Nordea har analyseret den seneste beslutning i ECB og Lagardes udtalelser og kommer til den konklusion, at renterne vil bevæge sig betydeligt opad. ECB vil øge sine opkøb, men ikke nok til at bremse en rentestigning. Nordea tolker udmeldingen i går som udtryk for uenighed i ECB mellem duer og høge om renten. Med genåbningen af økonomien vil det føre til højere renter inden sommer.

Uddrag fra Nordea:

ECB Watch: Significantly higher

The ECB promised to increase the pace of its bond purchases significantly over the next quarter, but refused to clarify what this means. Bonds rallied in response, but we continue to see more upside potential for long yields, as the economy recovers.

The ECB pledged to fight the higher longer-term bond yields by saying the Governing Council expects purchases under the PEPP over the next quarter to be conducted at a significantly higher pace than during the first months of this year.

On closer inspection, the statement looks like a compromise. There was no commitment to any specific level of purchases and the commitment covers only the next quarter, suggesting there were objections towards a longer-lasting pledge. Further, the chance of not having to use the entire Pandemic Emergency Purchase Programme (PEPP) envelope of EUR 1850bn was repeated, in a nod to the more hawkish members.

In the press conference, Lagarde argued she had no number in mind regarding the weekly pace of the purchases. However, she revealed it takes a Governing Council decision to alter the underlying pace of the purchases, and that a quarterly window was a suitable interval to take such decisions. In other words, the plan is to revisit the PEPP buying pace again in June. It would thus be surprising, if the Governing Council had not agreed on at least a rather tight target range for the weekly purchases. The fact that Lagarde did not reveal the number could suggest the number is not particularly high.

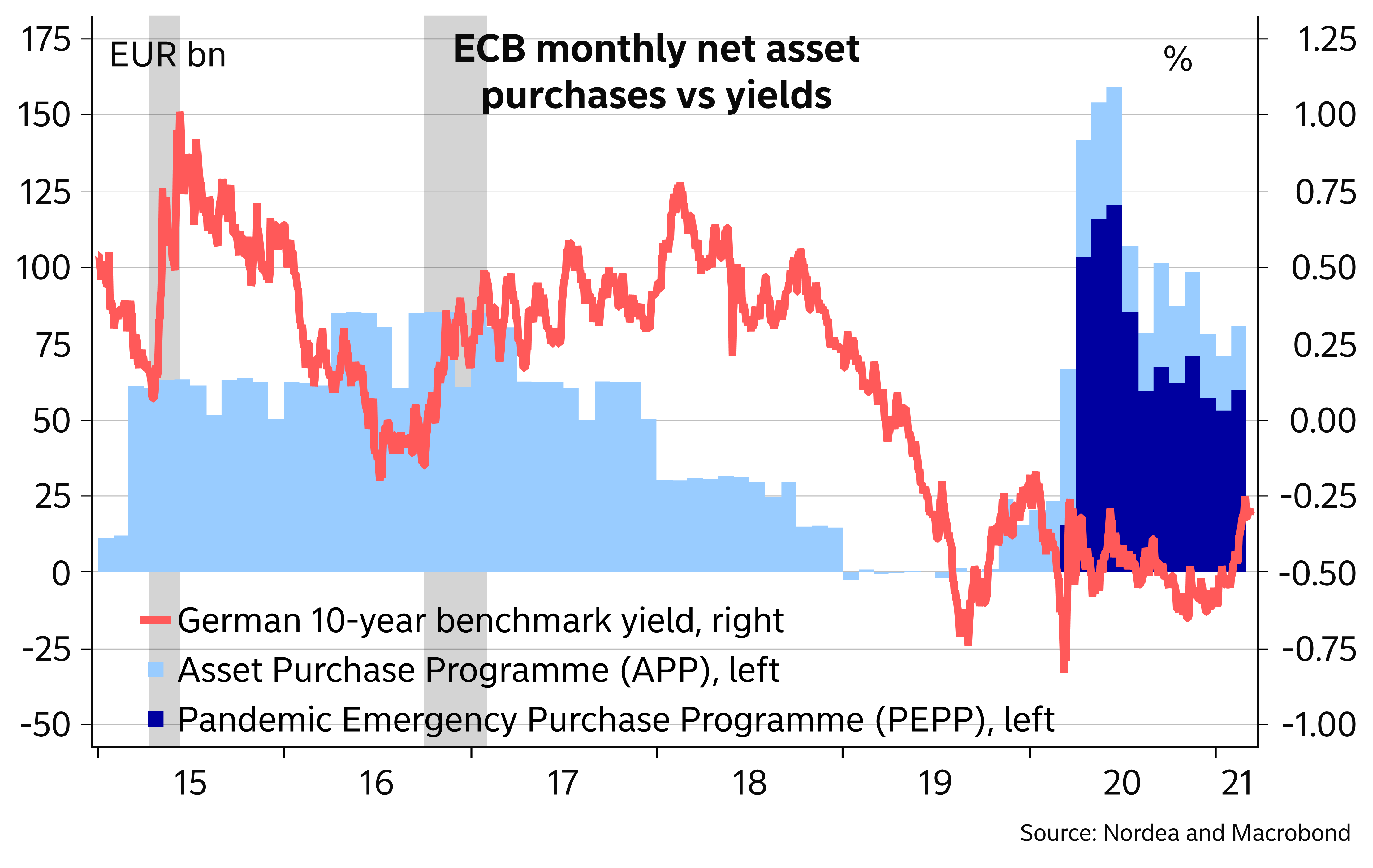

History has also taught us that bond yields are driven by also many other factors than central bank asset purchases, and yields can see substantial upward moves at times of large central bank bond purchases. We remain sceptical that the ECB is prepared for aggressive bond buying and see concrete yield or spread targets unlikely. Lagarde did not even manage to provide further clarity on what preserving easy financing conditions means. As a result, the ECB’s current stance is not enough to remove the risks of even faster increases in bond yields.

