Nordea skriver om den kraftige intervention, som Nationalbanken har været tvunget til at foretage i september. Det har lettet presset på kronen. Nationalbanken solgte for 23,4 milliarder kr. for at undgå en styrkelse af kronen over for euroen. Den fremtidige udviklinger afhænger dog meget af udviklingen på det amerikanske aktiemarked. Hvis de danske pensionskasser i stor stil forlader de amerikanske aktier og vender hjem, kan det tvinge Nationalbanken til store interventioner.

Denmark: Large-scale intervention in run-up to interest rate cut

The Danish central bank was forced to intervene on a large scale before the sanction of an independent interest rate cut. For now the pressure on the DKK has eased but much depends on the US equity market

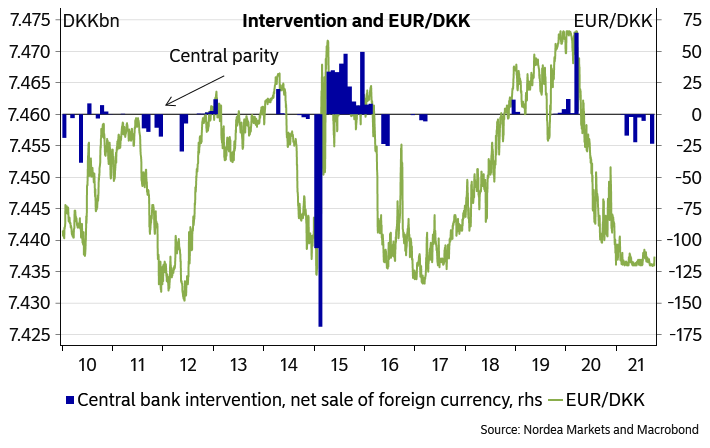

In September the Danish central bank sold DKK 23.4bn in the currency market to counter strengthening of the krone against the euro. This implies a total intervention of DKK 73bn since the start of February.

Chart 1: Intervention and EUR/DKK

Pressure on the krone has eased slightly

To counter the downward pressure on EUR/DKK the Danish central bank decided on 30 September to sanction an independent interest rate cut of 10bp. This has lifted EUR/DKK up to around 7.437, which is slightly above the level of 7.435 that according to our view marks the central bank’s lower tolerance level at the current juncture.

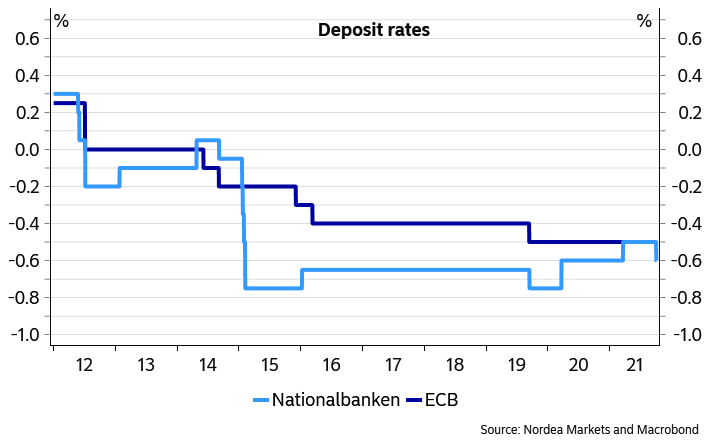

Going forward, we expect the Danish central bank to leave the deposit rate at the current level of -0.60% at least until early 2024. Over the coming months the amount of excess liquidity is expected to increase, which most likely will help further ease the pressure on the DKK.

Chart 2: Central bank deposit rates

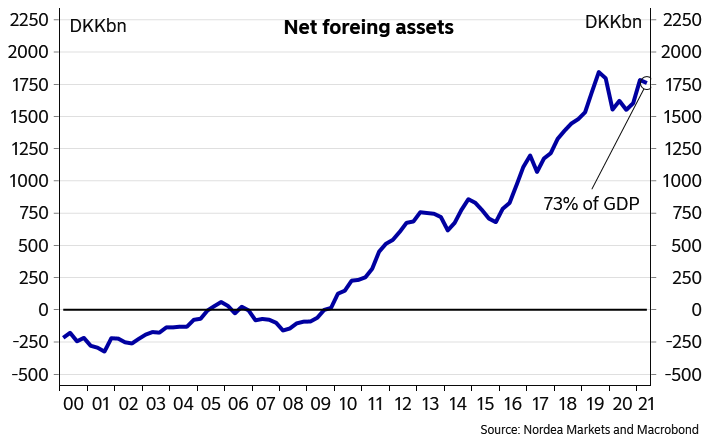

However, as recently described by the central bank the development in EUR/DKK depends very much on the US equity market. If the returns of Danish pension funds from the US equity markets continue to increase, it will likely cause more downward pressure on EUR/DKK and trigger a need for more intervention from the Danish central bank. On the other hand, if US equities fall back on a larger scale, the EUR/DKK will likely be pushed back towards the central parity of 7.462. A clear reminder of how the build-up of substantial net foreign wealth in Denmark has caused the monetary policy to be much more procyclical than previously.