Uddrag fra Authers FT

Nvidia Corp., the first company ever to amass a market capitalization above $4 trillion, continues to keep us excited. Its growth is undeniable, with the real concern more about the sustainability of revenues and profits, rather than share price.

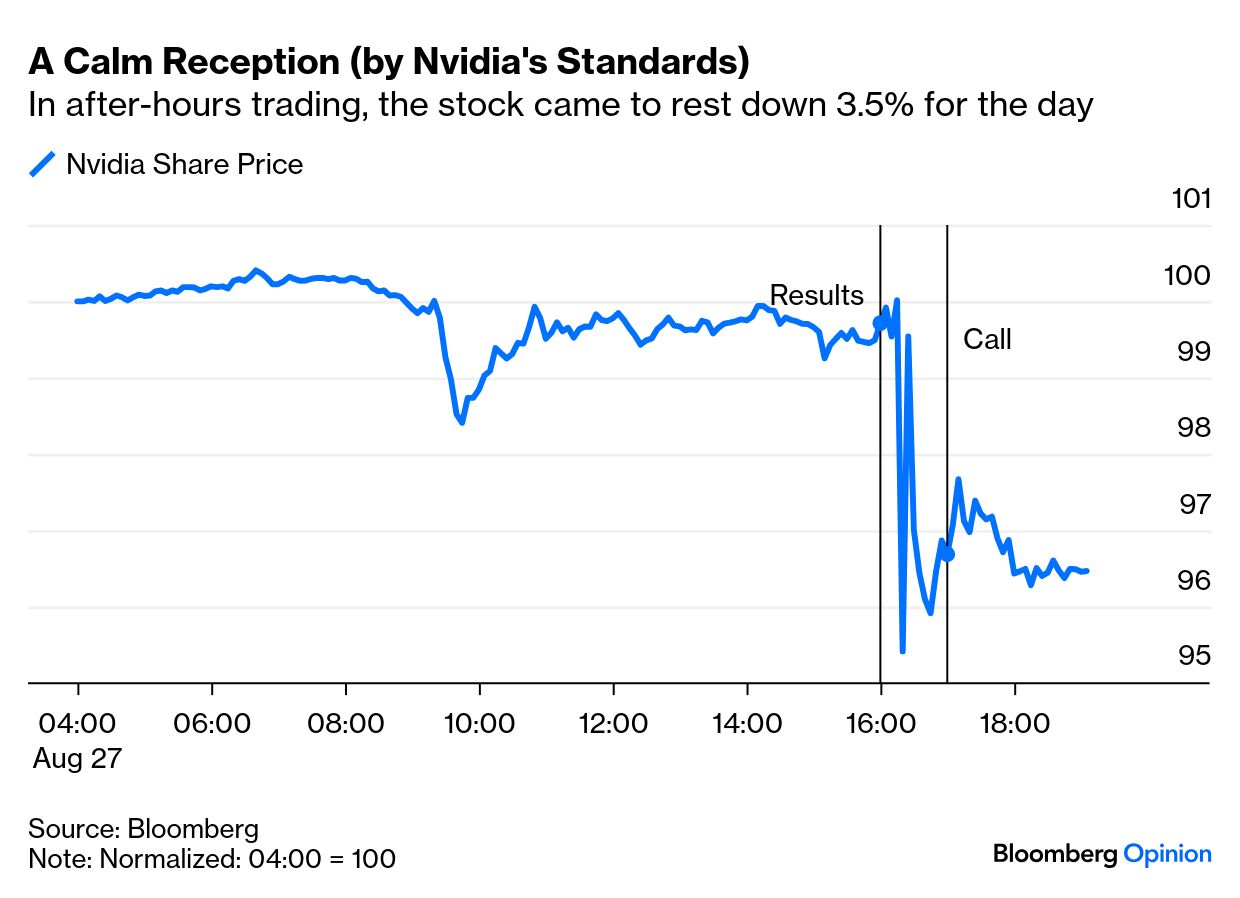

In the latest episode, the company announced second-quarter results after the market closed Wednesday, and after-hours traders didn’t like them. That said, a fall of about 3.5%, which CEO Jensen Huang’s appearance on the earnings call didn’t really shift, is a moderate response by Nvidia’s standards:

