Nordea analyserer det sædvanlige amerikanske drama om statens finansiering. Hvis Kongressen ikke enes om statens udgifter her i efteråret, kan staten ikke udbetale lønninger. Stridens nøglepunkt er datoen for gælds-loftet. Nordea og mange analytikere mener, det er i midten af oktober. Der findes ingen klar dato for det. Så skal staten have lov til at øge sin gæld. Men formelt skal staten have budgettet på plads i dag. Det er ren politisk strid mellem Demokraterne og Republikanerne, der står på, og vedtagelsen af Joe Bidens infrastruktur- og socialpakker står på spil. Hvis der ikke bliver en aftale om gælds-loftet til tiden, truer en dyb økonomisk krise.

US: Debt limit to strike by mid-to-late October

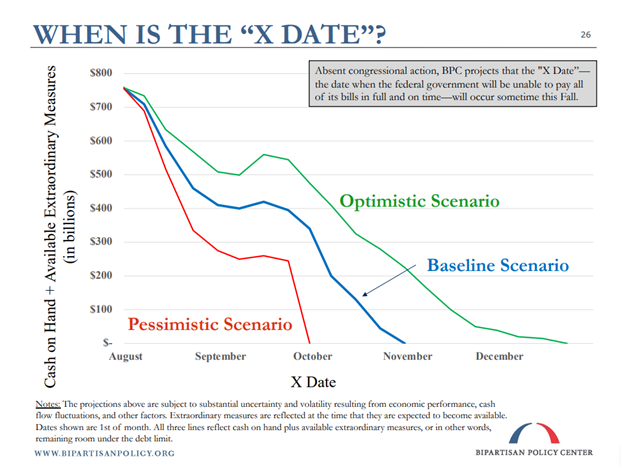

The annual debt ceiling soap opera is back! When will the US Treasury be short on cash to pay bills? We expect the x-date to occur already in October effectively forcing the soap opera to end. A stop-gap funding bill is needed already this week.

The US government will likely face a default on its debt obligations between mid-October and mid-November unless the debt ceiling is raised or suspended according to the Washington think tank Bipartisan Policy Center, why the political soap opera surrounding the debt ceiling will have to end soon to avoid a political disaster.

Chart 1. When is the X date? Latest update from Bipartisan Policy Center

Recently, the Treasury Secretary Janet Yellen also warned that the debt ceiling must be raised or suspended by sometime in October or the US government will be unable to pay its bills.

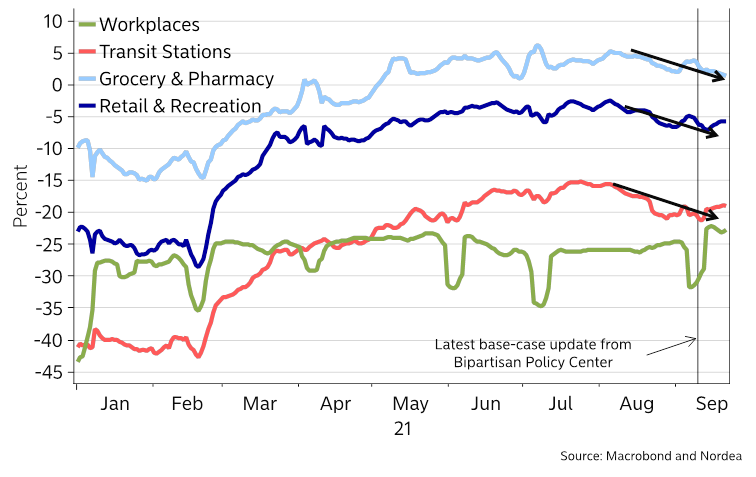

The debt limit has been particularly unpredictable this year. Beyond the federal spending and revenue volatility, cashflows related to COVID-19 relief efforts and the pace of economic recovery means that the uncertainty has been even greater. Looking at mobility trends for Transit Stations, Grocery & Pharmacy and Retain & Recreation, activity is slightly falling indicating reduced revenues compared to the central scenario from the Bipartisan Policy Center – we judge that a x-date around the middle of October now seems likely.

Chart 2. Activity seems to be sliding slightly since the most recent x-date update from the Bipartisan Policy Center

The Treasury Department is using “extraordinary measures” to keep the government functioning and from hitting the debt limit, which was reinstated on Aug. 1. As the US Treasury continues to spend these resources over the coming weeks, the department will soon have dangerously few reserves to fund the government’s obligations. Once the Treasury Department exhausts these resources, payments on Social Security, Medicare, military spending, interest on U.S. debt and other payments would come due in the following days.

