Offentliggørelsen af referatet fra det seneste ECB-møde viser, at der i ECB-rådet er en voksende frygt for en vedvarende, stigende inflation. ECB har hidtil omtalt den aktuelle, relativt høje inflation som midlertidig, men stadigt flere i rådet er bange for, at den høje inflation bliver vedvarende, bl.a. som følge af energikrisen. ECB er begyndt at reducere sine månedlige opkøb, og Nordea tror, de vil blive reduceret til 65-70 milliarder euro om måneden mod 80 milliarder euro. ECB-mødet i december bliver afgørende for, hvordan ECB vil håndtere inflationen og opkøbene i PEPP-programmet.

ECB Watch: Significant improvement

Upside inflation risks are increasingly discussed at ECB meetings as well, but the central bank is not close to changing its view of high inflation being transitory yet. Another step towards slower bond purchases will be taken in December.

The monetary policy account from the ECB’s September monetary policy meeting showed that upside inflation risks were increasingly discussed. In fact, it was noted that as for the assessment of the inflation outlook, a significant improvement over the course of the year was acknowledged. Further, it was argued that if supply bottlenecks lasted longer and fed through into higher than anticipated wage rises, price pressures could be more persistent.

It was also noted that, even if the current inflation shock was largely temporary, it would only require a relatively small percentage of the current shock to become permanent for inflation to be close to 2 per cent at the end of the projection horizon. In addition, the impact of climate change policies and the future development of carbon prices was likely to lead to sustained upward price pressures for a number of years.

However, and more importantly, monetary policy still had more work to do. Inflation was not expected to persistently reach levels that fully offset the pandemic impact on the inflation path at the relevant medium-term horizon, and it remained well below the ECB’s new inflation target.

The improvement seen was enough for the ECB to decide to moderately slow down the pace of buying under the Pandemic Emergency Purchase Programme (PEPP). The decision was taken due to persistently favourable financing conditions along with a somewhat improved medium-term outlook.

The ECB bought a net EUR 75bn of bonds in September, vs. around EUR 80bn per month in April, May and June (July and August numbers were affected by seasonality considerations). As the new buying pace did not apply for the whole of September, the new monthly pace is likely to be closer to EUR 65-70bn.

A number of comments were made in both directions on the recalibration of the pace of purchases under the PEPP. Some favoured a buying pace close to that prevailing early in the year, while others wanted to proceed more carefully in scaling down the purchases.

Nevertheless, it was noted that even with a moderately lower pace of purchases, the ECB’s monetary policy remained highly accommodative overall. Further, attention was drawn to the substantial stock of assets that the Eurosystem had acquired since the beginning of the year, which would provide significant accommodation over the coming years by compressing the term premium, even if the pace of purchases was reduced. In other words, even if the ECB stopped net purchases altogether, the central bank would see that the sizable stock of asset holdings would continue to mean a very accommodative monetary policy.

