Nordea vurderer, at der kommer større rentestigninger i USA end i Europa, men tendensen til rentestigninger ses overalt. De amerikanske T-bonds kunne blive markant højere, måske helt op til 3 procent. Nordea mener, at ledelsen i ECB er delt i spørgsmålet om rentestigninger, men de tyske statsobligationer er dog steget til mere end 1 pct. på bare to måneder, og det indikerer stigende europæiske renter – dog mindre end i USA.

Major forecasts: Not so fast

The recent rise in long yields has started to worry the ECB, and we expect the pace of the increase to moderate from here. US yields have more upside potential. We expect EUR/USD to drop like a stone later this year.

Highlights:

- The macro environment will continue to improve significantly later this year

- Despite the recent rise in EUR yields, we expect much more gradual upward moves going forward, but the chance of a faster rise cannot be excluded

- US yields have more upside potential

- EUR/USD has already peaked and will fall to 1.16 by the end of the year

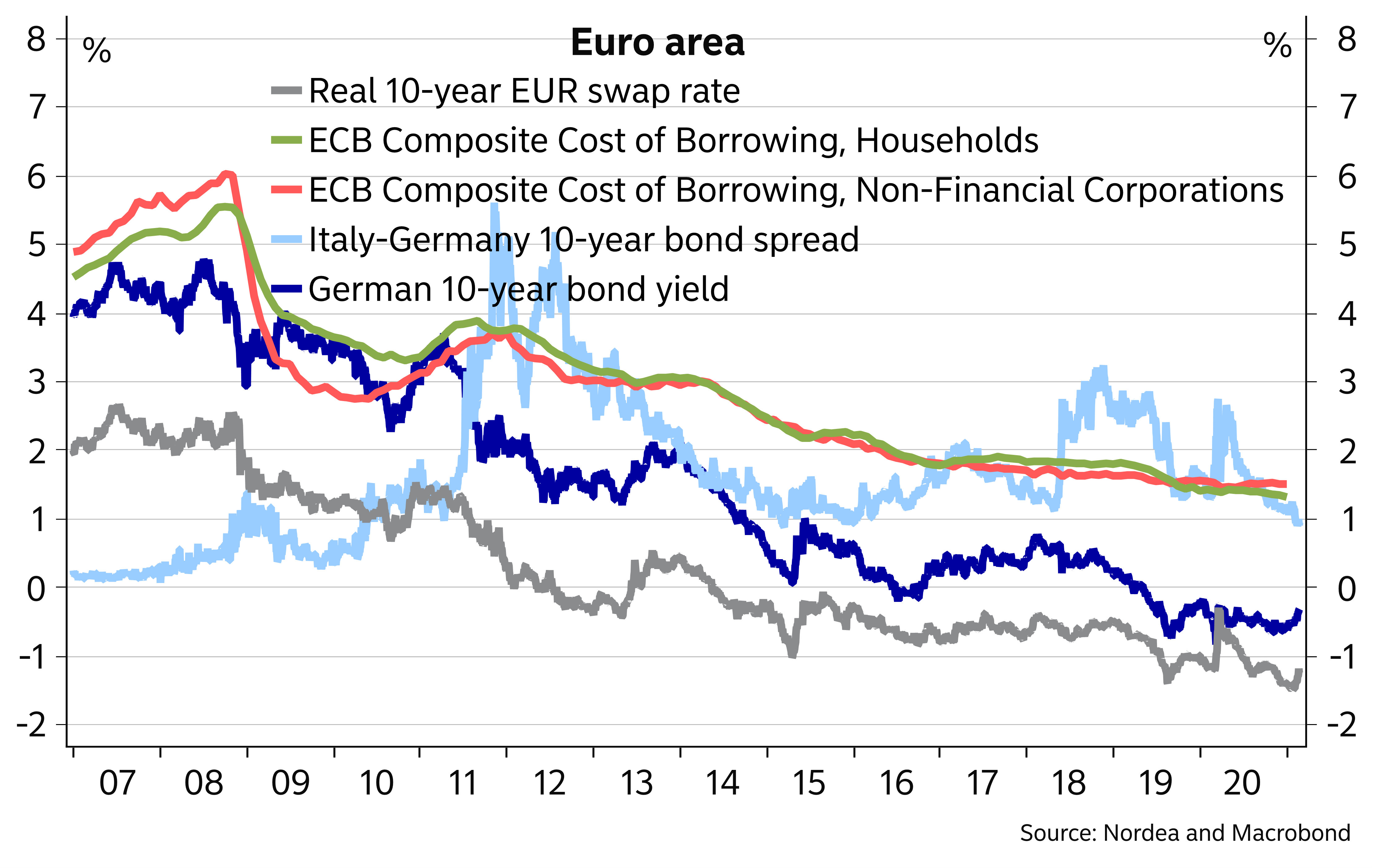

While longer US Treasury yields have been on an uptrend for more than six months already, German yields appear to have joined the party only in the past month or so. In the big picture, the moves seen in longer EUR yields in the past month still look very modest. However, coming after a long period of very subdued levels and given the ECB’s willingness to keep financing conditions easy, they stand out.

