Nordea tror, at den amerikanske centralbank vil hæve renterne hver eneste måned til et stykke ind i 2023 – ti styks i alt på hver 0,25 pct. Den korte rente vil komme over det neutrale niveau – til ca. 3 pct. engang i 2023. Markedet, herunder Nordea, tror, at centralbanken vil foretage flere rentestigninger, end Fed selv giver udtryk for. Syv af centralbankrådets 16 medlemmer stemte dog for kraftigere rentestigninger allerede i år. Krigen i Ukraine har betydning for stigningerne, men den største betydning har dog inflationen, der allerede var steget kraftigt før krigen. Nordea mener, at inflationsudviklingen ser meget bekymrende ud. Centralbanken vil også tage fat på en reduktion i dens usædvanligt høje balance på 9 trillioner dollar. Hvilken effekt det får, er analytikere usikre på, og endnu et bekymrende tegn er, at rentekurven flader ud.

Fed Watch: One down, ten to go

The Fed hiked rates for the first time since 2018 and signalled more to come. We think the challenging inflation outlook will force the Fed to hike at every meeting this year, and continue hiking well into 2023, lifting the short rate above neutral.

- The Fed started its rate hikes today with a 25bp move. We now see similar 25bp rate hikes in each of the six remaining Fed meetings this year and four more in 2023.

- A decision on the balance sheet contraction measures likely already at the next meeting in May.

