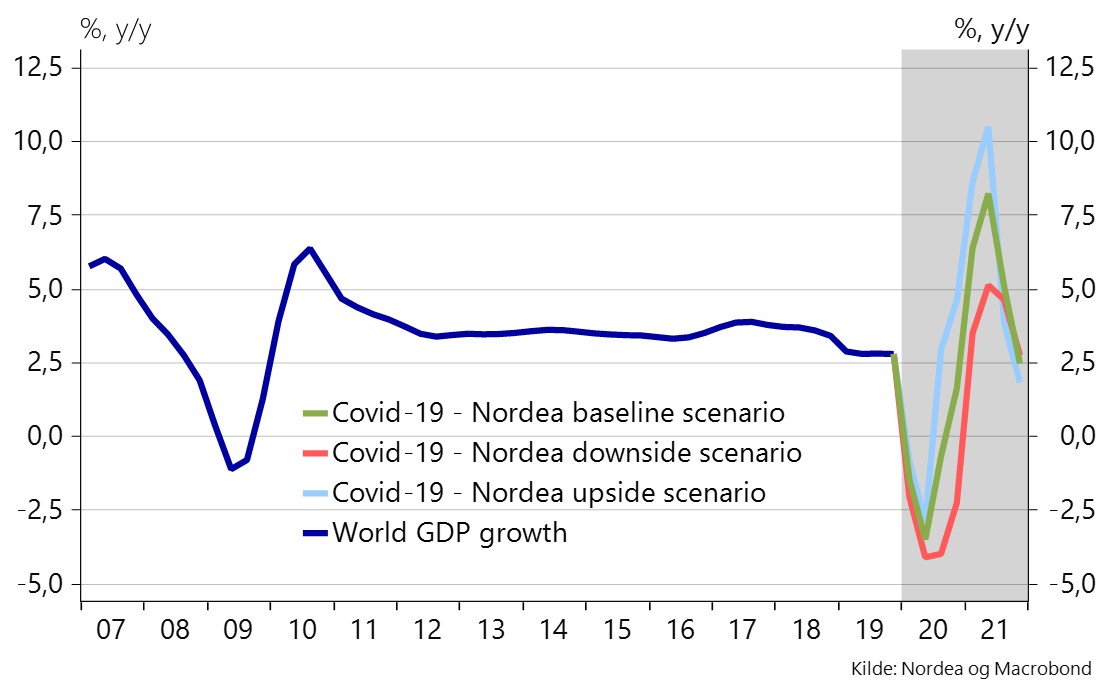

Nordea har lavet tre scenarier for coronakrisens udfald. De viser alle langt værre konsekvenser end finanskrisen i 2008-9 – med negativ vækst på mellem 2,5 og 4 pct.

Uddrag fra Nordea:

The global coronavirus recession

The coronavirus outbreak has now evolved into a pandemic with serious consequences for the world economy. We outline three scenarios for the global economy: Our new baseline indicates negative growth of around 1% for 2020.

Figure 1: Deeper than during the financial crisis

The coronavirus outbreak has now evolved into a pandemic with serious consequences for the world economy. The situation has been evolving almost on a daily basis with still more countries closing borders and locking down societies to contain the diffusion of the virus. Also on an almost daily basis finance ministers and central banks around the world has eased economic policy globally at an unprecedented scale to mitigate the economic consequences of the coronavirus outbreak.

This obviously makes it incredibly difficult to assess the impact of the coronavirus outbreak on growth globally. However, incoming data from China gives a first hint of the magnitude of the shock, while there are still only a few key figures from the US and the Euro to lean to for guidance.

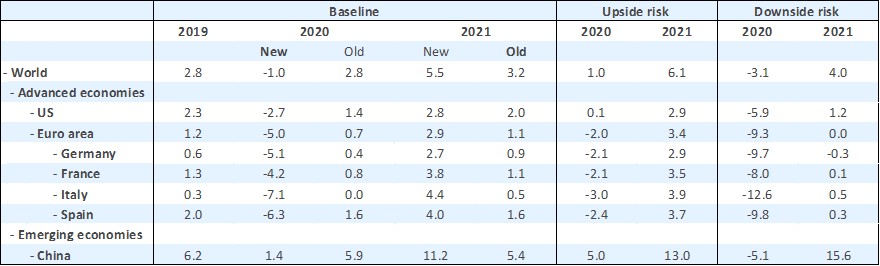

In this research note, we make assumptions on the degree and extend to which production in various sectors have been shut down in China, the US and the Euro area, followed by assumptions regarding the subsequent recovery. The results are presented in three scenarios for the global economy:

- An U-shaped baseline scenario with a deep shock and some quarters of very low activity before the recovery takes hold;

- An V-shaped upside risk scenario with a faster recovery;

- A L-shaped downside risk scenario, where the downturn will prove lengthy.

Table 1. Growth scenarios

The baseline scenario

The initial shock from the coronavirus to global economic activity will be huge, probably at least comparable to the two worst quarters during the global financial crisis.