Bond yields can see large upward moves also during sizable central bank bond purchases

Right or wrong reasons for higher yields?

Bonds rallied and spreads narrowed clearly in response to the ECB’s statement, but the moves moderated clearly later on, as Lagarde did not back the dovish message from the statement in the press conference. Most likely, she did not have a mandate for a more dovish message from the Governing Council.

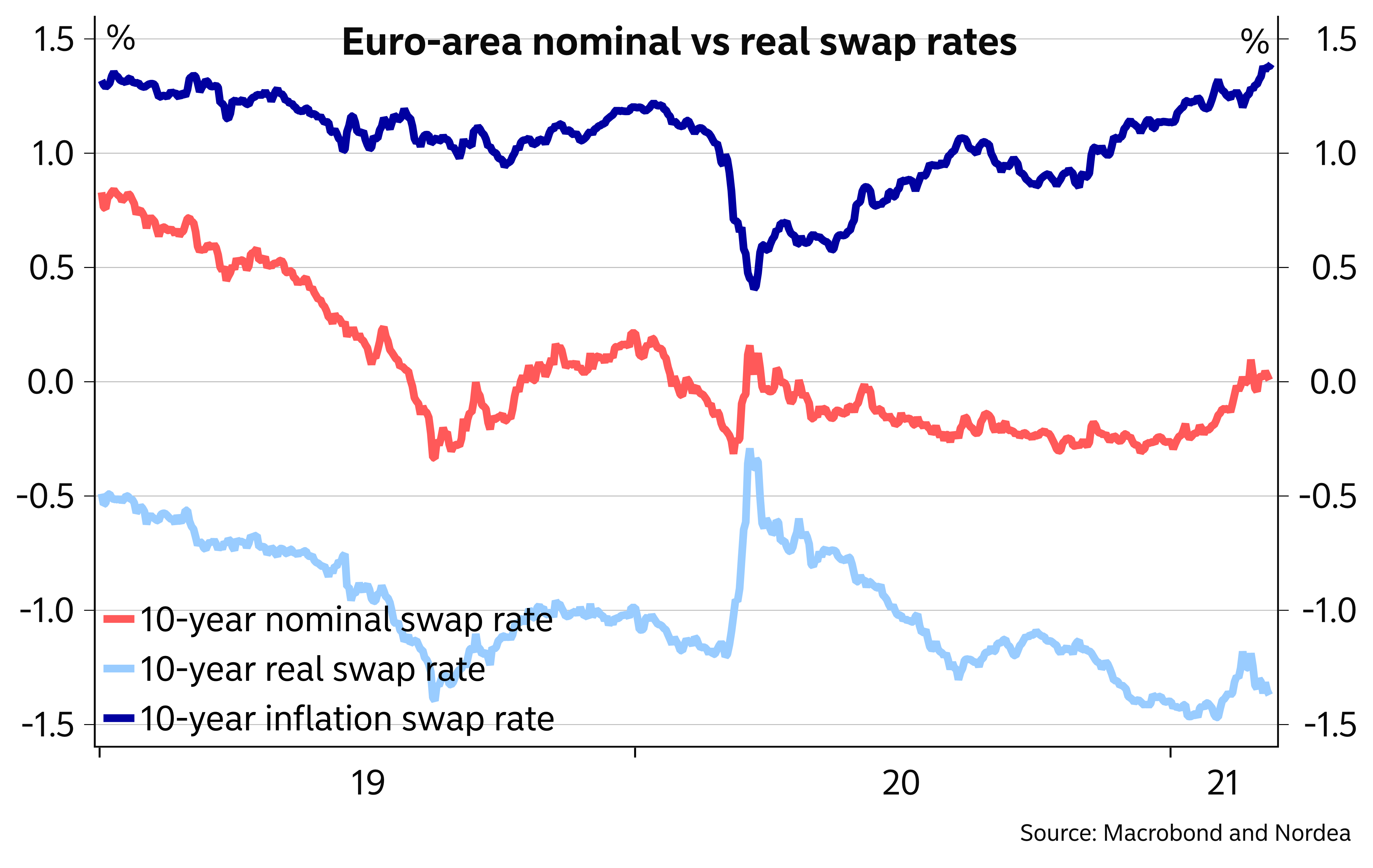

While there are clear disagreements withing the Governing Council on what kind of yield moves can be tolerated, some moves higher are probably allowed. As long as broader financing conditions remain easy, including narrow bond spreads, a gradual rise in long bond yields is probably ok. This does not mean that the ECB would allow bond yields to rise rapidly any time soon, but as long as the increase illustrates higher inflation expectations and increasing hopes of an economic recovery, the ECB can allow a slow increase in longer yields.

We see more upside potential in especially long US yields towards the summer, which together with an improvement in also the Euro-area outlook favours somewhat higher yields and steeper curves in the Euro area as well.

In the short end of the curve, the risks of a further cut in the ECB’s deposit rate have nearly vanished. We agree with this pricing, and find further cuts in the deposit rate unlikely.