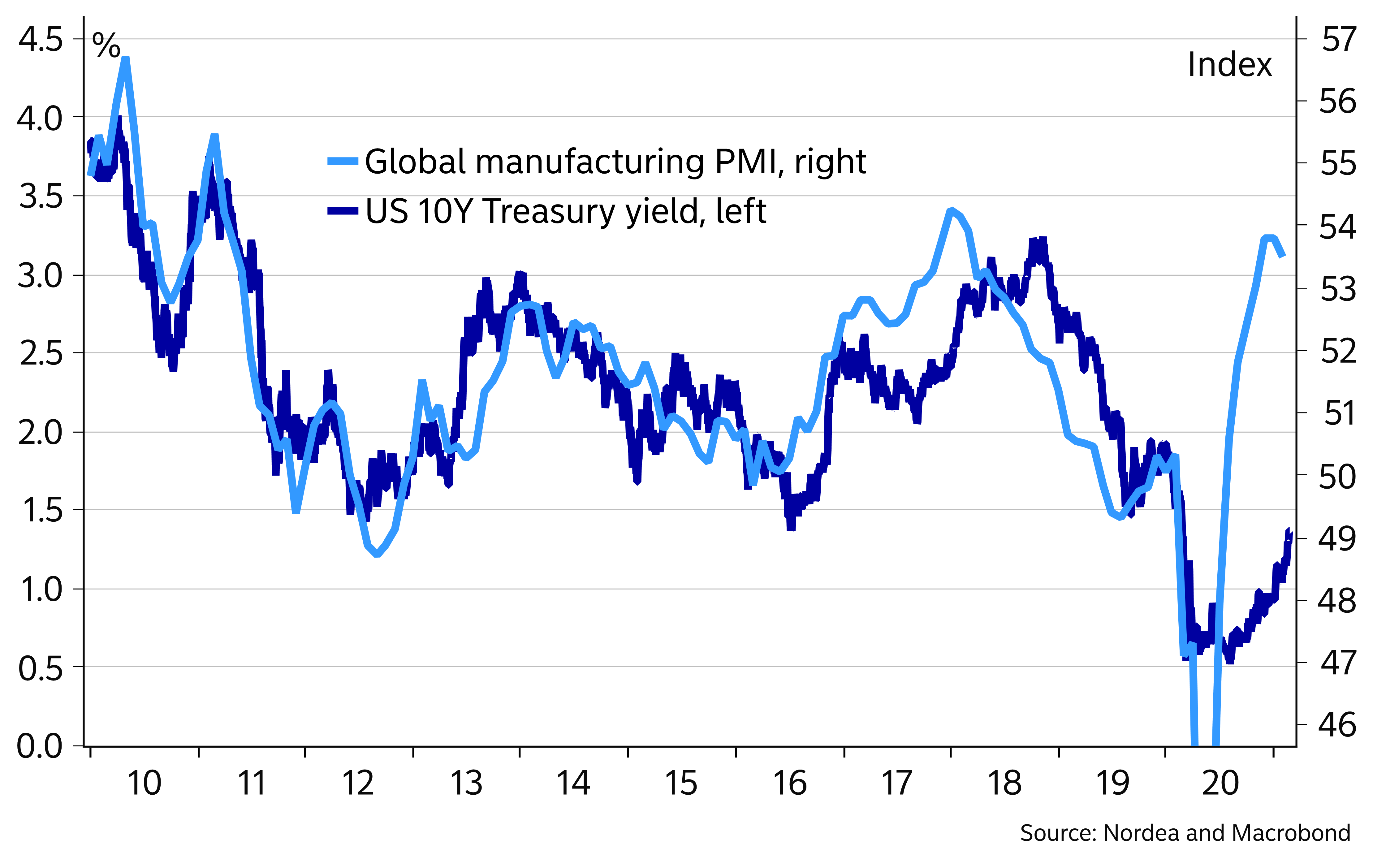

It is not difficult to find arguments why long yields should rise considerably more: the rebounding economy, huge stimulus measures, large bond issuance needs, higher inflation expectations, booming risk appetite and the reluctance of central banks to cut rates further.

Nevertheless, one big obstacle remains: the central banks have in theory unlimited ammunition to fight the rise in long yields if they choose to do so. Sure, the ECB faces some legal constraints as to how big a share of government bonds it can own, but such constraints have been pushed to the side in the Pandemic Emergency Purchase Programme (PEPP) for now.

