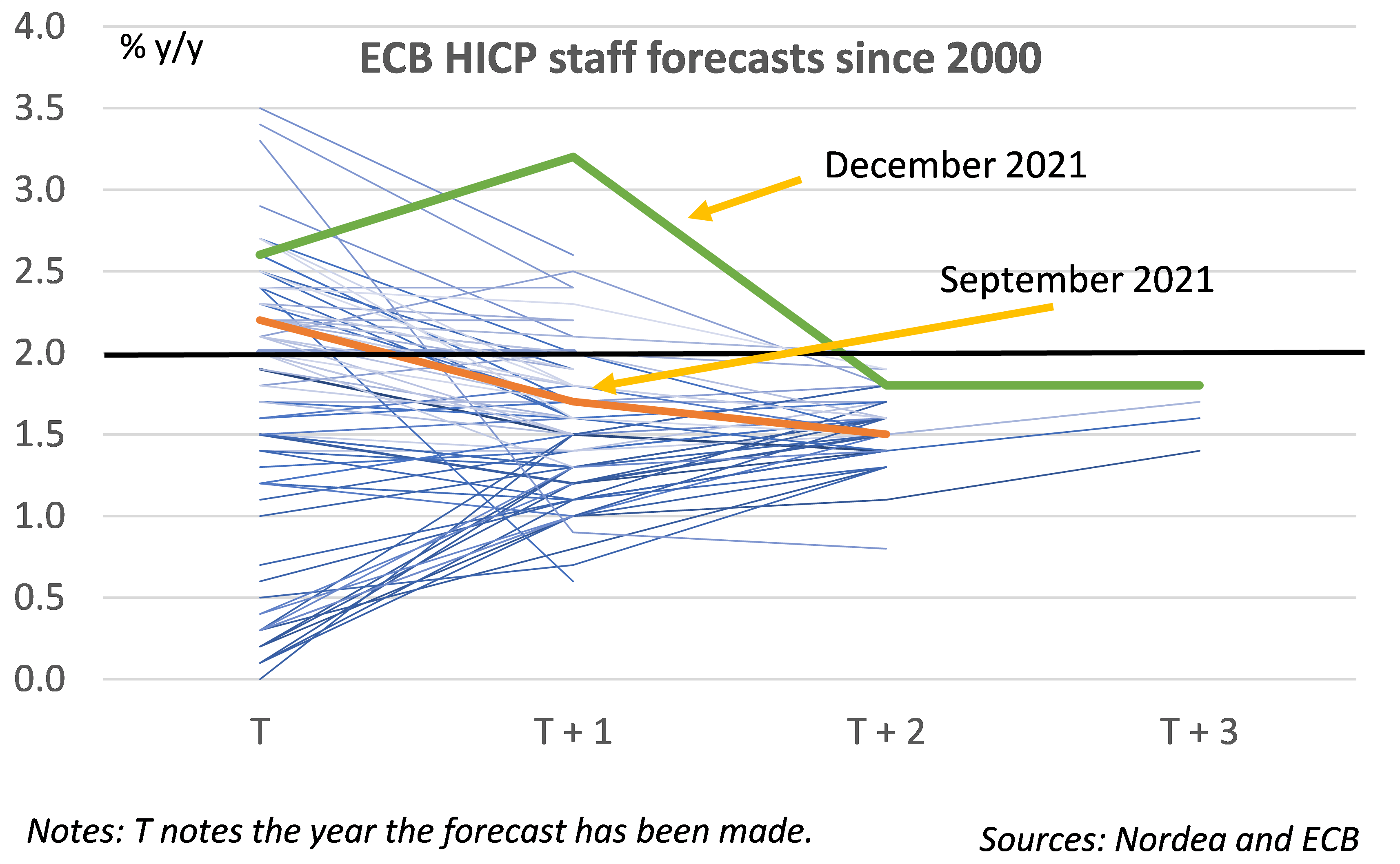

While the staff inflation forecast of 1.8% still leaves prices rising just below the 2% target in 2024, the gap is not that big. In fact, some Governing Council members have even argued that the current forecast is broadly in line with the ECB’s target. For the majority, the threshold for rate hikes has clearly not been met, but the current forecasts do not need to be adjusted that much upwards even for the ECB to start tightening its policy.

