Den europæiske inflation satte rekord i juli med 8,9 pct., og den udvikling vil fortsætte, vurderer Nordea. Det vil skade væksten, selv om den var overraskende høj i juli med 0,7 pct. Gaspriserne er kommet tilbage på det meget høje niveau som følge af Ruslands krig i Ukraine.

Euro-area: Record-high inflation hurts growth prospects

Euro-area inflation continued at record-high levels in July and will do so in the coming months. High inflation and uncertainty around energy supplies hurt economic outlook and we expect growth numbers to collapse after a positive GDP surprise in Q2.

Euro-area economy and inflation in a nutshell:

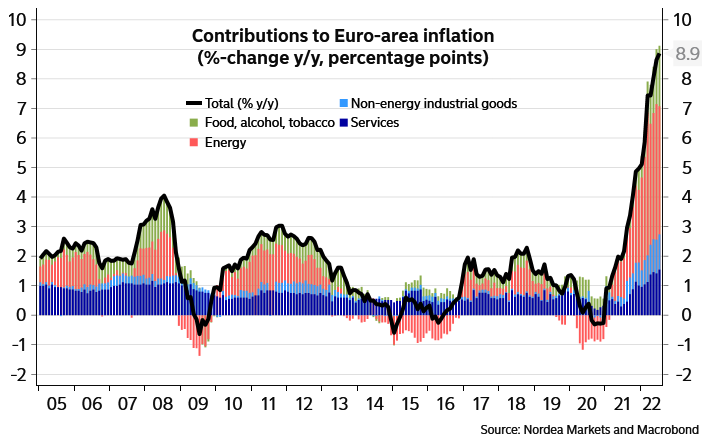

- Euro-area inflation numbers rose to another record in July. Inflation continued to be driven by high energy and food prices but price pressures were broadly based.

- The strong monthly changes in service and goods prices and the pressures in the energy sector imply that both headline and core inflation will be heading higher in the coming months.

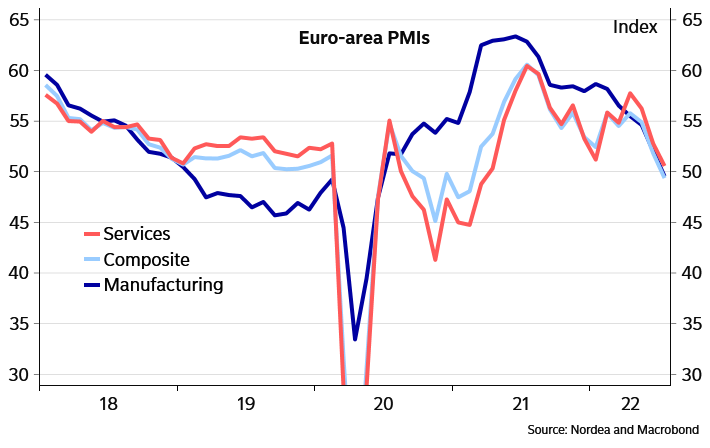

- Many survey indicators have recently collapsed and economic outlook is weak as high inflation, tighter financial conditions and uncertainty related energy supply hurt confidence. Thus, we expect growth numbers to collapse in the second half of 2022 after the surprisingly strong Q2 GDP numbers (0.7% q/q).

- The ECB will focus on high inflation and their possible second-round effects in the coming meetings. We expect rate hikes to continue in September (read our latest ECB analysis here).