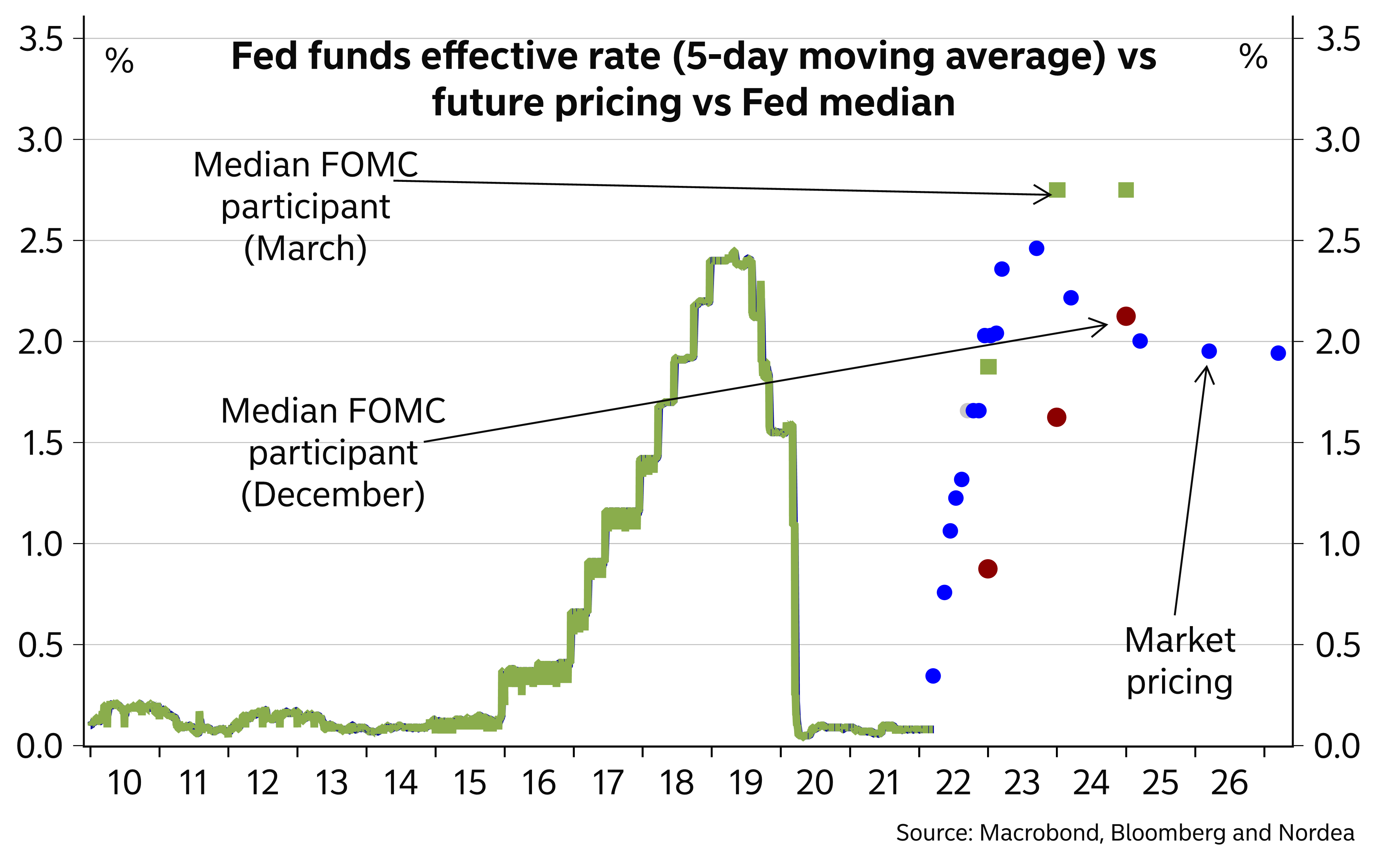

- The market currently prices in even faster rate hikes than we or the Fed see this year, but fewer hikes longer out. We think the hiking cycle will eventually result in a higher short-term rate – around 3% next year – compared to current market pricing.

The Fed delivered the first 25bp rate increase since the start of the global pandemic, in line with expectations. The statement was clear that the rate hikes would continue by saying that the Fed anticipates that ongoing increases in the target range will be appropriate. One member, James Bullard, voted for a 50bp hike today.

The dot plot, i.e. the median FOMC participant, signalled a total of seven hikes this year, assuming the Fed moved in 25bp steps, and just short of a further four next year, bringing the fed funds target rate to 2.75% by the end of next year. However, seven of the 16 FOMC participants called for a faster pace of rate increases this year compared to the median.

The Russian invasion was seen as a major source of uncertainty, but the larger implications were seen to be on inflation. Compared to the December projections, the unemployment rate forecast was unchanged for this year and next (and only slightly higher for 2024), but the median core PCE projection rose throughout the forecast horizon (to stand at an above-target 2.3% in 2024 vs. 2.1% in December).

In the press conference, Powell clearly left the door open for bigger rate moves (50bp) at individual meetings, if the incoming data supported such steps.

On the balance sheet measures, the statement signalled that the Committee expects to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities at a coming meeting. In the Q&A, Powell revealed that the Fed had made good progress in discussing the balance sheet measures, strongly suggesting that a decision will be made already at the next meeting in May.

