Nordea vil ikke udeklukke, at dollaren kan falde med 20 pct. i de næste to år. Spørgsmålet er, i hvor høj grad Den europæiske Centralbank vil gå med til en kraftig styrkelse af euroen. ECB har indikeret, at den vil kæmpe imod en styrkelse, der går over 1,20 i forhold til dollaren.

20% weaker USD over the next 24 months?

The USD has taken a beating over the summer but arguments for further USD weakness remain intact. The persistent twin deficits in the US could weigh on the USD if world trade rebounds further and global yield curves steepen.

The market has already traded the V-shape in most asset classes from equities, over credit to FX/commodity markets. Nasdaq is a story for itself, but several other equity markets are back at least on par with the levels seen prior to the Covid-19 lockdowns. The crisis has proven less severe than feared by many, including central banks and governments, in the early parts of Q2.

Demand has shown resilience and maybe this will be deemed predominantly a supply crisis once the dust settles. And what if we add a V for Vaccine to the mix? This could add fuel to the positive reflation fire already burning. We are fairly upbeat on risk assets in the coming couple of quarters.

Highlights:

- We see a clear risk of EUR/USD >1.25 in (2021 forecast at 1.26)

- USD weakness is likely to be broad-based against most peers including Scandies

- Bond yields will be glued to the floor at the front end but the curve could steepen

Chart 1. A clear chance of much higher PMIs due to the truckload of stimulus packages

FX: Focus on the persistent twin deficits in the US

The USD has had a rough summer as the rebound in consumption has led to dwindling demand for USD liquidity. The USD was, as per usual, sought after in the midst of the crisis since the truckload of global USD debt leads to a dash for USD cash when the storm is fierce. The Fed responded by providing USD liquidity to everyone and their mother and consequently the USD money supply ended up exploding on an historically unprecedented scale.

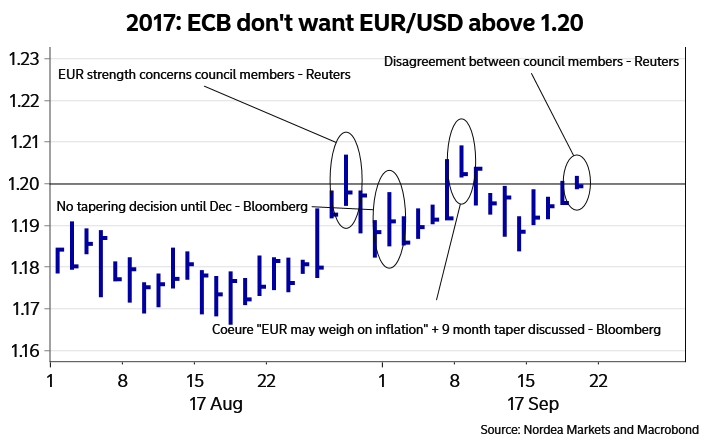

The big question is if the ECB will be afraid of “allowing” EUR/USD to move above 1.20. The ECB has earlier seen 1.20 as a clear line in the sand, which was e.g. the case in 2017 when verbal intervention was utilised every time the cross broke 1.20 on the upside.

Is the European growth and inflation outlook solid enough for the ECB to accept a euro rally already now? We don’t think so. The ECB could e.g. widen the PEPP (QE) wallet in an attempt to dampen the momentum in EUR/USD. This is a key argument behind our slightly sceptical EUR/USD view short term.

Chart 2. Could the ECB opt for verbal intervention to prevent EUR/USD from moving above 1.20?

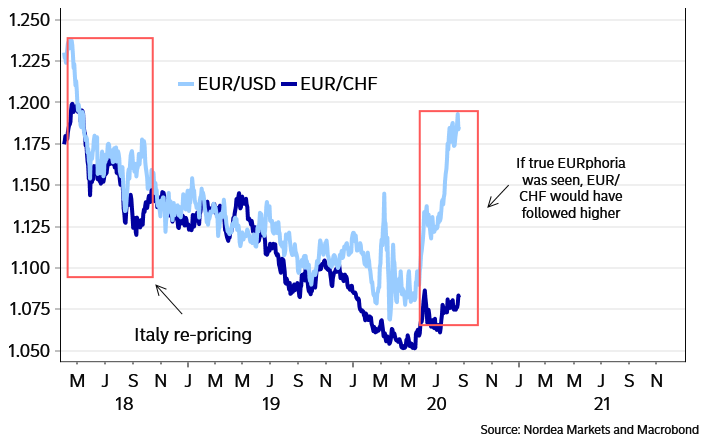

The EUR hasn’t been priced in an overly strong direction versus other peers such as the SEK, CHF, NOK and DKK, which have all gained versus the EUR since the early summer. Had this repricing in EUR/USD been a EUR story, we would have seen EUR/CHF follow suit and move higher. This is not yet the case, which is why very little of the recent positivity surrounding the EUR can be contributed to optimism for the EU after the agreement on common EU debt and cross-border grants. The EUR has much further to go when/if the market realises that the tail risks in the EUR are much smaller now compared to 9-12 months ago.

Chart 3. We are yet to see EURphoria after the common debt deal

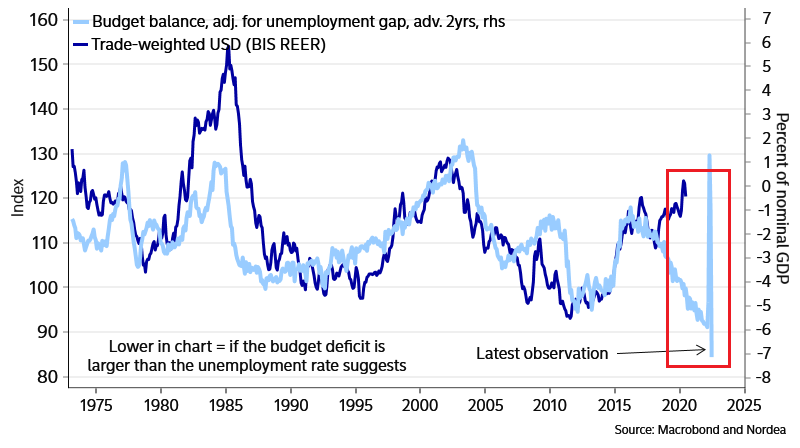

Instead, this is just a broad-based negative USD story, as we warned about back in April (Global: Once we are out of this mess, the USD will be slaughtered). A widening budget deficit paired with a continued trade deficit is an issue for the USD – but mostly when the rest of the world catches up growth-wise, as has been the case since the reopening of the global economy during Q2.

Why should foreigners accept to fund persistent twin deficits if the USD level is already very strong? This question is particularly relevant when tail risks abate elsewhere.

The scope for a weaker USD is clearly intact and there is even a risk of a pretty large move in a weaker direction. The below correlation between the trade-weighted USD and the budget balance adjusted for the unemployment gap suggests that the USD could weaken by as much as 20-25% over the coming two years.

We fully buy into this direction but the ECB will likely try to “fight gravity” with verbal intervention to prevent the pair from moving above 1.20 for a while before allowing it to run its course into 2021. We aim for (at least) >1.25 levels in EUR/USD.

Chart 4. USD will suffer due to the persistent twin deficits; 20-25% weakening is in play