Inflation: higher and higher

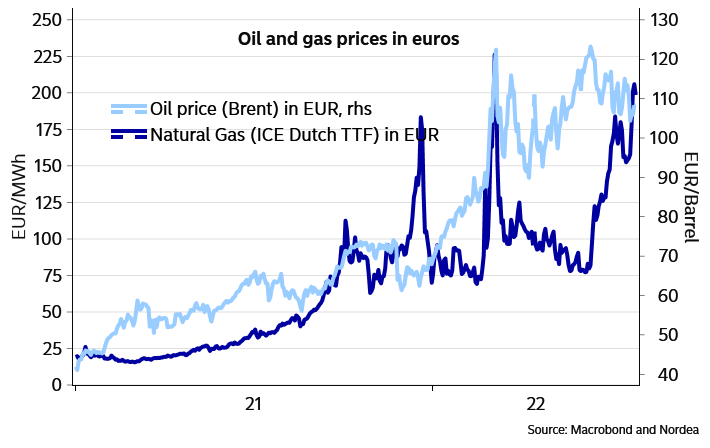

Euro-area headline inflation broke another record and rose to 8.9% in July (8.6% in June). Although the decline in the oil price and policy actions in many countries brought some relief to fuel prices, the overall energy index continued to rise (39.7% y/y) as e.g. gas prices continued to rise and their pass-through to consumer prices advanced. On top of energy, food has become a very large contributor to headline inflation as food prices increased already by 9.8% y/y.

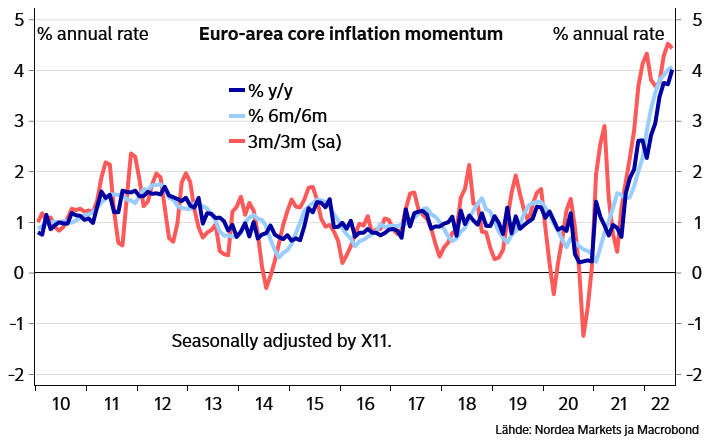

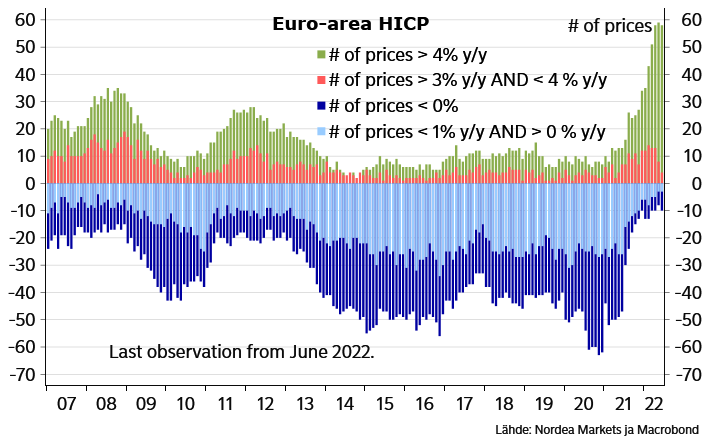

Core inflation also accelerated further to 4.0% (3.7% in June). Thus, the German 9-euro train ticket brought only a temporary relief on inflation figures in June and core inflation returned to the upward trend. Although the base effects imply that the steepest rise in core inflation numbers should now be over the strong monthly increases in both service and non-energy industrial goods prices indicate that core inflation momentum is very strong. Overall, inflation in Euro-area has become rather broadly based in the recent months and most prices are rising rapidly. On top of energy and food prices, hotels/restaurants and furniture are examples of very rapidly rising prices in all large Euro-area countries.

Record-high inflation stems from many sectors

Core inflation has a very strong momentum

Inflation is broadly based

Inflation outlook: upward trend likely to continue

There are reasons to believe that inflation numbers will continue to climb even higher in the coming months. The boom in energy prices has continued and the geopolitical factors behind them do not show any signs of easing. We expect gas supplies from Russia to remain very limited when the winter is approaching causing upward pressures on energy prices. Furthermore, the pass-through mechanism implies that many price increases to households are still in a pipeline – not least in Germany where the government recently decided about an energy levy on consumers starting in October. This implies that headline inflation may rise above 10% also in Germany.

