De seneste data fra Nationalbanken viser, at obligationsejerne nu bevæger sig fra Europa til USA, skriver Nordea i en analyse. Udenlandske investorer har reduceret deres andele af danske statsobligationer, men har øget deres andele af DGB 25 og DGB 29.

Market Pulse DKK: The first glance at the Corona-effect on the Danish bond market

The Danish Central Bank has published the investor numbers for April. These numbers are very interesting since they contain information on the aftermath of the Corona crises. Read all the details in our new improved report.

New improved report with all the details

We are happy to present our newest report on investor distribution in the Danish bond market. The new report is easy to navigate using links that jumps between the more than 50 pages. On page two (Table of contents) we have made an overview where the reader can click on the text to get the relevant page. On each page there is a box (back to contents) in the top right corner to navigate back to the Table of contents page.

Read the full report here. Download the report to use the links and navigate the report using the download button in the top..

What does the April number tell us

The April numbers are very interesting since it contains information on the behaviour of investors in the aftermath of the Corona market stress in March.

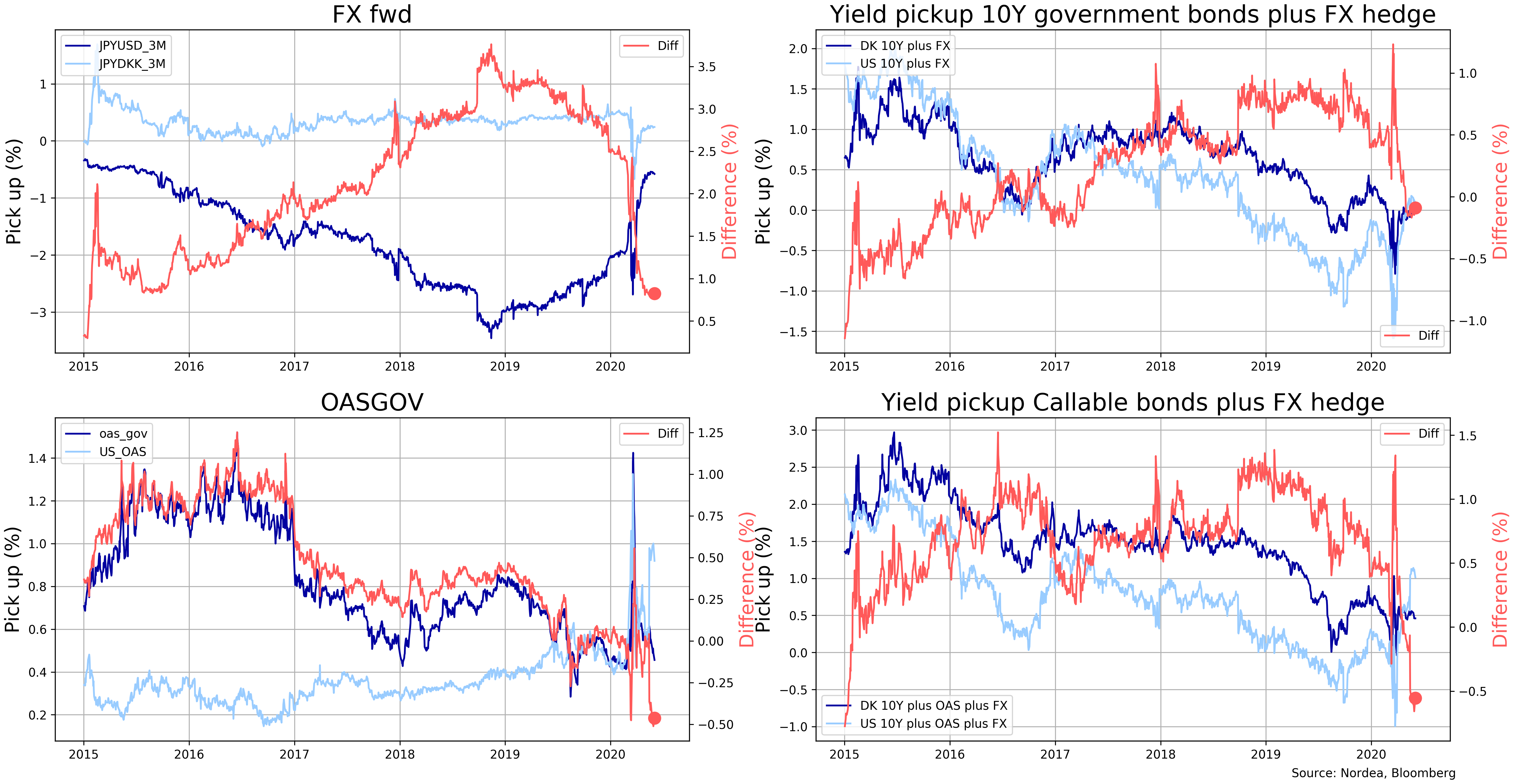

Before we go through the details of this morning’s numbers we note that in the fragmented data available on the global investor behaviour we see clear signs that bond investors are moving from Europe to the US. This is in our view a direct consequence of the much cheaper FX hedging of USD. The coming months data will show at what pace this will continue but since March the entry levels in US bonds have improved further.

Returning to todays numbers we find that:

- Data on the new DGB52 is available for the first time and shows. L&P owns 72.2%, Financials have 15.8% and Foreing 11.9%. Note that the total amounts DKK 10.3bn.

- Foreign investors have reduced their share of government bonds but have increased in DGB 25 and DGB 29

- Foreign investor continue to lower there relative share of RD but at a more dampened pace than in 2019. RD has instead been bought by L&P.

- Due to prepayments it doesn’t make sense to look on the overall changes for callable bonds since last month. Foreign investors have over the last three month increased their share of the callable market from 33.9% to 35.2% corresponding to an increase from DKK 394bn to DKK 414bn. We note a large increase in 1.5%50IO (from 57.9% to 64.7%)

- Foreign now own 80.1% of NDA 1%50IO