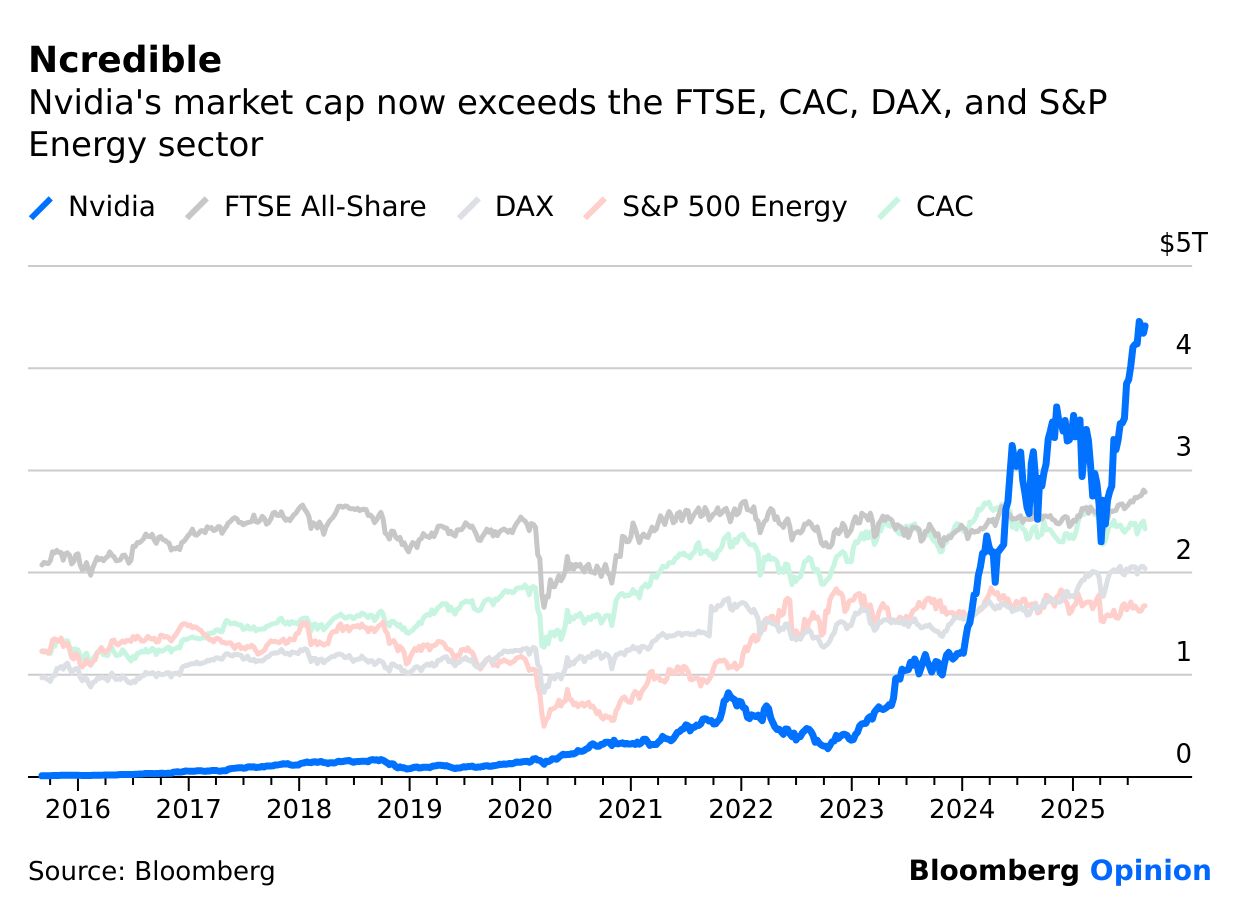

If that holds up once markets reopen, it will translate into a fall in market cap of about $140 billion. That is, of course, a lot of money; it’s roughly enough to buy the whole of Pfizer Inc. at current valuations. But Nvidia’s growth has been such that this may not hurt so much. Over the last year, its market cap has overtaken the total valuations of the main stock indexes in the UK, France and Germany. It’s also overtaken the entire S&P 500 energy sector, to whose members will fall the task of powering the machines that use Nvidia chips:

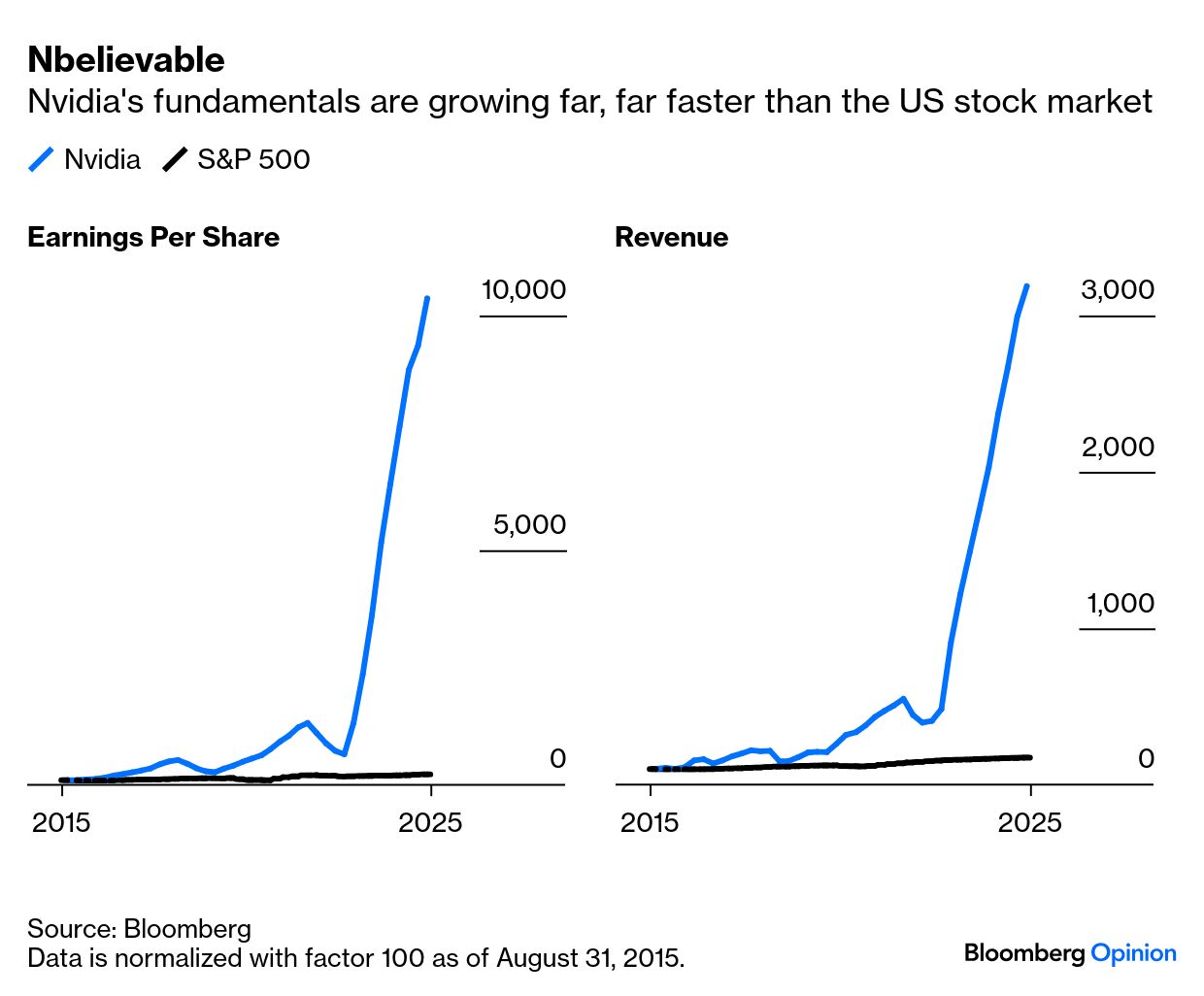

But the Nvidia narrative continues to be about its phenomenal success in selling people chips and doing so at a profit. This chart compares the growth of sales and of earnings for the company and the S&P 500 as a whole over the last decade. Since the arrival of ChatGPT in November 2022, Nvidia has gone into orbit:

Growth in EPS and revenue continue to be phenomenal. They cannot carry on at this rate indefinitely; Nvidia will have to start looking for customers elsewhere in the solar system, so deceleration per se is only to be expected before long. The two flies in the ointment that prompted the selling were:

- Data center growth — central to the artificial intelligence story — was a little below forecasts; and

- The company announced that it had effectively made no sales to China during the quarter, and that its future projections were based on the assumption that China would continue to be off-limits.

On the China issue, Nvidia also made the very disquieting disclosure that the much-ballyhooed deal to pay 15% of its Chinese revenues with the US government still hasn’t been finalized.

The good news, without being Pollyanna-ish, is that Nvidia is being very responsible, and any resumption of sales to China will be pure upside compared to the current forecast (even if they share a chunk with Uncle Sam). The bad news is that the administration’s modus operandi of striking vague deals in principle and not thrashing out the details creates real problems for anyone trying to plan their business with a spreadsheet.

Nvidia is trying to say that as clearly as it can without incurring presidential wrath. The company stood up to the administration about as much as anyone in the corporate world now dares, saying the government had “not published any specifics or codified any terms of the agreement.” As Dave Lee points out, from Huang’s perspective, the administration is standing in the way of a $50 billion bonanza.