Nordea venter, at renten i eurozonen kryber opad i de kommende måneder, og at det vil ske, uden at ECB griber ind. ECB har optrappet obligationsopkøbene siden marts, fordi økonomien stadig kræver det. Som ECB-chefen Lagarde har udtrykt det: Eurozonen har stadig brug for sine to krykker: Stimuli fra penge- og finanspolitikken – fra ECB og regeringerne.

ECB Watch: Both crutches still needed

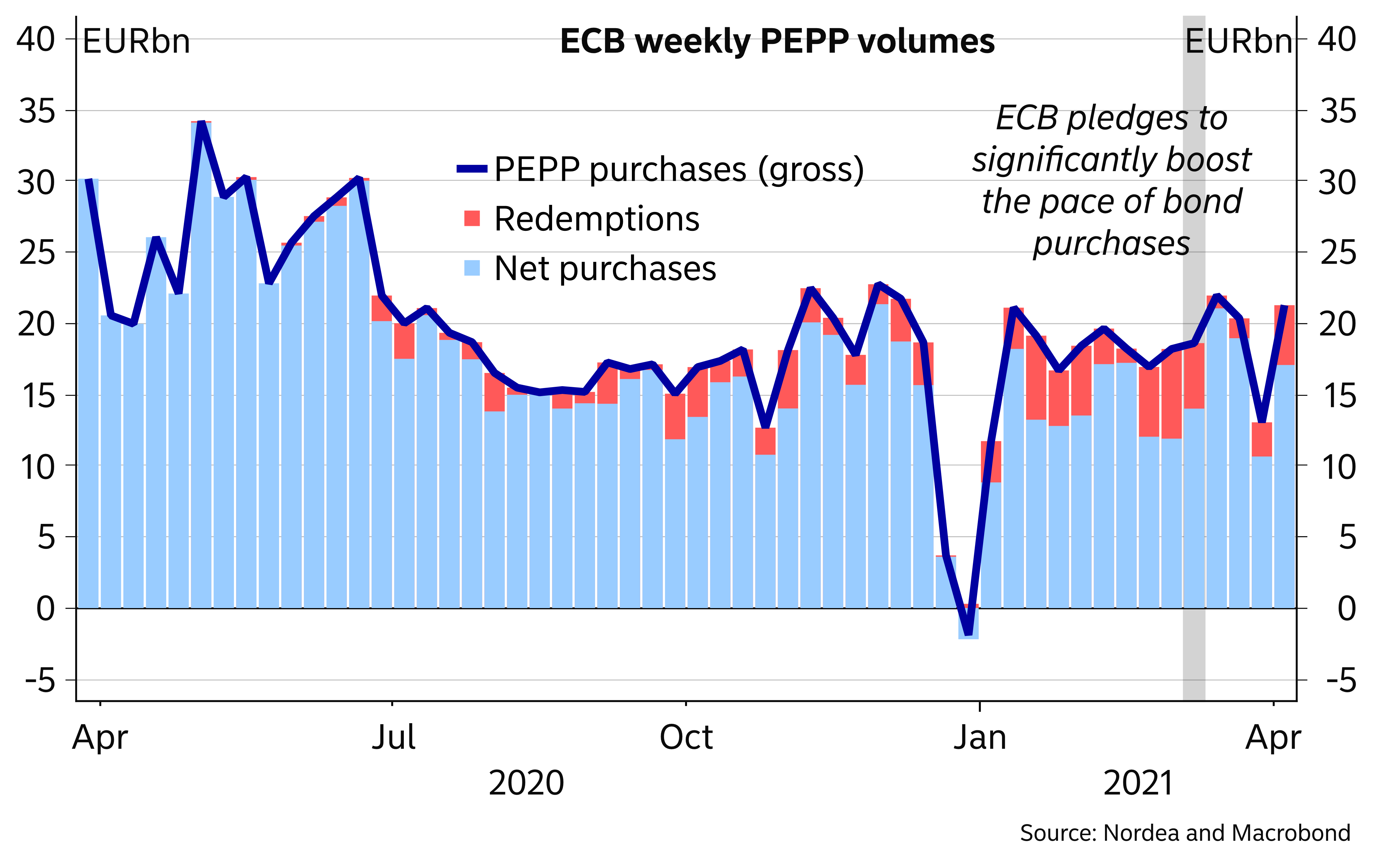

Despite the ECB’s pledges, the pace of bond purchases has seen less than a significant increase, questioning the ECB’s resolve to preserving easy financing conditions. We see room for higher bond yields, as the economy recovers.

Neither the economic situation nor the inflation outlook has changed materially since the ECB decided to significantly increase the pace of its bond purchases at the March meeting, while delays in the vaccination process threaten to push the recovery somewhat further into the future.

