Høgene i ECB har fået overtaget, og markedet venter en rentestigning på 50 basispunkter i juli. Det kan ikke udelukkes, skriver Nordea i en analyse, men Nordea tror ikke, at ECB vil stramme helt så meget. Nordea bygger bl.a. sin opfattelse på, at selv en af de stærkeste høge i ECB-rådet, den hollandske centralbankchef Klaas Knot, har sagt, at han støtter en rentestigning på 25 basispunkter – medmindre inflationsudviklingen i mellemtiden bliver værre. Men Nordea venter en hed diskussion i ECB på juni-mødet om rentestrategien: Skal ECB fortsat gå gradvist frem i stramningen af pengepolitikken, eller skal ECB gribe kraftigere ind for at få bugt med den inflation, som selv ECB har fejlvurderet? En række data tyder på, at inflationen bider sig fast.

ECB Watch: Goodbye to gradual?

ECB members have continued to send hawkish signals, prompting the market to price in a clear risk of a 50bp rate hike in July. We do not think the ECB would start with such a step, but the central bank’s inflation worries have clearly increased.

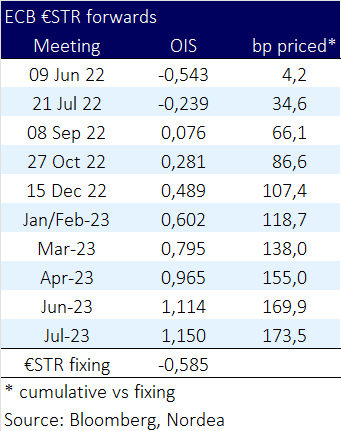

- Hawkish ECB signals have continued and the market has started to price in risks of a 50bp rate hike at the July meeting.

- We would not exclude the chance of 50bp moves, but find them unlikely for now and see the odds for a 50bp move clearly higher for the September meeting rather than July.

- The April monetary policy account illustrated it was inflation that is dominating in the ECB’s discussions, while the economy has so far fared relatively well amidst all the uncertainty.

- The ECB’s view on gradual policy normalisation will be hotly debated at the June meeting.

While the Fed seems to have managed to guide the markets to a hiking path it is comfortable with – 50bp rate hikes in at least the next few meetings – the ECB is not there yet. Signals from the ECB have strongly suggested a start to its rate hikes at the July meeting.

It did not take long after a 25bp July ECB hike had become consensus for one of the most hawkish Governing Council members to call for more. The Dutch Klaas Knot commented earlier this week that he supports a 25bp hike at the July meeting, but if incoming data suggested that inflation would be broadening or accumulating, then a 50bp increase needs to be considered.

As a result, the market is now pricing in around 35bp higher overnight rates for the July meeting. We think at most a couple of basis points of this could be due to expected changes in liquidity conditions, so the vast bulk should illustrate that the market is pricing in clear chance of a 50bp July rate hike.

Given the extent of upside inflation surprises and the pace at which central banks have changed their policy plans, one should not exclude even scenarios that appear unlikely at the moment. However, a 50bp rate hike at the July meeting looks unlikely for several reasons

- even though the ECB has changed tact rather rapidly, such changes have taken place in steps and until recently a hike as early as July seemed remote; for example, the ECB has held on to its sequencing, i.e. ending net asset purchases before hiking rates, and has scaled down the asset purchases in steps rather than rushed to hiking rates

- the ECB is still adding stimulus with its net asset purchases, and ending those purchases at the end of June and following that with a 50bp rate increase in July would represent quite a policy U-turn

- the ECB has repeatedly argued that it intends to normalise monetary policy gradually; a 50bp hike as a first move would not be in line with those signals

