Nu kan vi godt sige farvel til de negative renter, skriver Nordea i denne analyse. Der kommer flere rentestigninger på hver et kvart point i USA end i Europa, men ECB begynder at afvikle sit opkøbsprogram. Det bringer alt i alt renterne over nul, mens rentekurven bliver mere flad. ECB har stadig mulighed for at afværge en finansiel stramning for virksomhederne. Nordea forudser, at euroen stiger over for dollaren i løbet af året.

Major forecasts: Say goodbye to negative rates

Continued upside inflation surprises and hawkish ECB comments have brought more rate hikes also to the Euro-area profile. Tighter ECB policy opens more upside for also longer bond yields and limits how low the EUR/USD will go.

The ECB followed many other central banks in turning hawkish, and we have added hikes to our ECB forecast profile. Market pricing has become increasingly hawkish for the Fed outlook as well, but we continue to think that quarterly 25bp rate hikes remain a good baseline. In a nutshell, we expect

- the Fed to hike rates four times this year by 25bp, starting in March, followed by further four hikes in 2023. A decision to allow the balance sheet to contract will be taken during the summer.

- the ECB to decide in March to stop net bond purchases around the end of August. 25bp rate hikes will follow in December 2022, March 2023 and September 2023.

- EUR/USD to bottom at 1.10 later this year and climb to 1.18 by the end of next year.

- long bond yields to climb further, but the curve to flatten from current levels by the end of the forecast horizon.