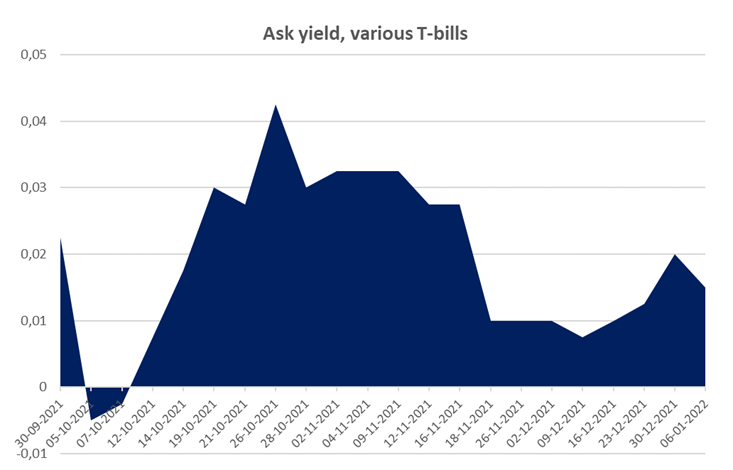

Financial markets are already “concerned” judging by the rising yields on short-term Treasury bills from mid-October. In previous years, uncertainty has caused interest rates on some Treasury bills to spike in anticipation of reaching the debt limit. The market seems to price in a x-date around the middle of October judging from the T-bill curve.

Chart 3. Ask yield on T-bills curve hinting of a x-date already in mid October

Bipartisan approach to debt suspension?

Government funding is set to expire on Sep. 30 due to the financial year ending, but Tuesday Sep 21. Democrats in the House of Representatives passed a bill that will suspend the U.S. debt ceiling until after New Year’s and keep the government open through Dec. 3. The bill now faces an uphill battle in the Senate.

Republicans have refused to vote for a short-term funding bill that deals with raising the debt ceiling. Republican Leader Mitch McConnell has explained that Republicans oppose raising the debt ceiling because it would pave the way for Democrats to pass the $3.5 trillion human infrastructure bill, that would undo much of former President Trump’s 2017 tax cut.

However, by combining the debt limit suspension and the funding bill, Democrats are basically daring Republicans to vote no and cause a shutdown. Without agreeing on a stop-gap funding bill THIS week, the government will hence have to shut down already Sep. 30, even despite the US Treasury still being able to run on fumes another few weeks without a debt ceiling suspension.

Republicans have said Democrats could raise the debt limit through reconciliation, a procedure that allows bills to pass with a simple majority in the Senate instead of 60 of the chamber’s 100 members. Democrats have resisted doing that so far, saying the vote to raise the debt limit should be a bipartisan one – and it is debatable whether senators such as “Blocking Joe Manchin” from West Virginia will accept using the reconciliation process. Manchin for example backed the Trump tax cuts in 2017.

If Democrats apply the reconciliation procedure they would need to raise the debt limit by a certain dollar amount instead of a calendar-based suspension. Democrats are avoiding this as it would put responsibility solely on Democrats to pass the increase, and it could risk reopening the debate on the $3.5 trillion human infrastructure bill, that is already meeting resistance among some Democrats.

If Republicans do not change their position at the last minute, it seems very likely that Democrats must compromise on parts of their infrastructure package. This will affect the federal deficit which in Joe Bidens initial budget plan will be hitting $1.8 trillion in 2022 before tapering off. We pencil in an expected deficit of $1.3-1.4 trillion in 2022 after a political compromise forced by the x-date hitting in October.

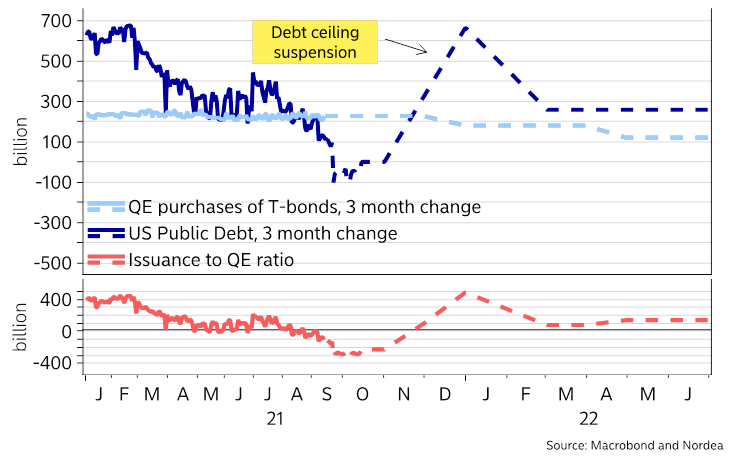

Stronger dollar in sight

Once the debt ceiling suspension occurs a USD 700bn mountain of net issuance between late October and New Year’s will be seen when the US Treasury is allowed to increase the debt burden again, which will take the issuance to QE ratios back to Q1 2021 levels, leaving a clear risk of 1) a stronger USD, 2) a tighter (more negative) OIS/OIS xCcy basis in EURUSD and 3) higher USD rates into the year-end.