Nordea fokuserer på de mange tegn på opsving i USA. Der bliver forår for Bidens stimuli-politik, og der kan blive fuld beskæftigelse inden jul. Men det vil også presse inflationen i vejret. Derimod er det usikkert, om han kan vende trenden med konstante skattelettelser.

Springtime for Biden

US stimulus checks (“stimmies”) and good weather will likely pump US macro data over the next several weeks. Remember the harsh winter storms back in February? Well, they are thankfully over and now spring is rapidly approaching. This is good news for US activity, on top of the usual culprits: i) fiscal expansion, ii) dollar weakness of 2020, and iii) fewer and less stringent lockdown rules.

Perhaps the US authorities will let their freedom-loving citizens enjoy a drink or two with their friends when dining outdoors in a couple of months’ time? Our friends in Manhattan are very eager to do just that.

Robinhood, maker of the infamous trading app, is not only preparing for its IPO, they have also been busy making bonus promises to clients who increase their deposits. Perhaps these “stimmies” will pump risky assets too or bring about new GameStop shenanigans? Robinhood is ready, are you?

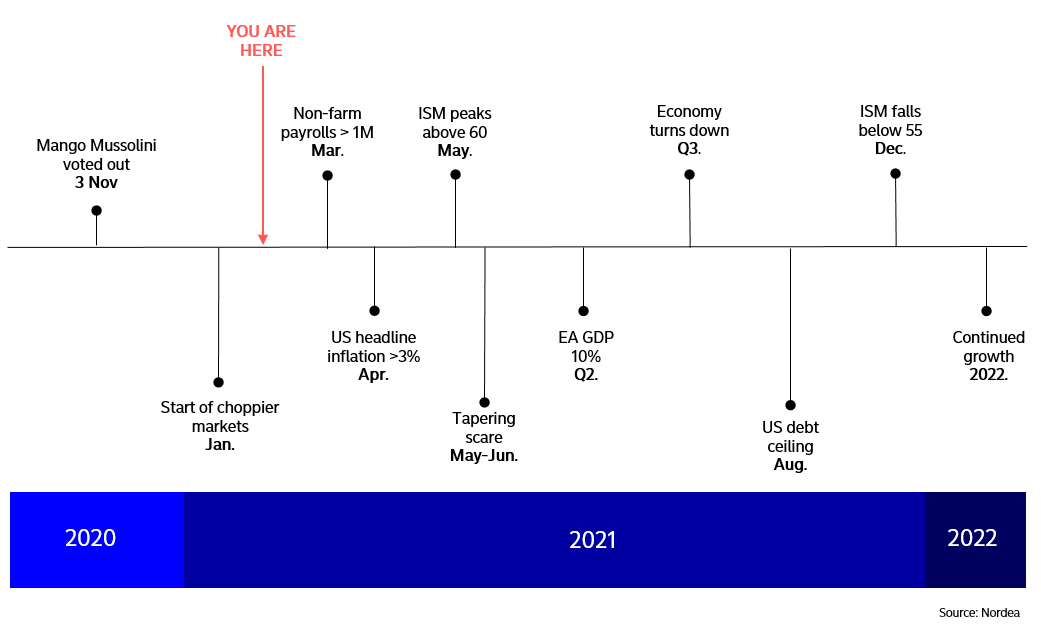

Chart 1: A schematic timeline for 2021

There’s currently speculation that EMU or German inflation might hit 4% as early as this side of the summer, roughly at the same time as US headline inflation could top 3%. Core will surely be on the move as well. And this at the same time as global sentiment measures such as PMI remain at super-strong levels.

Fading weather effects and the reopening of the service sector might even prompt US nonfarm payrolls readings of a million, if not now in March then in April or May.

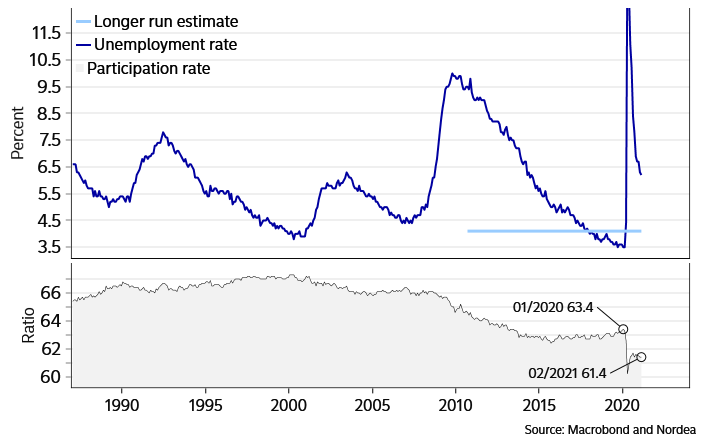

Chart 2: US unemployment rate understates labour market weakness…

US officials have argued that the unemployment rate understates labour market weakness due to people leaving the labour force – the participation rate has dropped by two percentage points. The employment-to-population rate is a measure encompassing this effect. This ratio dropped from the pre-pandemic level of 61.1% down to a record-low of 51.3% in April of last year, to now stand at 57.5%.

