Den svenske økonomi forbedredes en smule i november og viser dermed en robusthed – også i sammenligning med andre europæiske lande. Der har været en stærk fremgang på 11 pct. siden bunden i maj, og økonomien er kun 1,5 pct. under før-krise niveauet. Centralbanken venter et fald i økonomien i 4. kvartal på 1,2 pct. Det er for pessimistisk, mener Nordea.

Swedish economy resilient in November

GDP edged up in November.

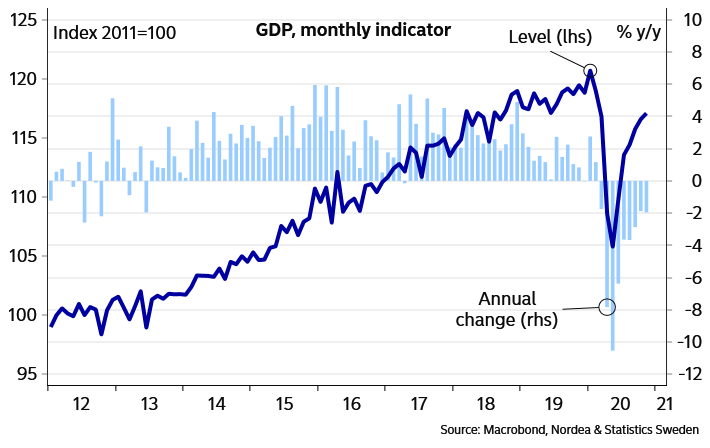

Statistics Sweden’s monthly indicator for GDP, the “activity indicator”, stood at +0.4% m/m and -2.0% y/y for November.

According to the indicator, GDP has risen by 11% since the trough in May and was 1.5% below pre-crisis levels in November.

There are no details, except for the press release saying that household consumption and the private service sector is the main draw-back compared to last year.

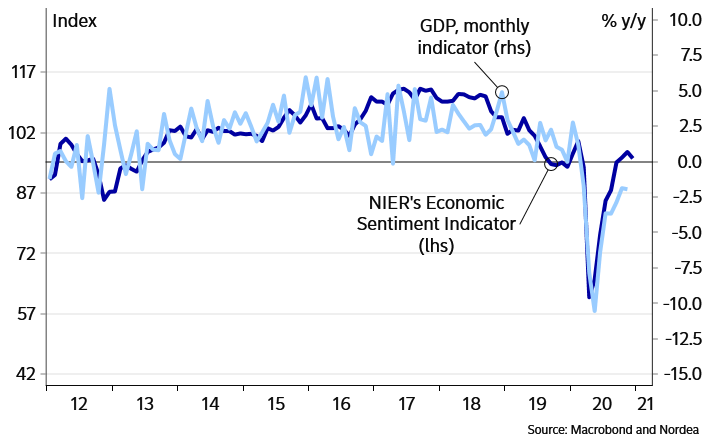

All in all, the Swedish economy has been resilient up to and including November. This goes hand in hand with the better-than expected situation on the labour market as well as the surprisingly strong public finances. Our call for Q4 is GDP unchanged q/q, which seems too weak. Even if GDP declines by 6% m/m in December, which is highly unlikely, GDP would still be unchanged q/q in Q4.

New restrictions have been implemented in Sweden and elsewhere, increasing the uncertainty. The Riksbank is nevertheless too pessimistic. First of all, GDP for Q3 has been revised upwards and the bank sees Q4 GDP down by 1.2% q/q. Above all, the Riksbank is far too gloomy as for 2021, despite a likely weak start of the year.

A better than expected economy doesn’t mean much for the Riksbank, though, as focus is on the too low inflation and the risk for the SEK strengthening too fast.

Read more:

Sweden Macro Forecast Overview: Swedish economy stands firm, 30 November