Kravet vokser mod ECB for at hæve renterne på grund af den voksende inflation i Europa, men reglerne for ECB gør, at det først kan ske på et møde i juli og ikke her i juni. Selv om man ikke kan udelukke en rentestigning på 50 basispunkter, så tror Nordea, at renten kun hæves med 25 punkter, især fordi ECB-chefen Lagarde har sagt, at rentestigningerne vil ske gradvist. Nordea venter også, at ECB vil nedjustere den økonomiske vækst og indikere, at det høje prisniveau vil vare længere end hidtil antaget. ECBs egne økonomer har undervurderet inflationen, som det også er sket i USA. ECB forudsiger betydelige lønstigninger.

ECB Watch: Forbidden to hike

The pressure for the ECB to act has increased considerably, but the central bank’s earlier guidance rules out hiking rates at the meeting next week. Along with updated inflation forecasts, the ECB’s signals will all but guarantee a rate hike in July.

- The ECB is set to confirm next week that it plans to end asset purchases very early in July and hike rates by 25bp later that month.

- While the door is not totally shut for a 50bp move in July, it would be quite surprising for the ECB to start its hiking cycle with such a big step, especially as Lagarde recently signalled the ECB’s first moves would take place gradually.

- Given the ECB’s gradual shift towards a more hawkish stance and the market’s receptiveness to such comments, we see risks tilted towards a hawkish interpretation of the ECB’s message next week, i.e. higher rates and a stronger EUR.

- The ECB staff forecasts are set to show clear downward revisions to GDP growth but see core inflation above the target also longer out.

