Der bliver stor forskel på, hvordan Europa og USA afvikler de stimuli, der har hjulpet landene gennem pandemien. Den amerikanske centralbank har indikeret en kraftig afvikling. Men Nordea tror, at ECB vil gå meget forsigtigt frem og kun tage små skridt i en afvikling af sine stimuli. Det vil også fremgå af ECB-mødet i næste uge. Derfor er der ikke udsigt til en snarlig afvikling af centralbankens støttepolitik. Der har længe været forventninger om afgørende beslutninger i næste uge, men Nordea tror, at de vil blive udskudt. Vi får et timeout. Mange beslutninger vil blive udskudt til første kvartal næste år, vurderer Nordea. Der er dog nye risici såsom en øget risiko for højere inflation, og desuden er der forskellige opfattelser i ECBs ledelse omkring bekæmpelsen af inflationen. Men Nordea tror, at duerne i ECB-rådet foreløbig får overtaget, selv om inflationsrisikoen har overrasket ECB. Opkøbsprogrammet PEPP ventes dog at blive afsluttet i marts – som allerede besluttet. Samtidig venter Nordea, at ECB vil bekræfte en tidligere melding om, at en rentestigning i det nye år er usandsynlig.

ECB Watch: Another timeout

The ECB will likely take small steps towards ending its pandemic-era support measures next week, but easy monetary policy is not about to end. Many decisions will be postponed into Q1 next year, as also upside inflation risks have risen.

- Major decisions on the monetary policy outlook also longer out were supposed to be taken at the December meeting, but amidst the risen uncertainty and differing opinions, many decisions may now be postponed into early 2022.

- Net purchases under the PEPP will likely end by the end of March 2022, but buying will still be notable in the coming months.

- The ECB will probably boost the APP as net PEPP ends, but it is far from certain that it is ready to make the detailed decision next week.

- The upside inflation risks and elevated near-term uncertainty regarding economic developments make many Governing Council members weary of pre-committing to long periods of time.

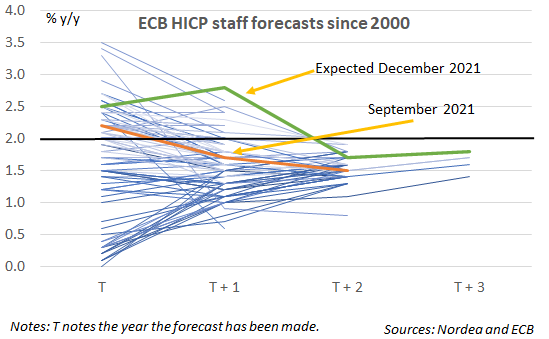

- Staff forecasts will probably show inflation below the target longer out.

- We see more downside for EUR/USD and upside potential for bonds yields.

The December ECB meeting (on 16 December) was set to become the big one where important decisions regarding future monetary policy would be taken. Since the outlook has again become more uncertain, not least due to another worsening of the COVID-19 situation and the Omicron variant, the ECB may not be ready to make all the decisions it originally planned at the December meeting.

The December meeting will still be interesting, probably the most interesting ECB meeting of the year, as many decisions simply cannot be postponed further, while it will also reveal for the first time how far below the 2% target, staff forecasts will put inflation in 2024.

