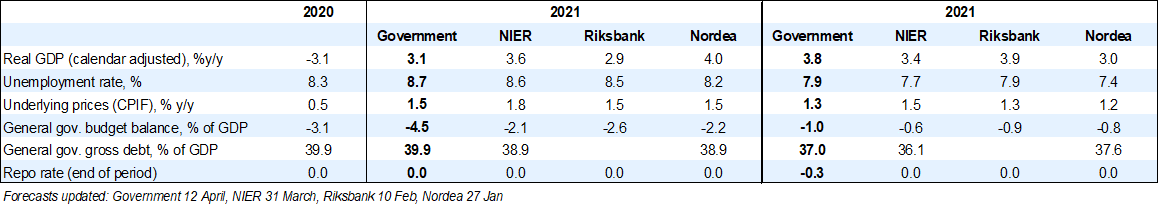

Nordea mener, at den svenske regering ser for dystert på de økonomiske udsigter. Regeringen venter en vækst i år på 3,1 pct., men Nordea vurderer, at væksten bliver på 4 pct. Regeringer ser også for dystert på beskæftigelsen – med en ventet stigning i ledigheden til 8,7 pct., mens Nordea selv venter en ledighed på 8,2 pct.

Sweden: Gloomy government

The government keeps its forecasts on the Swedish economy roughly unchanged, despite encouraging signs from the economy.

Ahead of the Spring Bill due out Thursday 15 April, the government has presented forecasts on the Swedish economy.

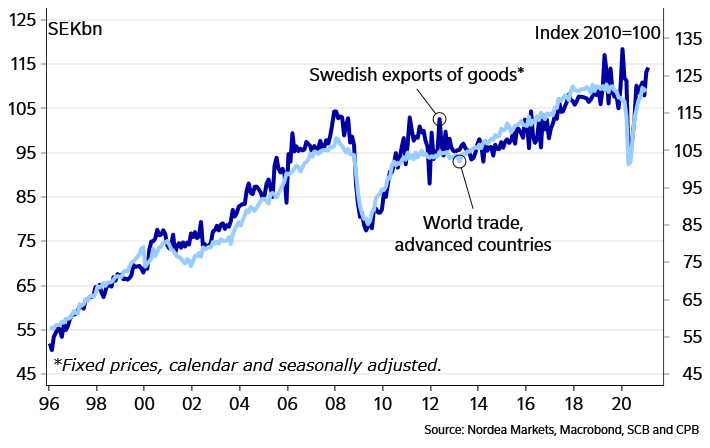

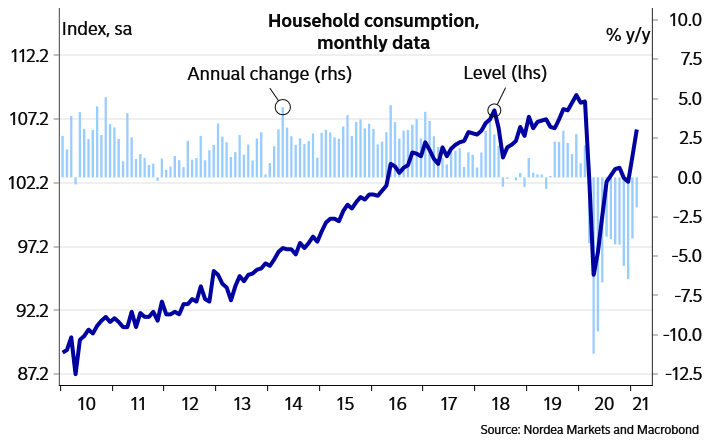

The government is too pessimistic on the growth outlook, we think. The government sees GDP up by 3.1% this year, only 0.2% point higher in their forecasts from December. In our Economic Outlook from January, we saw GDP at 4.0% for 2021, and NIER sees GDP at 3.6%. The government is too gloomy especially on household consumption and exports, which both have shown good growth in the beginning of this year.

The government is too pessimistic on the labour market as well. Unemployment will rise to 8.7% this year, which is well above our call at 8.2%. However, there are statistical issues with SCB’s Labour Force Survey, which makes developments and forecasts difficult to interpret.

Public finances remain robust, especially in an international comparison. Government debt (Maastricht) never rises above 40% of GDP and the budget deficit is only 1% of GDP this year. The government’s forecasts for the budget deficit is better than our view, especially considering the government being too pessimistic on GDP growth and the labour market.

Cost pressures are low and inflation will undershoot the 2% target for many years ahead, according to the government. As in December, the government has pencilled in rate cuts from the Riksbank and no rate hikes up to and including 2024. We agree that risks are tilted towards rate cuts but it nevertheless seems unlikely. The Riksbank will note the government’s view on inflation and monetary policy, but it will probably not affect the bank much.