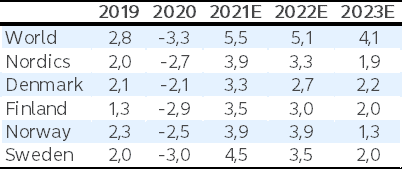

Ifølge Nordeas nye Economic Outlook er de nordiske lande kommet tilbage på niveauet fra før-pandemien, selv om coronakrisen langt fra er overstået. Men i alle de nordiske lande har myndighederne fået styr på pandemien. Hele Norden får en vækst i år på 3,9 pct., vurderer Nordea, men så falder vækstraten over de følgende to år. Danmark er det nordiske land, der får den laveste vækst, på 3,3 pct. i år og 2,7 pct. næste år og 2,2 pct. i 2023. Den globale vækst ventes at blive på 5,5 pct. i år. Også den ventes at falde i de kommende to år.

Nordea Economic Outlook: A new phase

The new Economic Outlook is out now!

The pandemic is far from over, but the global economic outlook remains benign. We expect global growth to land at 5.5% this year, before slowing to 5.1% and 4.1% in 2022 and 2023. Inflation has risen sharply, and it may stabilise at a higher level than seen in many years.

In the Nordics, the spread of the virus is under control, the last remaining restrictions are being lifted and growth is high. Pre-pandemic levels of production has been reached in all countries and we now enter a new phase where the need for further economic policy stimulus must be reviewed.

The Danish economy has moved from deep crisis to a risk of overheating in record time. Overall economic activity now exceeds pre-pandemic levels and the fast recovery requires full flexibility of the labour market and considerable adaptability in terms of economic policy. The housing market appears to be normalising after a period of very large price increases. Consumer prices have started to rise faster than previously and there are signs of mounting wage pressures.

In Finland, economic growth was strong during the summer. GDP reached the pre-pandemic level in the second quarter of 2021. The good export performance has initiated machinery investments and construction investments are benefitting from a strong housing market demand. Strong employment growth and gradually decreasing household savings rate is fuelling private consumption.

The Norwegian economy has now regained all the ground lost during the coronavirus crisis. Unemployment has dropped sharply in sync with the reopening of society. At the same time, the number of job vacancies is record high and signs of mismatch in the labour market are emerging – which could lead to higher wage growth. The housing market rally is over and prices will likely flatten going forward. Norges Bank will start normalising interest rates in September this year.

The Swedish economy is entering a new phase where high resource utilisation will hamper production growth. Growth is set to become more widespread, with investment as a key driver alongside exports and household consumption. Labour shortages will give rise to increasing concern and wage growth will pick up. Inflation will rise due to higher commodity prices and elevated transportation costs, however not persistent enough for the Riksbank to tighten monetary policy.

Source: Nordea Markets