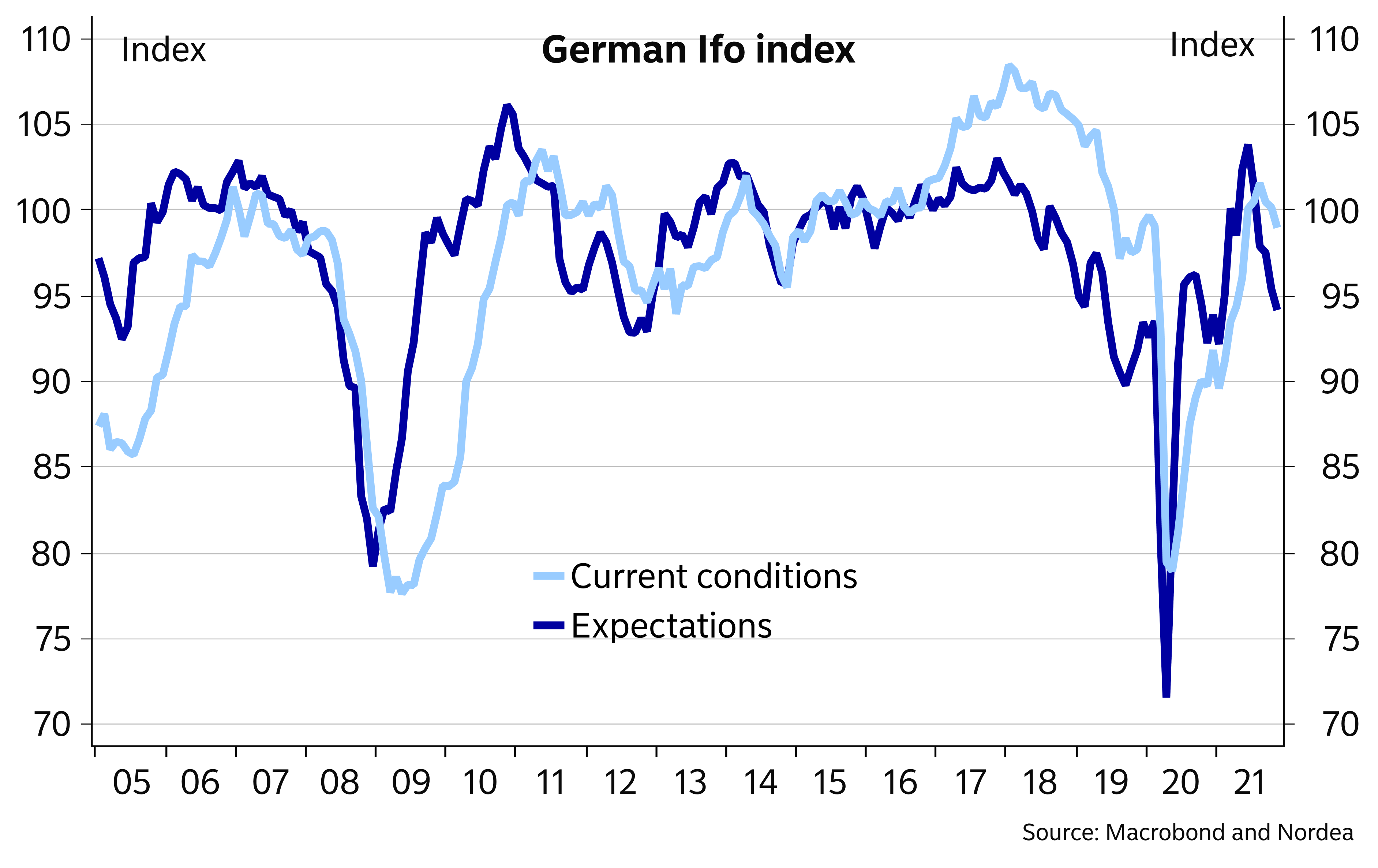

The Governing Council is somewhat divided between the more hawkish members, which point to the rising upside inflation risks, while the more dovish members point to the renewed hit to activity due to the new COVID-19 restrictions, the fall in many leading activity indicators and the ECB’s strategy of forceful and persistent monetary policy action at a time when the economy is operating close to the lower bound on nominal interest rates.

