Markederne har oplevet dramatiske forandringer i år med stor volatilitet, og den udvikling vil fortsætte, vurderer Nordea. Usikkerheden er ekstrem, og det afføder stor volatilitet. Det er vanskeligt at forudsige, hvordan inflationen udvikler sig de næste måneder. Det er vanskeligt at vurdere, om det er økonomien eller geopolitiske forhold, som driver forandringerne. Pandemien har lagt grunden til usikkerheden, fordi den brød med alle traditionelle opfattelser. De ledende indikatorer giver måske ikke længere en god pejling.

Uddrag fra Nordea:

Low visibility boosts volatility

The market environment has seen dramatic changes this year, which has led to uncertain and volatile market conditions. We find good reasons for the high volatility and expect the large market moves to continue.

“Forecasting has proven quite hard in recent years.” – Isabel Schnabel, Member of the Executive Board of the ECB on 16 August.

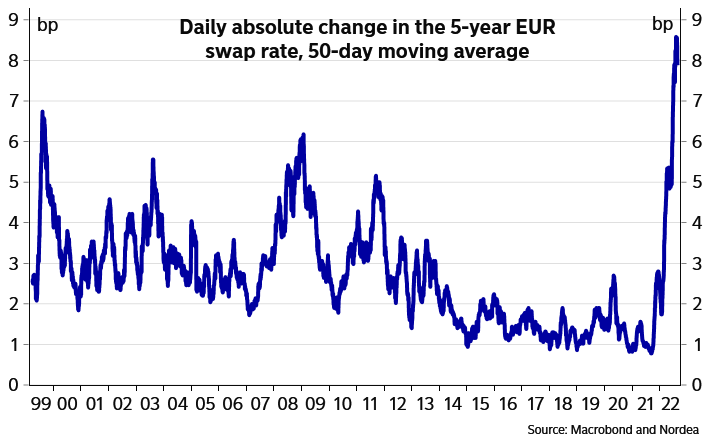

Extremely high uncertainty and elevated volatility have characterised financial markets this year, especially in interest rate markets. For example, EUR rate markets have seen both the largest short-term spikes as well as the deepest plunges in the history of the EUR currency in the past few months.

The main driver is naturally the generally low visibility in terms of the economic outlook. It is extremely difficult to forecast where inflation will end up over the next few months, let alone further into the future. Past forecasts have missed the mark entirely, which in itself makes current forecasts less credible. For example, the market is currently pricing in a peak in Euro-area inflation in December at above 10%. Back in January, the December fixing was seen at around 2.5% (even though headline inflation was already around 5%).

The economic environment is also very different from what financial markets have experienced for a long time. Inflation has made a comeback with a vengeance, and there is much more to it than being driven by a strong economy. In fact, the economic outlook is dire at the moment, especially in the Euro area.

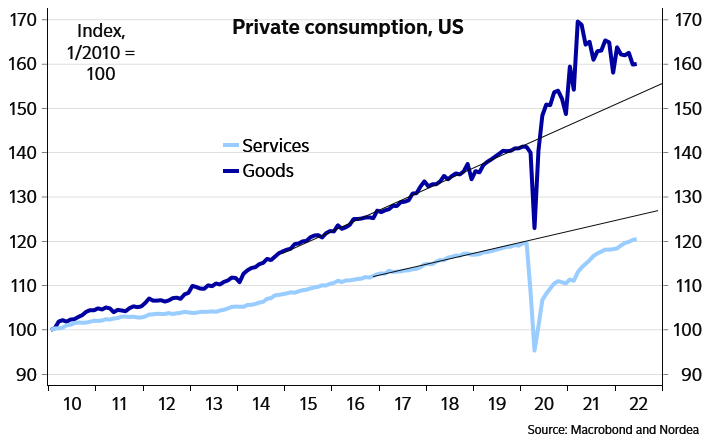

A global pandemic has distorted consumption patterns and behaviour. Lockdowns in economies pushed consumption towards goods, while re-openings started to support services consumption as well. Nevertheless, in the US, for example, the consumption of goods remains above and the consumption of services below the pre-pandemic trend. The transition towards services is thus still ongoing. It is difficult to distinguish between which part is driven by these changing patterns and which part by changes in general economic conditions.

At the same time, the traditionally more reliable leading indicators concentrate on the state and outlook for the industrial or manufacturing sectors, not services. Most services indicators have shorter histories compared to manufacturing key figures and usually attract less attention in financial markets. At the moment, the leading indicators that have previously guided the future path for the economy most reliably, may not be as good this time.

Add to the mix that financial markets had gotten used to years of suppressed volatility. Central banks were keeping rates low, buying bonds in their easing programmes and offering forward guidance even longer into the future. All that is gone now and is unlikely to return any time soon. Central banks are reluctant to give any firm guidance on rates and make decisions on a meeting-by-meeting basis. Moreover, given the rapid changes in the outlook, central banks have also needed to make quick policy changes.

