Nordea stiller spørgsmålet, om de store finanspakker for at løse coronakrisen fører til øget inflation. Bliver det en fornyet inflation, som skal bringe landene gennem det store gældsbjerg? Det er ikke kun et økonomisk spørgsmål, men også et generationsspørgsmål, mener Nordea, da den unge generation af økonomer måske er mere tilføjelige til at slippe inflationen løs.

Uddrag fra Nordea:

Week ahead: B.1.1.7 Blues

The cluster B.1.1.7 has kept authorities busy and strict lockdowns are likely to stay intact until the at-risk groups are vaccinated. More debt is coming, but that is not an issue according to for e.g. the OECD and FT. Will we inflate our way out?

More debt is coming across Europe as aid packages will need to be fully re-installed to combat the lockdowns but that is not an issue according to the (former) austeritynistas from the OECD and the FT. It is simply riskier not to bail out as much as possible from a cost/benefit perspective.

The younger generation of the Nordea Strategy team tends to agree, while this question is certainly one that causes an intergenerational debate. The big if is whether we will be able to reflate our way out of the piles of debt, and there are (finally) signs of actual inflation coming.

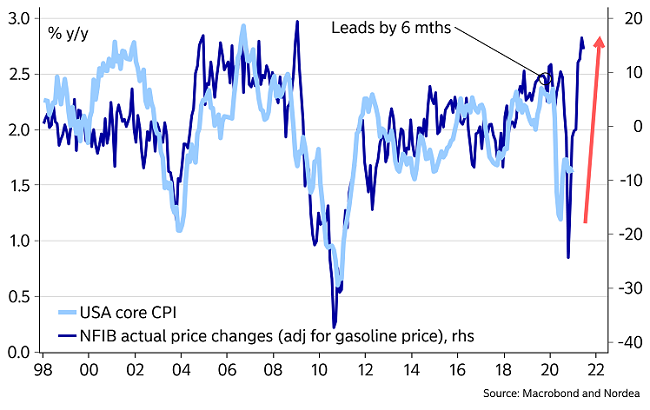

Price plans among SMEs are decade bullish, which is probably a combination of a distorted supply chain paired with a (surprisingly) stubborn demand side.

Chart 1. Inflation is finally coming!

So why is inflation suddenly showing signs of life on the heels of the worst recession in many years? First, the nature of the crisis is very different from for example 2000 or 2008/2009 since it is temporary in nature. That is probably also why it has proven politically palatable to try and bail out everyone. From too big to fail, to too many to fail.

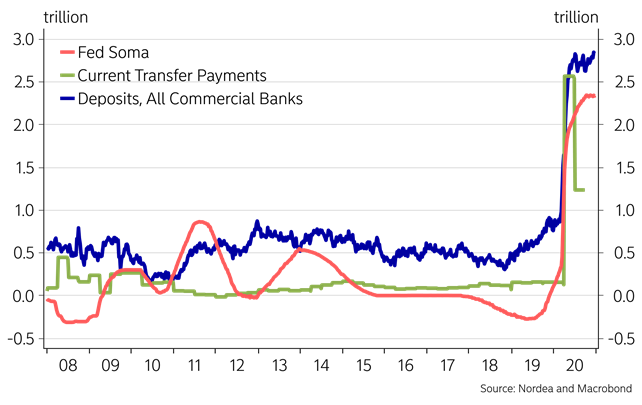

Second, the policy mix has changed in a clearly inflationary direction given the bigger focus on transfers to households during the coronavirus crisis. Commercial deposits have increased alongside money printing by central banks in sharp contrast to QE1, QE2, QE3 and the reason is direct transfers from authorities to households as we have seen on a large scale in the US but also on a small scale in parts of Europe.

This policy mix is inflationary. Asset swap QE is not inflationary on a stand-alone basis.

Chart 2. Finally, QE money reached commercial deposits (that is, households and corporates). Hallelujah!

