Fra Zerohedge:

As was hinted at, and discussed in depth here, the Fed decided – under political pressure from progressive Democrats such as Elizabeth Warren and Sherrod Brown – to let the temporary Supplementary Leverage Ratio (SLR) exemption expire as scheduled on March 31, the one year anniversary of the rule change.

The federal bank regulatory agencies today announced that the temporary change to the supplementary leverage ratio, or SLR, for depository institutions issued on May 15, 2020, will expire as scheduled on March 31, 2021.

The temporary change was made to provide flexibility for depository institutions to provide credit to households and businesses in light of the COVID-19 event.

This outcome is the one (again) correctly predicted by former NY Fed guru Zoltan Pozsar who following the FOMC said that “the fact that the Fed made this adjustment practically preemptively – the o/n RRP facility is not being used at the moment, so there are no capacity constraints yet, while repo and bill yields aren’t trading negative yet – suggests that the Fed is “foaming the runway” for the end of SLR exemption.”

Knowing well this would be a very hot button issue for the market, the Fed published the following statement to ease trader nerves, noting that while the SLR special treatment will expire on March 31, the Fed is “inviting public comment on several potential SLR modifications” and furthermore, “Board may need to address the current design and calibration of the SLR over time to prevent strains from developing that could both constrain economic growth and undermine financial stability” – in short, if yields spike, the Fed will re-introduce the SLR without delay:

The Federal Reserve Board on Friday announced that the temporary change to its supplementary leverage ratio, or SLR, for bank holding companies will expire as scheduled on March 31. Additionally, the Board will shortly seek comment on measures to adjust the SLR. The Board will take appropriate actions to assure that any changes to the SLR do not erode the overall strength of bank capital requirements.

To ease strains in the Treasury market resulting from the COVID-19 pandemic and to promote lending to households and businesses, the Board temporarily modified the SLR last year to exclude U.S. Treasury securities and central bank reserves. Since that time, the Treasury market has stabilized. However, because of recent growth in the supply of central bank reserves and the issuance of Treasury securities, the Board may need to address the current design and calibration of the SLR over time to prevent strains from developing that could both constrain economic growth and undermine financial stability.

To ensure that the SLR—which was established in 2014 as an additional capital requirement—remains effective in an environment of higher reserves, the Board will soon be inviting public comment on several potential SLR modifications. The proposal and comments will contribute to ongoing discussions with the Department of the Treasury and other regulators on future work to ensure the resiliency of the Treasury market.

The Fed’s soothing wods notwithstanding, having been primed for a favorable outcome, the Fed’s disappointing announcement was hardly the news traders were hoping for and stocks tumbled…

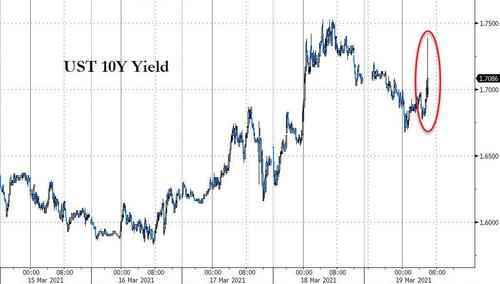

Bond yields spiked…

… while the stock of JPM, which is the most exposed bank to SLR relief (as noted yesterday in “Facing Up To JP Morgan’s Leverage Relief Threats“)…

…. slumped.

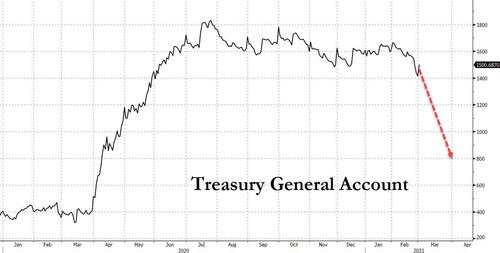

In case you’ve been living under a rock, here’s why you should care about the SLR decision: First, for those who missed our primer on the issue, some background from JPM (ironically the one bank that has the most to lose from the Fed’s decision) the bottom line is that without SLR relief, banks may have to delever, raise new capital, halt buybacks, sell preferred stock, turn down deposits and generally push back on reserves (not necessarily all of these, and not in that order) just as the Fed is injecting hundreds of billions of reserves into the market as the Treasury depletes its TGA account.

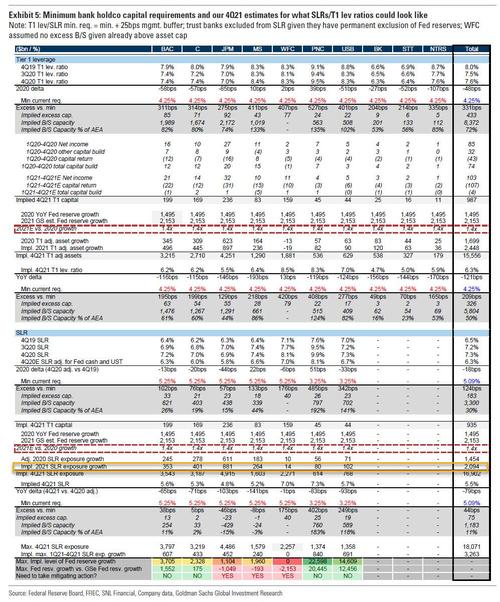

The massive expansion of the Fed’s balance that has occurred implied an equally massive growth in bank reserves held at Federal Reserve banks. The expiration of the regulatory relief would add ~$2.1tn of leverage exposure across the 8 GSIBs. As well, TGA reduction and continued QE could add another ~$2.35tn of deposits to the system during 2021.

