Estimater fra Finansministeriet peger på en stigning i statens finansieringsbehov til et rekordbeløb på 248 milliarder kr. Det skyldes primært, at virksomhederne har fået lov til at udskyde indbetalingen af skat og moms. Men udstedelsen af danske statsobligationer ventes at falde næste år, vurderer Nordea, fordi staten har store depoter i Nationalbanken. Det kan føre til lavere danske renter næste år i forhold til eurozonen.

Large financing requirement but lower issuance of Danish government bonds already next year

New estimates from the Danish Ministry of Finance point to a high financing requirement. However, as the central bank has already made a large prefunding, the issuance of Danish government bonds is expected to be lower already next year.

A very conservative estimate for 2020

In connection with the presentation of its Economic Survey, the Danish Ministry of Finance has updated its estimate of the central government financing requirement.

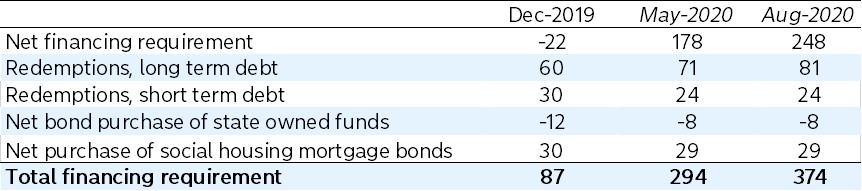

The 2020 net financing requirement has been revised up from DKK 178bn to a record-high of DKK 248bn. This DKK 70bn upward revision is mainly caused by government decision to allow companies to postpone paying income tax and VAT even longer. At the same time also the payment of holiday allowances in October has caused a higher expected net financing requirement.

Table 1: Expected financing requirement for 2020

In our view the expected net financing requirement for 2020 is very conservative and will most likely be proven to be much to large. In the last four consecutive months the drain on the government’s deposit has been much smaller than expected by the Ministry of Finance.

The reason for this is that the demand for disbursement of subsidies has been much smaller that anticipated by the government. Despite this, the Ministry of Finance continues to expect an even larger net financing requirement for the months to come – even though, the Danish economy is picking up speed rapidly according to leading indicators.

Negative net financing requirement next year

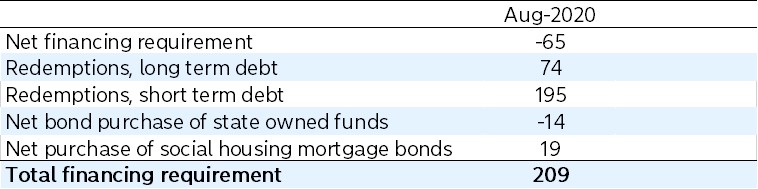

As usual in August, the Ministry of Finance also provides its first estimates of the financing requirement for next year. In 2021, the net financing requirement is estimated at DKK -65bn as the postponement of tax revenue in 2020 reduces the net financing needs for 2021.

As the central bank most likely will close its commercial paper programme in 2021 and at the same reduce the T-bill programme, the redemption of short term debt is expected to be very high next year. This brings the overall financing requirement to DKK 209bn, which is lower compared to this year but still very high in a historical context.

Table 2: Expected financing requirement for 2021

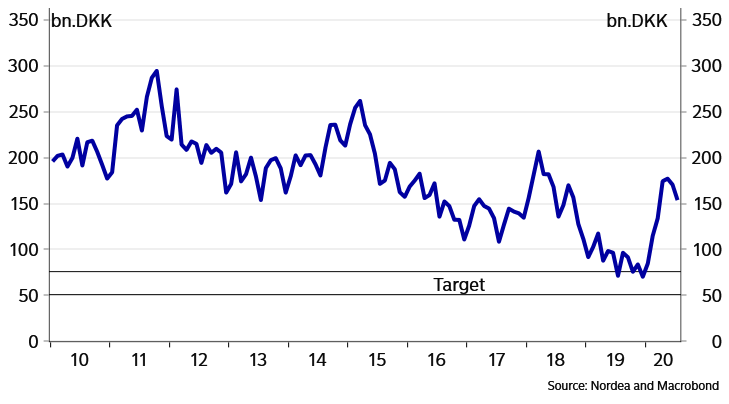

Lower target for issuance of government bonds in 2021

Despite the large total financing requirement we expect the Danish central bank to lower its target for issuance of government bonds in 2021. This is very much due to the current large government’s deposit at the central bank which at the of July amounted to DKK 154bn – compared to a target of DKK 50-75bn.

Chart 1. Government’s deposit at central bank stays elevated

The outlook for a lower supply of Danish government bonds already next year could lead to downward pressure on Danish government bond yields relative to Germany.

At the same time the expected drop in the government’s deposits at the central bank will most likely help to increase excess liquidity on the Danish money market. This could lead to downward pressure on short-term Danish money market rates relative to the Euro area.