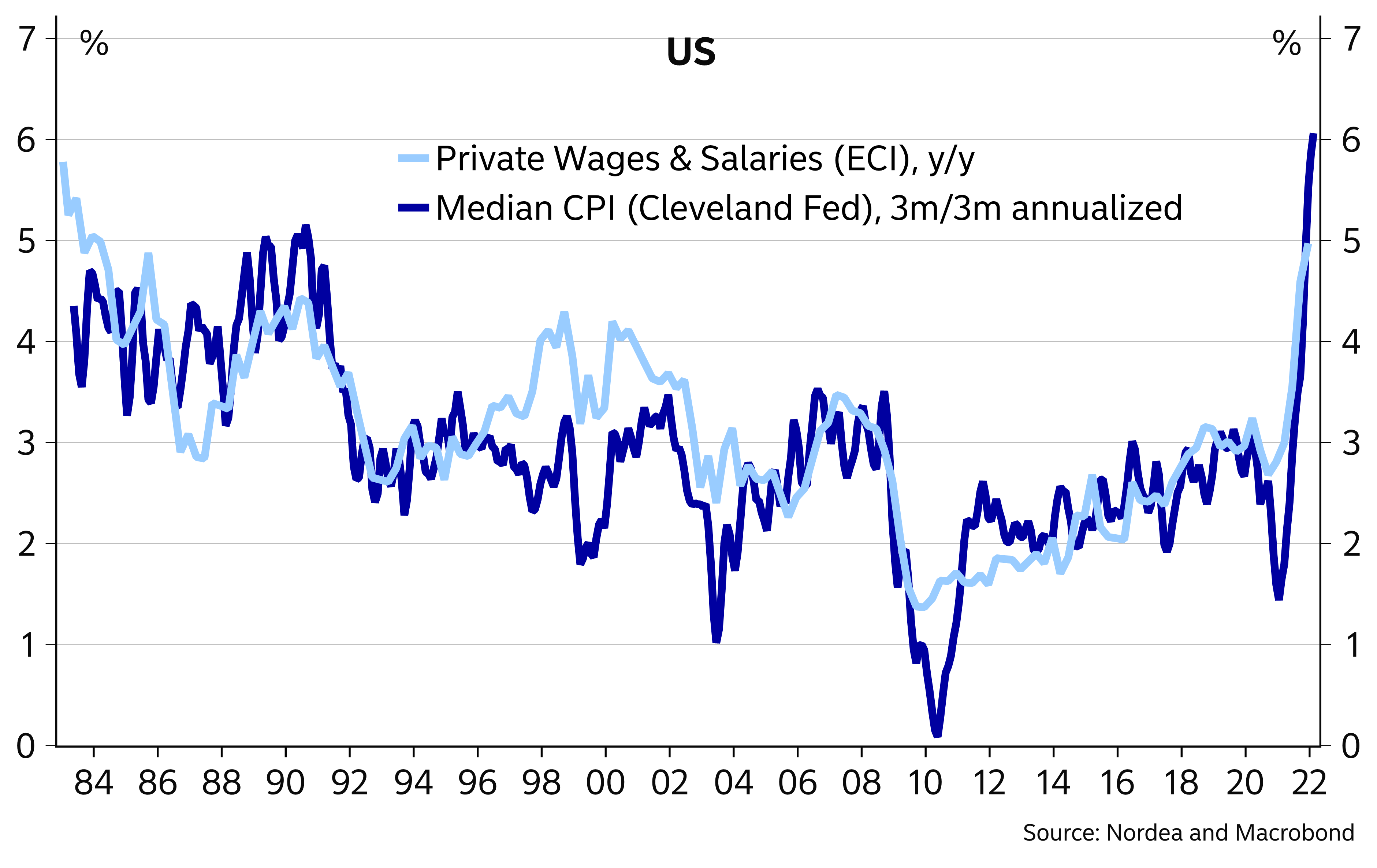

The inflation picture continues to look very worrying

A long series of rate hikes in store

We think the Fed needs to do much more than fine-tune its monetary policy to bring rampant inflation back in line with its 2% target. Even if the Fed is already late in its tightening efforts, we think the preferred course would be a series of consecutive 25bp rate moves, which we now expect to see in all the remaining six Fed meetings this year. We see four more hikes in 2023, which would bring the fed funds target rate to 2.75% to 3%, slightly above the Fed’s 2.4% estimate of the neutral rate.

In a cycle, where overly high inflation is a problem and growth is expected to remain solid, it should be only natural that monetary policy could turn restrictive. The Fed’s estimate of a neutral rate level around 2.4% should thus not be seen as any ceiling for its rate hikes, something which also Powell has reminded and today’s dot plot also suggests.

The market is currently pricing in around a further 160bp of tightening for this year, i.e. more than a 25bp hike at every meeting. For the May meeting, around 35bp is being priced in, implying a clear chance of a 50bp rate increase. Also 50bp increases are definitely in play, as the FOMC members are clearly concerned they are behind the curve and need to send clear signals that they intend to bring inflation back to target. However, we find a series of 25bp moves more likely, as such steps would also carry lower risks of rapid tightening of monetary policy causing market turmoil. Further, Powell has emphasized that the goal is to bring inflation down while maintaining a strong labour market, which may be easier to achieve, if more aggressive rate hikes can be avoided. Finally, as a decision on the balance sheet measures now looks likely already in May that could also moderate the calls for a 50bp hike at that meeting.

Longer out, markets are pricing a terminal fed funds rate of around 2.5%, so even if the market is pricing in slightly more than our view for this year, we see the short rate rising to above 2.5% next year.

The tightening power of rate hikes will be complemented by measures to allow the Fed’s balance sheet to start to contract in late spring. We expect the Fed to decide on the balance sheet measures at its next meeting in May.

