Nordea forudser en enorm stigning i den amerikanske likviditet i de kommende måneder, kun overgået af starten på coronakrisen sidste år. Vil det smadre dollaren? Stigningen i likviditeten kan næsten kun være negativ for dollaren, mener Nordea, der dog også opregner en række argumenter for, at dollaren på kort sigt ikke bliver svækket.

Global: will the liquidity tsunami crash the dollar?

We predict an enormous rise in US excess liquidity in the coming months, a liquidity tsunami only surpassed during the pandemic panic of spring 2020. Will this crash the dollar or are there reasons to doubt this story?

Will Jay-Jay mean Nay-Nay for the Dollar?

We have been tracking US excess liquidity and the Fed’s balance sheet for several years, at least since August 2014 when one of the authors of this piece argued Quantitative Tightening would push the USD higher. See here.

We have also tracked gyrations in the Treasury’s TGA, such as when we argued the debt ceiling deal of 2019 could cause a dearth of dollars here (and possibly force the Fed to start “soft QE”, which we can happily conclude that it did).

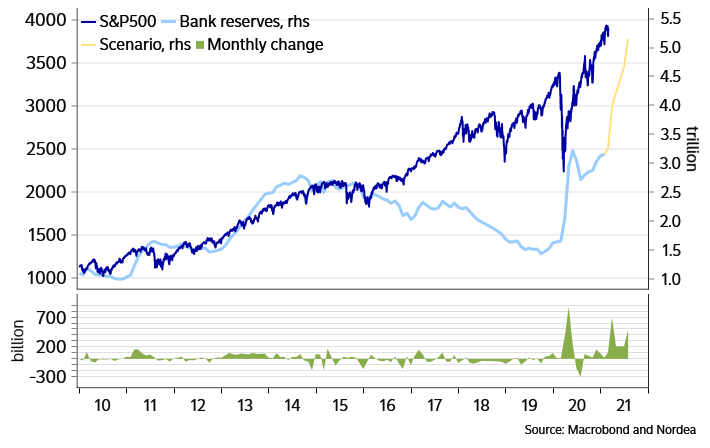

Chart 1: All aboard (stocks) ahead of the liquidity tsunami

Now, when we look ahead – we, and for once many others, predict a ginormous rise in US excess liquidity, a liquidity tsunami only surpassed during the pandemic panic of spring 2020.

In our assumptions, we have pencilled in i) continued Fed QE purchases of 120bn/month (Jay), ii) a drawdown in the US Treasury’s TGA to correspond with its latest forecast (Jay-net), and iii) an added bonus for the month of July reflecting the debt ceiling.

Indeed, unless lifted, cancelled (or bombed away by one of Biden’s drones?), the debt ceiling will come into effect on August 1, which would force the US Treasury do draw down the TGA even more (134bn) than the US Treasury currently predicts (500bn).

All of this means that the path for US excess liquidity in the banking system can’t be anywhere but up, up, and away! At least through the summer. The outlook for US liquidity is one of the differences when looking at 2021 vs the year of 2018 (for some definitely dollar-positive similarities, see the February dollar-o-meter).

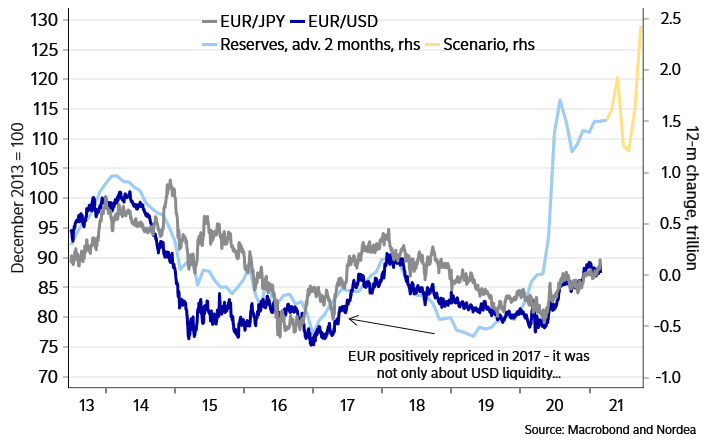

Chart 2: The rise in US liquidity is dollar-negative, but by how much?

We have a hard time to see a rise in liquidity as anything else but dollar-negative. However, the question is how negative, exactly. Despite the coming liquidity tsunami we would like to offer some reasons why the dollar may not weaken much – or at all.

- the liquidity tsunami has the potential to push long-term yields higher (especially given current uncertainty with regards to the Fed’s SLR rules), and rising yields would lessen the downside pressure on the dollar for those who fear the twin deficit narrative

- at the same time, higher yields risk causing risk-off episodes, which would probably be dollar-positive for safe haven reasons

- the rise in liquidity is also set to weigh on T-bill rates (& the Effective Fed Funds rate) which in turn could prompt a Fed response such as technical rate hikes (higher IOER/ON RRP rates – this would provide a dollar-positive sticker shock for the FX market), or uncapping the ON RRP and foreign repo pool facilities (the latter of which would help drain liquidity)

- what’s more, if the rise in liquidity is so adverse for the dollar, why isn’t the dollar already much weaker? (our old charts had liquidity momentum capped at +1000bn… vs the latest outcome of 1500bn which would, according to the chart, correspond to a 20% weaker USD than currently)

- the effects of additional liquidity also likely diminishes the more liquidity there is in the system (in contrast to larger effects when liquidity is much tighter, compare 2017-2019 to today)

- according to IMM data, market participants are the most long EUR (vs USD) since the beginning of 2018, suggesting that plenty of dollar bearishness is already baked-in

- finally, it may be that the rise in US liquidity causes US asset outperformance which may be USD-positive (perhaps via unhedged inflow – the Milkshake Theory)

So, despite the liquidity tsunami, we keep our EUR/USD short – for a target of 1.1750.

We expect growth outperformance (financial, fiscal and vaccination impulses), inflation outperformance (in part because of the dollar weakness in 2020) and a relatively more hawkish central bank(!) to help the dollar gain vs the EUR. Long-term we are not that upbeat on the greenback however.