Nordea regner med, at dollaren vil stige med 20 pct., og det skyldes udsigten til en højere økonomisk vækst end forventet – med efterfølgende stigende renter.

A 20% stronger USD on the cards?

The USD should be rising 20% in YoY terms instead of falling 15% according to relative growth expectations. Unless the Biden-administration annihilates the USD, there are strong reasons to expect a sound USD comeback this year.

The Fed wasn’t in any hurry to hike rates or taper its bond purchase program in March, as was broadly expected. While bad news for longer-dated bonds, we believe this still puts the Fed in a more hawkish camp when compared to its peers such as ECB or RBA which are promising to become even more aggressive.

As the Fed seems “hands off” for now with regards to US 10y Treasury bonds, then we would argue this is good news for the dollar. The twin deficit idea can be boiled down to that either i) US yields needs to rise, or ii) the USD needs to weaken so as to attract enough foreign funding of the US budget and current deficits. It thus follows that higher US yields means less downside pressure for the dollar.

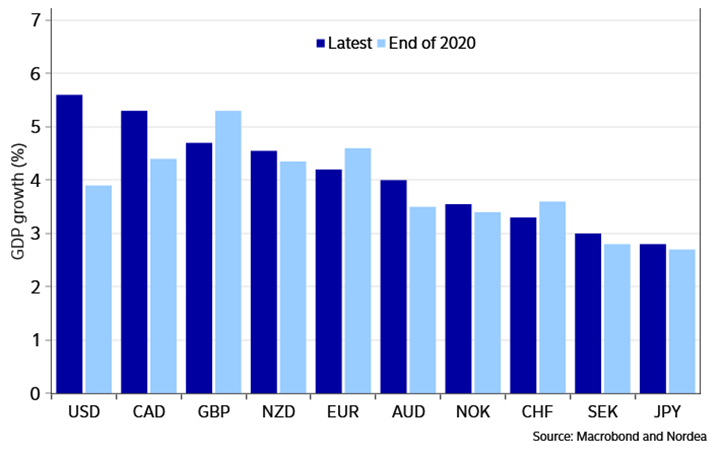

Chart 1. Massive hikes to 2021 growth forecasts – but primarily for the US

We have been asked a lot about our chart on the dollar vs relative growth expectations. As some of you were doubtful, we double-checked our numbers and found that they do seem to keep up. Consensus economists – on Bloomberg data – have seemingly been falling over themselves in a fight to lift their 2021 US growth forecasts, and this has not been as evident for most other G10 countries.

In terms of relative growth forecasts, or in term of revisions to said forecasts, the USD should be in a very strong spot – rising 20% yoy instead of falling 15% yoy(!).

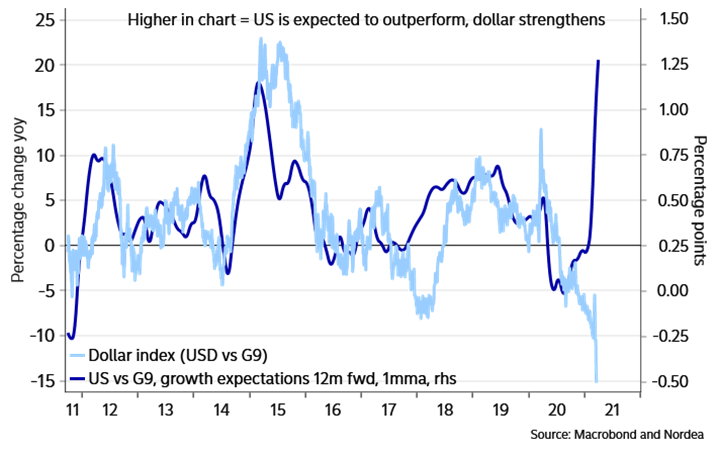

Chart 2. USD/G9 vs relative growth

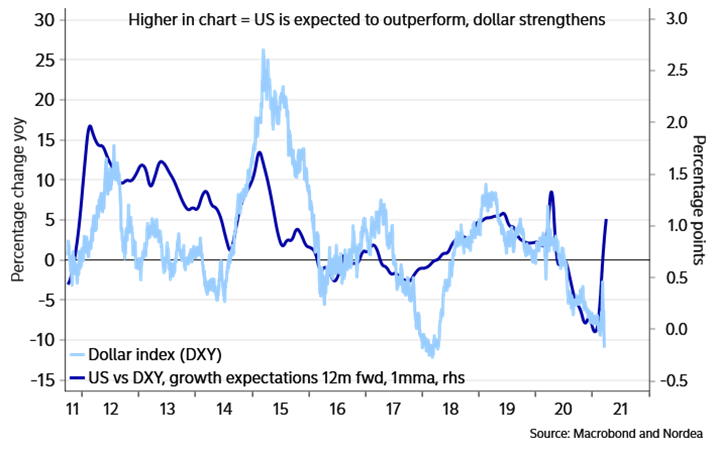

Also when we weigh the forecasts with the DXY weights, the USD should be gaining rather than weakening – though not as much as when we look at an equal-weighted average of G9 forecasts (since these are held down by Sweden, Switzerland and Norway). This is not the prettiest chart we have made, but we figured we’d show it anyway.

Chart 3. Dollar index (DXY) vs relative growth

The Fed may have made one costly mistake last week, even if almost no one has noticed yet. Powell said that the FOMC members ”have resisted the temptation to try and quantify what that means, but when we are above target… we can do that” referring to the “moderate overshooting” on inflation, which means that Fixed Income tensions should build up again ahead of the April inflation print. Powell and the FOMC risk building up a pent-up tantrum scope by refusing to address inflation until it is actually at a point which augurs tightening of the policy. This still holds the potential to turn into Powells taper tantrum.

We remain short EUR/USD with a target of 1.1750 and look for (at least) 2% in the 10yr Treasury Yield already before summer.