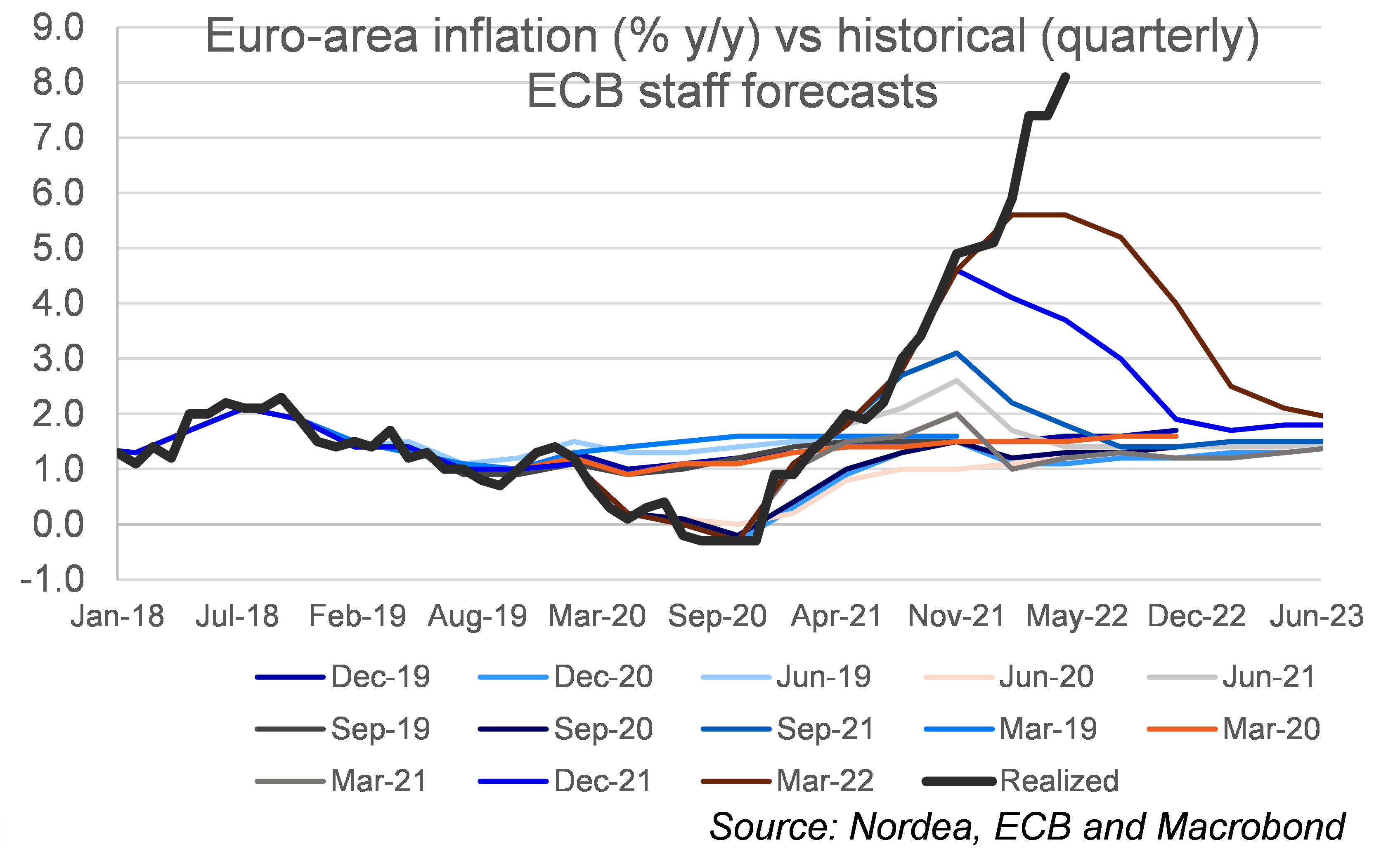

The pressure on the ECB to exit its ultra-accommodative monetary policy has continued to mount Euro-area inflation rose to above 8% in May compared to the ECB’s Q2 forecast of 5.6% from March. Core inflation accelerated to a record-high 3.8% y/y, far above the ECB’s 2% inflation target, while price pressures have become more widely spread both among sectors and geographically.

It is true that monetary policy affects the economy with a lag, the ECB has a medium-term horizon and the central bank has so far expected inflation to be rather below than above the target at the end of its forecast horizon. However, many Governing Council members have lost faith in the ECB’s ability to forecast inflation in the current environment and have seen enough signs of upside inflation pressures to warrant action.

In fact, the case for rates hikes has become so strong that even the more dovish Governing Council members have started to back it lately. The only reason the ECB will not hike rates as soon as next week (meeting on 9 June) is its earlier guidance that it intends to end net asset purchases in Q3 and rate hikes will start only some time after the net purchases have ended. The ECB has been keen to hold on to its earlier guidance and prefers to make changes to its earlier guidance in small steps. Net asset purchases are likely to end very early in Q3, maybe even on 1 July, which is a Friday.

Some of the hawks have started calling for a 50bp hike at the July meeting, but we continue to find such a move unlikely for now. As mentioned above, the ECB has had a preference to change its guidance only gradually, and both President Lagarde and Chief Economist Lane have recently signalled that the ECB’s baseline is for rates to be lifted by 25bp both in July and September. Whether such guidance will survive until the September meeting is another thing, but a deviation as early as July would be quite a turn. In addition, market-implied inflation expectations have retreated from their highs last month, so at least not all indicators have moved against the ECB lately.

Lagarde is unlikely to close the door for a 50bp move in July entirely, but it would be surprising if her comments deviated materially from the signals of her blog from last week. After all, it was quite unusual for her to give such clear guidance between meetings, so it would be a blow to her credibility, if such signals would not match the prevailing consensus in the Governing Council.

In the blog, she opened the door for the ECB to drop its insistence that rate hikes would take place gradually and argued it was hard to determine the pace of rate hikes from the autumn onwards. But the baseline until the autumn would be an exit from negative rates by the end of the third quarter.

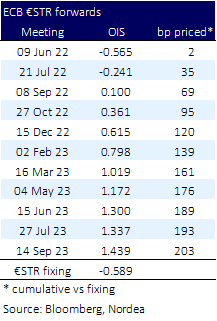

Even though the financial markets are already pricing in risks of a 50bp rate hike by the ECB in July (around 35bp higher overnight rates being priced for the July meeting and a cumulative of almost 70bp for the September meeting), given the ECB’s gradual moves towards a more hawkish stance and the reaction in financial markets to such turns, we think the ECB’s message next week could be interpreted somewhat hawkishly, i.e. higher rates and a stronger EUR. Such a message would be reinforced, if the updated staff forecasts showed inflation at slightly above the 2% target in 2024, which would strengthen the case for rate hikes. Beyond next week’s meeting, we see plenty more upside for long EUR yields, and also expect intra-Euro-area bond spreads to widen further.

For now, our own baseline remains one of 25bp rate hikes in July, September and December, but risks are clearly tilted towards the ECB hiking rates at every meeting this year, while also the chance of a 50bp rate hike in September has grown.