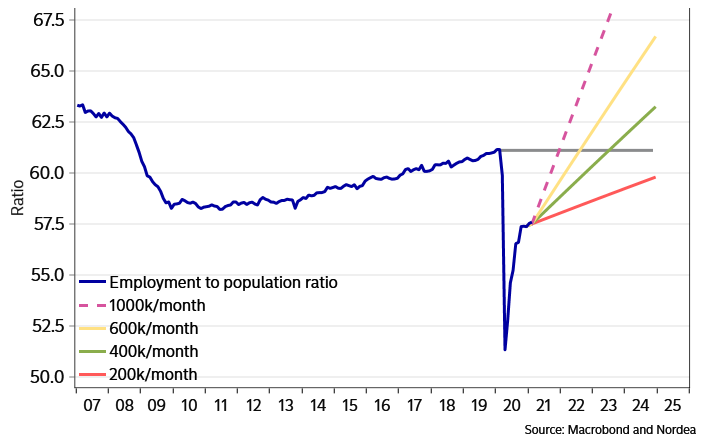

Chart 3: … but simple extrapolations may suggest full employment by Christmas

What is interesting is that if we extrapolate payrolls readings of a million, then the employment-to-population ratio will be back at pre-pandemic levels before Christmas.

We are not saying such extrapolations make fundamental sense, but from a market psychological point of view – this exercise can’t be construed as anything else than bond-bearish. And even if you think the above exercise is dumb, what if other market participants think it’s not?

As for US rates, the FOMC’s March meeting was not the most important event of our lifetimes. FOMC review: Officially behind the curve and proud of it. It changed nothing – the tug of war between the market and the Fed will likely intensify, and further “tantrummy” mood swings should be expected before summer.

It is refreshing, however, that the Fed is letting the market find its own equilibrium of sorts (more so than the ECB…). Higher long-term rates indeed spell headwinds for highly valued equity indices such as Nasdaq. The growth-to-value reallocation should thus be expected to continue.

Indeed, with the aforementioned (likely) mix of data in the pipeline, how can anyone continue to be anything else than a US inflationista for now?

Sure, the Biden administration has started to talk about tax hikes, but insofar taxes are lifted primarily for high-income households it won’t affect demand much given this group’s relatively low marginal propensity to spend.

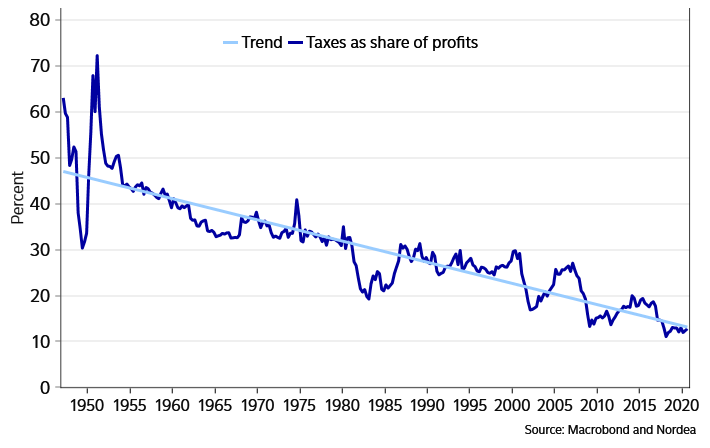

(Effective) corporate tax burdens have been dropping for 70 years, so tax hikes should not necessarily bring economic trouble either. The distributionary effects might prove troublesome though – tax hikes could have a greater and negative impact on job-creating SMEs, and less so on tax-planning MNCs (though the former are more republican-leaning, so perhaps they deserve to get it good and hard? Kto–kogo?).

One take-away from this discussion of tax hikes is that we would not be having these if we had been in a real and truly inflationary MMT regime – but that can’t be ruled out either down the line given the Chimerica’s Thucydides trap, or for that matter the green new deal.

Chart 4: The effective tax rate has dropped since 1950s

The situation in the EU, China or EM is not as “inflationary”. Imagine, only a week ago everybody worried about a lack of vaccine deliveries to the EU. EU officials then blamed the UK for an “export ban” preventing the distribution of Oxford-AstraZeneca’s vaccine. Several days later, all large EU countries had stopped using AstraZeneca’s vaccine (temporarily) – reportedly due to reports of adverse symptoms, and around the same time, Russia announced deals to start producing more Sputnik-V vaccines in the EU.

If one had a conspiratorial (and geopolitical) bent, one might almost surmise that it’s i) an example of Russia being successful in another disinformation operation, and ii) attempt of the EU countries to strike back at the UK, or iii) perhaps steer the narrative away from the EU’s vaccine failure. Or perhaps the worries are simply legitimate. This latest story is nonetheless a sign of a struggling EU, with a struggling vdL. A vdL who even threatened to cease the means of production (of vaccines) – what does that actually imply for globalism? Anyhow, the EU situation is clearly not as “inflationary” as the US.