Uddrag fra Zerohedge:

Picking up on something we pointed out earlier, namely that after pricing in as much as 20bps of rate hikes in Q1, the market is now once again expecting a rate cut in the first quarter of 2023…

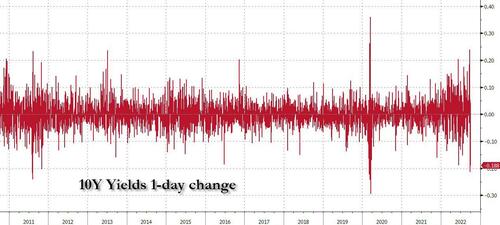

… Bloomberg’s Tatiana Darie writes that “stocks are soaring and bond yields are plummeting… as traders dial back expectations for Fed tightening, again betting on a rate cut arriving as soon as May 2023. They risk being disappointed.”

And while a bounce was very much overdue and may have legs, particularly after the catastrophic September for stocks, the wirst since 2008, Darie warns that “fighting the Fed hasn’t really worked out for investors this year.”

Bloomberg’s WIRP screen now shows a terminal rate of 4.38% vs 4.52% on Friday and as high as 4.7% in the days after last month’s FOMC meeting. The implied rate starts trending lower from March, suggesting investors expect the economic slowdown to prompt a change in policy from central bankers.

While Darie speculates that investors may be taking cues from some commentary from Fed speakers last week that revealed a slight variation from hawkish consensus so far, we believe it was Mark Cabana’s warning that the Fed is about to break the Treasury market that has spooked the hawks. That said, while caution may be inserted in upcoming speeches this week, it’s hard to see how the consensus deviates from the central bank’s resolve to crush inflation. That’s especially true with the Fed’s preferred inflation measure at the highest in almost four decades.