We expect the EUR 20bn pace in the APP to continue well into 2023 and end by the middle of that year. However, it is very possible that net purchases will end already at the end of this year, at least if price and wage trends this year suggest that the inflation target is within reach. Moreover, some further scepticism on the part of the Governing Council towards the effectiveness of asset purchases has been seen lately.

We continue to see the first ECB interest rate hike in late 2023, but not all risks are tilted towards a postponement of the first rate increase any more. The ECB has been rather aggressive in trying to persuade financial markets that rate hikes will not be on the table this year, but such assurances do not apply to 2023 anymore.

Latest ECB staff forecasts not that far away from the 2% target anymore

Fed to maintain steepness on the curve

There should be little doubt about the curve flattening when the Fed hikes its benchmark rates. Long yields have felt resistance to higher levels, even amidst a Fed repricing as there are doubts about the longer-term growth outlook, demographics and continued strong demand for bonds due to large central bank ownership and regulatory considerations. These issues are unlikely to dissipate quickly, which will continue to act as a brake for longer yields.

However, the Fed is not keen on a totally flat, let alone inverted, curve. This is where the balance sheet measures come into play. The Fed could try to engineer its balance sheet contraction operation in a way that maintains at least some steepness in the curve. It could even resort to asset sales if the curve starts to look too flat for the Fed’s liking. In our new forecasts, we target 3% for the US 10-year Treasury yield by the end of 2023.

In the Euro area, the forecast changes have been more modest. Even if we have not changed the call for the first ECB rate hike, we now see a better case for the market to price in slightly more monetary tightening than before by the end of next year. The overall yield levels in the Euro area remain rather modest also after the increase we are forecasting.