Even the ECB is now admitting that they cannot forecast inflation accurately, as their models simply cannot capture structural shifts related to the pandemic, the war, unprecedented moves in the energy market and the green transition. As a result, they have to pay more attention to realised inflation, which is quite volatile at the moment.

The economic and inflation uncertainty is here to stay, at least for a prolonged period. In short, this implies that also higher volatility is here to stay.

Interest rate volatility has surged after years of suppressed levels

Consumption patterns remain in transition

What is the data telling us?

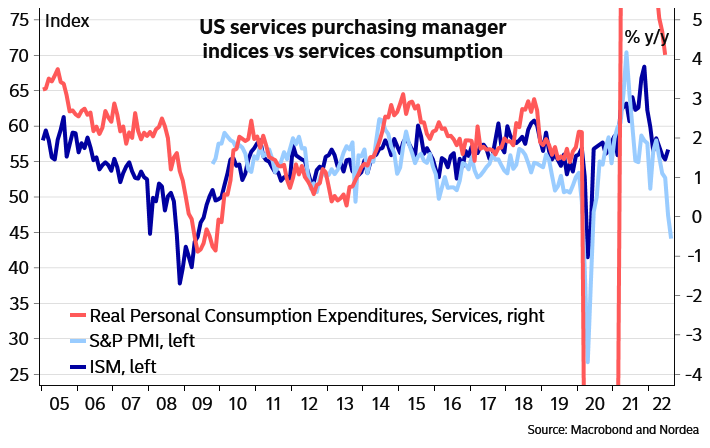

Given the increased importance of the service sector at the moment, the further plummet of the S&P flash US services PMI deeper into contraction territory raised further questions about the strength of the US economy. The index tumbled from a level of 47.7 to 45.0, with 50 index points generally marking the distinguishing line between growing and contracting activity. Apart from the COVID-19 lockdowns in 2020, the index has never been at such depressed levels, though its history only dates back to late 2009.

The more established non-manufacturing ISM index is telling a different story. The August reading will not be released until 6 September, but the July reading was still a relatively healthy 56.7 and the S&P and ISM surveys moved in oppositive directions in July.

It is difficult to say which survey is better at capturing the outlook this time. The ISM survey has a longer history and financial markets usually pay more attention to it. In fact, the S&P release only caused a short-lived drop in bond yields this week. The ISM survey is probably also more heavily tilted towards larger companies, while the S&P survey has a larger sample size. Neither of the surveys appears to have been particularly accurate in capturing the swings in services consumption, and the truth probably lies somewhere between these two readings. We would take the S&P numbers with a pinch of salt, and continue to think the US economy has plenty more growth potential.

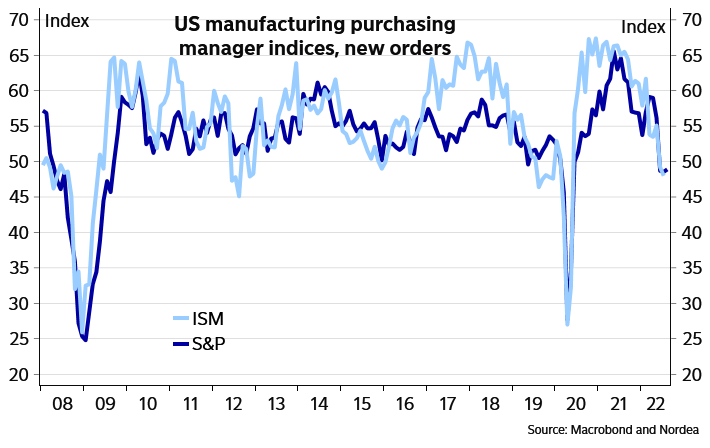

On the manufacturing side, the S&P and ISM surveys are currently painting a roughly similar picture (though that has not always been the case in the past). Growth is slowing down but still continuing. New orders are contracting, but there was actually a small rebound in the S&P survey, which was positive news.

What is the outlook for the US services sector really?

