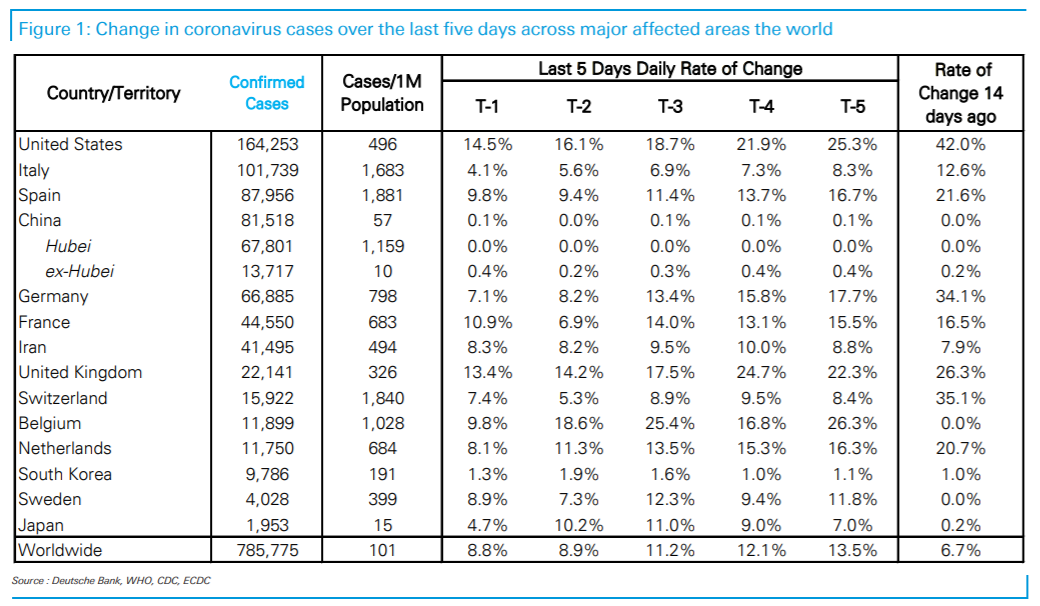

Antallet af nye corona-tilfælde begynder at aftage mange steder, skriver Deutsche Bank i sin daglige corona-analyse. Der har nu været to dage i træk, hvor det globale tal for nye tilfælde er steget med mindre end 10 pct.

Uddrag fra Deutsche Bank:

Global new cases have increased by 8.8 per cent over the last 24 hours, with

overall cases now over 785,000, but we continue to see significant slowing

across the most heavily impacted regions around the world. Today was the

second day in a row that global new case growth was under 10 per cent after

being well above for most of the last two weeks.

Italy now has over 100,000 cases and 11,000 covid-19 deaths, but growth

rates of both metrics have been flattening over the past week. Over the last

24 hours, Italian cases have grown by 4.1 per cent or about 4,000 people,

this is the lowest number of new cases in 13 days. Fatalities are also

trending lower, with a second day of 7.5 per cent growth, and four out of five

days in single digits now. Importantly, even as numbers start to dramatically

improve, the country is set to keep containment measures in place through

to at least the end of Easter in two weeks’ time.

The other European hot spot Spain, saw total confirmed cases pass China

over the past 24 hours (up to almost 88,000 cases). Yet like Italy, Spain has

now seen their metrics improve considerably after the lagged impact of

containment measures that were implemented two weeks back. Spain’s

new case growth went from 35 per cent three weeks ago, to averaging 20

per cent over the past two weeks, and has now dropped to single digits over

the last two days.

In Germany, new cases have increased by 7.1 per cent. Like Spain, this is

the second day in a row of single digit growth for the country, which would

be a fairly large deviation from the mid-teen range that case growth had

been in the previous 8 days.

The US continues to see new case numbers increase as testing increases.

It now has nearly double the reported cases that China has seen. However,

growth rates are also starting to show signs of slowing. New cases have

grown by 14.5 per cent over the last day, which is the second lowest daily

growth since the outbreak hit 100 cases. The growth rate of fatalities in the

country seems to have spiked higher to 27 per cent after falling sharply from

30 per cent to 12 per cent on Sunday, however the two-day average of 19

per cent is less than half the previous five-day average of 32 per cent.

Elsewhere, we have started to track Sweden as they have adopted a very

different and more relaxed stance to the outbreak. Schools are still sitting

and restaurants are still open for example. At the moment the table shows

that they are not suffering any more than those above it in terms of new

cases/ fatality rates. Time will tell if this proves to be a sustainable strategy.