In the Q&A, Lagarde will also be pressed for more information on what the ECB would do to counter the threat widening intra-Euro-area bond spreads pose to the transmission of the ECB’s monetary policy. We think Lagarde will merely repeat that the ECB can design and deploy new instruments to secure monetary policy transmission and point to the to the flexibility of its reinvestments under the Pandemic Emergency Purchase Programme (PEPP). We think that the discussions of new instruments are still at quite an early stage, but do see that the ECB will eventually have to come up with new measures to tackle the risks of fragmentation.

Continued upward surprises challenged the ECB’s inflation views

Market already pricing in clear risks of a 50bp ECB rate hike

Market-implied inflation expectations retreated from their highs

What is the ECB staff view on inflation?

In March, the ECB staff was very optimistic about the economic outlook but at the same time saw inflationary pressures calming down very quickly. Since then, inflation has surprised the staff very much to the upside, which implies that household purchasing power will develop very negatively hurting the growth outlook.

Thus, we expect that the growth forecast for 2022 and 2023 will be taken to clearly lower levels from 3.7% and 2.8% closer to Nordea forecast numbers (3.0% and 1.5%). At the moment, we see the risks even to our forecast to be slightly biased to the downside given the recent price increases especially in oil and food prices that hurt households’ position even more than in our baseline.

Regarding headline inflation, the ECB March projection for 2022 of 5.1% will rise to close to 7% but will most likely underestimated the fresh data point (8.1% in May) because the cut-off period for the projections probably implies that the oil and food assumptions in the projections are lower than what the market currently prices in. It is likely that the headline projection will again rapidly fall even below 2% in 2023 as the ECB normally uses the futures curves for food and energy in its projections and given their downward sloping profile those will contribute negatively to headline inflation numbers.

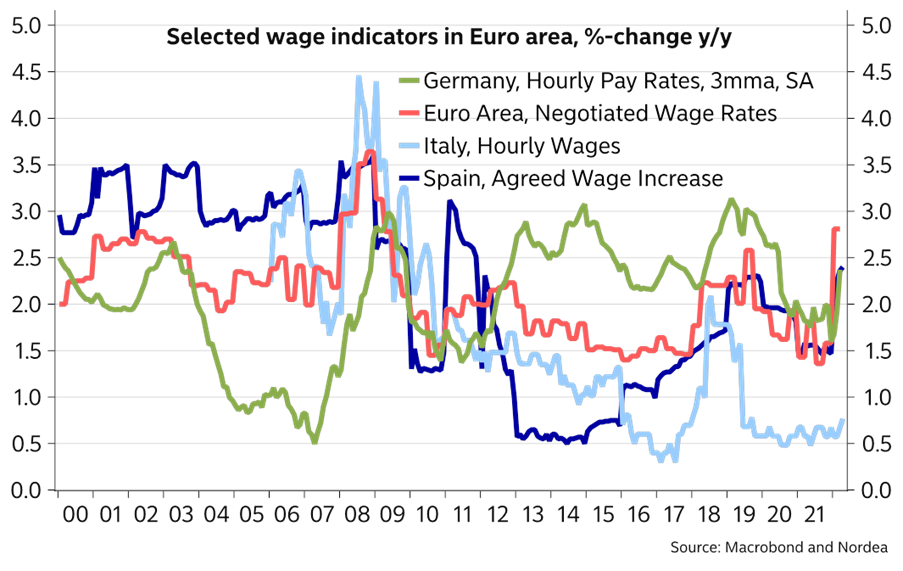

The most important question regarding the core inflation projection is what kind of second round effects the ECB staff sees that the current high headline inflation numbers will have on wages and prices. So far, the ECB staff has not seen much coming out from the second round effects and estimated back in March that the global supply chains will recover soon. taking off some upside price pressures. These rather strong assumptions kept the projected core inflation below the ECB target at 1.8% and 1.9% in 2023-2024.

However, given that headline inflation is now considerably higher than in March and it would be unrealistic to expect the global supply problems to disappear any time soon given the Covid policy in China, that view may well change (see the first graph above). Especially if the ECB continues to have a rather positive economic outlook, it would be logical to see significantly higher wage increases in the forecast horizon.

This should imply that core inflation is projected to continue to be higher than the ECB target in the coming years. Otherwise, the ECB should revise the economic outlook down clearly below the potential.