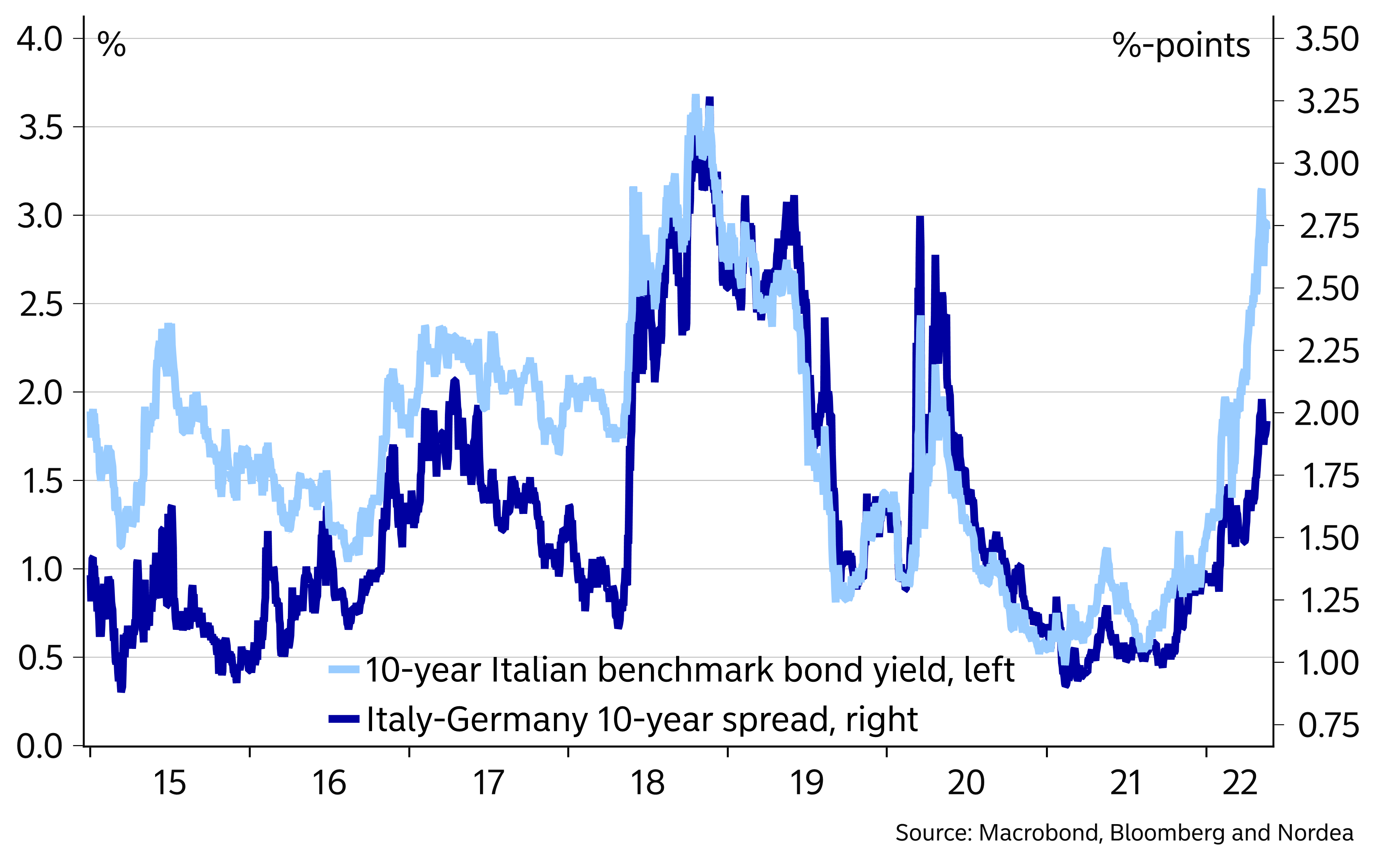

- a 50bp rate hike would risk upsetting financial markets and leading to more financial fragmentation in the Euro area, as already illustrated by the jump in the bond spreads between Germany and Italy

- even the Fed chose to start its rate hikes with a 25bp rate increase, and accelerate the pace only after the first increase, even if the US inflation outlook is much more worrisome for the central bank compared to the Euro area.

Nevertheless, the chance of 50bp rate hikes should not be excluded. But if inflation pressures continue to build and the ECB needs to raise rates at a faster pace, a 50bp move looks more likely in the September meeting rather than in July.

Our baseline remains 25bp rate hikes in July and September, followed by another such move in December, but risks are tilted towards the ECB raising rates at every meeting this year, starting in July. The market is pricing in around 105bp of higher overnight rates by the end of the year. As a result, we see the ECB hiking rates at a somewhat slower pace than currently being priced in.

Market already pricing in a clear chance of a 50bp ECB rate hike in July

Italy-Germany bond spread widened clearly

Discussion on inflation risks dominating

The monetary policy account from the 14 April meeting illustrated that while risks to the growth outlook were tilted to the downside, the economy had so far been able to handle the uncertain situation rather well, while it was the inflation risks that were dominating in the discussions. There was broad consensus that the upside inflation risks had increased.

The impact of the war was naturally uncertain, but it was argued that even if the economic consequence turned out greater than currently thought, there were a number of factors making inflation more persistent:

- Pipeline pressures:

- Euro-area producer prices had increased by more than 30% in January – an all-time high.

- The war in Ukraine and the pandemic measures in China suggested that pipeline pressures and bottlenecks were likely to intensify further.