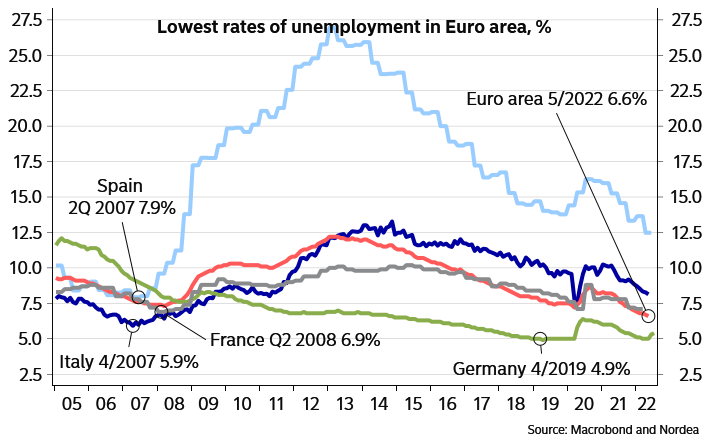

Also core inflation outlook is strong and we expect core inflation to continued above 4% in the coming months. The short-term outlook on non-energy industrial goods prices is strong but we expect that in 2023 the reported easing in supply problems, lower raw material and transport prices as well as weaker demand should take goods price inflation to lower levels. Regarding services, wage development will be the key. Our view is that as a result of strong labour market development and high inflation numbers, wage development will continue to accelerate in the coming months. This implies that core inflation will continue to be clearly above the ECB target also in 2023.

Gas prices have returned to very high levels

Low unemployment numbers will support higher wage growth

GDP growth was surprisingly strong in Q2

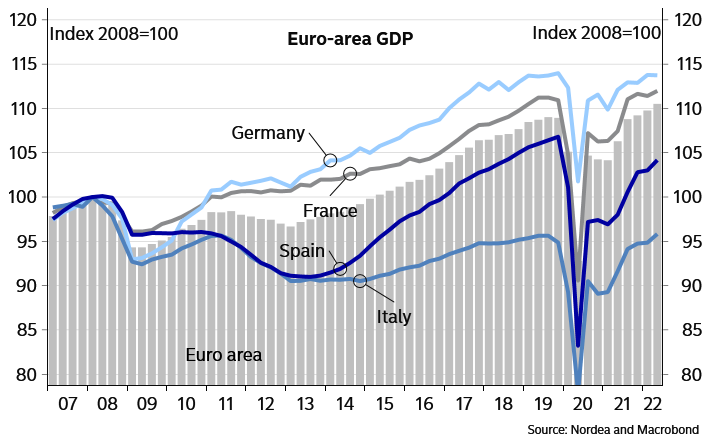

GDP growth at 0.7% q/q was surprisingly strong. We had pencilled in a 0.5% growth and consensus was even more pessimistic. Growth was strong in Spain (1.1%) where the level of GDP is still below the pre-pandemic level. We expect Spain to benefit from the recovery of foreign tourism this summer and to show positive growth numbers also in the coming quarters even if very high inflation hurts households in Spain even more than in many other Euro-area countries . Growth was strong also in France (0.5% q/q) and in Italy (1.0%). We don’t have much details of the growth composition in Italy but data from France show that while consumption continued to be weak, fixed investments and exports supported growth. In Germany, GDP was unchanged from January-March. Germany has been one of the countries suffering most from very high energy prices and challenges in global supply chains and as a result, weak growth numbers were not a surprise.

Growth stalled in Germany but was strong in all other large EA countries

GDP outlook has collapsed

Many survey indicators collapsed in July and point to even a more dramatic slowdown of economic growth than we expected in our spring forecast (we expected 0.2% q/q growth in Q3 and Q4). The PMIs, European Commission’s ESI and German Ifo all indicate that growth will be very weak in the coming months. Especially the decline in the service sector confidence has been steeper than we expected as we expected that sector to benefit from the end of the covid restrictions during the holiday season. It seems that high inflation and resulting negative real income development has hurt consumption more than we expected. Given that high inflation numbers are likely to continue and a rapid stabilisation around the energy outlook is unlikely, the next six months will be hard for many businesses and households.