Norge får en styrtende indtjening på den europæiske energikrise, som skyldes Ruslands krig i Ukraine. Den norske regering ventes at få en indtjening på salg af olie og gas på 1500 milliarder norske kroner, vurderer Nordea. Det vil stige til 1900 milliarder til næste år for at falde til 1500 milliarder i 2024. Den enorme indtjening skal ses i lyset af, at den norske stat i årevis har haft årlige indtægter på 250-300 milliarder kr. Nu er indtjeningen blevet mindst fem gange så stor.

Perfect storm in Europe, huge windfall for Norway

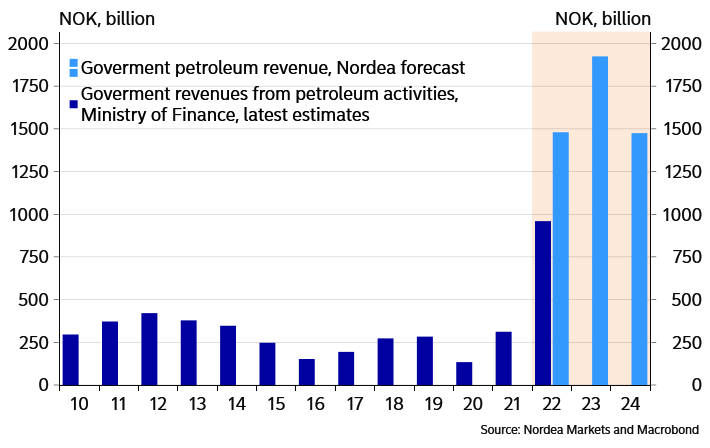

The perfect storm in European energy markets will lead to a huge windfall for the Norwegian government. For 2022, petroleum revenues could amount 1500 billion NOK. Next year, this figure could be surpassed, with estimated revenues at 1900 billion NOK

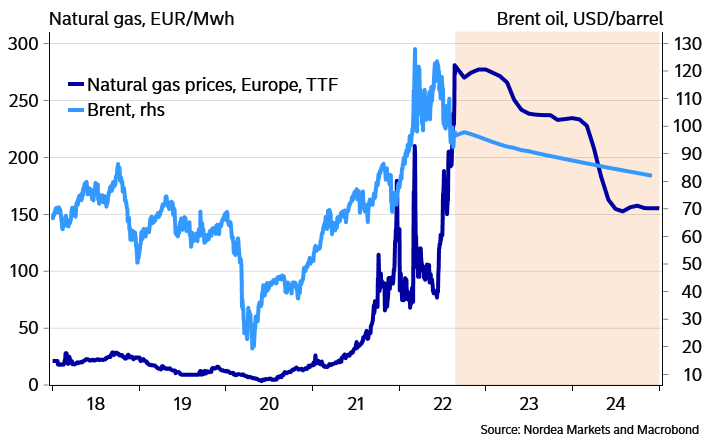

The perfect storm in European energy markets – lower Russian gas exports, extreme heat and drought which have led to problems with transportation of energy goods and French nuclear production – will likely lead to a huge windfall for the Norwegian government. If spot prices for gas and oil develop along the line of the current futures curves – and this is a big if given the extreme volatility – the 2022 petroleum revenues for the Norwegian Government will amount to almost 1500 billion NOK compared to their latest forecast at 960 billion NOK.

In 2023, revenues could rise further and end up close to 1900 billion NOK, before falling back to around 1500 billion NOK in 2024. These estimates include petroleum taxes paid by private E&P companies and the revenue from the government’s own petroleum activities via the State’s Direct Financial Interest (SDFI). In comparison, revenues in 2021 were around 830 billion NOK, which was a new record. The Norwegian oil fund’s value is currently estimated at 12 000 billion NOK, hence, this year’s petroleum revenues could easily end up being 12,5% of the current fund value.

Chart 1: Norwegian goverment petroleum revenues

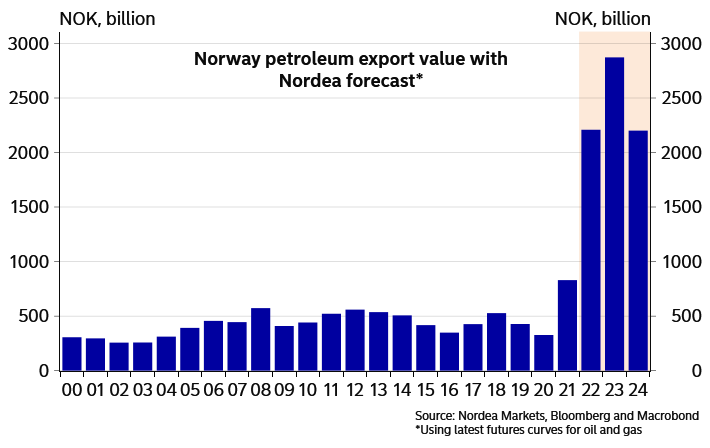

New records for Norwegian petroleum exports are in sight

Norwegian petroleum exports amounted around 830 billion NOK in 2021, around a doubling from the last few years. So far this year, Norway has exported close to 910 billion NOK worth of oil and gas, concluding July. We have five more moths left of 2022 and given the extreme situation for European energy prices, in particular gas, we estimate that Norwegian petroleum exports in 2022 will end up around 2200 billion NOK.

This calculation is based on futures curves and a projection of Norwegian oil and gas production. Moreover, and again given today’s future curves, we estimate petroleum exports at around 2900 billion NOK for 2023 and 2200 billion NOK for 2024. Thus, we are set to see new records for Norwegian petroleum exports in the months to come.