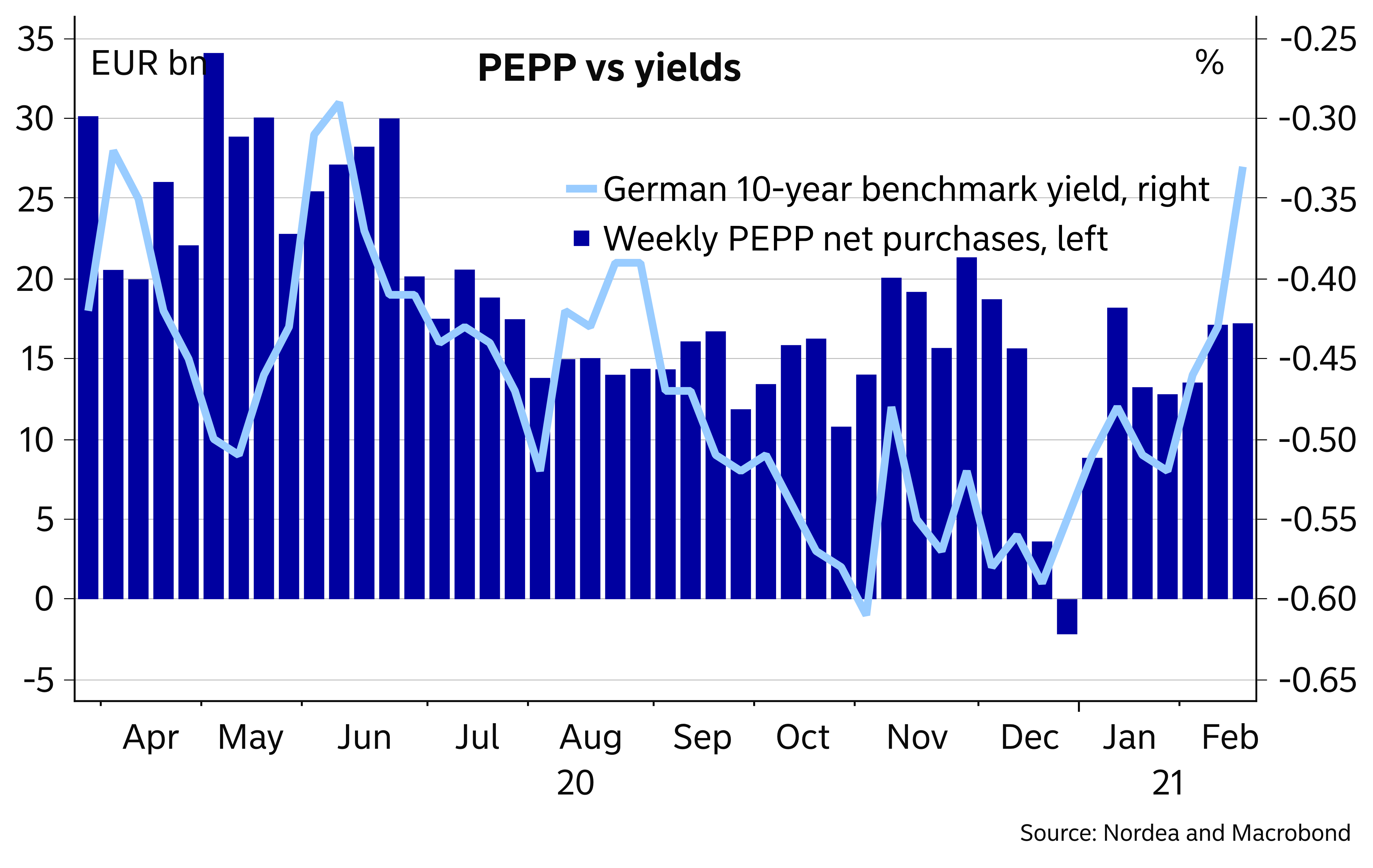

And at least the ECB has become worried about the recent rise in interest rates. President Lagarde commented earlier this week that the ECB was closely monitoring the evolution of longer-term nominal bond yields. Bonds immediately rallied following those comments, though the market development in the following days suggests that the ECB may need to increase the pace of its bond purchases to stop yields rising further.

The Fed seems more relaxed and takes higher longer yields and a steeper curve as a positive sign. While Chair Powell pledged this week that the Fed would continue its sizable bond purchases, he saw the higher yields as a statement of confidence on the part of markets that we’ll have a robust and ultimately complete recovery.

Given another sizable stimulus package is in the pipeline from the Biden administration and the green light from the Fed for yields to rise further, we see much more potential for longer US yields to continue to rise compared to European ones.

The general macro environment already suggests yields should be much higher

Risks tilted towards a faster increase in yields

Even the ECB seems very divided on how it should approach rising nominal yields. Some Governing Council members would seemingly have no problem with a gradual rise in nominal bond yields, as long as general financing conditions remained favourable and the rise reflected an improvement in the growth and inflation outlook. Others, in turn, appear more worried.

It remains to be seen how aggressively the ECB is prepared to fight rising nominal yields. At least for now, the ECB has not made big changes to the pace of the PEPP. We see potential for at least some further moves up on the back of the recovering economy and higher US yields, especially as broader financing conditions remain easy and we expect further falls in EUR/USD (see more below) to ease the ECB’s worries about an overly strong currency.

