Nordea mener, at chancen for en ny amerikansk finanspakke er meget lille før valget, selv om præsident Trump ønsker en ny finanspakke, og selv om der er forhandlinger mellem finansministeren og Kongressen. Centralbanken ventes også at være paralyseret på denne side af valget. Centralbanken ønsker, at det er politikerne, der skal tage slæbet denne gang.

The one on Trump and Covid-19

Trump has caught the virus but was healthy enough to release a video from the hospital on Saturday. What happens if Trump drops out of the campaign? Meanwhile Jay Powell emerged as a stimulus consultant in a telco with Mnuchin and Pelosi.

Trump managed to tweet from his sickbed that the two sides in Congress should gather around a fiscal stimulus plan and it almost seemed as if Jay Powell was brought in to highlight to Mnuchin and Pelosi how important a new round of stimulus is for the US economy.

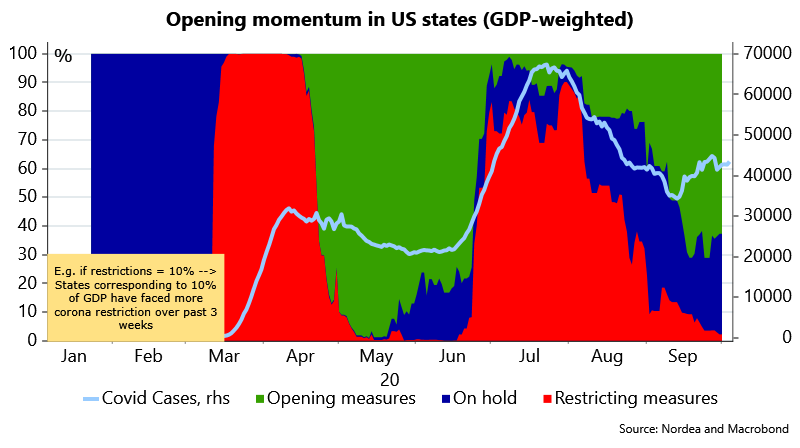

We still find the prospects of a big fiscal deal very slim ahead of the election, first as the political environment remains intoxicated by the Republican turbo-nomination of Amy Barrett for the vacant seat in the Supreme Court, but secondly also as large parts of the US economy still holds a re-opening momentum.

It is much harder to argue for a bailout when everything is open in practice, why the Oprahnomics of Q2 will not be repeated unless we get a new nationwide complete lockdown, which is essentially out of the question. The congress will likely go on a Covid-19 driven recess now, which also limits the chance of action. The big question is if it will be leaving the Fed as paralyzed as currently at least until after the election.

Chart 3. A big part of the US economy holds a reopening momentum – at least in practice

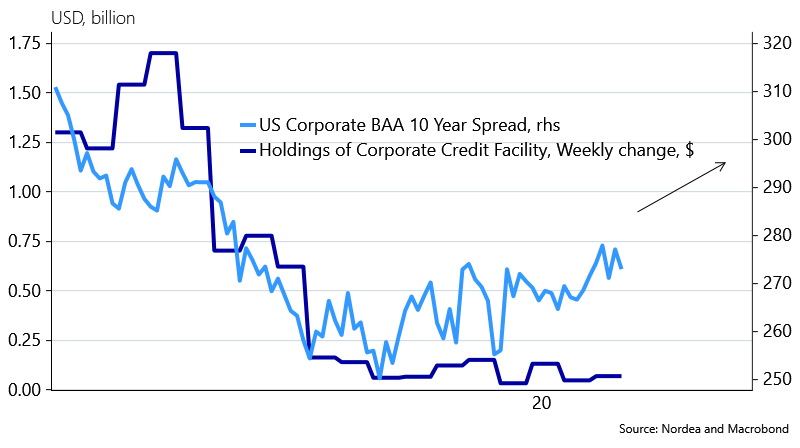

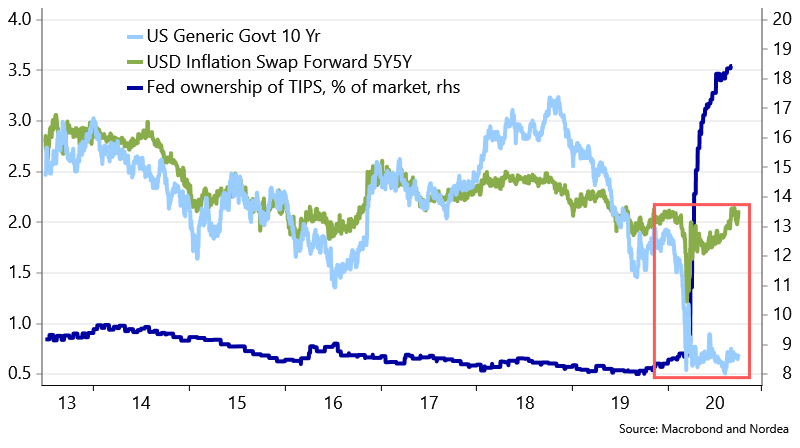

Jay Powell and the Fed is election paralyzed. The secondary market corporate credit facility is basically on pause, even if credit spreads have started to widen a little in recent weeks. The US Treasury purchases are glued to the floor of 80bn a month and the Fed has even almost decided to stop manipulating the TIPS market.

The positive take-away of this is that the Fed is probably more content with the outlook, but that take-away doesn’t really rhyme with what the important lieutenant Clarida from the FOMC has said recently.

The negative take-away is that the Fed wants politicians to do the dirty job before they increase the monetary aid again. The latter leaves a few tricky weeks ahead for risk assets, but also a potential party on the other side of the election.

Chart 4. The Fed has basically paused the SMCCF purchases

The Fed is likely to take new initiatives to signal that they mean business in this new AIT-regime. If inflation is supposed to average above 2% for a while, we probably need even easier conditions to get there.

The most obvious weapon of choice would be to continuously buy TIPS at a larger scale than issuance, while a more exorbitant choice could be to buy commodity futures in a direct attempt to prop up prices. We bet on an increased TIPS purchase tempo (and a generally higher purchase pace of US Treasuries) on the other side of the election.

Chart 5. The Fed bought a ton of TIPS in Q2 but lately the manipulation of inflation markets has abated.