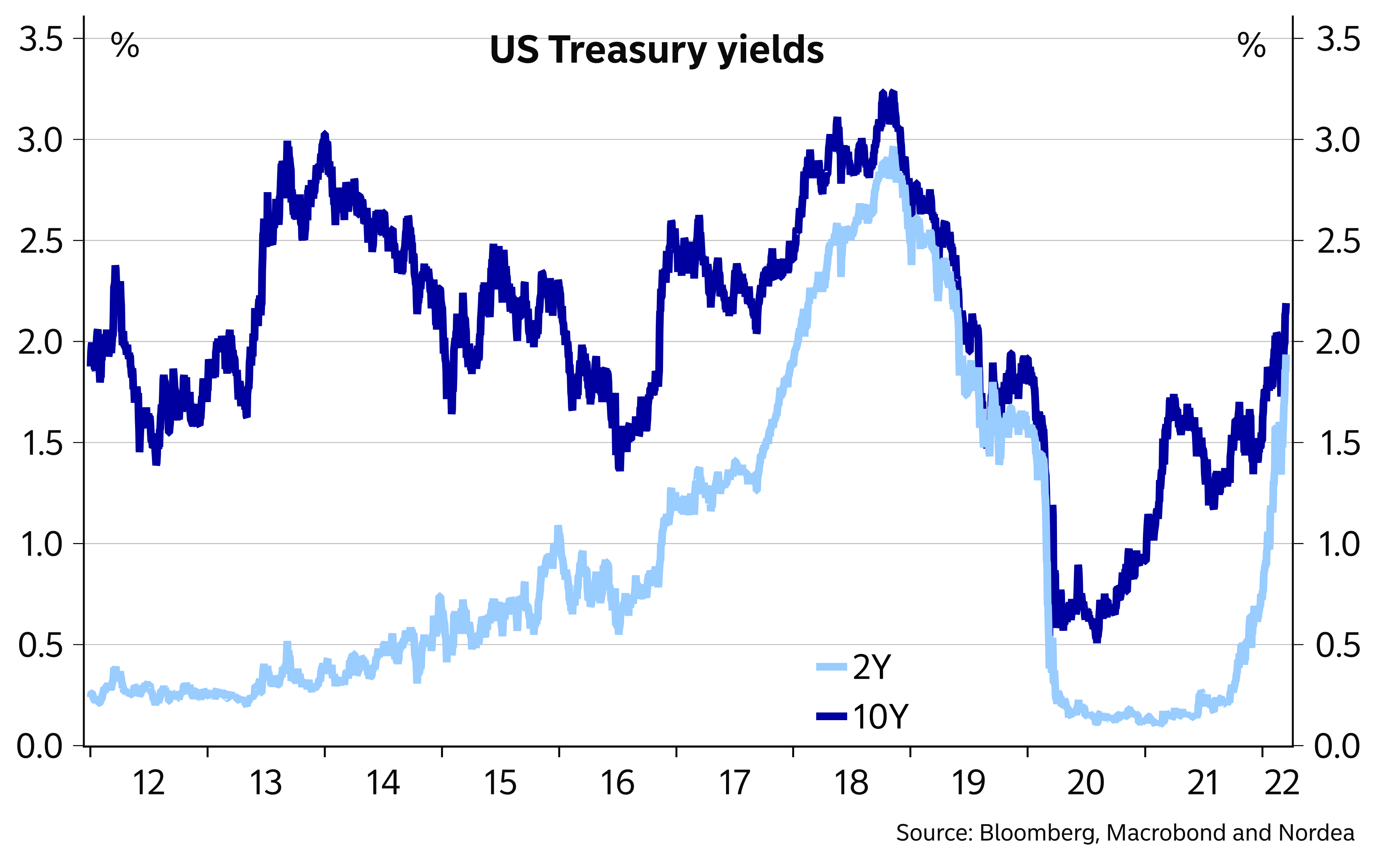

Given that long-term rates are more important to US financing conditions than shorter ones, and the fact that the Fed will likely want to avoid an inversion of the yield curve – often seen as a recession warning indicator – the Fed can also use its balance sheet measures to try to maintain some steepness in the curve.

The uncertainty over the terminal Fed rate obviously remains large, but the direction is clear. Even the most dovish FOMC policymaker sees the fed funds target rate at 2.125% at the end of next year, while the most hawkish two participants see it at 3.625%. For this year, even the most dovish policymaker sees at least four more rate hikes this year, while one participant actually suggests rates will rise by a further 275bp this year, equal to five 50bp hikes and one 25bp move in the remaining six meetings this year.