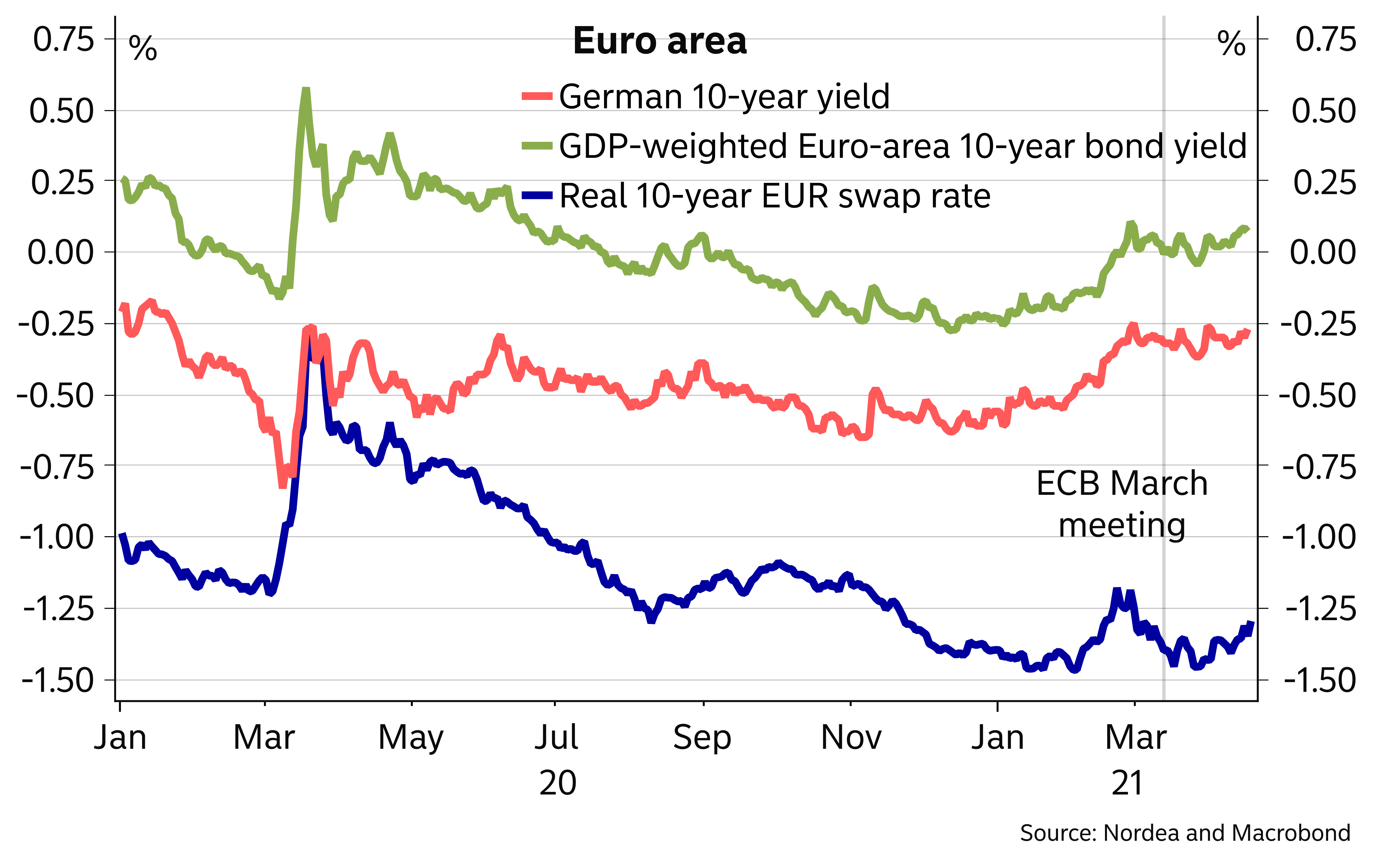

Longer bond yields, in turn, have moved mostly sideways. In addition, the ECB seems keen to review the pace of the bond purchases at quarterly intervals ,i.e. again in June, so changes to the current monetary policy setup look very unlikely at the Governing Council meeting on 22 April.

That the Euro-area economy still requires easy monetary policies is not up for debate. President Lagarde commented recently that the Euro area is still standing on the two crutches of monetary and fiscal stimulus, and neither of these can be taken away until well into the recovery.

In this week’s press conference, Lagarde will no doubt face questions about whether the recent pace of bond purchases constitutes a significant increase. While the Easter holidays distorted the weekly buying numbers in early April, it is hard to argue that the pace of buying would have seen more than a rather modest increase since the ECB’s March decision.

Executive Board member Schnabel has warned against drawing too hard conclusions based on the weekly data, and advised one to look at the monthly numbers instead. Based on the recent data, the significantly higher pace likely means around EUR 20bn per week in net terms.

We do not expect to see any major market reactions to this week’s ECB meeting, but if we have to take a stance, we see risks tilted towards a slightly hawkish market reaction, as Lagarde may struggle to defend the changed pace of purchases as being that significant in light of the recent numbers.

Financial markets would also welcome clarification on what the ECB means by wanting to preserve favourable financing conditions. However, various Governing Council members appear to interpret the concept quite differently, while the ECB has made it clear that it is not involved in any kind of yield curve control type of policy, so those hoping for more clarity will likely be disappointed.

Looking forward, we continue to expect EUR bond yields to creep higher in the coming months. Also the rise in US yields has taken a breather lately, so the ability of the ECB’s new bond purchase pace to prevent yields from rising has not really been tested yet.

Further, it will probably be easier for the ECB – or at least for a rather high number of Governing Council members – to stomach higher bond yields, when the rise takes place amidst a recovering economy.