ECB’s turning hawkish

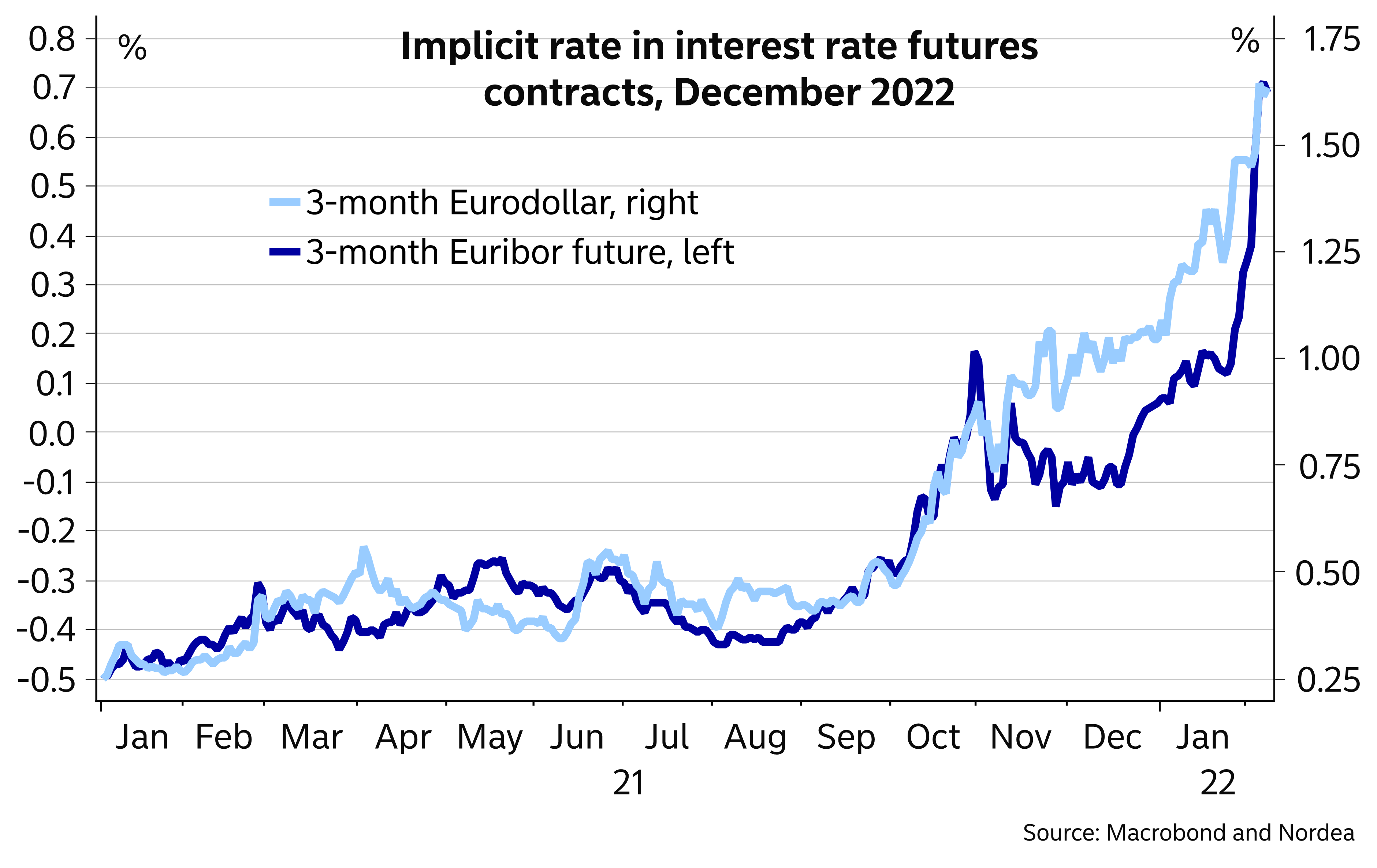

The ECB’s hawkish twist was a huge surprise to financial markets last week. For example, the 5-year EUR swap rate experienced the biggest 2-day jump in more than 10 years following the ECB meeting. We certainly noted the ECB’s signals and together with upward revisions to our own inflation forecasts, which now see Euro-area core inflation stay above the ECB’s 2% target for most of the forecast horizon, we now see three 25bp rate hikes during our forecast horizon until the end of 2023.

We still think that the market pricing of more than 50bp of higher overnight rates, ie around two 25bp rate hikes, until the end of the year looks excessive. After all, even Klaas Knot, one of the most hawkish ECB Governing Council members, indicated he sees the first ECB rate hike in the fourth quarter and another one during the spring. Further, according to a Financial Times story quoting ECB sources, even more hawkish ECB officials dismiss the idea of a rate hike this summer as ludicrous.

We note that one should not dismiss the chance of the scenario being priced by financial markets materialising altogether. After all, only a few months ago the ECB reassured that a rate hike this year was very unlikely – now it is not. A couple of more upside surprises to inflation and/or surprisingly high wage growth numbers could prompt plans to move as soon as in September. Based on the current information, however, we find the current pricing for this year overly aggressive.