The differing opinions will mean that a compromise will have to be found next week. We believe that the doves will retain the upper hand for now, but there will be general reluctance to pre-commit to longer periods of time. In a nutshell, we expect the ECB to

- confirm that the new purchases under the Pandemic Emergency Purchase Programme (PEPP) will end as scheduled at the end of March 2022

- boost the Asset Purchase Programme (APP) by a fixed envelope (of around 100-200bn) that can be used flexibly, as needed, but may not necessarily be used in full; it is very possible that the decision on the APP will be postponed to Q1 next year as well

- use PEPP reinvestments flexibly to tackle the risks of renewed fragmentation of Euro-area bond markets instead of going for a new bond buying programme

- leave forward guidance on rates and asset purchases unchanged

- postpone the decision on the future of Targeted Longer-Term Refinancing Operations (TLTROs) into early next year

- repeat that rate hikes as early as next year look unlikely.

We continue to think that broad US inflation pressures will force the Fed to outpace the ECB by far in its monetary policy tightening efforts, and see further downside potential for the EUR/USD. While we see more upside potential for US yields, we do expect also EUR yields to head higher, as the ECB decreases its bond purchases, uncertainty regarding the economy recedes and inflation pressures pick up. The immediate market reaction to the ECB’s message next week could well be slightly dovish, though.

Expectations regarding the future receded

Many Governing Council members will note the upside inflation risks

ECB to remain an important buyer in the bond market

Net PEPP buying was around EUR 68bn in both October and November, which together with the APP amounted to monthly net buying of around EUR 90bn. Those numbers may include some frontloading ahead of December, which will be a slower month purely due to seasonal considerations. Given the uncertain near-term outlook due to the virus developments, the ECB is likely to continue to utilise the PEPP to a significant extent in Q1 next year. As a result, the monthly PEPP buying could easily still total EUR 40 to 50bn early next year, even if net purchases under that programme are close to ending.

Boosting the APP with a fixed envelope vs an increase in the current monthly flow of EUR 20bn would have the benefit of being able to respond to changed market conditions and also to make the transition from the PEPP to the APP smoother. It would also serve as a compromise towards the hawks, as it would put a firmer limit on the amount of purchases, and especially if it came with a clause that the full envelope would not necessarily be used, as was seen with the PEPP. Given the current uncertainty, it is very possible that the ECB will leave the detailed decision on boosting the APP to Q1 next year as well, and merely indicate next week that it still intends to end the net phase of PEPP as planned at the end of March 2022.

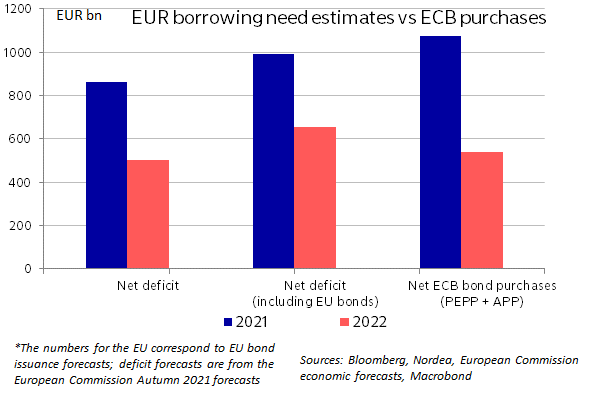

Despite a clearly smaller amount of net purchases, it is worth remembering that also the net issuance requirements of Euro-area governments are set to fall significantly next year. Even if we add European Union bonds to the mix, the decrease in net issuance of bonds could be around a third in 2022 compared to this year. As a result, even if ECB support is set to decrease next year, it will fall by much less than suggested by the lower amount of ECB net purchases, and the ECB will most likely continue to have an instrumental role in supporting the bond market also next year.

We do note that an increasing number of Governing Council members have become weary on continuing to buy bonds for longer. For example, Executive Board member Schnabel has argued that there are, on the one hand, diminishing returns to asset purchases and, on the other hand, increasing side effects. Therefore, eventually, there will be a shift from asset purchases towards other tools, most importantly our forward guidance.

In our baseline, we expect net purchases to continue well into 2023. However, we do note the shifting opinions on asset purchases, and the chance of the ECB stopping net purchases earlier and taking a longer pause between the end of net purchases and the start of rate hikes has risen.