In the big picture, Euro-area financing conditions remain very easy

PEPP volumes have not risen considerably lately despite higher bond yields

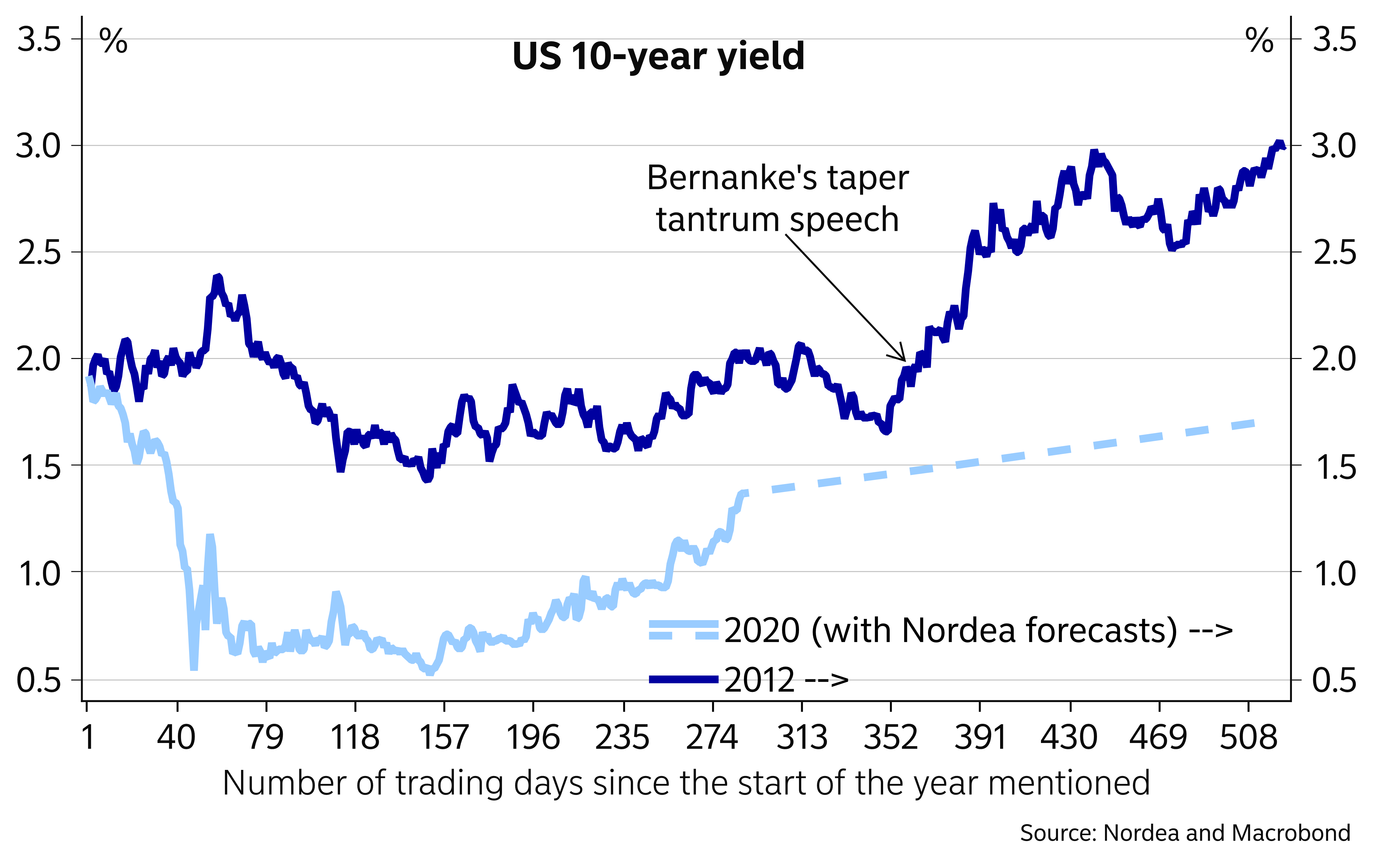

Risks are tilted towards a faster rise in yields. History has shown us that exiting from very easy central bank policies can be tricky, and another taper tantrum-like episode cannot be ruled out. In 2013, when the Fed chair at the time, Bernanke, signalled that the Fed would eventually have to scale back its net bond purchases, bond yields surged higher, with the 10-year Treasury yield jumping from around 1.60% a few weeks before Bernanke’s comments to touch 3% in just over four months. While Powell has for now promised that sizable bond purchases will continue, the time to start to tweak that communication may not be that far into the future.

Further, given that the Fed seemingly has no problems with the rise in yields, as long as rates climb for the right reasons, positive economic developments alone could send yields up much faster even without notable communication changes from the Fed.

Another taper tantrum-like episode cannot be ruled out

Given questions about how exactly the ECB defines easy financing conditions and how much preparedness there really is in the Governing Council to significantly increase the pace of bond purchases, a faster rise than we have in our baseline is very possible in the Euro area as well.

In the spring of 2015, long EUR yields continued to fall on the back of ECB bond purchases despite positive signs from the economy. The German 10-year yield bottomed at close to zero in April of that year and then surged to more than 1% in less than two months. At that time, many were expecting the ECB to step in to stop the rise, but it appeared that at least some in the Governing Council at that time were happy to see yields rise to remind investors that yields can move both ways and that the ECB had not taken away all the risks involved in investing in bonds.

Things are naturally different this time, with the ECB more openly targeting easy financing conditions, but such voices could still exist in the Governing Council, adding to uncertainty about how the ECB will respond.