Nordea vurderer, at dollaren vil styrkes i den kommende tid, mens euroen vil svækkes. Mens kursen svinger omkring 1,17 dollar for en euro i dag, så regner Nordea med en kurs på 1,10 dollar for en euro. Det kan ske hurtigere, end de fleste forventer, mener Nordea. Styrkelsen af dollaren skyldes den kommende neddrosling af obligationsopkøbene (tapering) samt en række rentestigninger, som Nordea venter, at centralbanken vil sætte i værk fra andet halvår 2022. Nordea tror, der vil komme fire rentestigninger i alt inden udgangen af 2023.

We increase our conviction in a stronger USD

The relative outlook between the Fed and the ECB will likely widen policy-wise over the coming year, leaving the EUR vulnerable versus the USD. We expect the Fed to deliver four hikes before the end of 2023, while the ECB is on hold.

Highlights from the analysis:

1) We increase our conviction in a stronger USD and target levels around 1.10 in EURUSD over the forecast horizon

2) We expect four hikes from the Federal Reserve before the end of 2023, while the ECB is on hold

3) Scandi FX may struggle to perform as long as tapering is a persistent market theme, while also currencies with a link to China will likely suffer this fall.

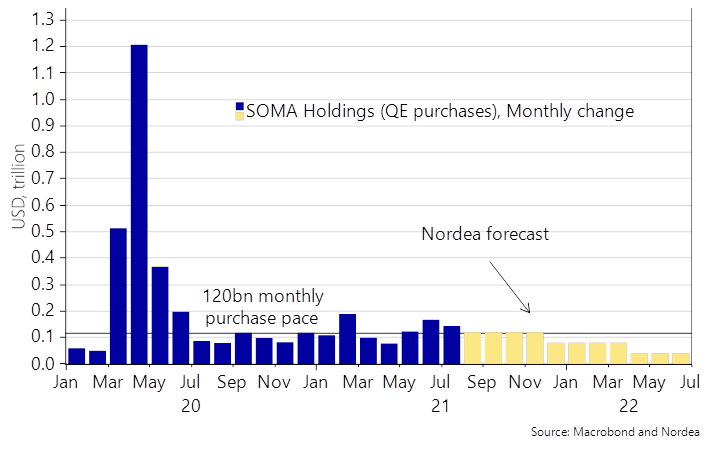

The Federal Reserve is moving closer to tapering, which was once again confirmed by a majority of the members of the FOMC in the latest set of meeting minutes. A majority of the Federal Reserve committee now expects the process of slowing purchases to be launched before year-end, which solidifies our long-held view of a decision on tapering taken in December before an implementation phase starting in December and ending in June 2022.

This is likely to prove to be a strong USD scenario, as was also the case in 2013/2014 when the Fed tapered the QE3 programme.

Chart 1. Nordea’s tapering forecast. A decision in September and implementation starting in December

EUR/USD has made several unsuccessful attempts of breaking below 1.17, while it seems as if the FOMC meeting minutes finally proved to be the needed catalyst for a sustained move below such levels, and we have increased our conviction on a further move lower in the cross.

We target levels around 1.10 in EUR/USD over the forecast horizon and expect the bulk of the move to happen sooner rather than later in conjunction with the launch of the tapering process. We always like when there is no “policy resistance” to our FX view and that currently seems to be the case for EUR/USD.

Would the Fed be annoyed with a lower EUR/USD reading? Not really, as they would then be able to partly export the current overshooting (supply side) inflation. Would the ECB be annoyed with a lower EUR/USD reading? Not at all since a lower reading would be helpful in bringing EUR inflation to 2% or above as wished for. This leaves a decent scope for a move lower in EUR/USD, also as positioning is not yet USD heavy.

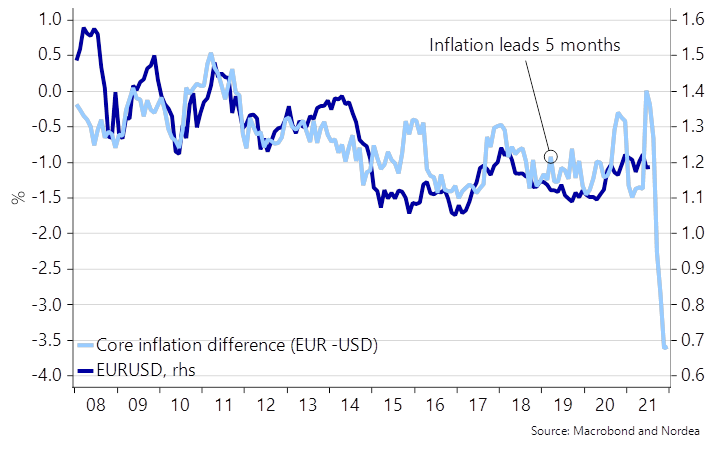

Chart 2. USD to gain from a relatively firm inflation picture?

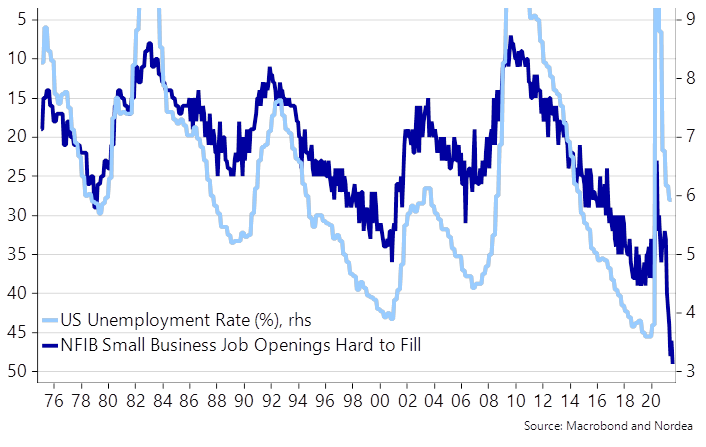

The relative inflation outlook also heavily favours the USD versus the EUR, likely as it hints of a growing policy divergence between the Fed and the ECB. The Fed will be faced with a super tight labour market maybe already before New Year’s as there are currently more job openings than unemployed in the US (in the U3 unemployment measure), which could lead to accelerating wage growth – the exact kind of inflation that the Fed is looking for.

Some of the dynamics that we will see inflation-wise in the US will look almost “late-cyclical” during 2022-2023, which also leaves a clear possibility of a hiking cycle being launched in the second half of 2022 with several hikes to follow in 2023. We expect the first hike from the Fed in September 2022, followed by another three hikes in 2023.

This forecast hinges on inflation staying around for longer than anticipated, where we find that the housing cost is the next inflationary culprit during the autumn. Rent of shelter is an important category in the US core inflation index (40%), which is why an acceleration in rents will almost on a stand-alone basis be enough to keep inflation elevated versus the Fed target.