While the expiry of the carve-out on March 31 would not have an immediate impact on GSIBs, the continued increase in leverage assets throughout the course of the year would increase long-term debt (LTD) and preferred requirements. Here, JPM takes an optimistic view and writes that “even the “worst” case issuance scenario as very manageable, with LTD needs of $35bn for TLAC requirements and preferred needs of $15-$20bn to maintain the industry-wide SLR at 5.6%.

The constraint is greater at the bank entity, where the capacity to grow leverage exposure to be ~$765bn at 6.2% SLR.” Goldman’s take was more troubling: the bank estimated that under the continued QE regime, there would be a shortfall of some $2 trillion in reserve capacity, mainly in the form of deposits which the banks would be unable to accept as part of ongoing QE (much more in Goldman’s full take of the SLR quandary).

* * *

So what happens next?

Addressing this topic, yesterday Curvature’s Scott Skyrm wrote that “the largest banks are enjoying much larger balance sheets, but there are political factors in Washington that are against an extension of the exemption…. Here are a couple of scenarios and their implications on the Repo market:

The exemption is extended 3 months or 6 months – No impact on the Repo market. It’s already fully priced-in.

The exemption is continued for reserves, but ended for Treasurys. Since large banks are the largest cash providers in the Repo market, less cash is intermediated into the market and Repo rates rise. Volatility increases as Repo assets move from the largest banks to the other Repo market participants.

The exemption is ended for both reserves and Treasurys. Same as above.

In other words, Skyrm has a relatively downbeat view, warning that “since large banks are the largest cash providers in the Repo market, less cash is intermediated into the market and Repo rates rise.” Additionally, volatility is likely to increase as repo assets move from the largest banks to the other Repo market participants…

Perhaps a bit too draconian? Well, last week, JPMorgan laid out 5 scenarios for SLR, of which two predicted the end of SLR relief on March 31, as follow:

3. Relief ends March 31, banks fully raise capital

Impact on Banks

- Expect issuance pace to increase significantly as banks look to get ahead of the leverage constraint. Expect preferred spreads to widen, muted impact on bank spreads.

Rates

- Swap spreads narrower on announcement.

- Swap spreads widen over medium term on commitment to raise capital versus reducing leverage exposures.

Front-End Rates

- Resistance to taking on new deposits, pushes more liquidity into the banking system; further downward pressure on money market rates.

4. Relief ends March 31, banks raise capital & de-lever

Impact on Banks

- Reducing PF leverage assets by $250bn would eliminate banks’ need to issue preferred to remain at 5.6%, but would require ~$25bn of preferred issuance to bring the aggregate SLR to 5.8%.

Rates

- Swap spreads narrower on announcement.

- More sustained narrowing over time on anticipation of bank selling of Treasuries, particularly focused on areas in which bank demand has been strongest, such as intermediates.

- Term repo higher and SOFR futures cheaper on anticipated rise in collateral supply to the market.

Front-End Rates

- Resistance to taking on new deposits and more aggressive shedding of existing deposits, pushes more liquidity into the banking system; further downward pressures on money market rates.

Going back to Zoltan, let’s recall that the repo guru also cautioned that “ending the exemption of reserves and Treasuries from the calculation of the SLR may mean that U.S. banks will turn away deposits and reserves on the margin (not Treasuries) to leave more room for market-making activities, and these flows will swell further money funds’ inflows coming from TGA drawdowns.”

More importantly, Zoltan does not expect broad chaos in repo or broader markets, and instead provides a more benign view on the negligible impact the SLR has had (and will be if it is eliminated), as he explained in a note from Tuesday.

How to determine if Zoltan’s benign view is correct? He concluded his note by writing that “given that our call for a zero-to-negative FRA-OIS spread by the end of June was predicated on the end of SLR extension and an assumption that the Fed will try to fix a quantity problem with prices, not quantities, today’s adjustments mean that FRA-OIS won’t trade all the way down to zero or negative territory.”

FRA-OIS from here will be a function of how tight FX swaps will trade relative to OIS, but Treasury bills trading at deeply sub-zero rates is no longer a risk…

While Bills have occasionally dipped into the negative territory on occasion, so far they have avoided a fullblown plunge into NIRP, which may be just the positive sign the market is waiting for to ease the nerves associated with the sudden and largely unexpected end of the SLR exemption.

* * *

Finally, for those curious what the immediate market impact will be, NatWest strategist Blake Gwinn writes that the Fed announcement that they’re letting regulatory exemptions for banks expire at the end of the month “really threads the needle and “assuages concerns about the potential long-term impact on the markets” as the SLR “ends it but defuses a lot of the knee-jerk market reaction” by pledging to address the current design and calibration of the supplementary leverage ratio to prevent strains from developing.

“I was never worried about a day-one bank puke of Treasuries or drawdown in repo or anything like that on no renewal,” Gwinn said. “My concern was the longer run,” like as reserves continue to rise, would the SLR “become a nuisance and drag on Treasuries and spreads” Gwinn concludes that with the statement, the Fed is “really speaking to those fears and basically saying, ‘don’t worry, we are on it’.”

Well, with yields spiking to HOD in early quad-witch trading, the market sure seems quite skeptical that the Fed is on anything.