Nordea har længe argumenteret for, at den meget lempelige amerikanske pengepolitik bliver vendt til en stramning (i amerikansk jargon: tapering), og meget tidligere end de fleste venter. Fed-chefen Powell var ude med forsigtige signaler i sidste uge, men så kom et centralbankmedlem, James Bullard, på banen i weekenden, og han udtrykte et ønske om en hurtig beslutning om en stramning i september – for dernlæst at få afsluttet den mangeårige lempelse i første kvartal næste år.

Uddrag fra Nordea:

Bullard may be a Muppet, but he is probably right

Even if it seems as if tapering is still not around the corner, if we take Powell at face value, it is getting clearer for each week that the Fed is preparing for tapering. Bullard from the FOMC even hints of QT, while the ECB is stuck in dove-land.

Quote of the week

“My preference would be to get to a decision in September and start sometime after that, and my main goal would be to get done by the end of the first quarter.” – James Bullard, St Louis Fed

Even if we have had an aggressive Fed forecast all year, we hadn’t dared to fully “Bullard it up”. Bullard now explicitly wants taper to start this fall and already end by March-22 and he even went as far as saying that markets “are ready for tapering”, which is probably right.

Everyone and their mother have been talking about tapering since the spring, why we clearly aren’t in for a 2013/2014 kind of surprise when the actual tapering decision is taken. We stick to our view of an almost Bullard-like tapering process with an announcement in September, actual tapering commencing in December and zero net purchases by June 2022.

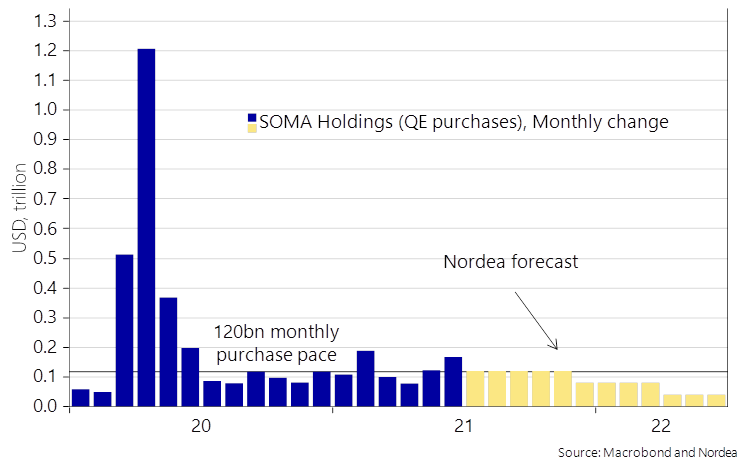

Chart 1. Bullard suggested an even more aggressive path to tapering than we forecast

Even if Bullard’s suggestion is obviously on the hawkish side of the FOMC consensus, we still find it likely that the actual tapering process can prove to be swifter than in 2013/2014 when the full process lasted more than 18 months including a failed attempt to pre-warn markets of tapering.

This time, Powell and his lieutenants, have already clearly paved the way for tapering rhetorically, and this time without causing a huge tantrum. If anything, this also supports a bet on a shorter actual tapering process than the 12 months it lasted in 2013/2014.

We continue to lean towards a flatter USD curve, a stronger USD and a more expensive USD in the xCcy basis as a consequence. This also holds versus Scandi currencies.

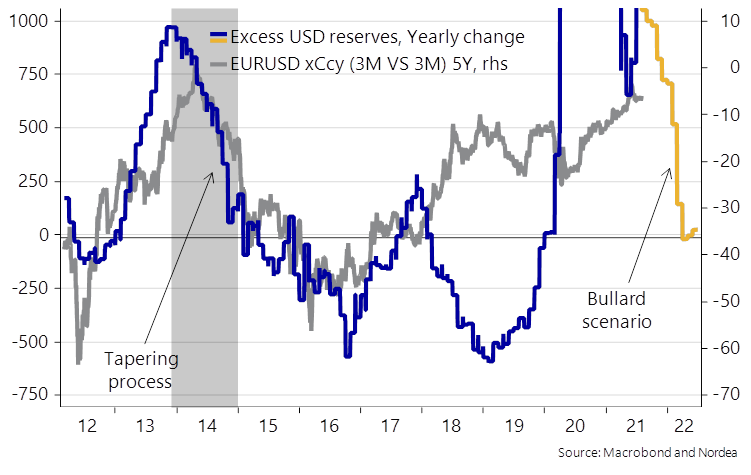

Chart 2. In Bullard’s tapering scenario, we may see a 15-20 bps drop in the 5yr EURUSD xCcy basis

Yes, we know that Bullard is a loose cannon, but his aggressive views on tapering come at an interesting time, when the Fed is doing EVERYTHING it can to prepare for tapering behind the scenes.

