Den amerikanske centralbank vil sænke renten allerede i juni, vurderer Nordea, fordi den amerikanske økonomi vil svækkes i de kommende måneder.

Uddrag fra Nordea:

Fed Watch: Rate cut ahead – new forecast

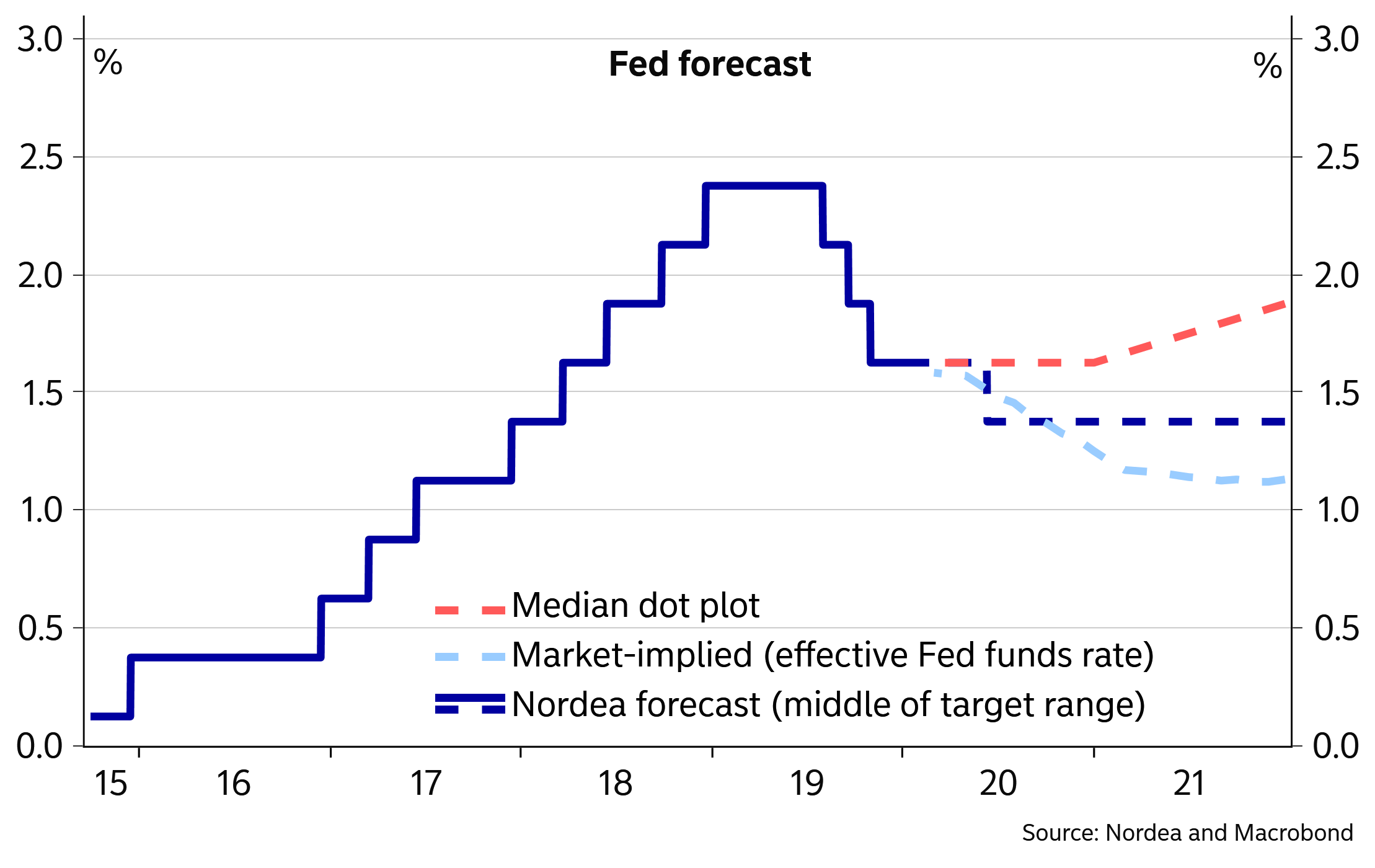

We expect the Fed to cut its policy rates in June (previously March), as we believe the labour market will weaken in tandem with the economic slowdown and as financial conditions might otherwise tighten when liquidity measures are tapered.

We change our forecast. We still expect the Fed to cut, but March is probably too early given the lack of FOMC speak on the subject and the generally positive key figure surprises during the first week of February. We still expect the Fed to cut rates, but probably not until June.

