Nordea betragter det som uundgåeligt, at der kommer en højere lang rente i Europa, mens det er usikkert, hvor meget inflationen stiger. Derimod venter Nordea en kraftig stigning i inflationen i USA i andet kvartal – op imod 3 pct. – som følge af Bidens finanspakke.

On why long bond yields increase during QE

Inflation is coming, at least in the US, while the ECB remains VERY unconvinced of inflation ever arriving in the Euro area. It is not given that an increase in PEPP will lead to lower long EUR rates. One can actually flip the argument.

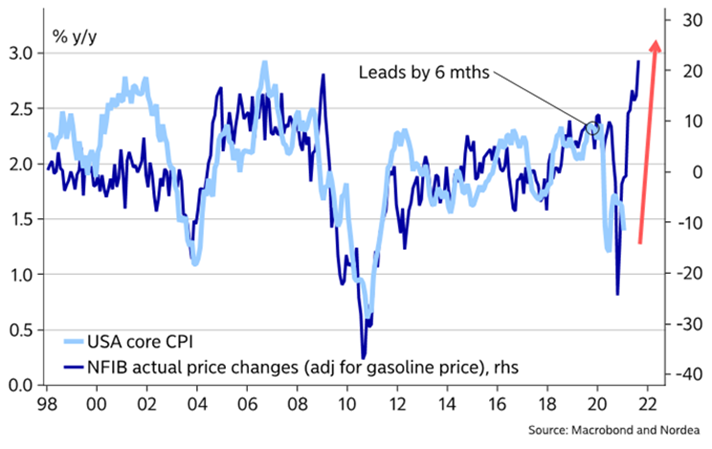

We have been saying it over and over that an inflation scare is coming in Q2, and the data that ticks in keeps supporting this viewpoint. The latest NFIB update now hints at the biggest price pressures EVER in the survey, which should lead to 2.75-3% core inflation in the US on usual correlations.

It will be tricky to handle for the Fed, since this is not “moderate overshooting” of inflation. Moreover, the Biden-nomics package is inflationary in its nature since it includes clear mechanisms that ensure that printed USDs end up at the account of SMEs and households. This is inflationary, in contrast to a QE-only setup. Expect the Fed balance-sheet policy to be debated already before summer.

Chart 1. Inflation is coming in size!

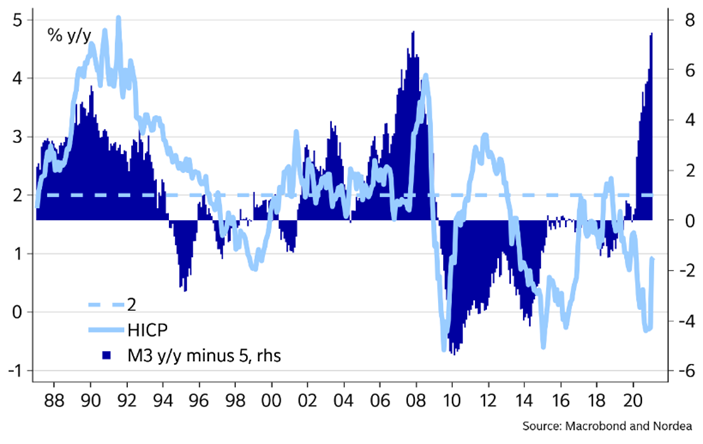

Whether the EUR inflation story is as bullish is another discussion. Not even the ECB itself is barely convinced of bringing inflation back to target before 2023, and the staff decided to lower the 2023 inflation projection at the meeting this week. As we know that the ECB is wrong on right about everything, it may be time to be a little bit more upbeat on EUR inflation as well?

Metrics such as M3 growth suggest that inflation pressure could be coming in Europe as well, and in such case the ECB is clearly too pessimistic about 2023. For now, don’t expect the ECB to do anything but PEPPing up markets.

Chart 2. Inflation could be coming in Europe as well?

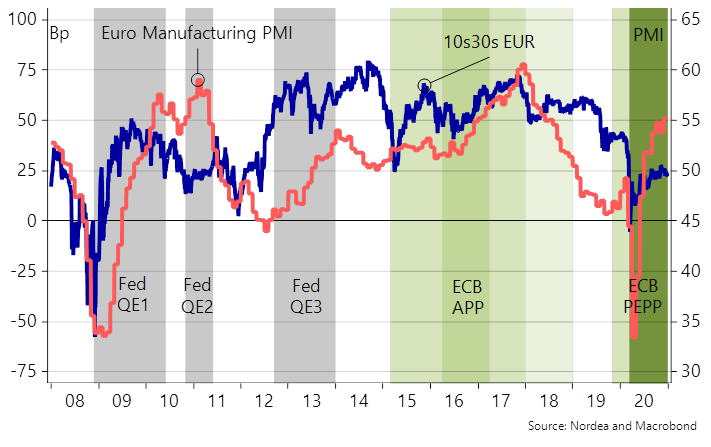

The interesting thing is that the ECB simply don’t get the Fixed Income dynamics around QE announcements. If they wanted LOWER long core bond yields (spreads is another discussion), then they should simply taper asset purchases, as it would work to kill the ongoing reflation repricing.

When the ECB decides to “significantly increase” PEPP purchases during Q2, it will likely rather lead to a continued reflationary pressure in inflation swaps and accordingly higher long bond yields. That could of course be OK, even to the ECB, as long as inflation expectations follow nominal bond yields higher almost 1-to-1.

But a general rule of thumb is that more QE leads to higher long bonds yields, in particular if the asset purchases are conducted during a business cycle that is gaining momentum as now. We stick to steepener bets in the EUR curve as a consequence, and we doubt that the ECB will be able to contain long bond yields in EUR without a much more explicit target – for instance outright yield-curve control.

Chart 3. The more the ECB buys, the bigger the chance of a steeper curve