- Given the size of the energy shock, the pass-through to consumer prices was likely to be greater than in the past and, in an environment of higher inflation overall, consumers could be more willing to accept a stronger pass-through from costs to prices.

- Wages: So far, only a small number of wage contracts had been renegotiated since inflation started to surge. But there could be little doubt that workers would eventually ask for compensation for the loss in real income.

- Structural upward pressures on inflation:

- The war had increased the prospects of a further acceleration in the green transition. This could exacerbate supply and demand imbalances in many commodity markets where the prices of many metals were already at record highs.

- European governments were trying to actively limit their dependency on global value chains in areas of strategic importance. This could be expected to accelerate “reshoring” efforts, loosening the brake of globalisation on wages and inflation.

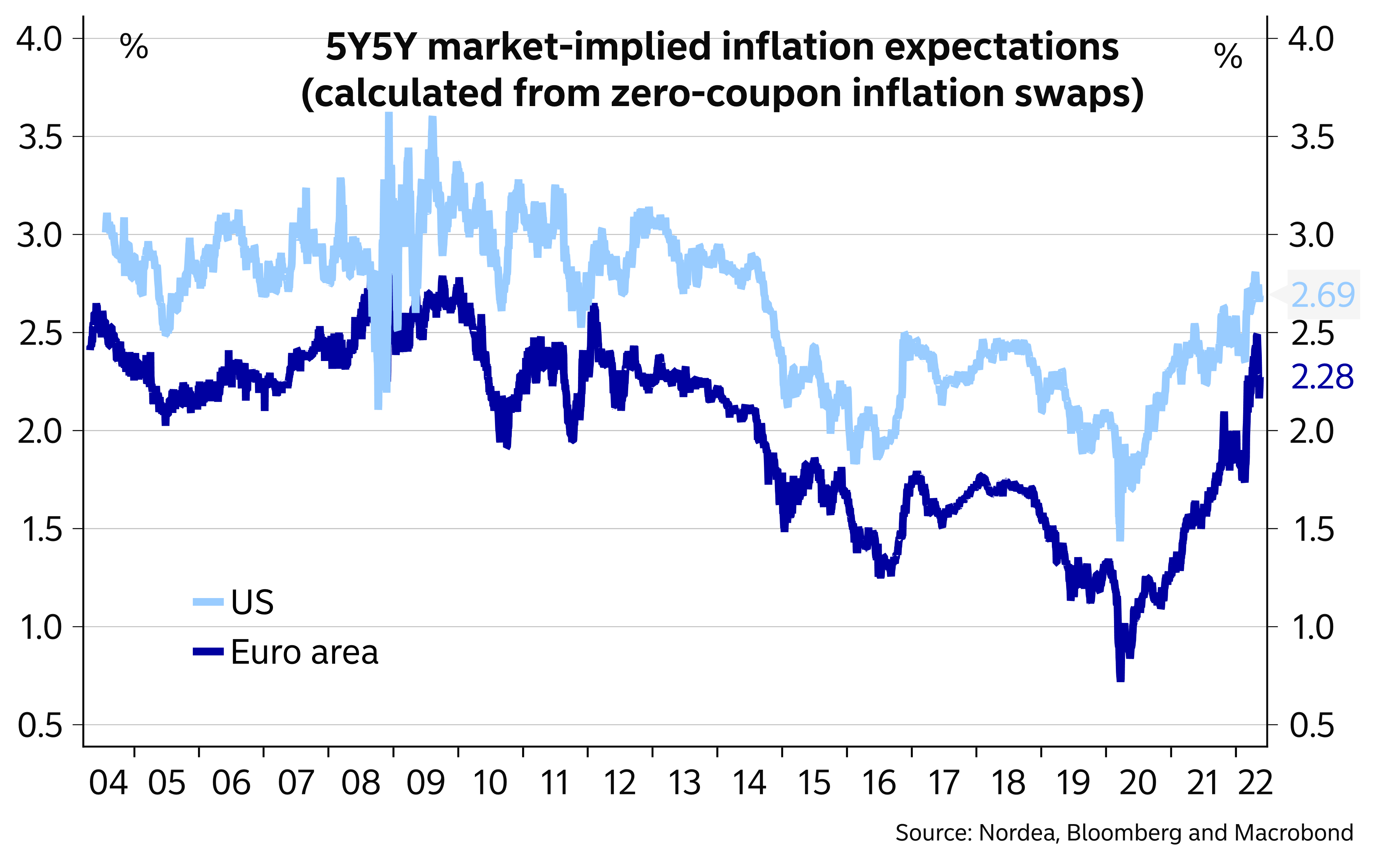

Market-based inflation expectations moved slightly lower from their highs lately