Fra Authers:

That has had the effect of seemingly eliminating concerns about inflation, even though the battle against it has barely begun. Breakevens, derived from yields on inflation-linked bonds, have dropped all around the world. The 5-year, 5-year forward breakeven, which aims to capture average inflation for the five years starting five years hence and is the measure most closely followed by the Federal Reserve, has now dropped below its level from much of 2018, before the pandemic. Fast approaching the Fed’s target of 2%, the bond market is saying that inflation is no longer anything to worry about:

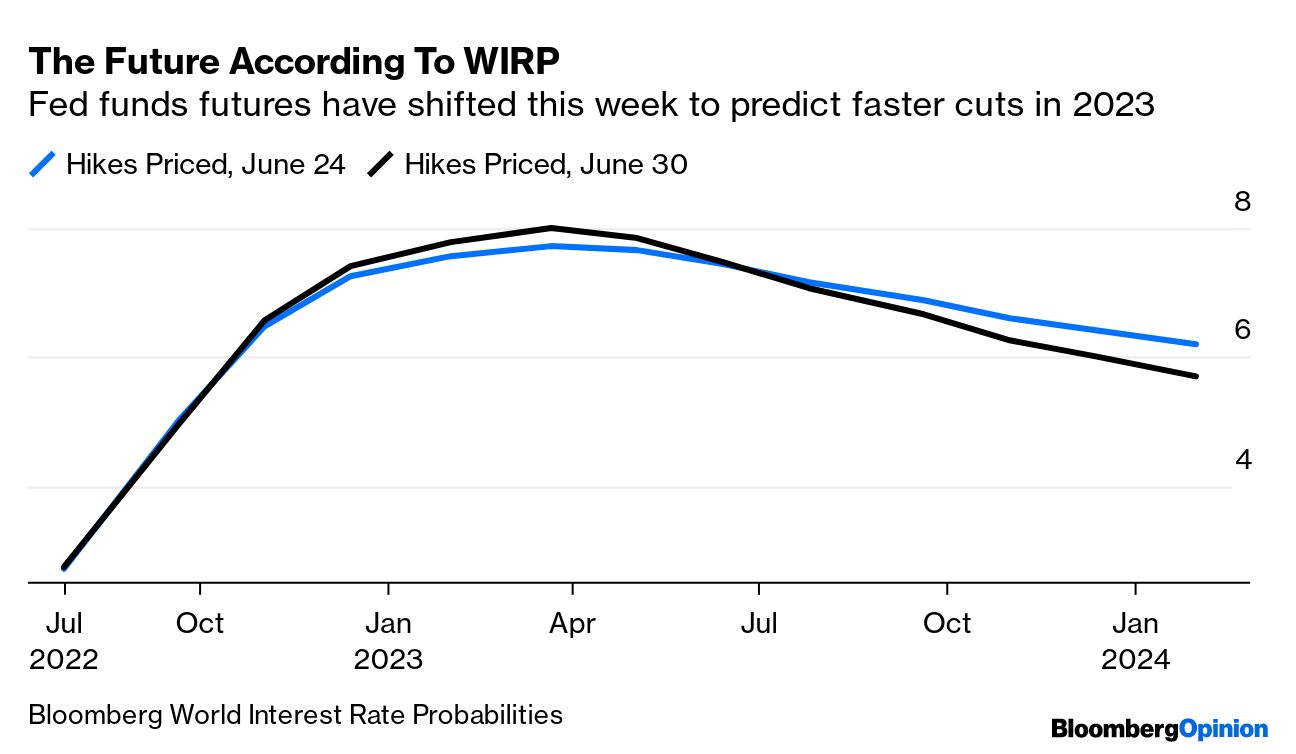

The problem is that inflation forecasts have shifted because growth forecasts are also shifting. With a recession now named as a base case for many next year, the belief is gaining greater hold that the Fed will hike rates by a further 2 percentage points, but then swiftly start cutting again. The easing cycle, if you believe the fed funds futures market, will be well advanced by the end of next year. The chart shows the number of 25-basis-point hikes implicitly priced in for each Fed meeting until early 2024. Over the last week, the belief in a swift start to easing has gained a hold — and that, sadly, is because pessimism about the economy has also taken hold:

Even if the markets are confident that inflation is as good as beaten already, however, central bankers are being careful not to seem complacent. The European Central Bank’s annual summit at Sintra in Portugal featured a panel (which you can see in full here, moderated by Bloomberg colleague Francine Lacqua) involving Agustin Carstens, Jerome Powell, Christine Lagarde and Andrew Bailey, heads of the Bank of International Settlements, the Fed, the European Central Bank and the Bank of England. None was prepared to divert from the message that inflation was the overriding priority. Powell asserted that the Fed was “committed to, and will succeed, in getting inflation down to 2%,” and that to do otherwise would cause more pain — a sentiment fully endorsed by the other central bankers.