Nordea mener, at meget taler for en overdreven optimisme på markedet, og at vi nærmer os et toppunkt. Men banken erkender, at markedet kan gå begge veje, så 2021 har så at sige to ansigter. Udviklingen afhænger i høj grad af den politiske udvikling i USA og af corona-vaccinens effekt på servicesektoren.

How close are we to peak bullishness?

Various fear vs. greed indicators hint of extreme optimism, so how close are we to peak optimism? We have looked at various measures, and our conclusion is that 2021 could be a year with two faces.

While most people have been busy in tribalistic debates on SoMe over the past week of complete political mayhem in the US, markets really did not care about the turbulence.

Instead, markets took the Georgia Blue Sweep as a bullish signal and not even a guy dressed as a bull at the lectern in the Senate could compete with that. Increased big-tech censorship of political candidates is on the cards and accordingly new tribalistic platforms will be formed.

This is probably not important for the short-term investment outlook, but the authors of this piece are not upbeat about the prospects of an increasingly censored or even doctored public debate. Maybe 2021 will turn in to 1984? For now, markets don’t seem to care, so let’s move on to more relevant topics.

The markets celebrated the Georgia blue sweep and find that a blue (de facto) senate majority will lead to further direct transfers and an increasingly reflationary environment. Chuck Schumer (Democrat senate minority leader) has promised to increase direct transfer cheques to 2000$, but outside of that promise, is it then crystal clear that Democrats will prove to be more reflationary than the Trump administration? We highly doubt it.

First, the idea of direct transfers was mainly “born and raised” in the Trump administration. Second, it is debatable whether the Democrats are interested in perma-subsidizing the exact groups that were represented at Capitol Hill on Wednesday – the mostly white man-dominated working class. They didn’t exactly put up a good lobbying effort on Wednesday, either.

We place our chips on LESS stimulus from Bidens administration compared to Trumps administration.

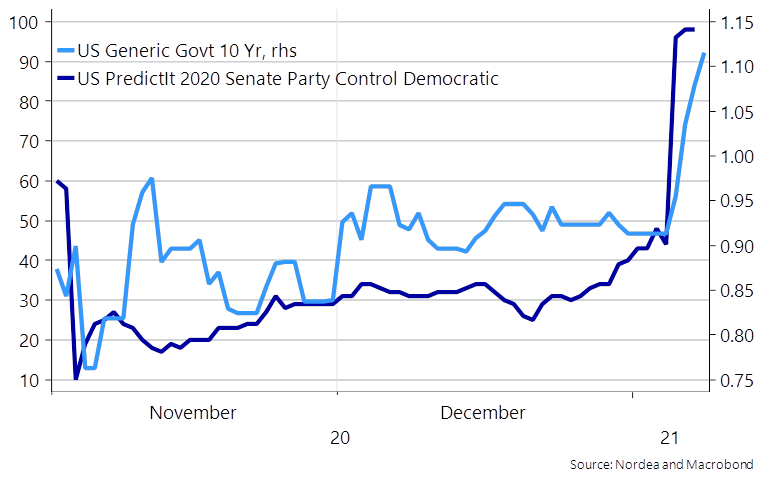

Chart 1. Blue sweep fueled the reflationary environment

Greed vs. Fear: How close are we to peak bullishness?

Various greed vs. fear indicators have started to hint of extreme optimism and a very uniform thinking/positioning. We also noted how not a single investment bank found reasons to doubt the current USD bear market in the 2021 outlooks. More than 9 out of 10 respondents found that EUR/USD would break above 1.25 during 2021 in a positioning survey of ours, which would obviously be statistically arrogant to trust. Have we all been hit by the recency bias disease by now?

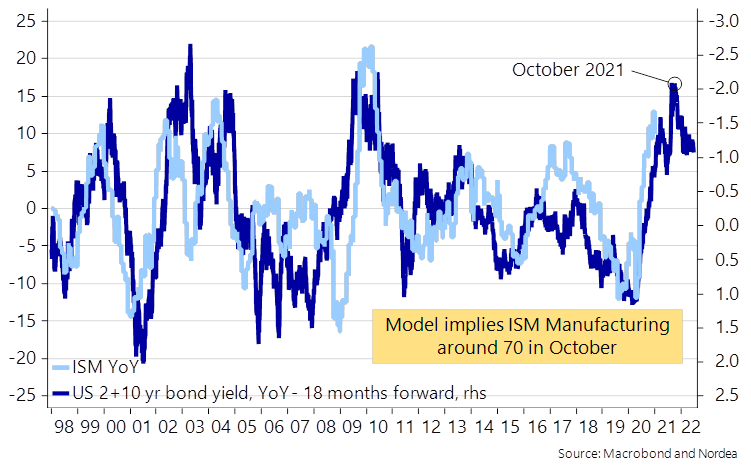

The reflationary environment has been driven mostly by the manufacturing sector so far. A combination of lagged effects of lower interest rates and catch-up effects from the supply-chain disruptions in Q2-2020 is driving manufacturing PMIs firmly higher despite new lockdowns. ISM Manufacturing recently broke through 60 only for the sixth time over the past 20 years. Is this a signal that we are about to reach peak bullishness? Let us have a look at what has happened after ISM broke through 60 historically.

