Nordea mener, at markedet bevæger sig lidt sidelæns i denne tid, men at tendensen dog er klar: Vi bevæger os mod en højere rente og en stærkere dollar. Nordea hæfter sig ved, at en af direktørerne i ECB, Schnabel, siger, at renten i eurozonen begynder at stige, og “det er præcist, hvad der er behov for.”

Week Ahead: Macro roads, take us home

Markets have started to trade sideways in a slightly boring way. We still think the macro roads will bring home our forecasts of higher yields and a stronger USD by the end of 2021.

After being relatively spot on in our rates and FX forecasts since last summer, clearly, our end-of-2021 market predictions are currently experiencing some headwinds. In FX space, the USD has lost ground to the EUR, the SEK has not really started to weaken and one of our long-term favourites, the NOK, is struggling.

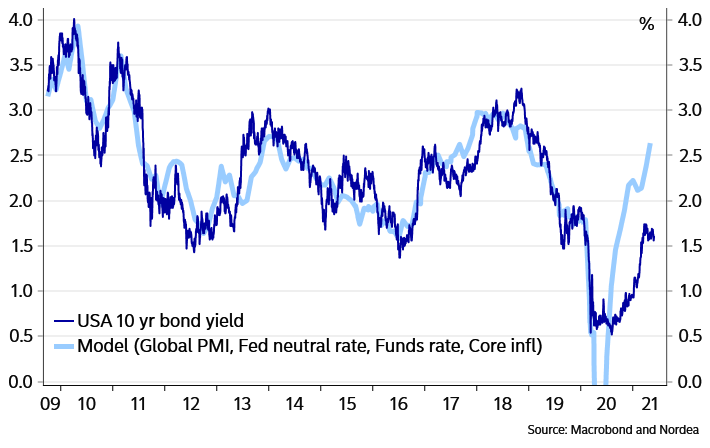

The US 10-year yield has dropped from 1.75% to 1.55% and technical momentum is starting to warn of further downside. We have previously concluded that the journey from 1.5% to above 2%, and for that matter a stronger USD, wouldn’t be a straight line in 2021, but we still ask ourselves if the storyline is changing? Our conclusion so far is no.

Chart 1. Macro indicators still point to a US 10-year yield above 2%

Recent weeks have been a reminder that neither the ECB nor the Fed is really fully ready to play ball in a more bond bearish way.

There have been many ECB statements summed up by Panetta as any “discussion of phasing out the PEPP is clearly premature” and should, according to Villeroy, reasonably come after any such discussion by the Fed.

At the same time, Schnabel’s statements on Friday that rising yields show a turning point in the recovery and are “precisely” what we need, are exactly the statements we have been predicting as the Euro area economy strengthens. They clearly indicate that the ECB is gradually moving to a stance where higher long-end yields will be allowed.

While some Fed governors, Clarida being the most prominent, have started to indicate that they at least are gradually moving towards talking about talking about tapering (it seems like central bankers are more interested in word games than discussing the risks of their wild policies), they clearly stick to the transitory inflation rhetoric and that the economy is far from full employment.

That type of rhetoric normally doesn’t bother us since over time the macro developments will win the day. Currently, however, and particularly in the US, bond bears could need some Fed support to push yields higher.

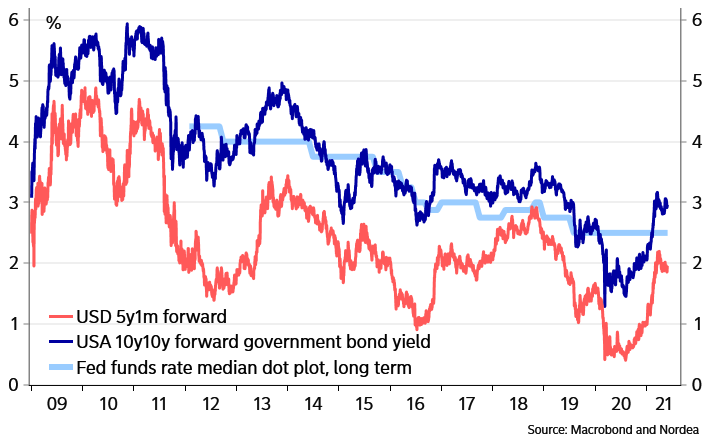

Firstly, as we have pointed out previously, forward rates have reached levels that are fairly close to normal; 5y1m at 2% while Fed’s medium-term dot is at 2.5% and 10y10y at 3% where it was when the Fed was hiking in 2017. In other words, the “easy” mean-reverting part of the US bond bear market is over.

Chart 2. US forward rates are fairly normal

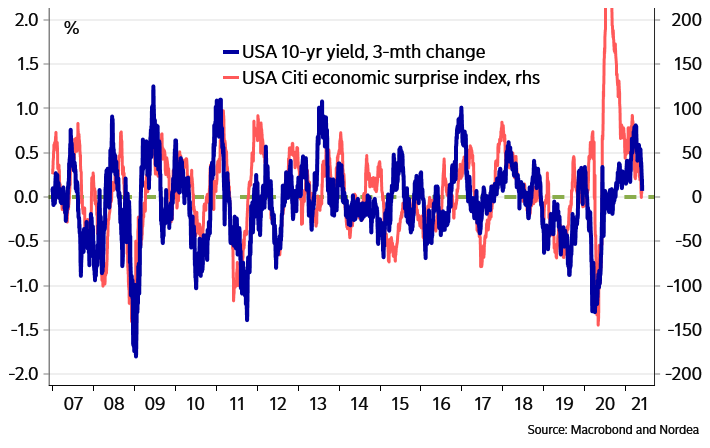

Secondly, US cyclical data have temporarily stopped surprising positively. When this has happened historically, long bond yields have more or less always entered a sideways range phase. Inflation surprises, on the other hand, have as we have predicted surprised markedly to the upside. But since the Fed seems not to care about the very high inflation rates – in some sense, if surging house prices aren’t inflation, roaring equity prices aren’t inflation, why would then inflation be inflation? – the market has decided not to care either.

Chart 3. US cyclical data surprises currently not helping bond bears

Thirdly, our take on bond positioning is that it was relatively neutral until mid-April but has since turned markedly short. This rhymes well with JP Morgan’s Treasury Client Survey. If US cyclical data surprises turn negative, this could trigger a short squeeze. However, we tentatively think NFP should surprise positively next week and ISM could bounce somewhat.

Short positioning is in itself not a hindrance to higher yields but when positioning is this short, it often isn’t enough with strong macro data for higher yields. At some point you also need help from the Fed. An example of this is 2017 when positioning probably was even shorter than today, but long-end yields still managed to rise quite a bit as the Fed hiked interest rates. But talking about starting to talk about tapering is probably not enough “help”…