Nationalbanken intervenerede igen i juli ved at sælge 5 milliarder kroner – for at hindre en for stærk krone. Det har bragt den samlede intervention på 50 milliarder kr. siden februar. Men Nordea tror ikke, det vil føre til en snarlig rentesænkning. Det sker ikke i år, men først i begyndelsen af 2022, mener banken. Likviditeten er blevet kraftig.

DKK: Renewed intervention in July, but a cut is not around the corner

Nationalbanken sold 5bn DKK in July, which brings the total since Feb close to 50bn, but we still find that a cut is off the table for now. Liquidity is now increasing leading to improved predictability, meaning that CITA fixings could drop anyway

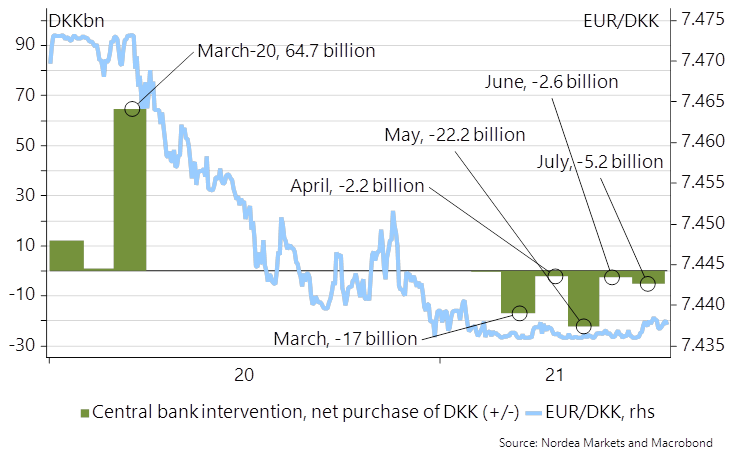

It has been one-way traffic in EUR/DKK since the early parts of 2021, and the central bank has now intervened against a strong DKK every single month since February. In July, the central bank sold 5bn DKK (and bought foreign FX), which takes the total since February close to 50bn DKK. Judging from the price action, the central bank hasn’t intervened since early July, due to the currently easing pressure in EUR/DKK spot.

Chart 1. Six straight months of FX intervention against a strong DKK, but March-2020 is not even undone yet

It smells a bit like a rate cut, but we still find that the Danish central bank is very patient on this agenda. It makes a lot of sense to keep adding DKK liquidity to the system instead of cutting. We deem that the central bank (at least) wants to un-do the more than 65bn DKK that were bought during the midst of the Corona-storm in 2020 before they consider a cut. We are still some 15bn DKKs away from that target leaving at least another three or four months without a cut, even with the current intervention pace.

There are good reasons to expect the intervention pace to fade during the next 2-3 months as 1) equities are seasonally weak, which will keep domestic institutional hedging flows muted, 2) the added DKK liquidity is about to ease some of the worst liquidity constraints seen in the DKK market in years and 3) the dividend season turns DKK-positive during August.

Hence, we are still not ready to add a cut to our forecast profile for Nationalbanken this year. A cut is in play during April and May-2022 (the strongest DKK season during the year), but we still find that the risk is low ahead of that. It may not matter a whole lot for the direction of market bets that we like, as a flood of DKK liquidity has arrived, which may compress liquidity premiums in DKK fixings again. More below.

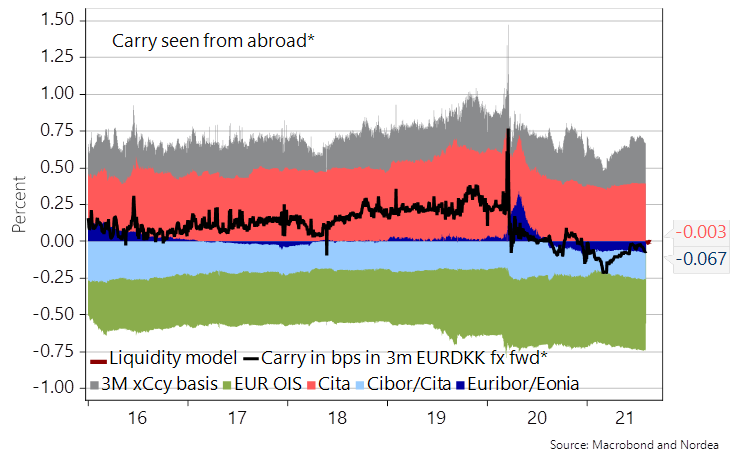

A truckload of DKK liquidity has arrived

The liquidity levels will reach >DKK 225bn and the daily liquidity increase could be as material as 40-45bn DKK today as almost all VAT payments are postponed in July (and paid in August), which effectively means that a big drawdown on the government account is to be expected. Current 3m EUR/DKK forward levels roll at almost 6.7 bp annualized (mid), which means that Danish hedgers of EUR assets opportunistically could utilize the current window to increase and/or extend EUR hedges.

We expect the annualized roll in EUR/DKK forwards to “fold like a lawn chair” in the coming weeks and see the 3m month forwards rolling around flat levels to EUR as the fair value. This effectively also means tighter DKK-EUR spreads in the front-end!

Chart 2. DKK-EUR spreads to fold like a lawn chair. A 3-month EURDKK forward to roll around 0 bps annualized