Chart 2. ISM Manufacturing could go all the way to 65-70 according to our stimulus model

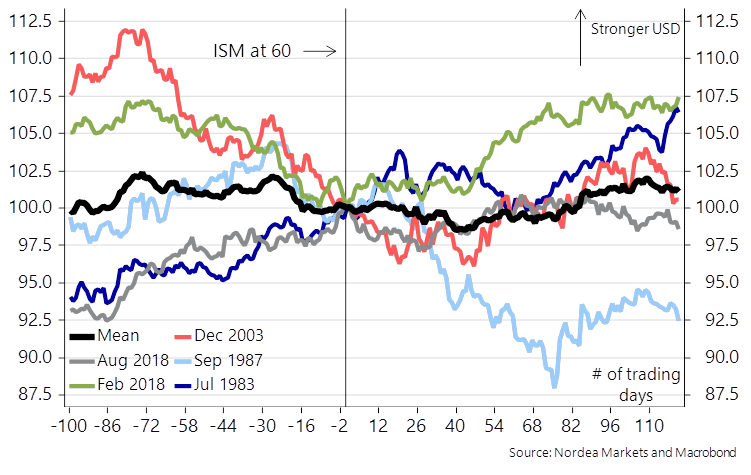

Three out of the last five times ISM Manufacturing reached 60, the USD started gaining over the following 100 trading days, while the 1987 USD bear market is the only true exception. If history is anything to go by, we may be in for a less clear USD bear market in 3-6 months from now, since the reflationary cycle will lose its steam.

Chart 3. The USD index before and after ISM hits 60

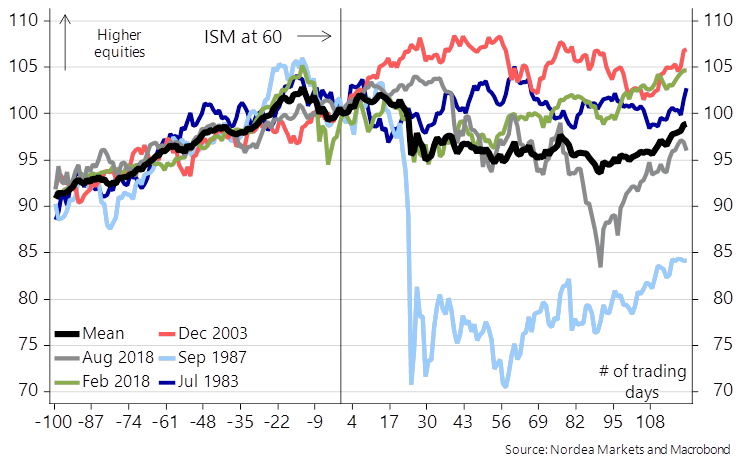

The conclusion is even clearer in risk asset space since there is generally a very uniform and solid uptrend in equities in the months leading up to ISM hitting 60, while the trend is clearly shakier in the months that follow. Equities were still higher 100 trading days later in 3 out of 5 instances, but the reflationary optimism is clearly not as certain as on the way up in ISM.

We are though not ready to scale down on risk yet, as there are reasons why this time is different.

Chart 4. S&P 500 before and after ISM hits 60

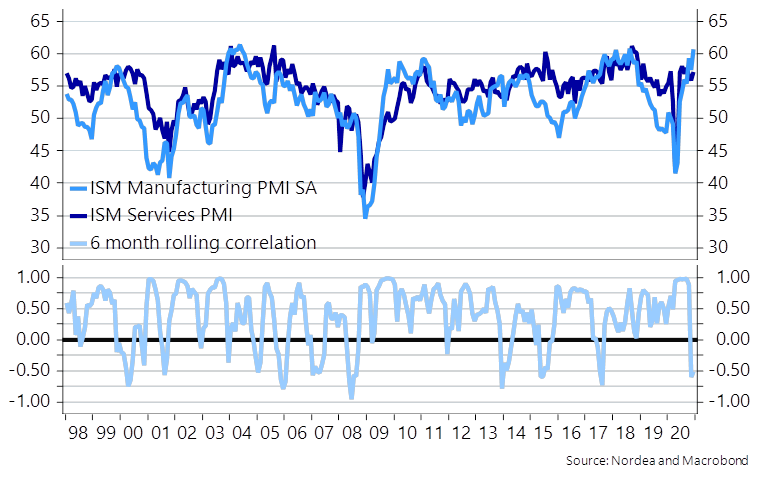

The correlation between the Manufacturing- and Service sector is generally high (and positive) but that has not been the case over the past 6 months. The service sector is clearly hit by restrictions and the Covid-19 spread, while the manufacturing sector is booming due to lagged effects of lower interest rates. This extreme discrepancy was also visible in the job report from December with many added jobs in manufacturing/construction and mass lay-offs in service sectors such as restaurant and hotels.

Assuming a decent vaccine-roll out, we could easily see a substantial pick-up in the service sector economy right when the manufacturing sector starts slowing again and in such a scenario, we would not bet that risk assets would suffer. This is rather a story for September/October and onwards in case, when the re-opening momentum of the service economy is also past its peak.

Chart 5. The correlation between Manufacturing and Services is currently clearly negative

So, when will various economies be allowed to re-open? We took a look at the global “vaccine race” (Global: Who will win the “vaccine race”?) and found both positives and negatives. If nothing changes (hopefully supply and roll-out pace will increase markedly) it will take years before even the broad at-risk-group is vaccinated.

The other potential game-changer for the USD bear market during 2021, is if the US oil producers will be able to re-launch the “self-sufficiency” campaign and re-increase production to pre-pandemic levels. The US production is already down 2-2.5 mn barrels a day, which will lead the US to import more oil again in a rebound scenario for the global economy and accordingly also start exporting USDs (via the trade deficit) again. At current oil price levels, the number of active rigs looks ripe for a decent comeback in the US, but CapEx has been surprisingly low, which could lead to (at least) an increased lag-time in the rebound of production. Domestic oil production remains vital for the USD spot level.