US manufacturing sector slowing down

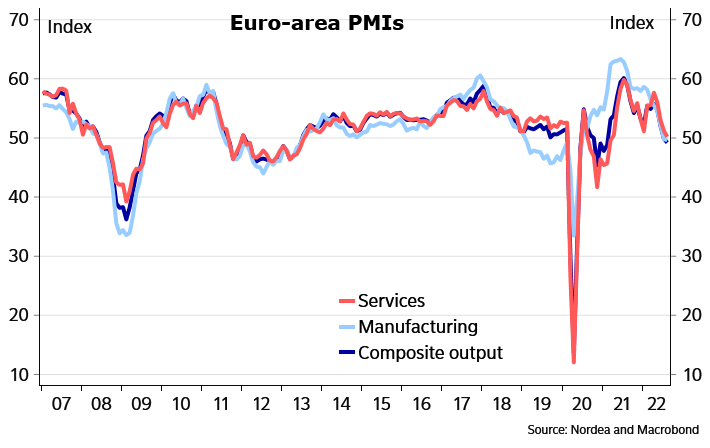

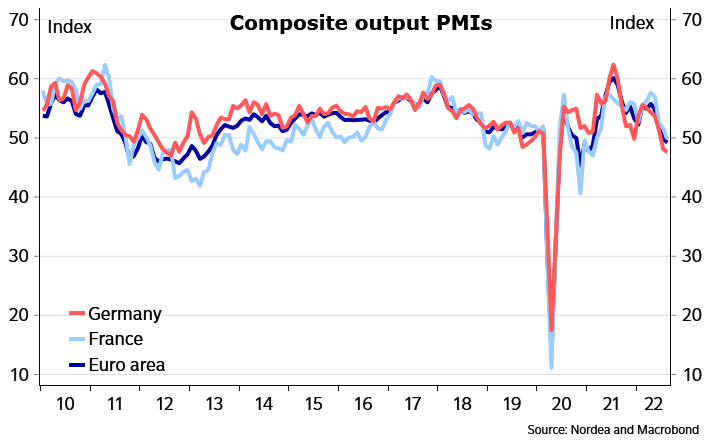

In the Euro area, the PMI data actually surprised slightly to the upside despite the increasing pressure from higher energy prices. Nevertheless, the composite output PMI has fallen below 50, which would be in line with a contraction in GDP. The German economy is suffering more than the French one. Also the German Ifo index beat expectations.

A recession in the Euro area and especially the German economy looks increasingly likely over the winter.

Euro-area PMIs fallen to levels suggesting falling GDP

German PMIs fallen more than French ones

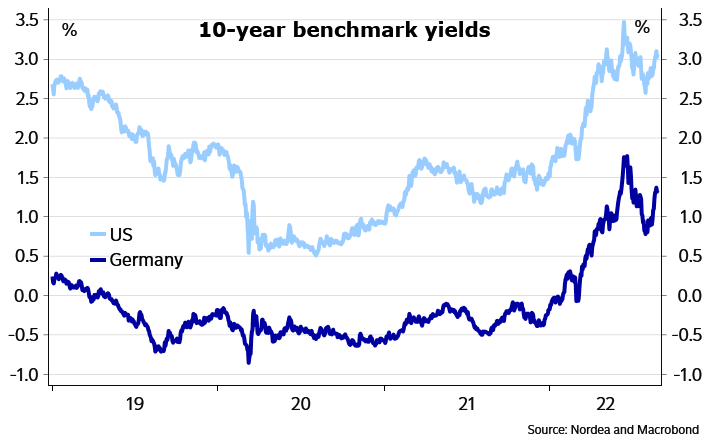

The US Treasury market has not been deterred by any growth worries recently and longer yields have continued to climb. We see more upside ahead and expect a breach of the June high of 3.50% in the 10-year yield until the end of the year.

We have been a bit surprised by the magnitude of the rise in longer German bond yields, which has been even faster than in the US. Some of those moves can probably be explained by calm summer markets. Nevertheless, the upside pressure could easily prevail in the near term, as ECB Governing Council members return from their summer holidays and the majority of their comments is likely to have a hawkish tone. The market has started to price in a risk of a 75bp ECB hike at the meeting on 8 September. We hold on to our baseline of a 50bp increase, but see a clear risk that the ECB could surprise hawkishly again and deliver an even larger hike.

In the FX space, the EUR/USD has fallen to trade more convincingly below parity. We see more downside ahead and continue to target 0.97 by the end of the year.

Long yields started to rise again

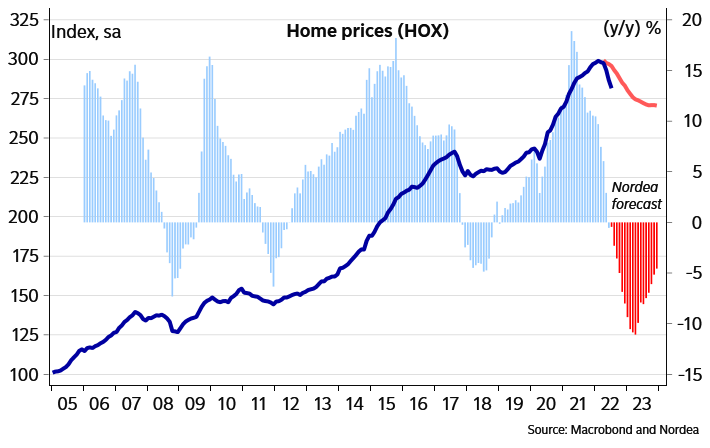

Collapse in Swedish home prices continues

Swedish house prices fell by 2.9% m/m in July; the fourth consecutive decline. Apartment prices in Stockholm have now collapsed by almost 10% since the peak earlier this year. There have been some indications that prices could be close to stabilising, but we continue to expect further declines ahead, as the Riksbank continues to raise rates and households try to adapt to the rapidly changing interest rate environment. The housing market outlook poses a risk for the SEK.

Swedish home prices fallen surprisingly rapidly

Meanwhile in Norway, the government will record huge revenues on the back of high energy prices. We estimate that petroleum revenue for the Norwegian government could amount to NOK 1500bn this year and NOK 1900bn next year. By comparison, the figure for last year stood at around NOK 310bn.