Finally, instead of going for a fully new buying programme to protect against fragmentation in the Euro-area bond markets, the ECB is more likely to point to being able to use PEPP reinvestments for this purpose. After all, the PEPP is not going away even as net purchases end, as the ECB has communicated that PEPP reinvestments will continue at least until the end of 2023. The flow of PEPP redemptions should be sufficient for a lot of flexibility, as for example in the past year, PEPP redemptions totalled around EUR 200bn.

ECB still set to buy a lot relative to net issuance in 2022

A million dollar question: where is the Euro-area inflation heading?

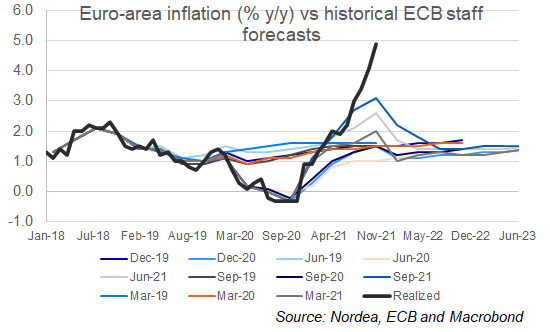

Next week, the ECB will also publish the new staff macroeconomic projections, which will cover also the year 2024 for the first time. While fresh data and shifts in the macro outlook will imply dramatic upward revisions to the inflation projections for 2021 and 2022, we expect that the ECB’s view on inflation longer out in the forecast horizon will change only slightly.

The ECB projections have recently foreseen a combination of relatively fast growth and only gradually accumulating price pressures, and it is likely that this tendency will continue in the new projections. This is simply because economic forecasting models, also those used at the ECB, are usually based on the assumption that history will repeat itself. The new projections are thus likely to assume that the second-round effects from the currently high energy and raw material prices will be rather small and also the pass-through from tightening labour market conditions to consumer price inflation continues to be rather weak – exactly what was the case in the years prior to the pandemic.

Thus, we assume that even if the headline inflation projection for 2022 will be revised dramatically up from 1.7% close to 3% in 2022, both headline and core inflation are likely to be projected to decline clearly below the 2% target in 2023. In 2024, one could see numbers already very close to the target given that the projections on economic growth are likely to show robust outlook.

We expect that the ECB will emphasise that the risks are biased to the upside around the inflation forecast. There is indeed a high probability that the inflationary environment is now fundamentally different than prior to the pandemic. Headline inflation is record high and the global factors – problems in supply chains, high energy prices and lack of labour force – are likely to boost inflation for longer than the ECB had thought. This may well imply that inflation expectations are reformulated among the public and we will see substantial second-round effects from the rising costs leading to permanently higher wage and price pressures in the Euro area.

However, all that is still highly uncertain and not likely to enter into the new ECB forecasts given that e.g. the results from the recent wage negotiations in Germany have not shown signs of spiralling wage increases. Furthermore, even if companies are reporting increasing challenges in recruiting, the labour market tightness is far from the levels we see in the US. Similarly, the recent dramatic rise in inflation continues to be very much concentrated on energy prices and certain temporary factors. The rise of Euro-area core inflation from 2.1% to 2.7% in November was to a large extent due to the often volatile prices of package holidays and flight tickets. In many Euro-area countries, core prices outside of these categories have continued to develop very gradually and in Germany, inflation numbers continue to be affected by the base effect from the VAT reduction in 2020.Thus, while the upside risks around the ECB’s gradual view on inflation has increased we do not expect the projections to change dramatically until the shift is visible in data.

New staff forecasts still likely to see inflation below target longer out

Tilmeld dig vores gratis nyhedsbrev om finans & økonomi og få de vigtigste nyheder direkte i din indbakke:

Tilmeld dig vores gratis nyhedsbrev

ØU Top100 Finansvirksomhed

Få de vigtigste om bank, realkredit, forsikring, pension

Udkommer hver mandag.