High stakes in December

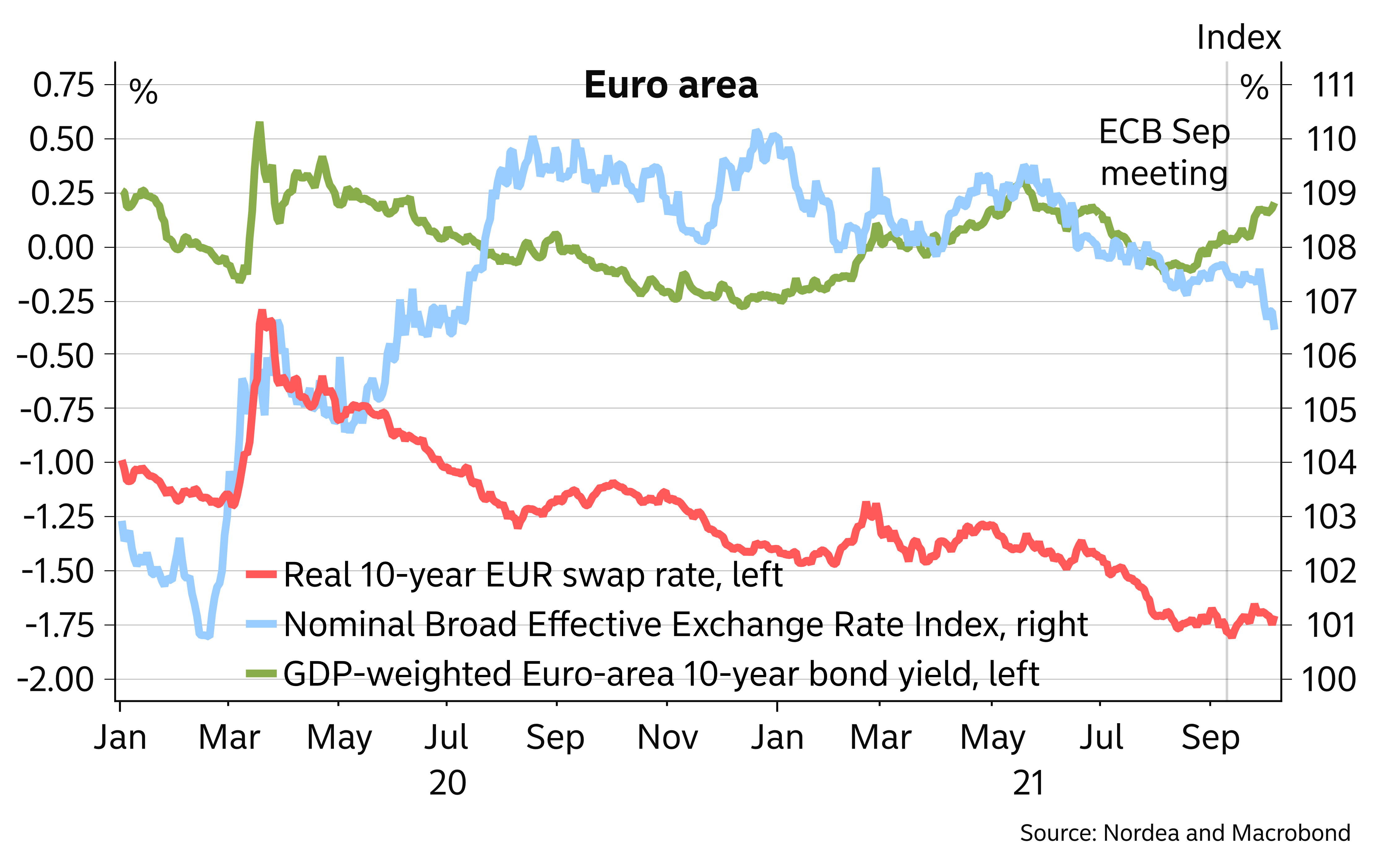

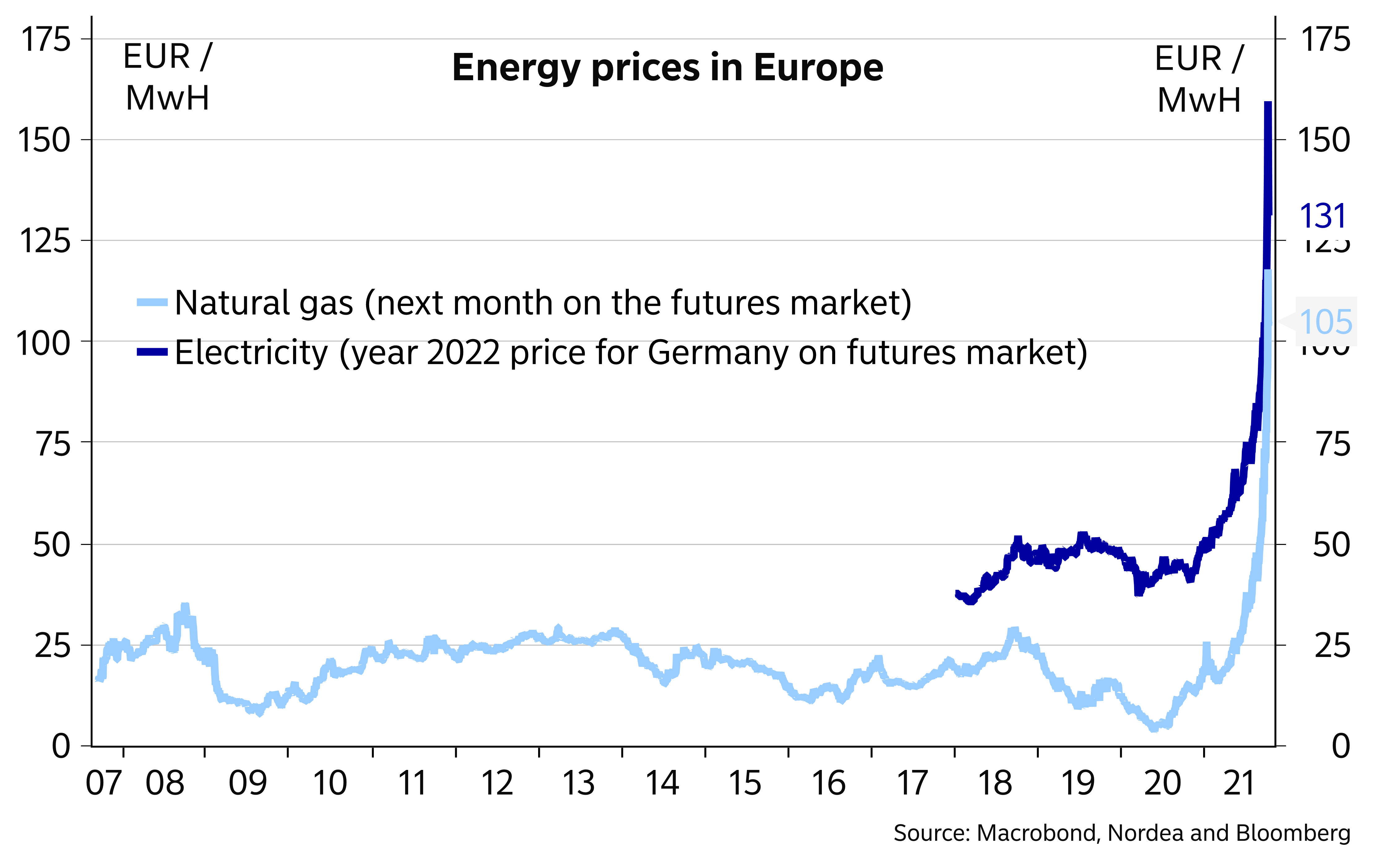

Financing conditions have tightened only moderately since the ECB’s September meeting. While long bond yields have risen, real yields have climbed less and the currency has weakened. At the same time, the surging energy prices will hit household purchasing power and push near-term inflation steeply higher.

The December meeting was set to be interesting in any case, but the recent developments may increase the range of opinions. The doves may continue to point to inflation being transitory and the weaker economic outlook due to higher energy prices. The hawks, in turn, may become more restless due to inflation rising even further above 2 %.

In December, the ECB is supposed to decide on how to provide sufficient accommodation after it ends the PEPP. We continue to think the central bank will boost the Asset Purchase Programme (APP), currently running at a monthly pace of EUR 20bn, not necessarily by raising the monthly pace but by adding a fixed amount envelope of purchases, that could be used flexibly e.g. over the following 12 months. Being of a fixed duration and at the same time flexible, the envelope approach might be a good compromise between the hawks and the doves. The forward guidance on asset purchases will likely also be tweaked to weaken the link between the end of net purchases and the start of rate hikes.

New tools may be on the table as well, as there have been reports that the ECB is studying a new bond purchase programme that could complement the APP and not necessarily follow the capital key in dividing the purchases between the bonds of Euro-area countries. We think that it is premature at this point to conclude that the ECB would decide to go for such a programme.

in the near term, financial markets will be more strongly driven by global drivers, such as the development of energy prices, rather than changes in ECB policy. But as the December meeting nears, the future course for ECB policy will return to the limelight.

Finally, it was suggested that more information be provided in official communication about the reasoning behind the APP, the PEPP and related policy decisions. Further communication changes may thus be ahead as well.