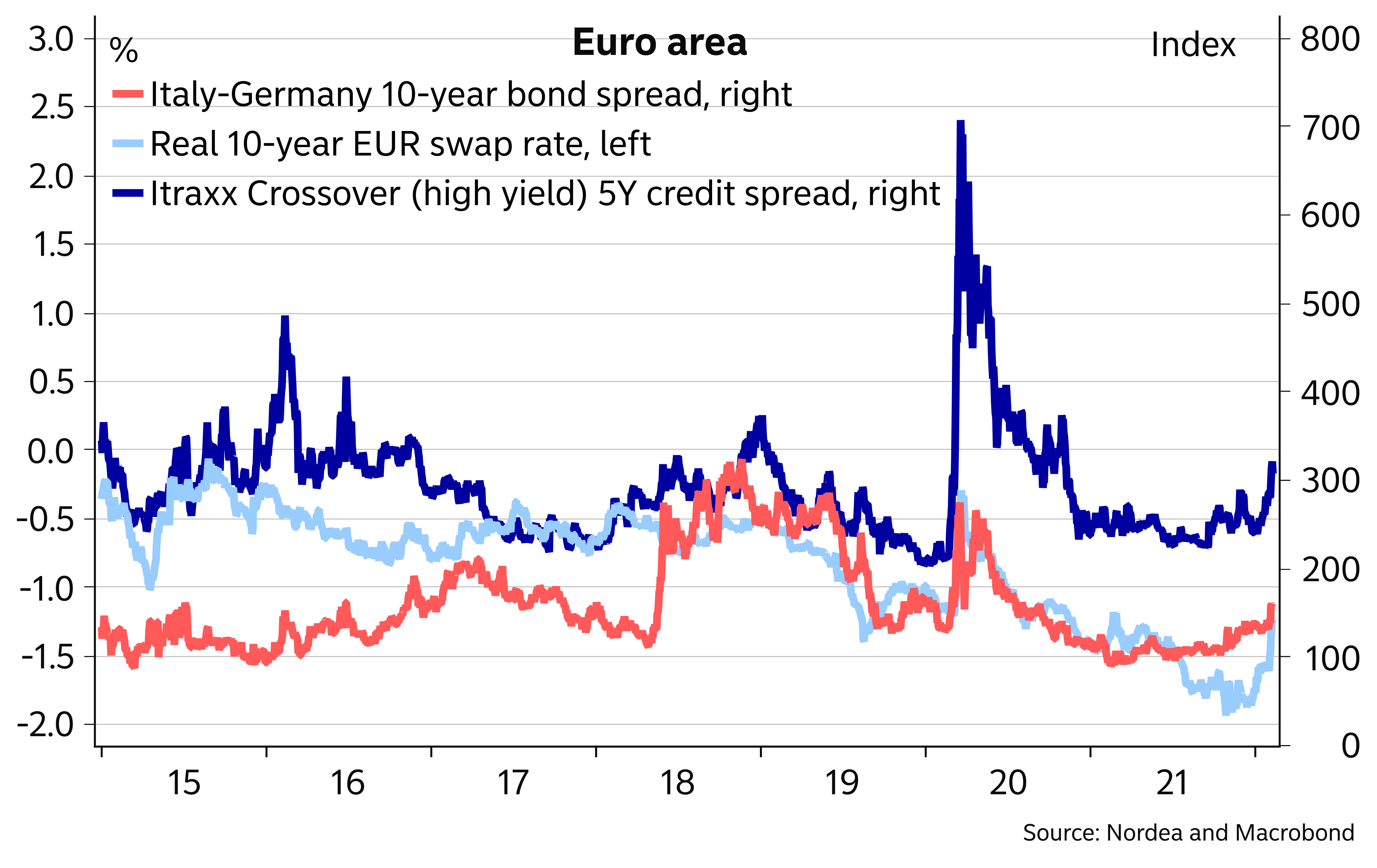

A notable risk factor for the ECB is a rapid tightening of financial conditions. While financing conditions remain easy, they have started to tighten quite rapidly. Nevertheless, it is important to distinguish between a situation where the Euro area was last year when the ECB was undershooting its target and arguing easy financing conditions were required to help push inflation to the target.

If the ECB is moving to a situation, where it needs to limit inflation pressures, then tighter financing conditions are the means to reach that goal. Still, an abrupt tightening would probably still not be in the ECB’s interests, and further increases in eg bond spreads could also raise worries that the ECB cannot tighten policy too aggressively and limit the pricing of ECB hikes.

Rapid tightening in financing conditions a risk scenario

The ECB does have some flexibility to try to prevent financing conditions from tightening even after it ends its net purchases. It has room to manoeuvre through its reinvestments in the Pandemic Emergency Purchase Programme (PEPP), which the ECB has pledged will continue at least until 2024. The magnitude of these purchases is not insignificant. For example, in the past year, the average monthly PEPP redemptions totalled around EUR 16bn. The ECB remains ready to use the PEPP reinvestments flexibly across time, asset classes and jurisdictions at any time.

Further, as the central bank owns a significant share of the debt of Euro-area governments and the starting point of bond yield is historically low, the risk of moderately higher interest rates should not be a big threat to government debt sustainability despite high gross debt levels.

We do not expect any changes to the reinvestment policy during our forecast horizon until the end of 2023.

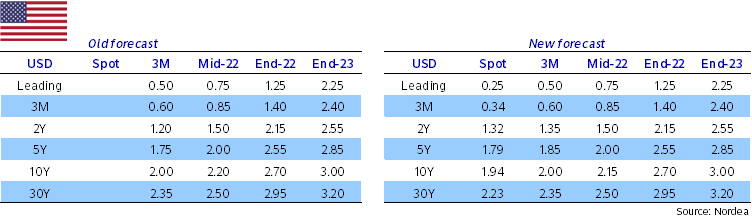

The Fed to start on a quarterly hike path

The pricing of Fed rate hikes picked up again last week after a strong labour market report, and the market is currently pricing between five and six 25bp rate hikes by the end of the year. Our view on the sizable US inflation pressures and the need for a longer rate hike cycle has not changed, but we read the recent Fed signals as confirming that a quarterly pace of rate hikes remains a viable baseline forecast for now. We would also be surprised, if the Fed decided to go for a 50bp rate increase at the March meeting.

Even if raising the fed funds target rate is the Fed’s primary means of tightening, the balance sheet measures will have an impact as well, and those will add to the Fed’s tightening efforts later this year.