Fed pricing still looks modest longer out

Another year with dollar dominance

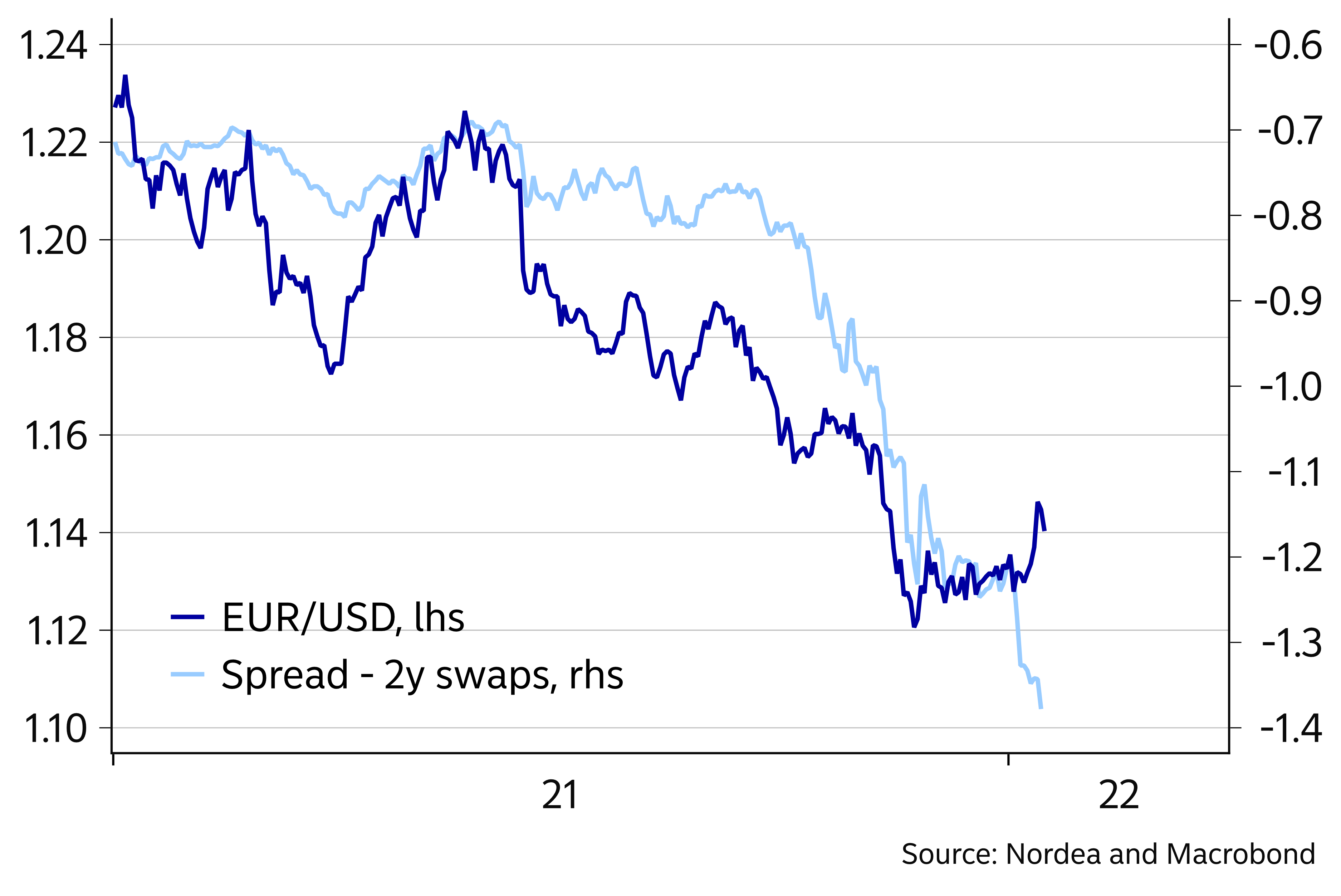

We have turned more hawkish on the Fed and that makes us stick to more dollar strength later this year. Widening of the interest rate differential in favour of the dollar was a key driver behind the move lower in EUR/USD last year, and we expect that this also will be the case again this year.

The dollar has been off to a disappointing start in the new year. The hawkish signals from the Fed have failed to lift the dollar. Instead we have seen EUR/USD move from 1.13 towards 1.15 during the first couple of weeks of the new year. But we put the weakening of the dollar down to adjustment of equity portfolios. Investors moving towards positions that are less overweight in US tech stocks. And we do not expect this to have a lasting negative impact on the dollar.

Rate differential a key driver for the dollar in 2021

Reprising of the euro down the road. At one point in time, we will get more hawkish signals from the ECB and that could trigger the beginning of a reprising of the euro. That was the case back in early 2017 when ECB president Mario Draghi stroke a more optimistic view on the outlook in the Euro area. And that could happen once again at the same time the ECB decides to bring an end to the APP programme, maybe already towards the end of this year or early next year. Hence, we look for a comeback for the euro next year even though we expect the Fed to deliver four more hikes again in 2023.

Sterling with a brighter outlook. We did not have high hopes for the sterling last year, but were proved wrong. Surprisingly hawkish signals from the Bank of England and an early rate hike in December leave the sterling on a firmer footing at the start of the new year. Inflation pressures are mounting in the UK, not least from a very tight labour market. The Bank of England is likely to tighten further although probably not by as much as the Fed. But it should be enough to lift the sterling versus the euro.

Winds will turn for the Chinese yuan. Last year, it was a big surprise to see the Chinese currency strengthening versus the US dollar despite an economic slowdown in China together with monetary easing towards the end of the year. Not even the uncertainty caused by the Chine real estate developer, Evergrande, was able to weaken the yuan. But in the next 24 months, we will see a sharp narrowing of the interest rate differential between the CNY and the USD and that should push USD/CNY higher.

Difficult year ahead for both the Swedish and the Norwegian krone. The Swedish krone struggled most of last year, especially versus the dollar but also against the euro. The Swedish krone was unable to benefit from positive equity markets as it struggles to perform when the dollar is getting stronger. The lack of hawkish signals from the Riksbank was just another drag on the SEK. And we do not expect at brighter outlook for the SEK this year.

The NOK did better than its neighbouring SEK last year, but we expect limited growth potential for the NOK in the coming 12 months. We see a balancing level for the oil price at USD 75-85 a barrel. And we see limited effect on the NOK from four rate hikes from Norges Bank when they are expected to be matched by the Fed. In recent years, the NOK har been vulnerable to global risk aversion, which is likely to hit the global markets from time to time this year. Hence, we look for another year with a bumpy ride for the NOK.