Extraordinary measures to contain the spread of the virus have had a dramatic impact on economic activity in Q1 and will last throughout the most of Q2, at least. The longer the lock down, the bigger the consequences for the sectors that have been hit the hardest, like tourism, restaurants, hotels. There will be defaults, bankruptcies and unemployment will rise. Households and business will remain cautious.

Never the less, the recovery will be strong once it takes hold. Large-scale fiscal and monetary policy measures have been implemented swiftly and are likely to keep most of the big economies intact, paving the way for most sectors to return to normal activity relatively fast. Pent-up demand is likely to be unleashed after many weeks of lockdown.

We expect global growth to be around -1% in 2020 followed by +5.5% in 2021 in the U-shaped baseline scenario. That is 3.8% points lower for 2020 than in our Economic Outlook from late January, showing just how fast things have evolved.

The upside risk scenario

The positive risk scenario looks much like the baseline U-shaped scenario, but the recovery is faster, like a V-shape.

The virus outbreak is being contained and the number of critical cases is kept controlled as the containment strategies works and weather conditions improves. The very significant policy easing that has been implemented will provide the economies with a massive boost once the recovery gets started. Many of the crisis facilities that were implemented gradually during the global financial crisis have been in place at the onset of the current crisis, leading to a faster and more decisive policy responses, which bodes well for a fast recovery.

In this scenario we expect global growth to end around 1% in 2020 and 6% in 2021.

The downside risk scenario

Several risks have the potential to make any eventual recovery very gradual and seem more like an L-shape than a U-shape.

The virus could come back in a an aggressive second and even third wave, prompting the shutdown to continue for much longer than earlier expected and even much more severe repercussions to the economy. The number of unemployed people rises sharply in line with major defaults and close downs of companies. Consumption and investment activity remains depressed. Real estate prices plummets, credit risks rises further, spreads are widening, and banks will be burdened by bad loans. An outright financial sector crisis will extend the downturn and make the recovery much shallower.

China

We expect the Chinese GDP to contract by around 10% in the first quarter of 2020 compared to the year before. Most sectors have taken a hit from the outbreak: numbers from retail sales, fixed asset investments and manufacturing all showed drops in a range of 10-25%.

Looking forward, the biggest challenge to the Chinese economy is not on the supply side as production is close to full capacity by the end of March. Rather, demand will likely see a slow and uneven recovery in the second quarter of 2020. The outbreak still not being contained as well as uncertainty about income compensation during the lockdowns cast a shadow on household consumption. The policy makers support growth through public infrastructure investments but are unwilling to overstimulate the economy. Thus, the overall growth is expected at 1.4% in 2020.

In a positive scenario, Chinese consumers have experienced little income losses during the quarantines and their propensity to spend is quickly restored. Although the weak global economy will restrict export development, China’s annual growth will be around 5%.

In a negative scenario, confidence is lost for longer, perhaps due to the fear of a second-wave outbreak. In that scenario, recovery rate is very weak and the Chinese economy will contract by 5% in 2020.

The US

In the US, our baseline scenario is that GDP growth for 2020 will decline by 2.7%, which is worse than during the Global Financial crisis. Supply chains slowly began feeling the disruptions from China in February, and with the partial lockdown now in place, we expect Q1 to be the weakest since Q1 2009. It is though nothing compared to Q2 where we forecast an unprecedented decline in GDP growth of 18.4% q/q ann. Hence, the longest expansion US history is over. A deep recession is coming.

There is, however, hope of a recovery in the second half of the year with the Fed firing yet another QE bazooka this week (Fed Watch: Unlimited QE), Congress injecting fiscal stimulus and most importantly a (hopefully) return to non-corona normalisation. Still, we expect the output gap to remain large with second round effects and lingering uncertainty putting a lid on growth in Q3.

In our worst case scenario, we assume that the partial lockdown continues throughout May and that the recovery rate is slow in June. This could take Q2 GDP growth to -28.4% q/q ann. In our best case, we still do not think a recession is unavoidable, but we assume a faster recovery in especially Q3.

The Euro area

Europe has rapidly become the epicentre of coronavirus infections. As a result, containment measures have been very rigorous, with many countries in partial or full lockdown, leading to a large drop in activity at the end of the first quarter, running into the second. There is no hard data to confirm this yet, but the first sentiment indicators for March suggest that the coming Euro-area numbers can follow in the footsteps of China’s awful data for February. The worst hit for the moment is Italy, which will bear more of the damage already in the first quarter, followed by Spain.

We see contraction in 2020 growth as inevitable, in all three scenarios (V, U and L). The measures taken by the ECB and the governments will not prevent a steep drop in activity in the first half of the year, deeper than in the financial crisis, but may be strong enough to avoid a credit crunch and help the economy to get back on track after the virus is brought under control. This is our baseline scenario (U-shaped), in which y/y growth in 2020 will be -5%, followed by a rebound in 2021. The downside risks to this scenario are rising as longer closures of shops, factories and schools deepen and extend the drop dramatically and make it very challenging for policymakers to provide enough stimulus to be able to return to “business as usual” after this period is over.