Nordea hæfter sig ved, at to amerikanske topøkonomer har advaret om, at de enorme finanspakker under coronakrisen kan føre til overophedning med stigende inflation og højere rente. Det er Larry Summers, der har været topøkonom i Obama-regeringen, og Olivier Blancard, der har været cheføkonom i Den internationale Valutafond. Spørgsmålet er, om den amerikanske centralbank vil følge trop, hvis inflationen kommer over 2 pct. Hidtil har det været en konventionel visdom, at der næsten ikke kan pumpes for mange penge i kredsløb for at afværge effekten af coronakrisen. Men nu sætter tvivlen altså ind.

Blanchard and the risk of overheating

Summers and Blanchard have started to warn about the risk of overheating the US economy, should the $1900bn Biden plan be implemented. Could the Fed turn similarly scared, if core inflation starts running above 2% in Q2?

Quote of the week

“think this package is too much.” Olivier Blanchard

One of the key findings in the aftermath of the Great Financial Crisis was that the risk of doing too much is way smaller than the risk of doing too little. This mantra has clearly paved its way in to most administrations during the Covid-19 crisis and even big institutions as the OECD and IMF have slowly but surely accepted that a debt-financed fiscal response is the only feasible way to ensure a swift rebound from the Covid-19 crisis.

In recent days, two of the more profiled advocates of easier fiscal policy just a few months back, namely Summers and Blanchard, have started to warn against the risk of overheating the US economy as a result of the $1900bn Biden-nomics plan.

This goes to show that it is easy to say that the risk of doing too much is low when nothing is done, but as soon as a big package is actually being pondered, the same experts start to back-paddle.

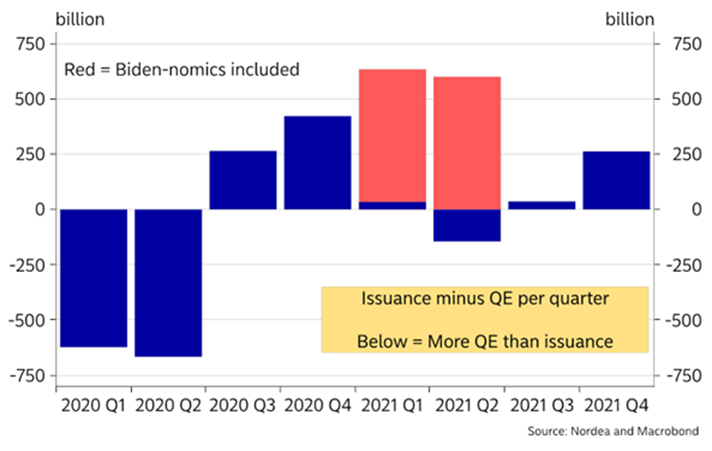

Chart 1. The debt to issuance per quarters depends on the size of Biden-nomics

We still expect a watered down version of the Biden plan to pass congress ($900-1200bn) and given the new strategy from the Yellen led US Treasury, debt will be issued WHEN the plan comes into fruition and not before as was the case in 2020.

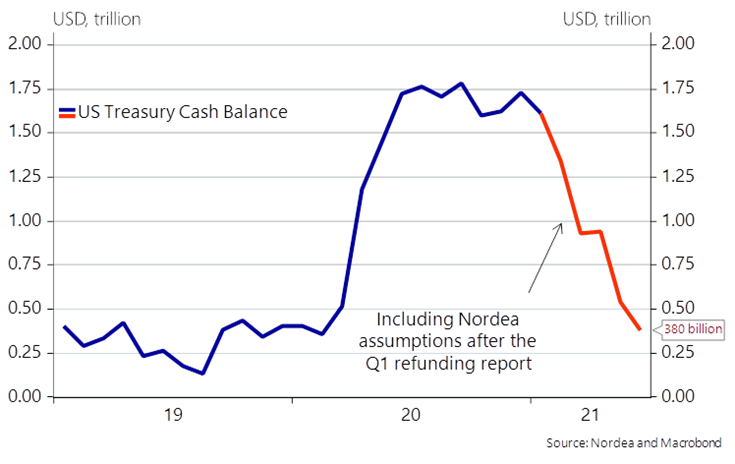

The US Treasury now also finally intends to spend the money on the TGA account at the Fed, which means that banks will be on the receiving end of that liquidity when the TGA is taken lower (USD liquidity is coming)

Excess liquidity in the banking system will accordingly increase, and if we include/assume a continued 120Bs a month in QE purchases by the Fed, the total liquidity increase in the first half of 2021 could end up around 1.6-1.8trn – (almost) without historical precedence. This should be good news for US assets vs. the rest of the world.

Chart 2. The Treasury General Account will finally be taken lower and commercial banks will receive the liquidity

There is clearly a possibility of a melt-up in US assets with cascades of liquidity arriving alongside a strong fiscal momentum, which could lead to a “ketchup effect” in core inflation during the second quarter of this year.

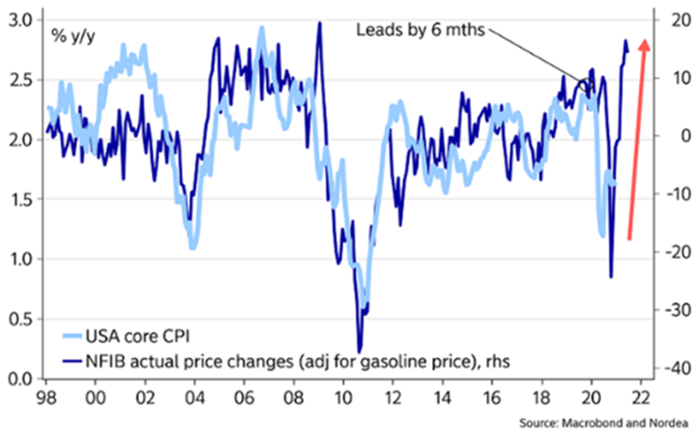

SMEs have started to hint of decade-high price plans, output prices from China are rising and both ISM surveys hint of a large price pressure. It is a fairly free lunch to talk about average-inflation-targeting when inflation runs far below the target, but will it be as straight-forward to keep referring to the AIT-regime once core inflation starts to run above target in Q2?

We see a clear risk that Powell and the Fed starts sounding a bit like Summers and Blanchard as soon as inflation is actually running above target, which could lead to an internal Fed debate on the appropriate balance sheet policy already before summer.

It is after all much easier to talk about average inflation targeting, as long as you are not tested on actual inflation that runs hotter than the target.

Chart 3. Inflation to run substantially above target in Q2?