Nordea hæfter sig ved, at Nationabanken er begyndt at sælge kroner for at imødegå den styrkelse af kronen, der har været igang det seneste år. Det er første gang i fire år, at Nationalbanken forsøger at svække kronen over for euroen. Nordea venter yderligere interventioner i marts, men tror dog ikke på en uafhængig rentesænkning.

Danish central bank has restarted intervention – and more is underway

The Danish central bank has started selling DKK to defend the peg. This is the first time in almost four years that the bank has tried to force EUR/DKK higher. More intervention is expected in the coming months.

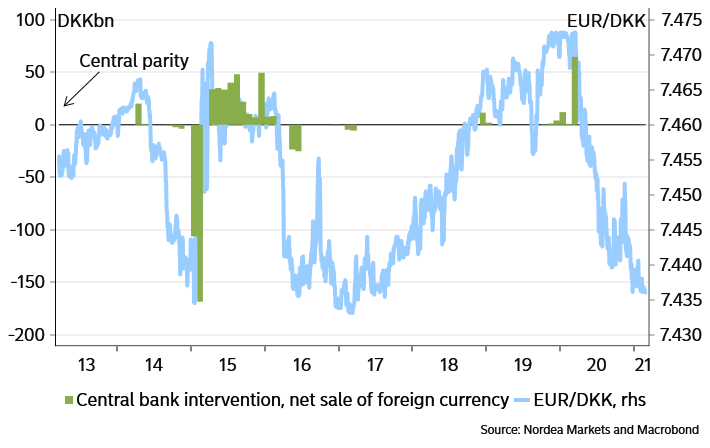

In February the Danish central bank sold DKK 0.4bn in the currency market to counter strengthening of the krone against the euro. This was the first time since March 2020 that the central bank had to intervene to keep the EUR/DKK cross within the desired range – and the first time since March 2017 that the intervention took place to counter strengthening of the DKK.

Chart 1: Intervention and EUR/DKK

The central bank’s selling in February marks the tentative culmination of a long period with a gradually stronger DKK versus the EUR. Since the independent Danish interest rate hike in March 2020, EUR/DKK has moved from above 7.470 to the current level around 7.436.

As usual the central bank has not revealed the exact EUR/DKK level where it intervened in February. However, judging from the development in EUR/DKK during the month it seems like at level slightly above 7.435 marks the lower tolerance level for the central bank at the current juncture.

More intervention is likely

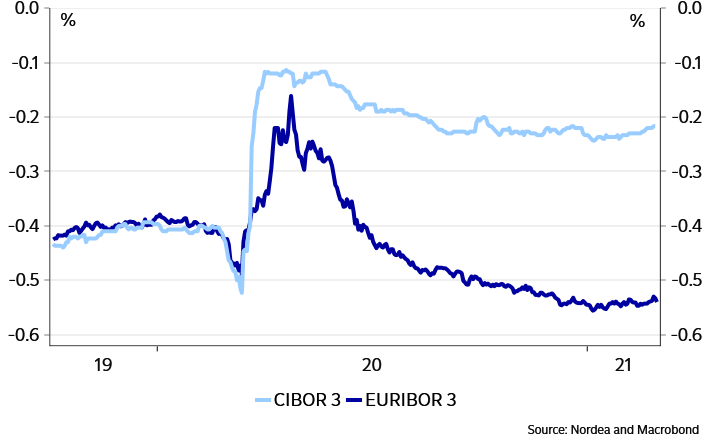

The key reason for the downward pressure on EUR/DKK is the very low excess liquidity that spills over to a very large spread between money market rates in Denmark and the Euro area.

Chart 2: Large spreads between money market rates in Denmark and the Euro area

According to our estimates the amount of excess liquidity in the Danish money market will be squeezed even further towards the end of March. This will most likely trigger more intervention from the central bank and probably also on a larger scale compared to February. Despite this we do not expect the intervention to trigger an independent Danish rate cut. We consequently expect the central bank to keep its certificate of deposit rate unchanged at -0.60% at least until end-2022.