Interest rate expectations increased rapidly

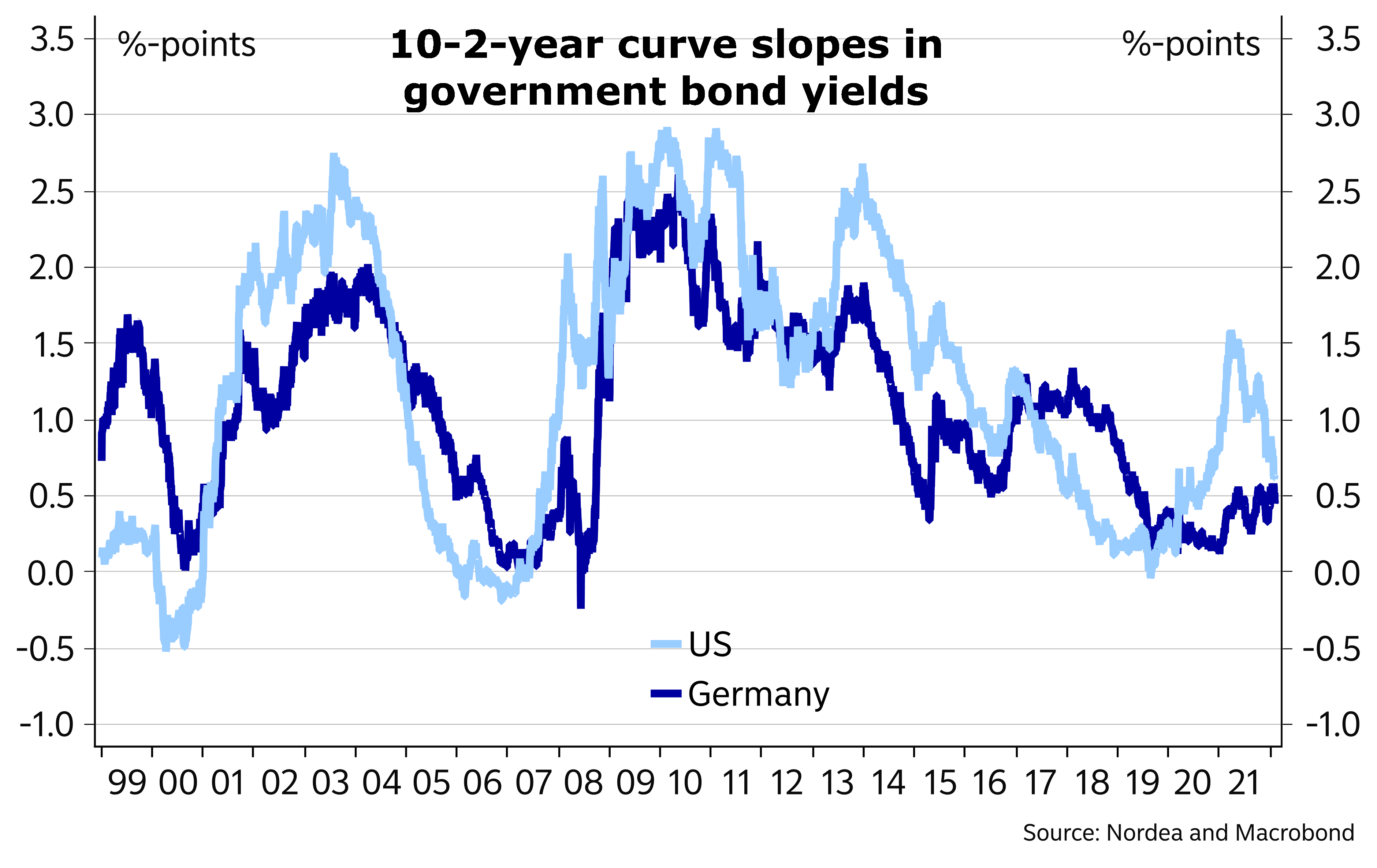

Curve to flatten but not to a pancake

The German curve never steepened so aggressively to begin with in this cycle. The US, curve, on the other hand, has already flattened notably during the past 10 months. We expect both curve slopes to end the forecast horizon flatter compared to current levels, but especially in the Euro area, the moves will be rather modest.

We have argued before that long yields have faced resistance towards higher levels due to doubts about the longer-term growth outlook, demographics and continued strong demand for bonds stemming partly from large central bank ownership and regulatory considerations. These issues have already prevented the curve from steepening aggressively, and with monetary policy tightening starting/approaching, flattening pressure usually prevails.

We are not forecasting totally flat curves at the end of the forecast horizon either. One reason is that we do not expect either the ECB or the Fed tightening cycles to be complete at the end of 2023.

In addition, the Fed is not keen on a totally flat, let alone inverted, curve. It could try to engineer its balance sheet contraction operation in a way that maintains at least some steepness in the curve. It could even resort to asset sales if the curve starts to look too flat for the Fed’s liking.

Curves already quite flat historically seen

We target a German 10-year yield of 1.10% by the end of 2023, while we have maintained the forecast for the corresponding US yield at 3%.

The outlook remains uncertain, not least because of great inflation uncertainty, and also a faster rise in rates remains a viable scenario.

Our new forecasts for US Treasury yields

Our new forecasts for German bond yields

Washout of short EUR/USD positions

There was a true washout of short EUR/USD positions after the surprisingly turn in hawkishness from the ECB last week. And the period since the start of the year has been volatile for EUR/USD. A top close to 1.15 in the middle of January was followed by a sharp decline towards 1.11 by the end of January after a hawkish signal from Powell & Co at the FOMC meeting on 26 January. And the bounce in the beginning of February has been even more fierce, although it has stopped short of the January top close to 1.15.

The tug of war between the Fed and the ECB will be decisive for EUR/USD this year. The key questions will be which central bank will be the most hawkish and which will deliver. For now dollar bulls have experienced a serious setback after last week’s ECB meeting, and it will take some strong data and hawkish signs from Fed members to lure them back in the game.