Three arguments for a Fed cut

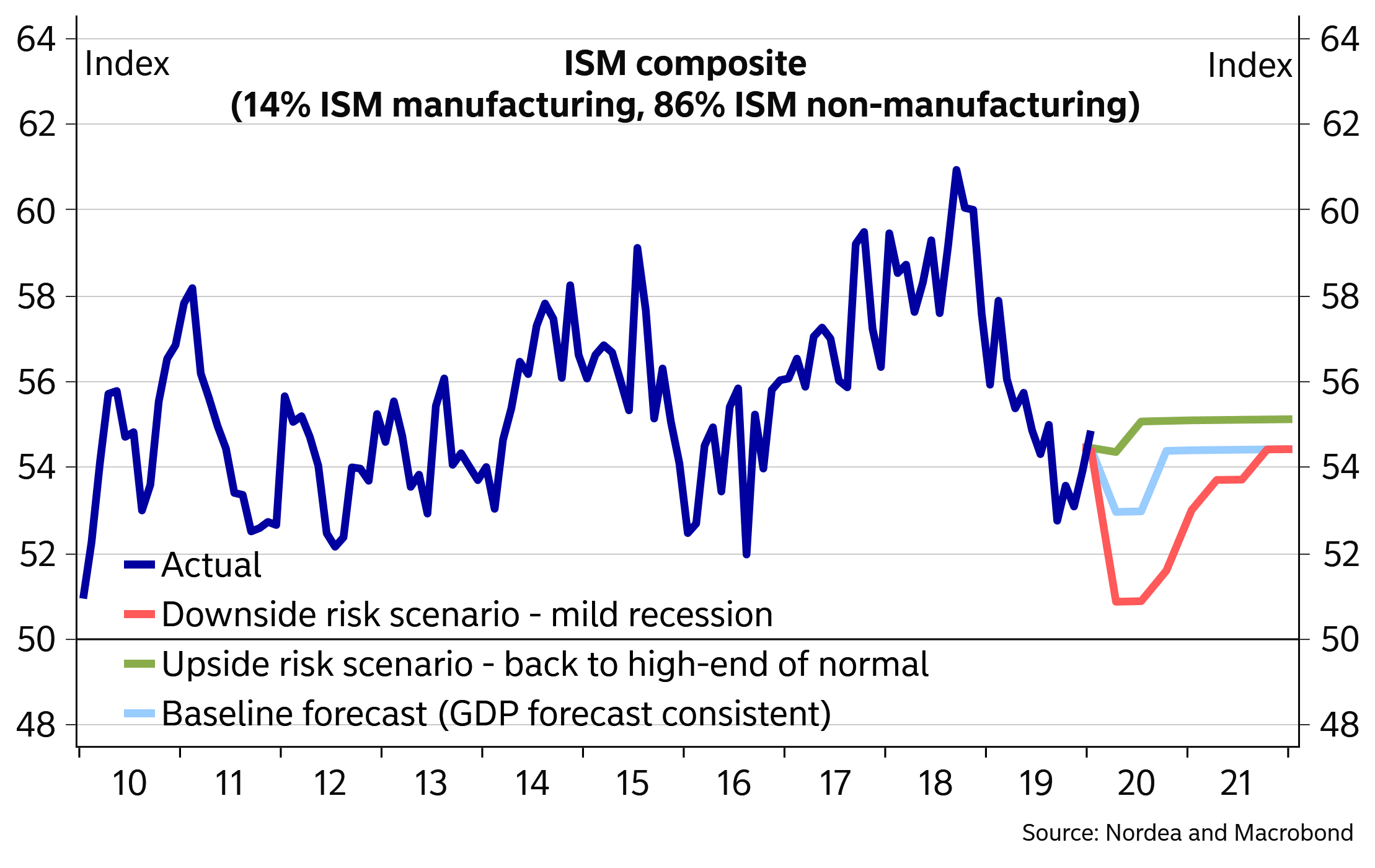

1) Growth is likely to slow below its potential in the first half of the year. So far, the labour market has held up despite the slowing economy, but we believe it will be a matter of time before the labour market weakens to reflect the slowdown. Macro Theme US slowdown and recession risks.

2) Tapering of the short-term liquidity provisions is planned for the coming months and, in turn, the balance-sheet expansion will be much more moderate. How much of the easing of financial conditions since early October – lower rates, tighter credit spreads and higher equities – that can be attributed to the balance-sheet expansion is anybody’s guess, but history should have taught the Fed that any type of normalisation of its balance sheet comes with a significant risk of rapid tightening of financial conditions. The bar to cutting rates should be fairly low from a risk management point of view.

3) Market expectations have moved in favour of rate cuts. Minutes from the January FOMC meeting showed that the Fed attributed the 30bp implied drop in policy rates by year-end at that time as a combination of market participants expecting unchanged rates and seeing risks tilted heavily towards cuts rather than hikes. A few bad numbers could move the implied rate cuts forward and add pressure on the Fed to act.

While not in itself an argument for a rate cut, we do believe the market consensus is wrong to believe monetary policy inaction during an election year. The Fed changes policy when policy changes are necessary. Electionomics: No, the Fed is not on “election pause”.

Risks to the forecast

The review of the monetary policy strategy will be concluded during the summer, and clear, simple communication will be part of the review. In that sense, the bar to mixing near-term policy considerations into the medium-term framework communication might be slightly higher for the FOMC meetings on 9-10 June and 28-29 July.

The labour market might continue to surprise positively! The historical relationship between GDP growth and nonfarm payrolls pointed to significantly weaker payrolls increases in the second half of 2019 than what was realised. If job growth continues to surprise positively in the first half of this year, consumer spending will hold up and the spill-over from last year’s trade war-related manufacturing weakness to the service sector will be modest and the Fed will likely continue to see the current level of policy rates as appropriate for a while longer.