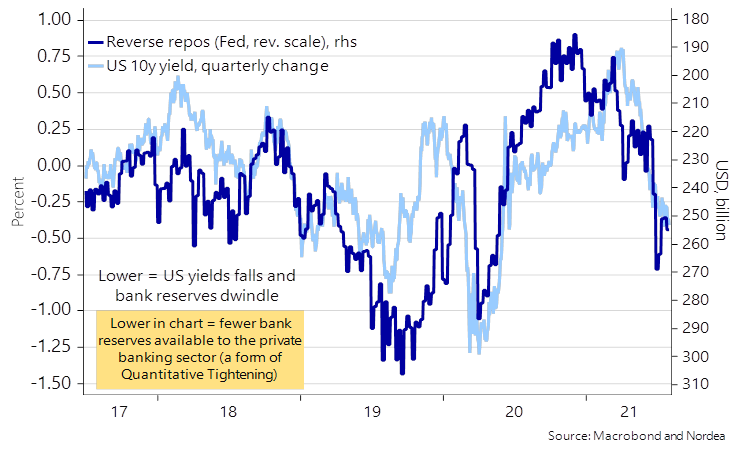

The new standing repo facilities from the Fed are of very little relevance just now when excess liquidity is massive, and collateral is scarce, but they create a much more stable demand for Treasuries going forward as certainty on repo rates is increased. Currently, the Fed is stuck battling it out against negative money market rates, why the surge in the Reverse Repo continues.

The debt ceiling suspension has now ended, and accordingly the collateral scarcity will only worsen until a political solution is found. Should we care?

Not a whole lot since the duration absorption of the QE program remains intact, but the overall amount of USD reserves in the commercial banking system has likely peaked, which could be seen as a USD positive and slightly risk negative scenario, AND the current collateral scarcity is another, albeit very technical, argument in favour of early Fed tapering.

The opposite scenario from September 2019 was very scary for RV hedge funds as repo rates temporarily blew up completely due to the lack of USD reserves, which is the ultimate worst-case-scenario for leveraged funds. The new standing repo facility is likely celebrated around the hedge fund offices for the same reason as it back-stops such a scenario from happening again.

Chart 4. Foreign central banks hold a large liquidity buffer at the reverse repo.. but for how long?

Foreign central banks hold around $250bn in the FIMA reverse repo facility, which is essentially a liquidity buffer parked at 5 bps. It is likely that foreign CBs will increase Treasury holdings and decrease liquidity holdings, due to the launch of a the FIMA standing repo facility. $250bn is obviously not a lot compared to current QE sizes, but not irrelevant either.

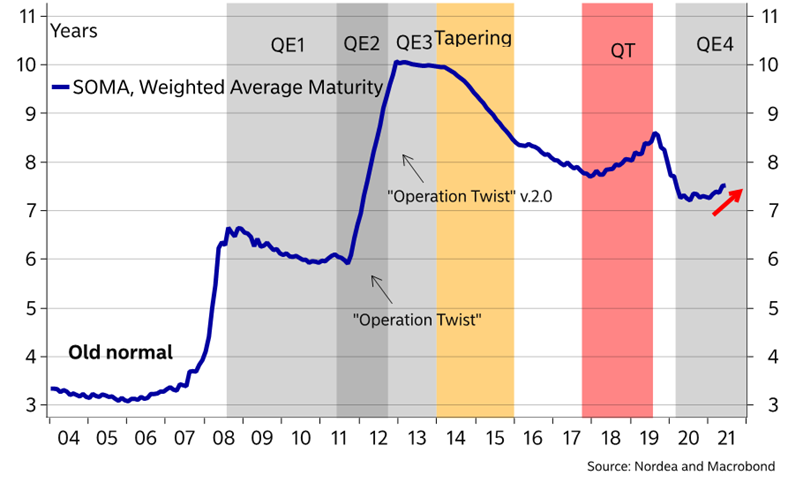

Both hedge funds and foreign CBs are now incentivized towards increasing Treasury positions compared to a scenario without standing repo facilities that ensure that there is no stress in repo rates in times of fewer USD reserves than currently. Furthermore, the Fed seems to be stealth-twisting it’s bond portfolio towards longer bonds (mainly due to the 20yr Treasury).

If that doesn’t smell tapering, then we don’t know what does… Maybe Bullard is a muppet, but he is probably right (on the direction of the Fed). From an asset allocation perspective, this makes us like: Large Cap vs. Small cap, DM vs. EM and Tech vs. Value into the early stages of such a tapering process.

Chart 5. There is a smell of tapering in the air now that the Fed sugarcoats the market via an increasing WAM