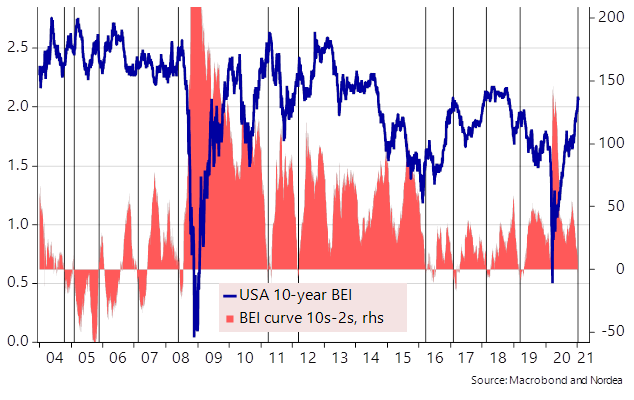

Markets have clearly also traded the inflationary narrative in recent months with a clear steepening of the USD curve as a result. The 2s10s USD break-even curve is now inverted, which is typically a signal that inflation bullishness is about to peak.

Everyone knows that Q2 will include massive reflationary baseline effects from commodities, but the dark horse is if the Fed AIT regime has changed the reaction function of inflation expectations. After all, Clarida revealed that as much as 7 FOMC members expected inflation to overshoot by the end of the forecast horizon in 2023 at the latest meeting in December – and yet almost no-one truly wanted to tighten up again.

Chart 3. 10Y break-even inflation tends to drop when the 2s10s BEI curve inverts. Will this time be different due to AIT?

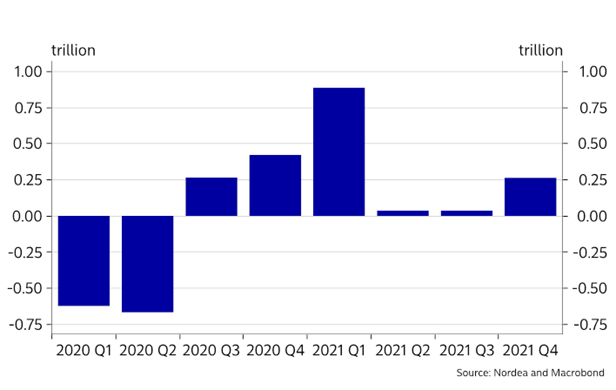

The supply story continues to support a further steepening of the USD curve as a load of debt will be issued this quarter now that the 900bn$ stimulus package has been agreed upon and maybe Biden has even more stimulus in store for us!

This is a marked change of scenery for the QE to issuance ratio, which was much more benign during 2020. The curve could steepen further simply due to supply considerations unless the Fed puts the pedal further to the metal in the QE programme during Q1, which we consider unlikely because of the importance given by FOMC members to communication around the topic recently.

Mnuchin has by the way also left Yellen with a truckload of bills to roll into a bond space during 2021. Will that be possible without material QE? Let’s see.

Chart 4. Issuance will outweigh the QE pace by miles in Q1, which is a decent steepener story on the USD curve – at least short term

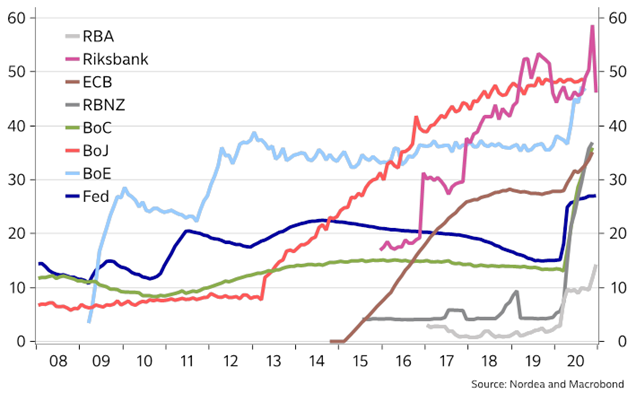

The Fed is one of the few central banks that is still far from any operational thresholds on holdings of government debt with below 30% market share of eligible bonds. Other central banks such as the Riksbank, the BoE and the BoC are closer to operational limits, which will initially 1) make them more creative or 2) in the BoC’s case lead to a tapering decision paired with twisting (Global: Mirror, mirror on the wall, who has got the biggest printer of them all).

Chart 5. Central bank ownership of bonds as a % of the (current) eligible bond market size